Montana Minimum Auto Insurance Requirements for 2026 (Coverage You Need in MT)

Montana minimum auto insurance requirements are $25,000 for bodily injury per person, $50,000 for bodily injury per accident, and $20,000 for property damage liability. Minimum car insurance rates in Montana start at $14 per month, making coverage affordable for most drivers.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Insurance and Finance Writer

Laura Gunn is a former teacher who uses her passion for writing and learning to help others make the best decisions regarding finance and insurance. After stepping away from the classroom, Laura used her skills to write across many different industries including insurance, finance, real estate, home improvement, and healthcare. Her experience in various industries has helped develop both her ...

Laura Gunn

Licensed Insurance Agent

Scott W Johnson is an independent insurance agent in California. Principal Broker and founder of Marindependent Insurance Services, Scott brings over 25 years of experience to his clients. His Five President’s Council awards prove he uses all he learned at Avocet, Sprint Nextel, and Farmers Insurance to the benefit of his clients. Scott quickly grasped the unique insurance requirements of his...

Scott W. Johnson

Updated December 2024

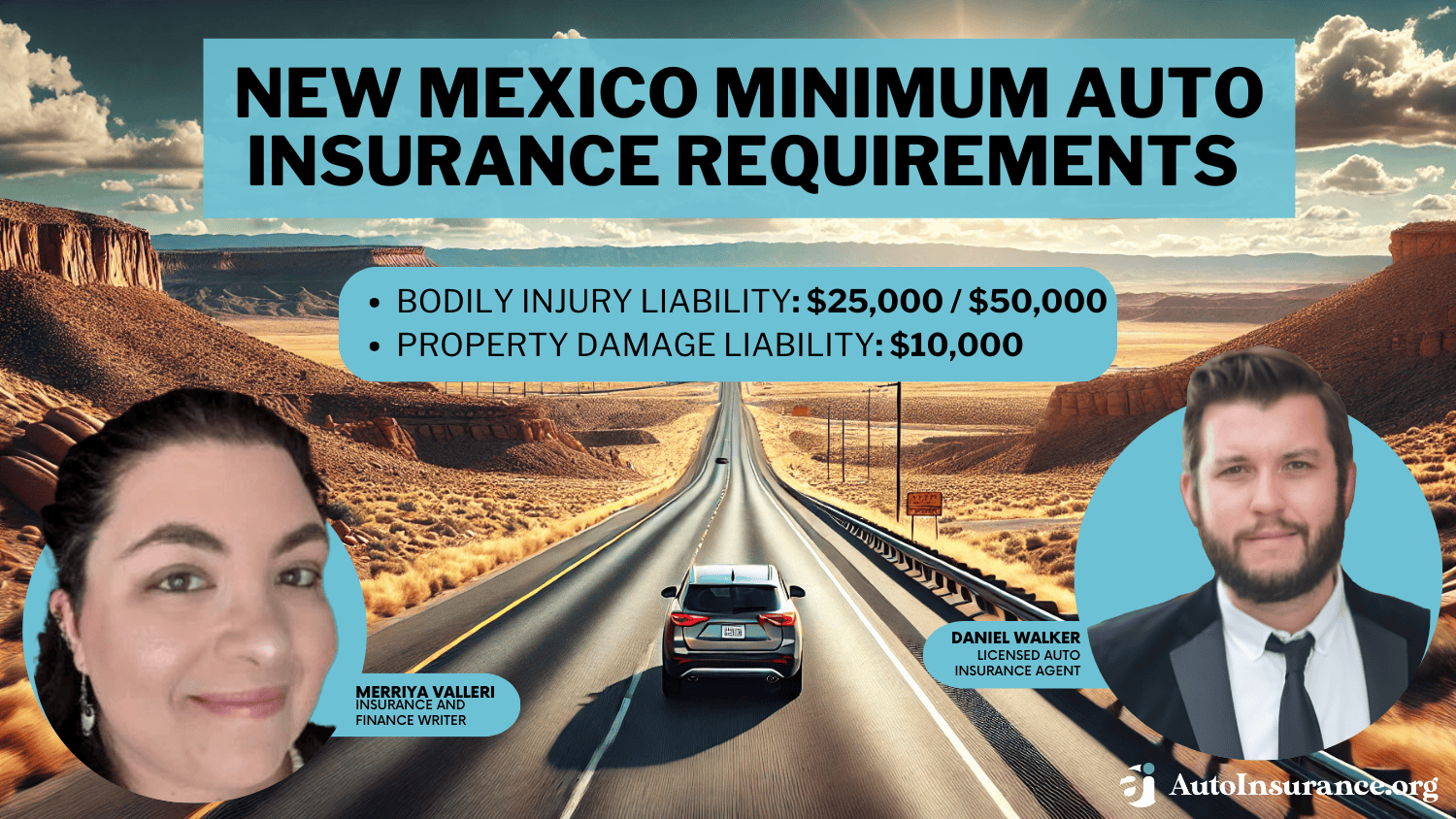

Montana minimum auto insurance requirements ensure drivers have essential liability protection with limits of $25,000 per person, $50,000 per accident for injuries, and $20,000 for property damage.

