Best Doctor Auto Insurance Discounts in 2026 (Save up to 30% With These Companies)

Geico, Liberty Mutual, and Farmers Insurance offer the best doctor auto insurance discounts out there, with savings of up to 30% for doctors, healthcare workers, and other medical professionals. They make it easy to get affordable, customized coverage that fits the unique needs of busy medical staff.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Insurance and Finance Writer

Maria Hanson grew up with a unique passion and understanding of both the automotive and insurance industries. With one grandfather in auto mechanics and another working in insurance, you could say automotive insurance is in her blood. Her love of research and finance serves her well in studying insurance trends and liability. Maria has expanded her scope of expertise to home, health, and life...

Maria Hanson

Licensed Insurance Agent

Jeffrey Manola is an experienced insurance agent who founded TopQuoteLifeInsurance.com and NoMedicalExamQuotes.com. His mission when creating these sites was to provide online consumers searching for insurance with the most affordable rates available. Not only does he strive to provide consumers with the best prices for insurance coverage, but he also wants those on the market for insurance to ...

Jeffrey Manola

Updated November 2024

The best doctor auto insurance discounts are available from Geico, Liberty Mutual and Farmers Insurance offering a 30% discount on car insurance for doctors and healthcare workers.

These top providers outshine the competition by offering great pricing and coverage options, as well as specialty benefits for on-the-go medical professionals.

Use the zip code box to compare rates from insurers near you today and get your cheapest quote.

Our Top 10 Company Picks: Best Doctor Auto Insurance Discounts

| Company | Rank | Savings Potential | A.M. Best | Who Qualifies? |

|---|---|---|---|---|

| 1 | 30% | A++ | Licensed doctors and medical professionals | |

| 2 | 25% | A | Doctors and healthcare workers |

| 3 | 22% | A | Physicians and medical staff | |

| 4 | 20% | A+ | Medical professionals and doctors |

| 5 | 18% | B | Doctors and medical employees | |

| 6 | 17% | A+ | Doctors and healthcare professionals | |

| 7 | 15% | A+ | Licensed doctors | |

| 8 | 12% | A++ | Medical workers, including doctors | |

| 9 | 10% | A+ | Physicians and medical staff |

| 10 | 9% | A | Doctors and healthcare workers |

Consequently, these are our winners in all categories for value and service. They make it easy to combine discounts and find that full coverage auto insurance formula that suits your lifestyle and budget.

