Auto Insurance Companies Pulling Out of Florida

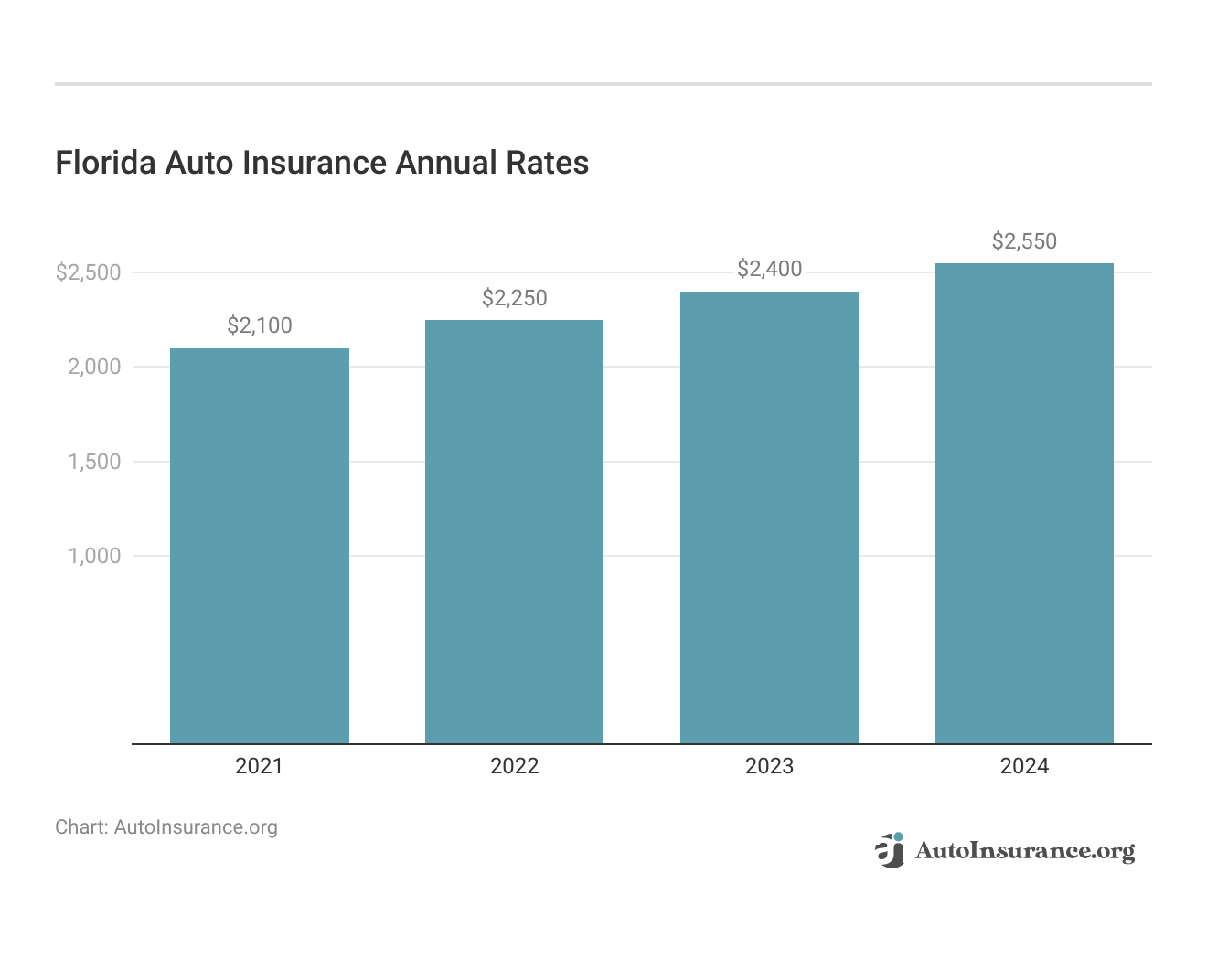

Auto insurance companies, including AAA and Farmers, are pulling out of Florida. Car insurance companies are leaving Florida to avoid the increased risk of expensive claims caused by natural disasters. This has also led to an increase in Florida auto insurance rates by $150 each year.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Licensed Insurance Agent

Jeff is a well-known speaker and expert in insurance and financial planning. He has spoken at top insurance conferences around the U.S., including the InsuranceNewsNet Super Conference, the 8% Nation Insurance Wealth Conference, and the Digital Life Insurance Agent Mastermind. He has been featured and quoted in Nerdwallet, Bloomberg, Forbes, U.S. News & Money, USA Today, and other leading fina...

