Best Auto Insurance for a Student Away at College in 2026 (Big Savings With These 8 Companies)

The best auto insurance for a student away at college comes from Geico, Liberty Mutual, and USAA. #1 in the rankings, Geico stands out for its good student discount, offering up to 25% off monthly rates. You can find rates for students away at college for as low as $69 per month

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Managing Editor

Laura Kuhl holds a Master’s Degree in Professional Writing from the University of North Carolina at Wilmington. Her career began in healthcare and wellness, creating lifestyle content for doctors, dentists, and other healthcare and holistic professionals. She curated news articles and insider interviews with investors and small business owners, leading to conversations with key players in the le...

Laura Kuhl

Licensed Insurance Agent

Brandon Frady has been a licensed insurance agent and insurance office manager since 2018. He has experience in ventures from retail to finance, working positions from cashier to management, but it wasn’t until Brandon started working in the insurance industry that he truly felt at home in his career. In his day-to-day interactions, he aims to live out his business philosophy in how he treats hi...

Brandon Frady

Updated August 2025

19,116 reviews

19,116 reviewsCompany Facts

Full Coverage

A.M. Best

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 3,792 reviews

3,792 reviewsCompany Facts

Full Coverage

A.M. Best

Complaint Level

Pros & Cons

3,792 reviews

3,792 reviews 6,590 reviews

6,590 reviewsCompany Facts

Full Coverage

A.M. Best

Complaint Level

Pros & Cons

6,590 reviews

6,590 reviewsThe best auto insurance for a student away at college can be found at Geico, Liberty Mutual, and USAA. Geico takes the lead as the provider with the best car insurance for college students, with a standout good student discount.

Our Top 8 Company Picks: Best Auto Insurance for Students Away at College

| Company | Rank | Distant Student | Good Student | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 25% | 15% | Students Away | Geico | |

| #2 | 25% | 12% | Parental Coverage | Liberty Mutual |

| #3 | 22% | 10% | Military Students | USAA | |

| #4 | 20% | 35% | Good Students | State Farm | |

| #5 | 20% | 25% | Low Mileage | Allstate | |

| #6 | 20% | 18% | Solo Coverage | Nationwide |

| #7 | 10% | 8% | Comprehensive Coverage | Travelers | |

| #8 | 10% | 10% | Competitive Rates | Progressive |

Young drivers’ high-risk status can lead to inflated premiums for inexperienced drivers’ vehicles, but the best car insurance for college students helps keep rates more affordable.

You can read more about car insurance for a college student in our auto insurance for drivers under 25 years old guide.

- Drivers with under five years of experience are considered high-risk

- College students excelling academically will receive a good student discount

- Independent college students should buy their own auto insurance policy

If you’re a college student looking for car insurance, enter your ZIP code to start comparing cheap student rates today

