Best Berkeley Springs, West Virginia Auto Insurance in 2026 (Top 10 Companies Ranked)

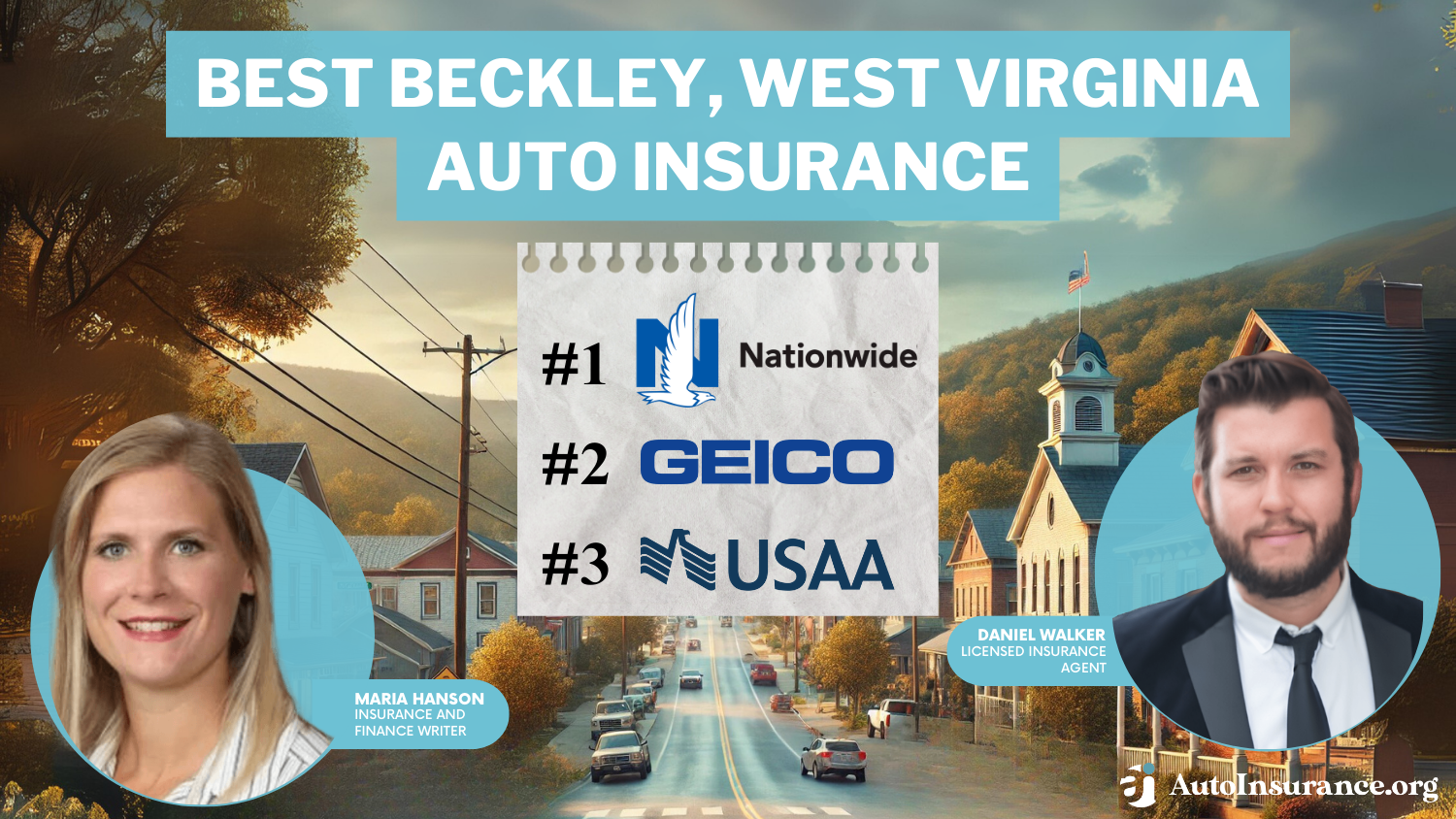

The best Berkeley Springs, West Virginia auto insurance providers are Nationwide, Geico, and USAA. With a monthly rate of $60/month, Nationwide offers top coverage, Geico is the most affordable, and USAA provides military discounts, making them the best options for Berkeley Springs residents.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Insurance and Finance Writer

Maria Hanson grew up with a unique passion and understanding of both the automotive and insurance industries. With one grandfather in auto mechanics and another working in insurance, you could say automotive insurance is in her blood. Her love of research and finance serves her well in studying insurance trends and liability. Maria has expanded her scope of expertise to home, health, and life...