Jeff Root

Updated January 2025

- Several car insurance companies no longer sell insurance in Florida

- Reasons for pulling out of Florida include increased storm damage

- Florida insurance rates have increased by $150 over the last few years

Known as the Florida insurance crisis, several insurers have chosen to stop offering new policies in the Sunshine State. This situation affects not only smaller, liquidated companies but also major providers like Farmers, which is also exiting California, and AAA. This crisis has impacted the Florida average car insurance rate and contributed to the rising Florida car insurance cost.

Insurance companies are leaving Florida for a variety of reasons, including increased weather damage and insurance scams. Below, you’ll find more information about why Florida is losing insurance companies. Once you’ve explored why companies are leaving, you can use our free comparison tool above by entering your ZIP code to find the best Florida auto insurance rates.

List of Auto Insurance Companies Pulling Out of Florida

With the pressures of climate change, increased traffic, and local laws, many Florida car insurance companies are leaving the state. Currently, these Florida auto insurance companies have left the Sunshine State:

- Farmers Insurance

- Bankers Insurance Group

- Lexington Insurance Company

- Centauri Insurance

- AAA

If you’re currently insured with any of these companies, such as those impacted by State Farm pulling out of Florida or other insurance companies that have left Florida, you likely don’t need to be concerned about your coverage. Although your provider might cancel your policy after a claim or numerous traffic violations, most insurance companies remain dedicated to honoring their existing policies. This applies even amidst fluctuations in Florida car insurance rates.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Top Reasons Why Insurance Companies are Leaving Florida

Why are insurance companies leaving Florida? With weather patterns seeming to get more intense, the answer might seem obvious. However, the answer is more complex than climate change.

- Climate change: Hurricanes and other weather phenomena are increasing in strength and frequency in Florida. Since car insurance does cover storm damage, the price of insurance is rising due to weather-related claims.

- Increased traffic: Florida roads are more congested than ever. More drivers on the road increase the chances of accidents, which leads to more claims.

- Local laws: A large part of the Florida insurance crisis is explained through state law. It’s much easier to sue companies in Florida, which has directly led to some insurance companies leaving Florida.

- Property scams: Florida has seen a dramatic increase in the number of home insurance scams, which cost companies millions.

The issue extends beyond out-of-state insurance companies impacting Florida drivers. For example, with Progressive pulling out of Florida and other changes, the average auto insurance cost in Florida has risen significantly in recent years, as illustrated below.

Finding the cheapest auto insurance companies in Florida is more difficult than ever before, but it’s not impossible. Shopping around and comparing quotes is the easiest way to find the cheapest auto insurance in Florida.

Comparing Florida Auto Insurance Rates

While many factors affect insurance rates, one of the most important is your ZIP code. Florida car insurance coverage rates vary significantly between cities because of differences in traffic, crime, and overall claims.

Check below to see average rates for minimum and full coverage in your city.

Florida's Auto Insurance Monthly Rates by City

| City | Minimum Coverage | Full Coverage |

|---|---|---|

| Fort Lauderdale | $90 | $180 |

| Jacksonville | $85 | $170 |

| Miami | $95 | $190 |

| Orlando | $80 | $160 |

| St. Petersburg | $88 | $176 |

| Tallahassee | $87 | $174 |

| Tampa | $82 | $164 |

As you can see, purchasing Florida minimum auto insurance requirements is your cheapest option for coverage. However, the bare minimum Florida insurance requirements leave your car without much protection.

Minimum insurance requirements in Florida are $10,000 worth of coverage of personal injury protection and property damage liability. Most insurance experts suggest purchasing more than this amount to protect yourself in case of an accident.Michelle Robbins Licensed Insurance Agent

Comprehensive or full coverage auto insurance offers superior protection for both you and your vehicle. If your budget allows, opting for full coverage is generally a more suitable option for your car insurance needs in Florida. This approach can be particularly advantageous given the average car insurance price in Florida. Additionally, exploring various car insurance companies in Live Oak, Florida, may help you find the best coverage within your budget.

Learn More: Best Pay-As-You-Go Auto Insurance in Florida

How to Find Affordable Florida Auto Insurance Companies

While there are some auto insurance companies pulling out of Florida, you still have plenty of affordable options. Check the average rates from some of Florida’s largest car insurance companies below.

Florida Auto Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full coverage |

|---|---|---|

| $82 | $245 | |

| $43 | $141 | |

| $40 | $120 | |

| $72 | $216 |

| $69 | $205 | |

| $44 | $132 | |

| $75 | $223 | |

| $21 | $63 |

Once more, opting for minimum insurance provides the lowest cost. Most insurers offer various auto insurance coverage options, allowing you to tailor your policy to your needs. However, adding additional coverage will lead to higher rates. For reference, the average cost of car insurance in Florida can vary, with locations like Arcadia, Florida potentially influencing rates.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How to Switch Florida Auto Insurance

Switching Florida auto insurance is usually simple and can even help you save.

First, you’ll need to learn how to cancel your auto insurance. Most companies don’t have an online option for how to cancel car insurance in Florida, so you’ll probably need to call.