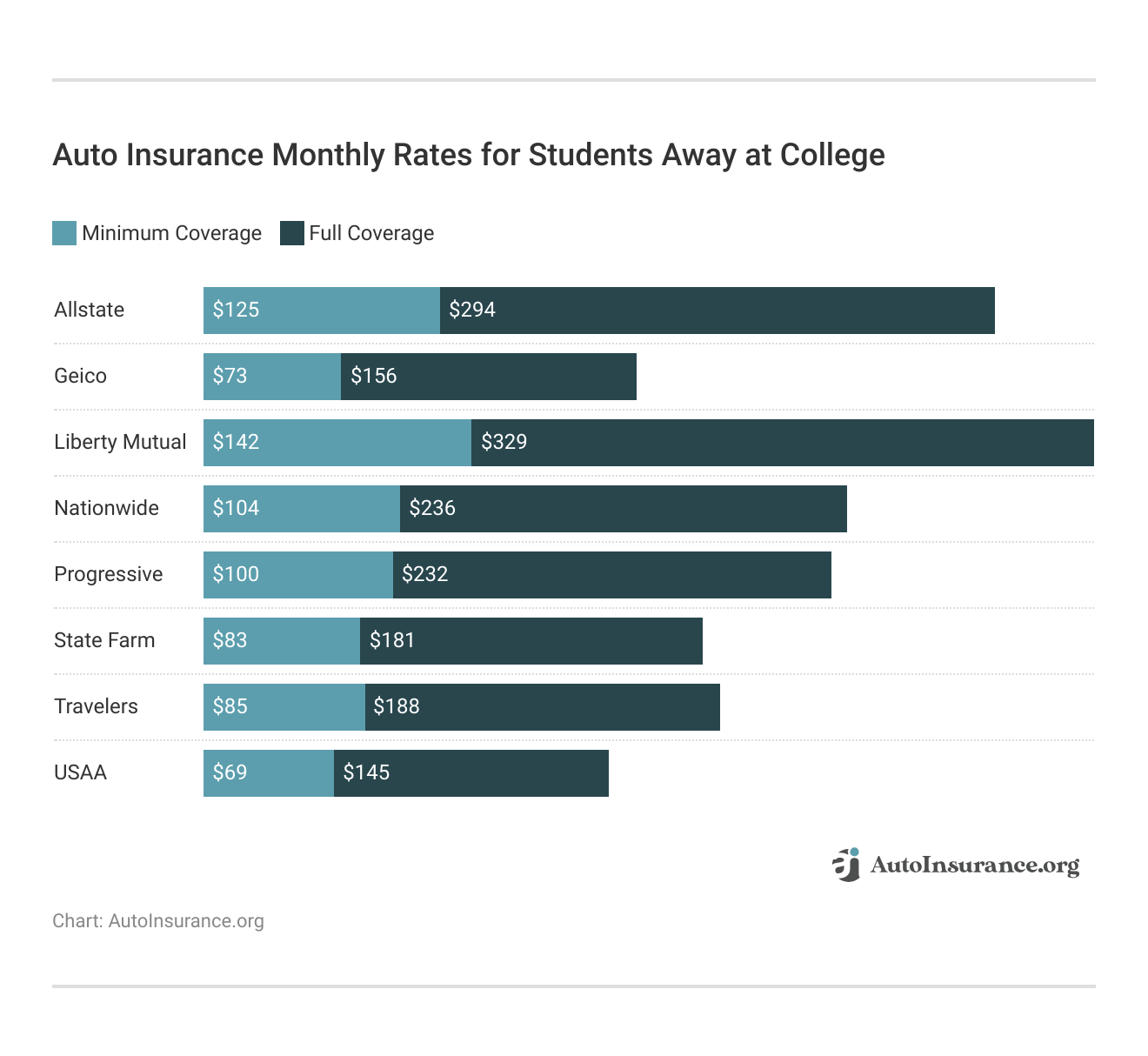

College Student Auto Insurance Rates

When students attend school far away from their childhood homes, there may still be a need for auto insurance coverage. It all depends on whether the student takes a car with them or if they regularly use other vehicles to commute to school or work.

You should also be looking into what companies offer the cheapest car insurance for college students.

USAA has the most affordable car insurance for college students, but college students will only qualify if they are military or their parents are veterans or military service members (Read More: Best Auto Insurance for Military Families and Veterans). If students don’t qualify for USAA, Geico has the best auto insurance for students at an affordable rate.

A student’s driving record will also affect auto insurance rates.

College Student Auto Insurance Monthly Rates by Driving Record

| Insurance Company | Clean Record | One Ticket | One Accident | One DUI |

|---|---|---|---|---|

| $318 | $382 | $445 | $530 | |

| $153 | $184 | $215 | $260 | |

| $398 | $478 | $558 | $665 |

| $239 | $287 | $335 | $400 | |

| $400 | $480 | $560 | $660 | |

| $178 | $214 | $250 | $295 | |

| $443 | $532 | $620 | $730 | |

| $125 | $150 | $175 | $210 |

Students with clean driving records will find it easiest to get cheap car insurance for college students.

You should always keep students on your insurance if they are regularly driving to college. You know you have to insure a car that they take with them, but you should also have that barrier of protection if the student will be borrowing or renting cars.

It’s better to pay for good car insurance for students than to face an uninsured loss, where you could lose everything.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Coverage for a College Student Still on Your Policy

You might be surprised at how many different scenarios your teen might need coverage to drive a car when they are away. You can’t keep an eye on your college student all the time, so you don’t truly know if they will be driving.

