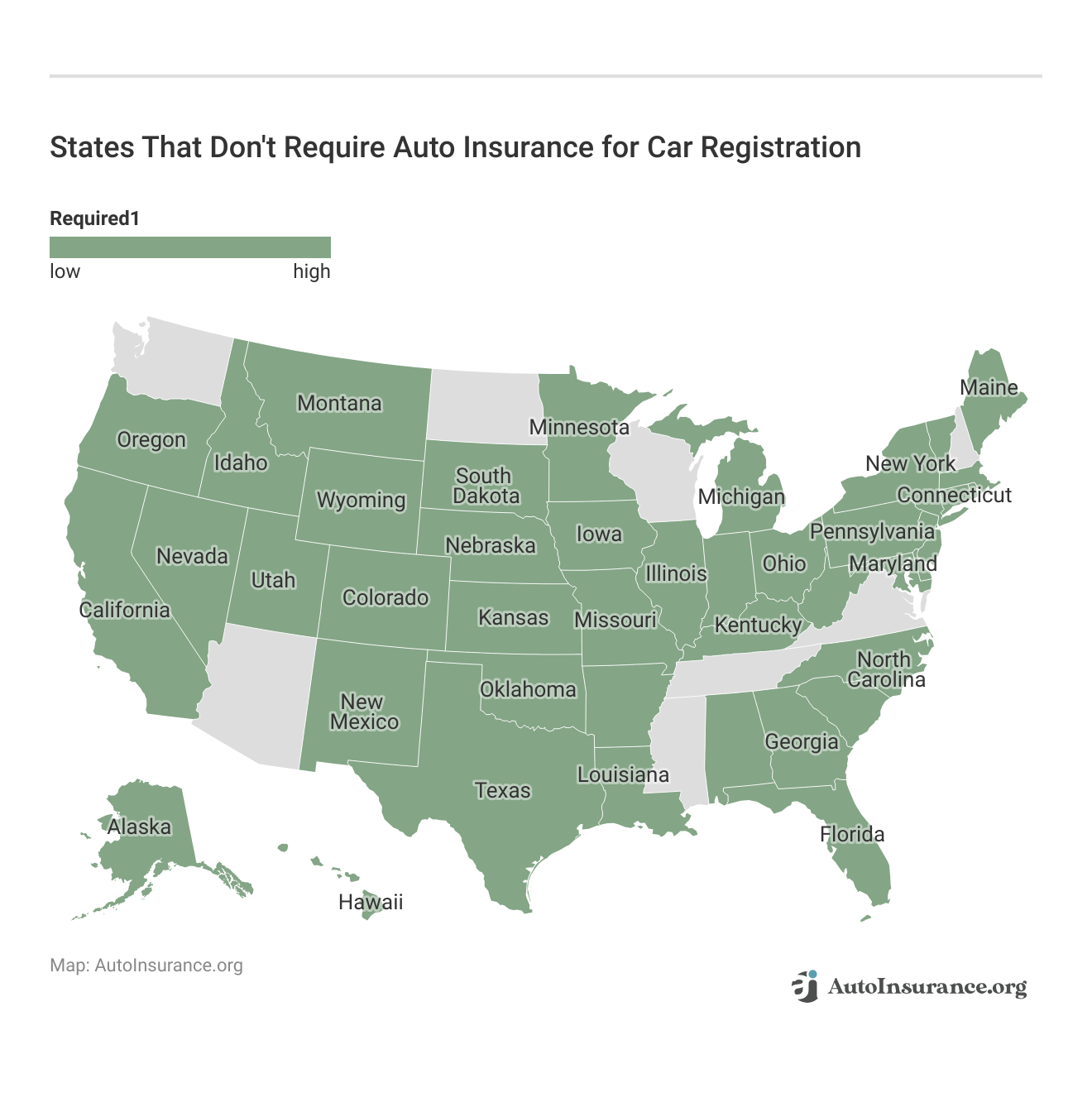

So, can I get car insurance without registration? The best auto insurance companies will generally sell you a policy without registration, but you’ll have to provide your VIN.

There are certain scenarios where drivers may want to get coverage if they haven’t registered with the DMV. For instance, you may wonder how to insure a new car without registration.

So, when will insurance cover an unregistered car? Situations where drivers may want to insure an unregistered vehicle include:

- After buying a new car: Can you get insurance without registration if you just bought the car? Insurers will often issue temporary policies to drivers who recently bought a new car and need to drive it off the dealership lot. However, you’ll still need to register and insure it later on. (Read More: Auto Insurance for New Cars)

- Non-operational vehicles: Can you insure an unregistered car that isn’t operational? Someone who owns a car that doesn’t operate or is being restored might want to insure it against theft or weather damage without registering it.

- Long-term storage: Can you insure a car that’s not registered if you’re storing it? If you plan to store your car for a long period without using it, you could get insurance on it without registration to cut down on costs.

- Preparing to sell it: Can you get insurance without a registration if you’re selling the car? Vehicle owners getting ready to sell their car may want to insure it in preparation for a sale without registering it.

However, you might also wonder, “Can you get insurance on a car with expired registration?” Yes, since auto insurance is often required to register a car, you can purchase coverage for a vehicle with expired registration.

You should always check your local insurance laws to ensure you can get insurance on an unregistered vehicle in these situations. Now that you know the answer to, “Does a car need to be registered to be insured?” keep reading to learn about the registration process without insurance.