Before you go through with canceling your policy, you should purchase a new policy. Having even a small gap in your insurance coverage can increase your rates, so most experts recommend setting up new coverage first. Find your most affordable insurance options by entering your ZIP code into our free comparison tool today.

Once you’ve established your new policy, such as Dairyland Insurance in Live Oak, FL or Direct Auto Insurance in Ocala, FL, you can safely cancel your previous coverage without concern.

Other Ways to Save on Florida Auto Insurance

Rates are increasing in Florida, but it’s not impossible to save on your insurance. Try the following money-saving methods if you’re looking to save:

- Find discounts: There are plenty of Florida auto insurance discounts to help you save. Popular options include safe driver and policy bundling discounts.

- Keep your record clean: Keeping car insurance claims and traffic violations off your record can help you save. However, you should know how to file an auto insurance claim if you need to.

- Lower your coverage: While it’ll put your car at a higher risk, you can save on your monthly premium by lowering your coverage.

- Raise your deductible: Your deductible is the portion you pay when you file a claim. Choosing a higher deductible will help you save, but you’ll have to pay more if you file a claim.

Before committing to a policy, it’s essential to compare quotes from different providers. This practice is crucial to avoid overpaying for coverage, especially with insurance companies like Farmers pulling out of Florida. Comparing auto insurance quotes from various companies helps ensure you get the best value for your coverage.

Bottom Line on Auto Insurance Companies Pulling Out of Florida

Although companies like Farmers and AAA have pulled out of Florida, it’s not all doom and gloom. There are plenty of affordable insurance options left in the Sunshine State.

While steps like finding discounts and choosing the right coverage are important in finding low rates, the most crucial step is comparing quotes. Use our free comparison tool below by entering your ZIP code to start looking at quotes today.

Frequently Asked Questions

What states are insurance companies pulling out of?

When it comes to insurance companies pulling out of states, Florida and California are the top places. Weather phenomena like hurricanes and wildfires are a primary force behind the California and Florida insurance crises.

Why are auto insurance companies leaving Florida?

There are several reasons why insurance companies are leaving Florida, including stronger weather, insurance scams, and increased traffic.

How many insurance companies have left Florida?

Today, at least five car insurance companies have left the Sunshine State. On top of those, 11 home insurance companies have left.

What insurance companies are being pulled out of Florida?

Currently, AAA, Farmers, Bankers Insurance Group, Centauri Insurance, and Lexington Insurance Company are the providers leaving Florida.

Is Progressive pulling out of Florida?

Progressive currently has no plans to halt its sale of car insurance policies in Florida.

Is AAA pulling out of Florida?

AAA is currently denying renewal requests on some of its policies in Florida. However, it still sells some new policies in the Sunshine State.

Who is the largest auto insurer in Florida?

Geico is the largest auto insurance provider in Florida, claiming about 25% of the total market.

Who has the best auto insurance rates in Florida?

The best auto insurance rates in Florida typically come from Geico, USAA, and Progressive. However, the best rates for you depend on your unique circumstances. Enter your ZIP code into our free tool to see how much you might pay.

How much does the average person pay for auto insurance in Florida?

In Florida, minimum insurance costs an average of $109 per month. Full coverage, which includes car insurance that covers leaks, animal contact, theft, and vandalism, costs an average of $329 per month.

Why is Florida auto insurance so expensive?

Car insurance rates are impacted by several factors. These include increased weather damage and insurance scams. Additionally, car accident claims in Florida are on the rise due to the increased driver population.

Which insurance company has the highest customer satisfaction in Florida?

Why are insurance companies leaving Florida?

Why are insurance companies leaving California and Florida?

What Florida insurance companies were downgraded?

Is Progressive pulling out of Florida?

What happens if your insurance company goes out of business in Florida?

Why is Florida insurance so expensive?

Which insurance company has the highest customer satisfaction in Florida?

Does Florida have an insurance problem?

Who has the most affordable auto insurance in Florida?

Is Allstate still in Florida?

Did AAA pull out of Florida?

Why is it hard to get insurance in Florida?

Why are Florida insurance rates so high?

Who bought out USAA?

Why is USAA car insurance so expensive in Florida?

Can an insurance company drop you in Florida?

Can you sue an insurance company for taking too long in Florida?

Can you sue your own car insurance company in Florida?

What is the 90-day rule in Florida insurance?

Is it Florida law to have car insurance?

What type of insurance is mandatory in Florida?

What is going on with car insurance in Florida?

Why has car insurance doubled in Florida?

What is the cheapest insurance company for Floridians?

Who has the best car insurance in Florida?

How much is auto insurance in Florida?

How many insurance companies went out of business in Florida?

Why is Florida uninsurable?

Is car insurance expensive in Florida?

Is State Farm leaving Florida?

Does AAA have Gap insurance?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.