Maria Hanson

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Brad Larson

Updated December 2024

3,071 reviews

3,071 reviewsCompany Facts

Full Coverage in Berkeley Springs West Virginia

A.M. Best

Complaint Level

Pros & Cons

3,071 reviews

3,071 reviews 19,116 reviews

19,116 reviewsCompany Facts

Full Coverage in Berkeley Springs West Virginia

A.M. Best

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 6,590 reviews

6,590 reviewsCompany Facts

Full Coverage in Berkeley Springs West Virginia

A.M. Best

Complaint Level

Pros & Cons

6,590 reviews

6,590 reviewsThe best Berkeley Springs, West Virginia auto insurance providers are Nationwide, Geico, and USAA. Nationwide is the top pick known for its well-rounded coverage and dependable customer service.

Geico has some of the best rates in the industry and an easy-to-use online platform. USAA is well known for providing veteran members and their families the best services and benefits.

Nevertheless, it is still wise to compare quotes from the best auto insurance companies to get a policy that suits your lifestyle and ensures your driving safety.

Our Top 10 Company Picks: Best Berkeley Springs, West Virginia Auto Insurance

| Company | Rank | UBI Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 40% | A+ | Reliable Coverage | Nationwide |

| #2 | 25% | A++ | Discount Options | Geico | |

| #3 | 30% | A++ | Military Discounts | USAA | |

| #4 | 30% | B | Local Agents | State Farm | |

| #5 | 30% | A+ | Flexible Pricing | Progressive | |

| #6 | 30% | A | Comprehensive Plans | Liberty Mutual |

| #7 | 20% | A++ | Strong Service | Travelers | |

| #8 | 20% | A | Personalized Care | American Family | |

| #9 | 40% | A+ | Extensive Coverage | Allstate | |

| #10 | 15% | A | Coverage Variety | Farmers |

Start comparing total coverage auto insurance rates by entering your ZIP code above.

- Nationwide stands out as the top pick for comprehensive coverage and service

- Geico and USAA offer competitive rates and unique benefits for drivers

- Berkeley Springs drivers enjoy coverage options that balance protection and cost

#1 – Nationwide: Top Overall Pick

Pros

- Tailored Policies: Explore our Nationwide auto insurance review to see how it offers customizable options for the best auto insurance in Berkeley Springs.

- Accident Forgiveness: Nationwide’s accident forgiveness program helps protect careful drivers in Berkeley Springs from premium hikes after their first accident, offering peace of mind on the road.

- Strong Mobile Features: Locals in Berkeley Springs also appreciate the convenience of mobile applications that allow easy policy management and claims adjustment in no time.

Cons

- Higher Charges: Some drivers find Nationwide’s premiums higher than those of other West Virginia car insurance companies.

- Claims Delays: There have been occasional reports of delays in processing claims, leaving some residents frustrated when quick resolutions are needed.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Geico: Best for Discount Options

Pros

- Affordable Pricing: Compared to other auto insurance providers in Berkeley Springs, Geico has one of the best pricing policies.

- Convenient Tools: Based on our Geico auto insurance review highlights its user-friendly website, which makes it easy for Berkeley Springs residents to obtain quick quotes.

- Discount Opportunities: Geico has a variety of discounts, including policies for safe drivers, which allows drivers in Berkeley Springs to lower their rates.

Cons

- Limited Personal Touch: Considering that there are few local agents in Berkeley Springs, a driver may receive less personalized service than from competing companies.

- Coverage Limitations: Standard policies may need more features in comprehensive plans, which could leave some drivers in Berkeley Springs wanting more coverage options.

#3 – USAA: Best for Military Discounts

Pros

- Top-Notch Service: USAA scores highly in customer assessment, which makes it popular among military families looking for the best auto insurance in Berkeley Springs.

- Member Rates: In our USAA auto insurance review discusses how affordable premiums maximize coverage for eligible members in Berkeley Springs.

- Quick Claims Handling: Many USAA Berkeley Springs members acknowledge the organization’s quick processing of claims, a source of great comfort in stressful times.

Cons

- Membership Limitations: USAA offers services to active duty personnel and their dependents, which may restrict access for some people living in Berkeley Springs.

- Less Flexibility: Some Berkeley Springs customers might need more coverage options than broader providers.

#4 – State Farm: Best for Local Agents

Pros

- Local Agent Network: The extensive network of agents at State Farm facilitates the ability of drivers in Berkeley Springs to assess and select the best suitable policy.