Read More: Auto Insurance for Different Types of Drivers

As much as you’d like to trust your children, it’s always possible that they are doing things they aren’t telling you. Even though the intention is innocent, if something happens while they are driving a non-owned car, that innocent joyride can turn into a nightmare.

Here are scenarios where your teen will be covered if you keep them on your policy:

- They drive a friend’s car while they are away at school

- They have to drive someone else’s car because of an emergency near the campus

- They return home and drive their vehicles or their friends’ vehicles in your local area

As long as your college student hasn’t taken a family car to school, they can stay on your auto insurance policy. This will ensure they have good car insurance for college students when driving a car.

Reasons to Include a Student Away at College in Your Policy

If you were lucky enough to convince your student to attend a college in your local area, you don’t have to worry about saying the emotional goodbyes. Some young adults want to move as far away from home as possible to enjoy their newfound independence, and others understand just how much it costs to move to a new state or city.

As long as your child is living in your home while attending a local college or university, you should keep him or her on your auto insurance just like they were when they were in high school. If they move away but don’t have a car, you can still keep them on your auto insurance policy as your home is still their primary address.

Learn More: Should I add my teenager to my auto insurance policy?

You have to take a step back and assess the whole situation so that you can fully comprehend why it’s so important to approach the insurance topic the right way.

Students who are away at college are usually still dependents. When you have a dependent who drives, it always puts you at risk.Kristen Gryglik Licensed Insurance Agent

If you’re paying for room and board or you’re helping your child pay for college tuition, they are financially dependent on you, and this can work against you if there’s ever an accident.

When parents remove their children too soon, they will not have liability protection to pay for claims made by other drivers. They also will not be entitled to have the insurance company cover the cost of legal defense.

Discounts Available for Students Who Go Away to College

A student who is attending school miles and miles away from you without their car isn’t quite the same type of risk as a student who still lives with you. They may still be a risk, but they aren’t exposed to the same level of risk as a student who has regular access to a vehicle and who can come and go as they please.

Most companies have a student away at school discount for students attending full-time school at least 100 miles from their primary residence.

For the student to qualify for the savings, they must be 24 or younger. You may have to provide proof of their attendance at a school far away to get car insurance with a student discount. Some other student discounts on car insurance include bundling and multi-car discounts.

Top Auto Insurance Discounts for Students

| Insurance Company | Bundling | Distant Student | Good Student | Safe Driver | UBI |

|---|---|---|---|---|---|

| 25% | 20% | 22% | 18% | 30% | |

| 25% | 25% | 15% | 15% | 25% | |

| 25% | 25% | 12% | 20% | 30% |

| 20% | 20% | 18% | 12% | 25% | |

| 10% | 10% | 10% | 10% | $231/yr | |

| 17% | 20% | 35% | 20% | 20% | |

| 13% | 10% | 8% | 17% | 30% | |

| 10% | 22% | 10% | 10% | 30% |

Ask your insurance agent if they offer insurance discounts to help get the cheapest student car insurance, whether you are looking at rates for car insurance for an 18-year-old college student per month or a 20-year-old.

Both local and distant students can qualify for good student discounts as long as they earn a 3.0 GPA or higher and they are attending college full-time.Daniel Walker Licensed Insurance Agent

Discounts like the Progressive good student discount and the Geico student discount for getting good grades are a great incentive for your student to do well in school and score cheap auto insurance for college students (Read More: How to Get a Good Student Auto Insurance Discount).

Along with discounts for student drivers like the Progressive student discount, you can also check into discounts for safe drivers if the student has a good driving record. If they completed driver education, the student may be eligible for a driver training discount, making it even easier to get cheap auto insurance for students.

Let your college student stay on your policy for as long as they are dependent on you. When they become independent, they can start to shop for their policy.

Students shopping for their own policy can get quotes directly from their top companies or use a quote comparison tool to quickly find the cheapest rate.