- Find the best doctor auto insurance discounts for medical professionals

- Geico provides top rates with up to 30% savings for doctors

- Affordable coverage tailored to busy medical staff needs

Insure Your Vehicle to Unlock Doctor Auto Insurance Discounts

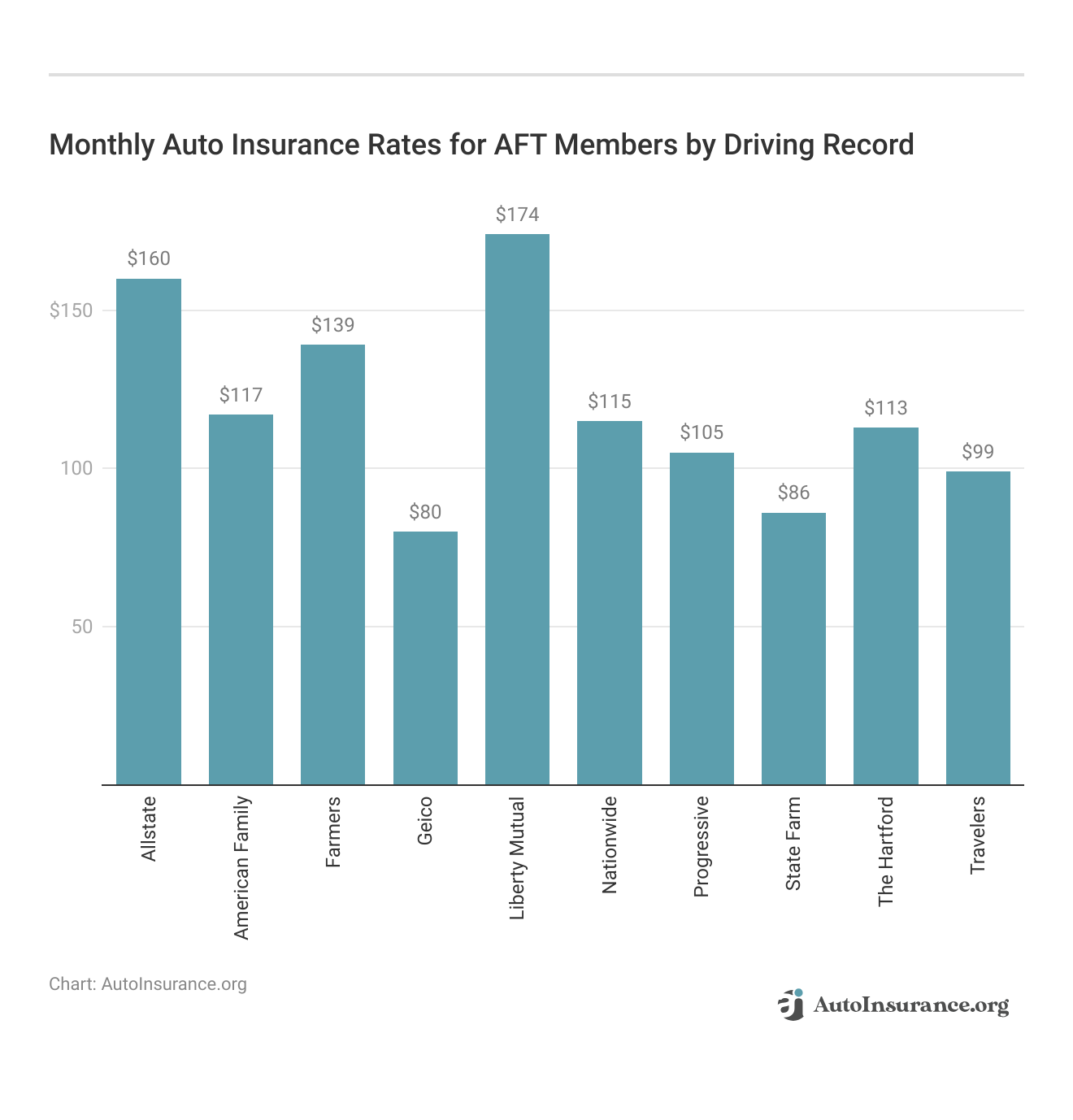

Find the best doctor auto insurance discounts with monthly full coverage rates tailored for medical professionals. We’ve compared top companies to bring you the most affordable options, helping you save up to 30% on premiums with providers like Geico, Liberty Mutual, and Farmers.

Top Doctor Auto Insurance Monthly Full Coverage Rates With Discount

| Insurance Company | Rates After Discount |

|---|---|

| $140 | |

| $150 |

| $156 | |

| $160 |

| $164 | |

| $166 | |

| $170 | |

| $176 | |

| $180 |

| $182 |

Shop rates to save on full coverage tailored for busy medical professionals, including the best auto insurance discounts for a new car and essential coverage options with doctor discounts.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Auto Insurance Savings for Medical Staff

Auto Insurance discounts are geared toward medical professionals. It offers savings on premiums via its rebates, and you can still meet your needs while working away from home. If you are looking to cut costs without compromising your safety, here is how you can save money.

- Better Driver and Defensive Driving: Reduced premium if you have a good driving history or complete an authorized defensive driver training course from your insurer.

- Telematics & Anti-Theft: Drive less and save with telematic programs, and learn how to get an anti-theft auto insurance discount.

- Bundling & Multi-Car:< Save by bundling multiple policies or insuring more than one vehicle with bundled discounts and multi-car savings.

Make sure to talk it over with your provider, including discounts for anti-theft devices so you can find just what suits your needs.

What is awesome, though, is that these savings from our tailor-made partners can really add up for medical professionals — like into the thousands over time.

Extra Ways Doctors Can Save on Auto Insurance

For doctors looking to cut auto insurance costs, there are a few smart strategies worth considering. One option is to raise your deductible—it can help lower your monthly premiums, although you’d need to cover more out-of-pocket if you file a claim. And if you ever need to know how to dispute an auto insurance claim, it’s a good idea to be familiar with the process beforehand.

Healthcare workers 🧑⚕️👩⚕️devote their lives to others, often neglecting their own interests. https://t.co/27f1xf131D can help you take charge of your car 🚘 insurance and find a policy that takes care of you. Want to save money? Check this out 👉: https://t.co/4iPYpAQurK pic.twitter.com/8coFBCmOIe

— AutoInsurance.org (@AutoInsurance) June 17, 2023

Adding extra security to your vehicle is also worth considering—parking in a garage or installing anti-theft devices like alarms or GPS tracking can earn you solid discounts.

Don’t forget about comparing quotes regularly; checking with different providers is one of the best and easiest ways to find great rates and coverage that actually fit your needs. Combining these tactics can make a real dent in your insurance costs over time.

And who knows, you might stumble across some extra perks or discounts that you hadn’t considered, making it all the more worthwhile to shop around. Putting these tips together can really add up to noticeable savings on your insurance over time.

Unique Car Insurance Discounts for Healthcare Professionals

Medical professionals, in particular, often work under unique demands, and late-night calls or frequent commutes between clinics are specific examples. To address these needs, some auto insurance providers have developed several healthcare field-exclusive discounts and benefits.