- Safe Driving Rewards: In the Drive Safe & Save program, residents of Berkeley Springs can engage in safe driving practices and get discounts.

- Reliable Claims Process: View our State Farm auto insurance review to learn about its well-regarded claims-handling process in Berkeley Springs.

Cons

- Potentially High Rates: Certain policyholders in Berkeley Springs, particularly those with a poor history, may notice increased premiums.

- Online Tools May Lag: The website and app could be more user-friendly for Berkeley Springs customers than competitors.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Progressive: Best for Flexible Pricing

Pros

- Flexible Pricing: The Name Your Price tool helps Berkeley Springs customers find coverage within their budget for the best auto insurance.

- Safe Driving Incentives: The Snapshot program rewards good driving habits among Berkeley Springs drivers with potential discounts.

- Informative Resources: Explore our Progressive auto insurance review for insights into how it clarifies various policy options for Berkeley Springs residents.

Cons

- Inconsistent Premiums: Insurance coverage options tend to be overpriced for every resident of Berkeley Springs since they depend on the person’s driving history.

- Mixed Claims Experience: While some Berkeley Springs residents are satisfied with the Company’s approach to handling claims, others have had a different experience

#6 – Liberty Mutual: Best for Comprehensive Plans

Pros

- Diverse Choices: Liberty Mutual provides a range of policies tailored to meet the needs of different drivers in Berkeley Springs.

- Safe Driving Discounts: Discover our Liberty Mutual auto insurance review highlighting how the RightTrack program rewards responsible drivers in Berkeley Springs.

- 24/7 Support: Customer service is accessible around the clock for assistance in Berkeley Springs.

Cons

- More significant Costs: Some Berkeley Springs drivers may find Liberty Mutual’s prices to be on the higher side.

- Complicated Claims: The claims procedure can sometimes be lengthy and confusing for residents in Berkeley Springs.

#7 – Travelers: Best for Strong Service

Pros

- Customizable Coverage: Travelers allows customers in Berkeley Springs to select from a range of policies for the best auto insurance.

- Financial Stability: Strong ratings provide confidence in claims payouts for Berkeley Springs residents.

- User-Friendly App: See our Travelers auto insurance review to learn how the app simplifies policy management and claim filing for Berkeley Springs residents.

Cons

- Claims Process Issues: Some Berkeley Springs customers report difficulty handling claims.

- Premium Hikes: Rates for Berkeley Springs residents can be more expensive for those with certain risk factors.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – American Family: Best for Personalized Care

Pros

- Personalized Coverage: View our American Family auto insurance review to explore how it emphasizes customized policies for Berkeley Springs drivers.

- Strong Support: The commitment to service experienced by the American Family helps enrich the overall experience of the immigrants to Berkeley Springs.

- Bundling Discounts: American Family has excellent offers for its clients in Berkeley Springs who purchase several insurance products in one policy.

Cons

- Higher Rates: Some residents of Berkeley Springs could view the rates provided by American Family as more expensive than other insurance providers.

- Limited Availability: Certain parts of Berkeley Springs might have restricted access to American Family’s services.

#9 – Allstate: Best for Extensive Coverage

Pros

- Extensive Agent Network: Berkeley Springs residents seeking the best car insurance can benefit from the company’s vast network of local agents.

- Safe Driving Incentives: Allstate’s Drivewise program is available to the residents of Berkeley Springs residents and offers discounts to drivers who demonstrate safe driving habits.

- Helpful Online Tools: Based on our Allstate auto insurance review, discover how resources simplify policy management for customers in Berkeley Springs.

Cons

- Higher Rates for Some: Many customers in Berkeley Springs note that Allstate’s premiums can be expensive, especially for younger drivers.

- Variable Claims Processing: Claims experiences for the residents of Berkeley Springs may vary from one person to the other, leading to some dissatisfaction among the people.

#10 – Farmers: Best for Coverage Variety

Pros

- Customizable Options: Farmers offers various options to satisfy customers looking for the best auto insurance in Berkeley Springs.

- Bundling Benefits: Check our Farmers auto insurance review to see how bundling auto and home insurance can bring significant savings for Berkeley Springs.

- Educational Resources: Farmers help the customers by providing them with the necessary tools for making informed decisions.

Cons

- Premiums Increase: In Berkeley Springs, drivers with little driving experience incur high insurance coverage rates.