USAA offers the most affordable minimum coverage at $14 per month, followed by Liberty Mutual at $16 and Geico at $23. These companies provide budget-friendly options while meeting state-mandated coverage requirements.

Montana Minimum Auto Insurance Coverage Requirements & Limits

| Coverage | Limits |

|---|---|

| Bodily Injury Liability | $25,000 per person / $50,000 per accident |

| Property Damage Liability | $20,000 per accident |

However, minimum coverage might not be enough for serious accidents, leaving drivers financially exposed. Many Montanans opt for higher liability limits or add comprehensive and collision insurance coverage for better protection.

Comparing quotes from top providers regularly can help secure the best rates and coverage. Enter your ZIP code today to find the most affordable car insurance in Montana.

- Montana minimum auto insurance requirements are 25/50/20 for liability coverage

- Drivers should consider higher coverage limits for better financial protection

- USAA offers the cheapest minimum coverage in Montana, starting at $14 per month

Montana Minimum Coverage Requirements & What They Cover

Montana drivers must meet specific auto insurance requirements to comply with state laws and avoid costly penalties. Understanding these coverage limits is essential for maintaining legal and financial protection on the road.

According to Montana car insurance laws, all drivers must carry at least the following coverage: $25,000 for bodily injury liability per person, $50,000 for bodily injury liability per accident, and $20,000 for property damage liability.

These minimum auto insurance requirements provide basic liability protection in case of accidents. However, drivers should consider purchasing additional coverage for better financial security. Many drivers opt for coverage beyond the minimum car insurance in Montana to safeguard against unexpected expenses.