8 Best Insurance Companies for a Student Away at College

We’ve ranked the best companies for student car insurance plans below. Each one offers great car insurance for college students away from home, and we’re sharing the pros and cons of each to help you make the right choice.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#1 – Geico: Top Pick Overall

Pros

- User-Friendly: Geico’s intuitive online tools and mobile app make it easy to manage auto insurance for students.

- Quick Claims Process: Geico is known for its streamlined claims process, ensuring college students receive prompt assistance.

- Coverage Options: Geico provides a range of coverage options, allowing college students to customize their policies, which you can learn more in our Geico auto insurance review.

Cons

- Limited Agent Interaction: Geico’s emphasis on online services may not be suitable for college students who prefer face-to-face interactions with agents.

- May Not be Cheapest for All Drivers: While competitive, Geico’s college student car insurance rates may not be the cheapest car insurance for college students away from home.

#2 – Liberty Mutual: Parental Coverage

Pros

- Best for Staying on Parent’s Policy: Liberty Mutual’s online tools are great for students staying on a parent’s policy, as they make it easy for parents to adjust their college students policies and make updates.

- Various Coverage Options: Liberty Mutual provides a wide range of coverage options, allowing college students to tailor their policies. You can learn more in our Liberty Mutual auto insurance review.

- Customer Service Reputation: Liberty Mutual is recognized for its strong customer service.

Cons

- Rates Not as Competitive: While strong in service, Liberty Mutual’s student car insurance quotes may not be the most competitive in certain regions.

- Fewer Unique Discounts: Liberty Mutual may not have as many specialized discounts as some other insurers.

#3 – USAA: Best for Military Students

Pros

- Military Students: USAA offers great coverage options to students in the military or students with military or veteran parents.

- Members-Only Benefits: USAA offers exclusive benefits for its members, enhancing the overall value for college students. You can learn more about USAA’s benefits in our USAA auto insurance review.

- Financial Stability: USAA’s financial stability provides college students with confidence in the company’s ability to meet its obligations.

Cons

- Membership Eligibility Restrictions: USAA is limited to military members and their families, potentially excluding some college students.

- Fewer Physical Branches: USAA’s limited number of physical branches may be a disadvantage for college students who prefer in-person interactions.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#4 – State Farm: Best for Good Students

Pros

- Good Students: State Farm offers a 35% discount to students under 25 with a 3.0 grade average or higher.

- Personalized Service: State Farm’s extensive network of agents provides college students with personalized service and assistance. Learn more in our State Farm auto insurance review.

- Educational Resources: State Farm offers educational resources to help customers better understand their college student auto insurance options.

Cons

- Premiums May Be Higher: State Farm’s focus on personalized service may come with slightly higher premiums.

- Limited Online Quotes: State Farm’s online quoting system may not be as user-friendly as some competitors.

#5 – Allstate: Best for Low Mileage

Pros

- Milewise For Students Who Drive Infrequently: Students who rarely drive can sign up for Allstate’s Milewise insurance program, where coverage is paid for by the mile.

- Claim Satisfaction Guarantee: Allstate guarantees that customers will be satisfied with their claims experience, adding an extra layer of assurance.

- Discounts for Safety Features: Allstate may offer discounts for vehicles equipped with safety features. You can learn more about Allstate’s discounts in our Allstate auto insurance review.

Cons

- Higher Premiums: Allstate’s premium rates may be on the higher side for some college students, so it may not be the best for cheap insurance for students.

- Fewer Discounts: While providing discounts, Allstate may not have as many discount options as some competitors.

#6 – Nationwide: Best for Solo Coverage

Pros

- Great for Students Buying Own Coverage: Nationwide offers a personalized On Your Side insurance review to help college students buying their own policy identify potential coverage gaps.

- Bundle Discounts: College students can benefit from Nationwide’s discounts when bundling multiple policies.

- Good Student Discount: Nationwide may provide discounts for college students with good academic standing. You can find more discount options in our Nationwide auto insurance review.

Cons

- Higher Premiums: Nationwide’s premiums for auto insurance for college students may be relatively higher compared to other providers.

- Fewer Safe Driver Discounts: While offering discounts, Nationwide may not have as many options specifically for safe driving habits.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#7 – Travelers: Best for Comprehensive Coverage

Pros

- Customizable Coverage Options: College students can tailor their policies with Travelers to meet their specific needs. You can learn more in our Travelers auto insurance review.