- Slow Claims Processing: There are times that the processing of the settlement of claims takes excessively long and inconveniences some clients in Berkeley Springs.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Best Berkeley Springs Auto Insurance: Coverage Comparison

When looking for the best Berkeley Springs, West Virginia auto insurance, it’s crucial to evaluate the monthly rates of various insurance providers, especially about the coverage options they offer.

Berkeley Springs, West Virginia Auto Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $80 | $170 | |

| $75 | $165 | |

| $76 | $167 | |

| $65 | $145 | |

| $75 | $165 |

| $60 | $140 |

| $70 | $155 | |

| $66 | $150 | |

| $72 | $152 | |

| $62 | $135 |

The following table compares the monthly rates for minimum and full coverage offered by various insurance companies.

Geico and Nationwide offer their clients competitive insurance prices and excellent customer service. As a result, they make excellent vehicle insurance agencies for drivers on a tight budget. USAA is the best coverage option for military members and their families, offering fantastic customer service and bespoke cover options.

Considering these aspects and costs, drivers can find coverages that fit their budget and, at the same time, get the needed protection and assistance. For additional details, explore our comprehensive resource, “Full Coverage Auto Insurance.”

Discount Opportunities for Auto Insurance in Berkeley Springs

When searching for low-priced insurance coverage, it is essential to consider the discounts offered by the major providers. Many of the leading insurance providers in Berkeley Springs have made it possible for most drivers to reduce their costs considerably, more so when they combine multiple discounts wisely.

The following table summarizes the discounts the leading providers offer, which should help drivers looking for the cheapest car insurance in West Virginia, auto insurance, to narrow their search.

Auto Insurance Discounts From the Top Providers in Berkeley Springs, West Virginia

| Insurance Company | Available Discounts |

|---|---|

| Multi-Policy, Safe Driver, Good Student, Drivewise, Accident-Free, Anti-Theft | |

| Multi-Policy, Safe Driver, Good Student, Defensive Driving, Accident-Free, Vehicle Safety | |

| Multi-Policy, Safe Driver, Good Student, Accident-Free, Defensive Driving, Homeowners | |

| Multi-Policy, Safe Driver, Good Student, Military, Anti-Theft, Emergency Deployment | |

| Multi-Policy, Safe Driver, New Vehicle, Good Student, Accident-Free, Homeowners |

| Multi-Policy, Safe Driver, Accident-Free, Anti-Theft, Good Student, Defensive Driving |

| Multi-Policy, Safe Driver, Snapshot, Homeowners, Good Student, Continuous Coverage | |

| Multi-Policy, Safe Driver, Good Student, Defensive Driving, Accident-Free, Vehicle Safety | |

| Multi-Policy, Safe Driver, Good Student, New Car, Accident-Free, Homeowners | |

| Military, Multi-Policy, Safe Driver, Good Student, Vehicle Safety, Annual Mileage |

Geico, for example, offers military and emergency deployment discounts, providing valuable savings for service members. Liberty Mutual and Nationwide offer discounts for vehicles with safety features like anti-theft systems, helping safety-conscious drivers save more.

Progressive’s Snapshot review program rewards safe driving habits, while USAA offers discounts on low annual mileage and additional savings on vehicle safety for military families.

Drivers in Berkeley Springs can use these discounts and get quality coverage at a cheaper rate; hence, it is easy to balance protection and cost savings.

Minimum Auto Insurance Requirements in Berkeley Springs

Drivers should also understand the minimum coverage obligations when focusing on the best Berkeley Springs, West Virginia, auto insurance. In West Virginia, all drivers must obtain liability insurance with limits for bodily injury and accidents.

These requirements are put in place so drivers can cover damages in the event of an accident, including property damage liability auto insurance coverage, and protecting themselves and others on the road.

West Virginia Minimum Auto Insurance Coverage Requirements & Limits

| Coverage | Limits |

|---|---|

| Bodily Injury Liability | $25,000 per person, $50,000 per accident |

| Property Damage Liability | $25,000 |

Geico has attractive rates and good customer service, allowing easy enhancement of the policy liability limits to the preferred higher levels for drivers. Allstate offers affordable insurance packages with various coverage limits and several benefits that assist drivers in meeting the statutory regulations with sufficient coverage.

Liberty Mutual supplies broad insurance policies beyond the minimum threshold, allowing drivers to experience less stress regarding the coverage limits.

By exploring these providers, drivers in Berkeley Springs can find insurance that meets legal requirements and offers added financial protection.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Best Berkeley Springs, Auto Insurance: Rates by Demographic

Auto insurance rates in Berkeley Springs, West Virginia, fluctuate widely depending on age, gender, and marital status. Knowing the factors that affect auto insurance rates and how each impacts premiums can help residents secure the best possible rates.