- On-Call and Commuter Discounts — Providers often provide discounts for healthcare professionals who commute between facilities or are on-call acknowledging that, especially with unpredictable schedules reliable coverage is needed.

- Additional Security Incentives: Specialized standards for medical professional supplier vehicles, including discounts on anti-theft devices if physicians install them or use skilled hospital parking to aid these drivers during long shifts.

- Increased Liability Coverage: Doctors are able to get the higher limits of liability or discounts on full coverage policies that provide them with comprehensive protection where and when they need it most as at work.

If you’re after the cheapest liability-only auto insurance, look for perks built with professionals in mind. Many insurers now offer packages geared toward healthcare workers, helping them save on coverage. It’s a thoughtful way for employers and talent agencies to support those in healthcare by making quality auto insurance more affordable.

With a series of targeted benefits such as commuter discounts, security incentives and improved liability options, insurers also aid in securing doctors, nurses and other healthcare staff the affordable comprehensive coverage specific to their individual schedules.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Healthcare Heroes: Exclusive Auto Insurance Savings

If you're in health care, there are some really cool auto insurance benefits just for you. Some companies, such as Geico Insurance, will even provide a Geico healthcare worker discount to assist with insurance costs.

Geico stands out as the top choice for medical professionals, offering unbeatable discounts tailored to the unique needs of healthcare workers.Daniel Walker Licensed Auto Insurance Agent

Some of the features include an auto insurance discount for healthcare workers along with car insurance discounts for healthcare workers, so you have a few extra perks to save some money all around.

Doctors have some special offers also, like auto insurance for doctors, cheap car insurance for doctors, doctor car insurance, and even physician auto insurance policies designed only for medical professionals. It’s a clever way to get coverage without stretching your budget. For a detailed exploration, delve into our guide entitled Best Auto Insurance for Doctors.

Find the Best Savings With Auto Insurance Discounts for Medical Professionals

No matter what role you play in the healthcare field, finding an auto insurance discount for doctors can be difficult. Few of the best auto insurance companies offer insurance discounts for healthcare workers, but that doesn't mean you won't be able to find affordable coverage.

From finding other discounts to keeping your driving record clean, there are plenty of ways to find a cheap auto insurance policy for doctors. One of the best ways to ensure you're not overpaying for your doctor's auto insurance is to compare quotes.

Enter your ZIP code into our free quote comparison tool below to get started.

Frequently Asked Questions

Who is the market leader in insurance offering discounts for doctors?

Market leaders like Geico, Liberty Mutual, and Farmers Insurance offer doctor-specific auto insurance discounts, providing affordable coverage options tailored to medical professionals.

Who do auto insurance companies see as the highest risk, and how does this affect doctor discounts?

Younger drivers are high-risk, while doctors often receive discounts due to their lower-risk profiles. Insurers like Geico and Liberty Mutual extend these benefits to medical professionals.

Enter your ZIP code to compare quotes on auto insurance today.

Which demographic pays the most for car insurance, and do doctors qualify for lower rates?

Younger, high-risk drivers pay more. Doctors, thanks to their stable income and low-risk status, typically receive reduced rates with providers like Farmers. To expand your knowledge, read our thorough guide, Best Auto Insurance Companies for High-Risk Drivers.

What are the top 3 insurance companies that offer doctor discounts?

Geico, Liberty Mutual, and Farmers Insurance are top choices, known for competitive rates and doctor-specific discounts.

What is the best and cheapest car insurance for doctors?

Geico, Liberty Mutual, and Farmers offer some of the best rates for doctors, with discounts that keep premiums affordable.

Which insurance company has the highest satisfaction for doctors seeking discounts?

Liberty Mutual leads in doctor satisfaction, with Geico and Farmers also highly rated for tailored, discounted policies. For more insights, check out our comprehensive Liberty Mutual Auto Insurance Review guide.

Which insurance company is best for cars with doctor-specific discounts?

Geico, Liberty Mutual, and Farmers are top options, providing doctor-focused discounts and comprehensive coverage.

Which insurance company offers the most discounts for Doctors?

Geico, Liberty Mutual, and Farmers Insurance provide the most substantial discounts for doctors, offering savings up to 30%.

Which auto insurance company spends the most on advertising for Doctors?

While exact spending isn’t specified, Geico, Liberty Mutual, and Farmers Insurance promote discounts tailored to medical professionals. To gain a thorough understanding, don’t miss our detailed analysis titled Geico Auto Insurance Review.

Who is the target audience for auto insurance discounts for doctors?

Licensed medical professionals, including physicians, surgeons, and other healthcare workers, are the main audience for these discounts.

Which company offers the best car insurance discounts for doctors?

Who is the biggest auto insurer for doctors?

Which car insurance company offers the best coverage with doctor discounts?

What’s the leading insurance brand globally, and do they offer discounts for doctors on auto insurance?

Which insurance company has the best rates, and do they offer discounts for doctors?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.