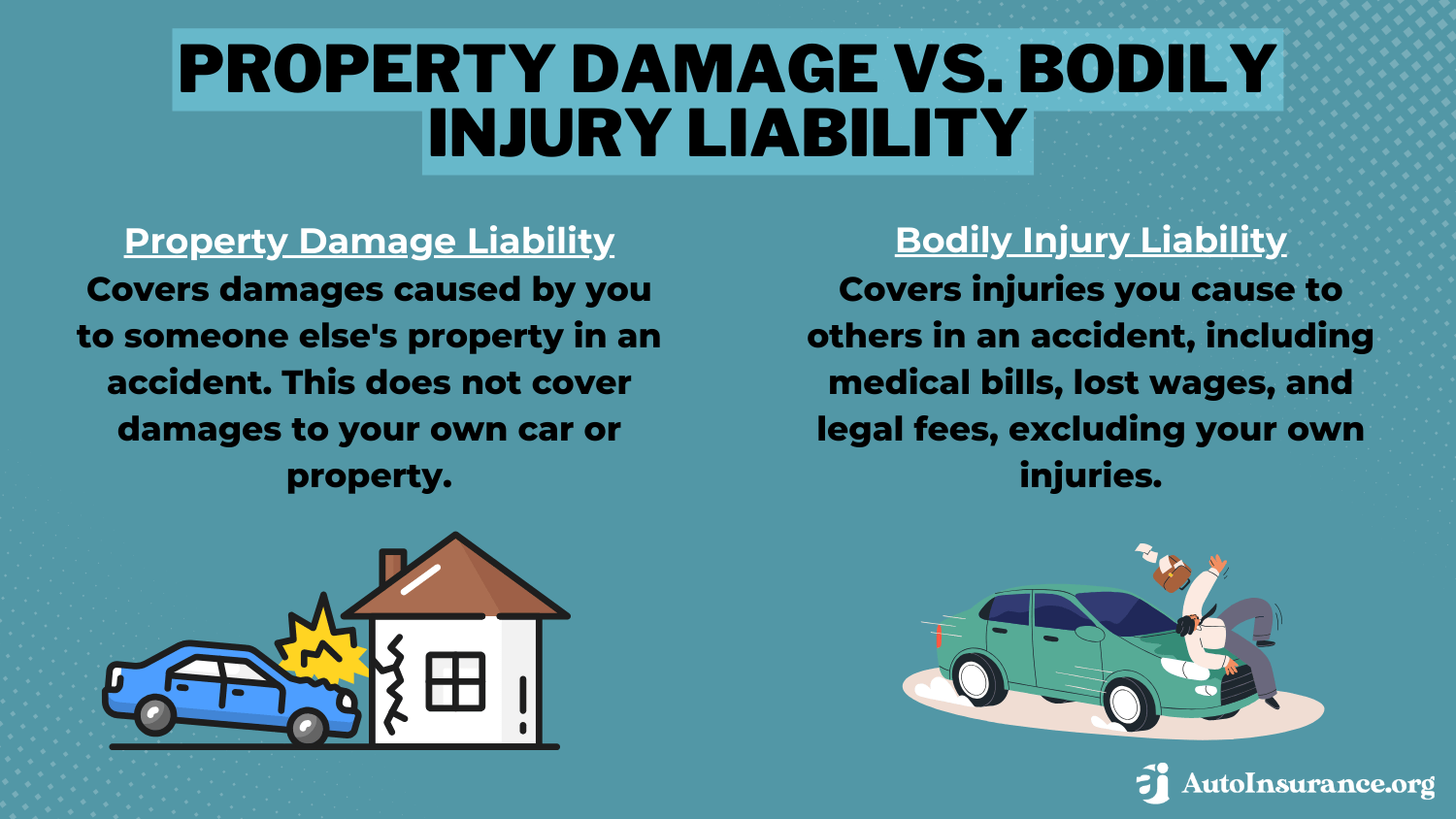

- Bodily Injury Liability: Covers medical expenses and healthcare costs for others if you are responsible for causing injuries in an accident.

- Property Damage Liability: Pays for repairing or replacing another person’s property or vehicle if you are at fault in a collision.

If you use your vehicle for business purposes, additional Montana insurance requirements may apply. Note that Montana liability insurance only covers damages to others; it does not cover your personal losses.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Cheapest Car Insurance in Montana

Finding affordable Montana auto insurance is essential for drivers looking to meet Montana auto insurance requirements while staying within budget.

6,590 reviews

6,590 reviewsCompany Facts

Min. Coverage in Montana

A.M. Best

Complaint Level

Pros & Cons

6,590 reviews

6,590 reviews 3,792 reviews

3,792 reviewsCompany Facts

Min. Coverage in Montana

A.M. Best

Complaint Level

Pros & Cons

3,792 reviews

3,792 reviews 19,116 reviews

19,116 reviewsCompany Facts

Min. Coverage in Montana

A.M. Best

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviewsComparing rates from different providers can help drivers secure the best Montana car insurance rates and avoid overpaying. Below are some of the lowest monthly rates for minimum auto insurance needed for Montana from top providers:

Monthly Minimum Auto Insurance Rates from Top Providers in Montana

| Insurance Company | Monthly Rate |

|---|---|

| $61 | |

| $53 | |

| $30 | |

| $39 | |

| $33 | |

| $22 |

These companies offer competitive prices while meeting Montana car insurance requirements. Keep in mind that the average cost of car insurance in Montana can vary depending on your driving record, age, and coverage level.

According to Montana auto insurance laws, drivers must have Montana liability insurance, including Montana uninsured motorist coverage, if desired. If you’re wondering how much car insurance is in Montana, use online tools to compare auto insurance quotes in Montana and find the best fit for your needs

Use a reliable Montana auto insurance guide to ensure your coverage complies with Montana insurance laws and provides the protection you need. By comparing auto insurance quotes in Montana, you can find the average car insurance cost in Montana that works best for you while staying covered and legal on the road.

Other Coverage Options to Consider in Montana

When purchasing car insurance in Montana, it’s essential to consider additional coverage options beyond the state’s minimum car insurance in Montana requirements. These options provide extra financial protection and peace of mind in case of accidents, natural disasters, or collisions.

- Personal Injury Protection (PIP) / Medical Payments: Some people have health insurance and do not necessarily need Personal Injury Protection, which pays for your own medical bills related to an accident. However, PIP can be used to pay for expenses not covered by your health insurance, so it can be financially beneficial for some Montana drivers to buy.

- Uninsured and Underinsured Motorist Coverage: This coverage is also optional for Montana drivers. It pays for your medical bills and vehicle repairs if you collide with an uninsured or underinsured motorist.

- Collision Coverage: If you are involved in a collision only, this type of auto insurance will pay for your car’s repairs or for a full replacement if the car is totaled.