For younger drivers, premiums tend to be higher since they haven’t yet accumulated much driving experience. On the other hand, older drivers usually enjoy lower rates because their years behind the wheel indicate lower accident risk.

The table below provides a detailed comparison of monthly rates across several leading insurance providers in Berkeley Springs.

Berkeley Springs, West Virginia Auto Insurance Monthly Rates by Provider, Age, & Gender

| Insurance Company | Age: 17 Female | Age: 17 Male | Age: 25 Female | Age: 25 Male | Age: 35 Female | Age: 35 Male | Age: 60 Female | Age: 60 Male |

|---|---|---|---|---|---|---|---|---|

| $759 | $792 | $238 | $239 | $215 | $200 | $192 | $192 | |

| $465 | $560 | $182 | $190 | $190 | $187 | $180 | $175 | |

| $1,142 | $1,288 | $310 | $342 | $301 | $326 | $242 | $294 |

| $377 | $475 | $167 | $179 | $149 | $151 | $136 | $143 |

| $723 | $813 | $203 | $210 | $170 | $164 | $156 | $156 | |

| $126 | $126 | $113 | $120 | $126 | $126 | $126 | $126 | |

| $468 | $515 | $181 | $180 | $166 | $163 | $168 | $168 |

State Farm in Berkeley Springs, West Virginia, makes a remarkable impression on the residents as they consistently ranked with the lowest rates for nearly all age groups and gender categories. Geico offers quite favorable rates, and Nationwide provides competitive pricing for young drivers and the older population, which is a significant plus.

To locate the best vehicle coverage in Berkeley Springs, obtaining insurance quotes and considering other factors such as age, occupation, driving history, and many others is advisable. It will help you identify cheap West Virginia car insurance companies and secure the most affordable coverage and benefits.

Smart Insurance Options for Teen Drivers in Berkeley Springs, WV

Finding affordable auto insurance for teen drivers in Berkeley Springs, West Virginia, can be daunting. Because young drivers have less driving experience, their insurance premiums are generally much higher than those for more seasoned drivers.

The table below shows monthly auto insurance for 17-year-old drivers in Berkeley Springs, listed by provider and gender.

Berkeley Springs, West Virginia Teen Auto Insurance Monthly Rates by Provider & Gender

| Insurance Company | Age: 17 Female | Age: 17 Male |

|---|---|---|

| $759 | $792 | |

| $465 | $560 | |

| $1,142 | $1,288 |

| $377 | $475 |

| $723 | $813 | |

| $270 | $348 | |

| $468 | $515 |

Teenage drivers find Nationwide to be a good substitute, and young men and women can afford it. Parents who are worried about the cost of insurance for their children will find this quite enticing.

State Farm and Geico provide comparable, affordable rates, making them appropriate for budget-conscious families. While comparing insurance providers takes time, it’s time well spent.

Dani Best Licensed Insurance Agent

It can help you identify the best West Virginia auto insurance company, leading to meaningful savings and peace of mind knowing young drivers are well-protected on the road.

Understanding Senior Auto Insurance Rates in Berkeley Springs

For seniors in Berkeley Springs, West Virginia, understanding auto insurance options and the factors that impact the rates can pay off. With several providers, comparing rates is crucial in finding the best policy for your needs. Seniors often enjoy certain advantages when it comes to auto insurance. Many insurers offer discounts for mature drivers who demonstrate safe driving habits.

It is essential to evaluate specific rates to ensure you secure the best possible deal. Below are the annual average rates available for senior drivers in Berkeley Springs.

Berkeley Springs, West Virginia Senior Auto Insurance Monthly Rates by Provider & Gender

| Insurance Company | Age: 60 Female | Age: 60 Male |

|---|---|---|

| $192 | $192 | |

| $180 | $175 | |

| $242 | $294 |

| $136 | $143 |

| $156 | $156 | |

| $113 | $113 | |

| $131 | $132 |

Nationwide is an excellent option as it provides various coverage alternatives, such as accident forgiveness to avoid premiums increasing after the first accident, and offers specific discounts for senior citizens.

Customers are delighted with State Farm’s services in Berkeley Springs, WV, and praise its excellent customer support. Mobile apps or phones help seniors manage policy and file claims with other added benefits easily. On the other hand, one of the things that Geico boasts about is the discounts and rates that they offer.