- Educational Resources: Travelers provides educational resources to help college students understand their insurance options.

- Strong Financial Stability: Travelers’ financial stability provides assurance to college students regarding the company’s reliability.

Cons

- Fewer Local Agents: Travelers may have fewer local agents compared to some traditional insurance companies.

- Rates Vary by Location: Travelers’ rates may vary, and customers should compare car insurance quotes for students to ensure competitive pricing.

#8 – Progressive: Best for Competitive Rates

Pros

- Competitive Rates: Progressive’s emphasis on competitive rates makes it an attractive option for college students.

- Name Your Price Tool: Progressive’s unique tool allows college students to set their budget and find a policy that fits within that range.

- Customer Service Reputation: Progressive is known for its commitment to customer service. You can learn more in our Progressive auto insurance review.

Cons

- Customer Experiences May Vary: While generally strong, some individuals may have varying customer service experiences.

- Fewer Local Agents: Progressive may have fewer local agents compared to some traditional insurance companies.

Ready to find affordable auto insurance rates online for students at college? Start comparison shopping for insurance for college students today to find an auto insurance company near you that offers car insurance discounts for students. Find cheap car insurance for students today by entering your ZIP in our free quote tool.

Frequently Asked Questions

Do college students need auto insurance if they are living away from home?

Yes, college students who have a vehicle and are living away from home should have auto insurance. It is important to maintain coverage to protect against accidents, theft, and other unforeseen events.

Will my child be covered under my auto insurance policy while they are at college?

It depends on the specific policy and insurance company. Some auto insurance policies may extend coverage to children who are attending college and living away from home. It’s best to contact your insurance provider to confirm the details and any potential limitations.

Find affordable car insurance for students today by using our free quote tool to comparison shop, whether you are shopping for cheap car insurance for college students in California or Pennsylvania.

What if my child doesn’t have a car at college, do they still need auto insurance?

If your child doesn’t have a car at college and won’t be driving any vehicle, they may not need their own car insurance student policy. However, it’s essential to review your existing policy to ensure it covers them adequately when they occasionally borrow or rent a car (Read More: Do you need auto insurance if you don’t drive your car?).

Can my child stay on my auto insurance policy if they attend college out of state?

In most cases, yes, your child can remain on your auto insurance policy if they attend college out of state, and you may even get student discounts on car insurance with a student away discount.

Auto insurance policies typically cover drivers in various locations. However, it is recommended to inform your insurance provider about the change in location to ensure your child remains properly covered.

Do college students get a discount on car insurance?

Yes, many insurance companies offer discounts specifically for college students. Common discounts include good student discounts for maintaining high grades, distant student discounts if the student is attending a college far from home, and discounts for completing driver’s education courses (Learn More: Best Driver’s Ed Auto Insurance Discounts).

Contact your insurance provider to inquire about available car insurance discounts for college students.

Should my child notify the insurance company about their college attendance?

Yes, it’s important for your child to inform the insurance company about their college attendance, especially if they are taking a vehicle with them. Notifying the insurance company ensures that they are aware of the change in circumstances and can adjust coverage accordingly.

What happens if my child gets into an accident while at college?

If your child gets into an accident while at college, the insurance coverage should typically apply, provided they are properly insured. The claims process will proceed as it would for any other accident. It’s important to report the accident to the insurance company promptly and follow their instructions.

Does State Farm offer any programs to students away at college?

State Farm offers the Drive Safe and Save Program to students away at college (Learn More: State Farm Drive Safe & Save Review).

What are the top insurance companies for students away at college?

The companies with the best car insurance for students are State Farm, Geico, and Progressive.

How long can college students stay on their parents’ car insurance?

College students can stay on their parents’ car insurance as long as their primary address is still their parents’ residence.

What is the best car insurance for college students away from home?

What type of insurance is tailored to students who are going away from college?

Does a college degree lower car insurance rates?

What is the monthly cost for students away at college with State Farm?

How much is the Geico good student discount?

How much is the USAA good student discount?

How can students afford car insurance?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.