- Comprehensive Coverage: Comprehensive auto insurance pays for your car’s repairs or for a full replacement for damage caused by bad weather, criminal activity, an animal hit, and other events.

For every type of auto insurance in Montana coverage you select, you’ll need to set a coverage limit. This limit determines the maximum amount the insurance company will pay after a covered incident. Be sure to assess your financial needs and driving habits to choose adequate limits.

The right auto insurance coverage protects you from unexpected expenses and ensures legal compliance on Montana roads.Jeffrey Manola Licensed Insurance Agent

By understanding Montana car insurance rates and available coverage types, you can build a policy that fits your budget while ensuring proper protection on the road.

Penalties for Driving Without Auto Insurance in Montana

According to Montana car insurance laws, driving without auto insurance is both risky and illegal. If you are involved in an accident without insurance, you will be responsible for paying all damages, including medical bills and vehicle repairs, out of your own pocket. In addition to financial liability, drivers face serious legal consequences such as fines, license suspension, and even jail time.

Penalties for Driving Without Auto Insurance in Montana

| Offense | Penalty |

|---|---|

| First Offense | Fine of $250–$500, suspension of driver’s license, and up to 10 days in jail |

| Second Offense | Fine of $350–$1,000, suspension of driver’s license, and up to 10 days in jail |

| Third and Subsequent Offenses | Fine of $500–$1,000, suspension of driver’s license, and up to 6 months in jail |

Montana imposes escalating penalties for repeat offenses. For a first offense, drivers can be fined between $250 and $500, have their driver’s license suspended, and face up to 10 days in jail.

A second offense results in a $350 to $1,000 fine, license suspension, and another possible 10-day jail sentence. For third and subsequent offenses, fines increase from $500 to $1,000, with license suspension and potential imprisonment for up to six months. Understanding and complying with Montana car insurance laws is essential to avoid these harsh penalties.

Read more: Does a suspended license affect auto insurance rates?

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Buying Car Insurance in Montana

All drivers in Montana need to buy auto insurance to comply with state law, and it makes sense to compare new rates from top providers every six months.

By doing so, you can potentially identify a lower rate on your car insurance, and you can also ensure that all of your auto coverage needs are met. Requesting quotes for new car coverage online is one of the fastest ways to learn more about rates that may be available to you.

If you plan to buy car insurance in Montana soon, learn more about the best auto insurance companies. Compare customer reviews and financial ratings online before you make any purchases.

Consider repeating this same process twice yearly to stay on top of the best auto insurance rates available. Explore your auto insurance options by entering your ZIP code into our free comparison tool today.

Frequently Asked Questions

What are the minimum auto insurance requirements in Montana?

Montana car insurance laws require drivers to carry at least $25,000 for bodily injury per person, $50,000 per accident, and $20,000 for property damage liability (Read more: Best Property Damage Liability (PDL) Auto Insurance Companies).

Is uninsured motorist coverage required in Montana?

No, uninsured motorist coverage is not required in Montana, but it is recommended to protect against drivers without insurance. Start saving on your auto insurance by entering your ZIP code and comparing quotes.

What happens if I drive without auto insurance in Montana?

Driving without auto insurance in Montana can lead to fines, license suspension, and even jail time, with penalties increasing for repeat offenses.

How can I lower my car insurance rates in Montana?

You can lower your car insurance rates by maintaining a clean driving record, comparing quotes, bundling policies, and qualifying for discounts like a safe driver or multi-car discount.

Does Montana require proof of insurance?

Yes, drivers must always carry proof of insurance and present it during traffic stops, accidents, and vehicle registration.

What factors affect car insurance rates in Montana?

Key factors include your age, driving history, location, vehicle type, coverage limits, and chosen deductibles (Read more: How Auto Insurance Companies Check Driving Records).

Can I use out-of-state insurance in Montana?

No, if you move to Montana, you must update your policy to comply with Montana car insurance laws.

Is full coverage required in Montana?

Full coverage auto insurance is not legally required but recommended, especially if your vehicle is financed or leased, as lenders often require comprehensive and collision coverage.

How do I file a car insurance claim in Montana?

Contact your insurance company as soon as possible after an accident. Provide details about the incident, including police reports, photos, and contact information of involved parties.

What is the average cost of car insurance in Montana?

The average cost of car insurance in Montana varies based on coverage levels and personal factors but starts as low as $14 per month for minimum liability coverage from some providers. Get fast and cheap auto insurance coverage today with our quote comparison tool.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.