Policy provisions that reward safe driving for older people are significant. They benefit the senior age group looking for cost-effective yet dependable policies.

Comparing providers can help seniors identify a plan that fits their budget and includes valuable additional benefits. Seniors have to look for different policies because this will help them look for the most suitable auto insurance based on their needs and budget.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Auto Insurance in Berkeley Springs: Driving History and Premiums

Drivers looking for the best Berkeley Springs, West Virginia auto insurance should consider how their driving record impacts premiums. Driving history with clean records has the lowest premiums.

However, drivers with past accidents, tickets, or DUI offenses often see substantial rate increases. Here’s a breakdown of average annual rates based on driving records for top providers in the area.

Berkeley Springs, West Virginia Auto Insurance Monthly Rates by Provider & Driving Record

| Insurance Company | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| $165 | $265 | $458 | $177 | |

| $158 | $183 | $170 | $170 | |

| $179 | $237 | $275 | $199 |

| $276 | $330 | $330 | $324 | |

| $300 | $354 | $421 | $339 | |

| $187 | $220 | $315 | $227 | |

| $435 | $549 | $608 | $531 |

Nationwide offers consistent and reasonably priced rates, increasing only slightly after an accident or DUI, which makes it attractive to low-risk drivers who have only committed some minor offenses.

Clean record drivers find Geico’s low rates very appealing. However, this brings the challenge of having their rates rise dramatically after an accident or DUI conviction.

USAA provides services to service men and women and their families, does not charge moderate rates, and affects rates minimally, even in cases of violations.

Insurance companies vary their rates on how risky a person’s history is, and a particular driving offense like DUI can significantly affect the total cost.

The table highlights annual policies against car accidents by different companies targeting drivers with DUI, making it easy to see how prices of premiums can change, assisting in knowing the options availed to the drivers in the harsh insurance market.

Berkeley Springs, West Virginia DUI Auto Insurance Rates

| Insurance Company | One DUI |

|---|---|

| $421 | |

| $458 | |

| $608 |

| $275 |

| $330 | |

| $170 | |

| $315 |

Drivers in Berkeley Springs can benefit from analyzing the strengths and weaknesses of insurance providers like Nationwide, Geico, and USAA. The comparison will help to determine which company provides value according to the insurance history of other drivers.

Analyzing these tables with your record enables you to make wise decisions to get the best auto insurance fit for your needs.

To gain further insights, consult our comprehensive guide, “DUI Definition and Implications.”

Credit Scores and Auto Insurance Rates in Berkeley Springs, West Virginia

When searching for the best Berkeley Springs, West Virginia, auto insurance, it’s important to remember how your credit background can considerably affect premium rates. Most insurers rely on credit scores when determining the rates, meaning drivers with bad credit scores will likely pay much higher than those with suitable ranges.

The following table illustrates the annual auto insurance rates in Berkeley Springs, categorized by credit score.

Berkeley Springs, West Virginia Auto Insurance by Provider & Credit Score

| Insurance Company | Poor Credit | Fair Credit | Good Credit |

|---|---|---|---|

| $428 | $341 | $292 | |

| $321 | $261 | $216 | |

| $759 | $466 | $367 |

| $253 | $214 | $200 |

| $364 | $316 | $293 | |

| $244 | $149 | $117 | |

| $351 | $201 | $161 |

For drivers with poor credit, premiums can be notably higher. Nationwide stands out for offering competitive rates and valuable benefits, such as the vanishing deductible, which lowers the deductible for safe driving over time. On the other hand, Budget-conscious drivers prefer State Farm or Geico, which typically offer good selections regardless of a person’s credit score.

To obtain excellent coverage, Berkeley Springs homeowners need to know how credit scores affect auto insurance rates. After evaluating each provider and their benefits, choosing affordable car insurance makes the most sense.

Mileage Matters: Savings on Berkeley Springs Auto Insurance

When looking for the best Berkeley Springs, West Virginia auto insurance, it’s helpful to consider how your commute length and yearly mileage can impact your premiums.

Insurance providers often consider factors in the amount you drive—typically, shorter commutes mean lower premiums since there’s less risk on the road.

The following table presents annual auto insurance rates in Berkeley Springs.

Jeff Root Licensed Insurance Agent

Drivers with shorter commutes, such as those traveling 6,000 miles annually, generally benefit from lower premiums.

Bellflower, California Auto Insurance Monthly Rates by Provider & Annual Mileage

| Insurance Company | 6,000 Miles | 12,000 Miles |

|---|---|---|

| $371 | $452 | |

| $409 | $493 | |

| $218 | $262 | |

| $254 | $300 |

| $400 | $506 |

| $309 | $311 | |

| $406 | $437 | |

| $286 | $350 | |

| $220 | $256 |

Insurers like USAA and Geico favor low-mileage drivers for their competitive rates. In contrast, drivers commuting 12,000 miles pay higher premiums due to the increased risks tied to longer distances. Nationwide, Farmers typically charge more for these high-mileage drivers.

Drivers should understand and choose the best car insurance in West Virginia by weighing various car insurance providers and their services against one’s driving patterns. To learn more, explore our comprehensive insurance resource, “How Annual Mileage Affects Your Auto Insurance Rates.”

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Auto Insurance Coverage Levels in Berkeley Springs, West Virginia

While looking for the best Berkeley Springs, West Virginia auto insurance, knowing the impact of different coverage levels on your premium is helpful. Most policies have three levels: low, medium, and high.

Each level has its purposes and affordability. Low coverage meets the minimum legal requirements, making it a popular choice for budget-conscious drivers, especially those with older cars or fewer assets.

Providers like Geico and USAA often have competitive rates in this category, helping drivers get essential protection at a reasonable cost. Lots of people buy Medium Coverage. It gives you some extra safety but keeps your expenses relatively high. It is a compromise between costs and comfort.

The following table outlines the various coverage levels and associated costs from different providers.

Berkeley Springs, West Virginia Auto Insurance Monthly Rates by Coverage Level

| Insurance Company | Low Coverage | Medium Coverage | High Coverage |

|---|---|---|---|

| $343 | $353 | $365 | |

| $250 | $267 | $281 | |

| $504 | $529 | $558 |

| $218 | $221 | $228 |

| $312 | $321 | $340 | |

| $161 | $170 | $180 | |

| $229 | $237 | $246 |

This level works for most drivers who want extra safety but do not wish to increase their monthly payments significantly. High coverage will satisfy those who want the highest level of security available because it covers all hazards, including robbery, accidents, and even personal injury protection.

This choice best suits people who own expensive cars and extensive property—organizations like Nationwide and Progressive design plans to provide the additional coverage you need.

The adequate coverage limit comes down to your priorities, budget, and comfort with risk. Once you evaluate these factors, you’ll be ready to choose the best West Virginia auto insurance plan that provides the proper protection for your time on the road.

Discovering the Best Rates for Auto Insurance in Berkeley Springs

Auto insurance quotes in Berkeley Springs, West Virginia, are essential for those drivers who want to save while getting the right auto insurance coverage. In the following sections, we present the cheapest providers per different driver profiles to help you obtain the best rates suitable for your requirements.

Cheapest Berkeley Springs, West Virginia Auto Insurance Providers by Driver Profile

| Driver Profile | Insurance Company |

|---|---|

| Teenager | |

| Senior | |

| Clean Record | |

| One Accident | |

| One DUI | |

| One Ticket |

In terms of rates, State Farm has proven to be the most competitive among other insurance companies for nearly all drivers, from teens who are just learning the ropes to senior citizens to those with clean records. State Farm has affordable options for people with one accident, DUI, or traffic ticket, which makes it useful for many.

It is always helpful to compare rates while determining how to get the best price for the right policy and which profile works best for you. To delve deeper, refer to our in-depth report titled “How Auto Insurance Companies Check Driving Records.”

Factors Affecting Auto Insurance Rates in Berkeley Springs

When searching for the best Berkeley Springs, West Virginia, auto insurance requires understanding the various factors that impact insurance rates. Numerous local and personal elements contribute to the fluctuations in premiums.

Local Traffic and Theft Rates

The decisions you make in your everyday life, especially where you live and the distance you commute, directly influence the amount you pay for auto insurance.

Berkeley Springs, West Virginia Report Card: Auto Insurance Premiums

| Category | Grade | Explanation |

|---|---|---|

| Discounts Available | A | Variety of discounts offered to policyholders |

| Customer Service | A- | Responsive and helpful customer support |

| Claims Processing | B+ | Efficient claims processing with some delays |

| Premiums Comparison | B | Rates are competitive but higher than state average |

Also, understanding the traffic in your area and the likelihood of car theft can help you significantly improve your rate. Explore our detailed resource, “Does auto insurance cover vehicle theft?”

Commute Length

The distance you travel to work daily significantly affects your car insurance rates. Longer commutes typically lead to higher premiums as spending more time on the road increases the chances of an at-fault accident occurring.

Berkeley Springs, West Virginia Auto Accident & Insurance Claim Statistics

| Factor | Value |

|---|---|

| Accidents Per Year | 120 |

| Claims Per Year | 85 |

| Average Claim Cost | $4,200 |

| Percentage of Uninsured Drivers | 12% |

| Vehicle Theft Rate | 1.8 per 1,000 vehicles |

| Traffic Density | Moderate |

| Weather-Related Incidents | High (Snow/Ice) |

A policyholder with a shorter commute is likely to pay lower insurance costs. In Berkeley Springs, the average commute time is 26.9 minutes, a factor that insurers may consider when evaluating risk and determining pricing.

Considering the local environment and their driving profiles, they can help find the most affordable car insurance in Berkeley Springs, West Virginia, which is also the most suitable.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

A Smart Driver’s Guide to Auto Insurance in Berkeley Springs, WV

Determining the best Berkeley Springs, West Virginia, narrows down to meeting the most appropriate coverage options with your demands and budget.

Prominent companies like Nationwide, Geico, and USAA offer various benefits and advantages that you should carefully consider to find the one most suited to your needs. For instance, when providing extensive coverage focusing on customer appreciation, Nationwide is the best alternative for those whose quest is reliability.

Prominent companies like Nationwide, Geico, and USAA offer various benefits and advantages that you should carefully consider to find the one most suited to your needs.

For instance, when providing extensive coverage focusing on customer appreciation, Nationwide is the best alternative for those whose quest is reliability. Geico appeals to those who are more price-sensitive drivers.

Daniel Walker Licensed Insurance Agent

Offering financial benefits designed for military members and their families, USAA is one of the best choices.

While deciding which is the best type of auto insurance policy one should consider their driving record, the car’s safety features, and the available discounts. By doing so, residents can seek services from an insurance agency in Berkeley County known for its low rates, comprehensive coverage, and commitment to ensuring safety and comfort while on the road.

Explore your auto insurance options by entering your ZIP code into our free comparison tool below today.

Frequently Asked Questions

What is the average cost of auto insurance in Berkeley Springs?

Auto insurance rates in Berkeley Springs, West Virginia, vary by provider, with minimum coverage starting at $60 with Nationwide, $62 with USAA, and $65 with Geico. Residents are encouraged to compare these options to find the coverage that best fits their needs.

Who is the cheapest car insurance company in WV?

Geico is highlighted as having some of the best rates in the industry, making it one of the most cheap car insurance in Berkeley County, WV.

Enter your ZIP code into our free quote tool below to find the best auto insurance providers for your needs and budget.

What are Berkeley Springs’s minimum requirements for auto insurance?

In West Virginia, drivers must maintain liability insurance, including coverage for bodily injury liability and property damage liability.

What type of auto insurance is cheapest in Berkeley Springs?

Affordable auto insurance in Berkeley Springs, WV, usually involves liability coverage meeting state requirements. Comparing car insurance quotes in Berkeley Springs is essential, as rates vary by individual factors.

What is the best Berkeley Springs, West Virginia auto insurance for first-time car owners?

When it comes to first-time cars, Nationwide stands out due to its all-around coverage and efficient customer service. Geico suits new drivers as well due to its cost-effectiveness.

What is the liability limit in West Virginia?

In West Virginia, drivers must carry liability-only auto insurance, but the regulations do not specify exact liability limits. Consider getting auto insurance quotes in Parkersburg and Berkeley Springs for accurate coverage.

Which is the most expensive form of auto insurance in Berkeley Springs?

High-coverage auto insurance, which provides extensive protection and is suited for those with expensive vehicles or significant assets, is generally the most expensive form of auto insurance in Berkeley County, WV.

At what age is auto insurance cheapest in Berkeley Springs, West Virginia?

Cheap car insurance in West Virginia is typically most affordable for older drivers. Premiums tend to be lower for older drivers compared to younger drivers, who often face higher rates due to their limited driving experience.

Does Berkeley Springs, West Virginia require uninsured motorist coverage?

Berkeley Springs, West Virginia, requires uninsured and underinsured motorist coverage as part of its minimum insurance requirements. This coverage helps protect drivers in an accident with an uninsured driver.

Do I need insurance to register a car in West Virginia?

In most states, vehicle registration requires a validity check on an insurance policy, which is often mandatory. Working with an independent insurance agent, Berkeley County WV, can help ensure your policy meets state requirements.

Protect your vehicle at the best prices by entering your ZIP code into our free auto insurance quote comparison tool.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.