Louisiana Minimum Auto Insurance Requirements in 2026 (See What All LA Drivers Need)

Louisiana minimum auto insurance requirements are 15/30/25 for bodily injury and property damage coverage while Louisiana car insurance rates average $30 per month. Louisiana drivers can rely on USAA for affordable minimum auto insurance that meets the state’s required liability and property damage standards.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Professor & Published Author

D. Gilson is a writer and author of essays, poetry, and scholarship that explore the relationship between popular culture, literature, sexuality, and memoir. His latest book is Jesus Freak, with Will Stockton, part of Bloomsbury’s 33 1/3 Series. His other books include I Will Say This Exactly One Time and Crush. His first chapbook, Catch & Release, won the 2012 Robin Becker Prize from S...

D. Gilson, PhD

Licensed Insurance Agent

Heidi works with top-rated insurance carriers to bring her clients the highest quality protection at the most competitive prices. She founded NoPhysicalTermLife.com, specializing in life insurance that doesn’t require a medical exam. Heidi is a regular contributor to several insurance websites, including FinanceBuzz.com, Insurist.com, and Forbes. As a parent herself, she understands the need ...

Heidi Mertlich

Updated March 2025

Louisiana minimum auto insurance requirements are 15/30/25. This means basic liability protection for all drivers. These rules help pay for bodily injury and property damage if you cause a car accident.

Drivers can add extra choices to their policies beyond the basic level. These extras might protect them from drivers without insurance or increase how much they are covered for if something happens, giving more financial safety overall.

Louisiana Minimum Auto Insurance Coverage Requirements & Limits

| Coverage | Limits |

|---|---|

| Bodily Injury Liability | $15,000 per person / $30,000 per accident |

| Property Damage Liability | $25,000 per accident |

By knowing Louisiana’s insurance laws, drivers can feel sure about choosing coverage and make smart choices for following the rules and feeling secure personally. Explore how the best Louisiana auto insurance options can help you save.

Compare car insurance quotes today to find the company that offers you the best rate for the coverage you need. Enter your ZIP code into our free quote tool above to get started.

- Louisiana’s minimum auto insurance requirements include 15/30/25 coverage

- Meeting state insurance standards helps protect against liability in accidents

- Optional coverage can enhance protection beyond Louisiana’s required minimum

Louisiana Minimum Coverage Requirements & What They Cover

All drivers should carefully review and comply with the Louisiana state minimum car insurance requirements, but you may also consider increasing your limits and buying other types of coverage.

Find out the minimum auto insurance requirements by state and how they vary. After all, each coverage type can yield substantial benefits in different situations.

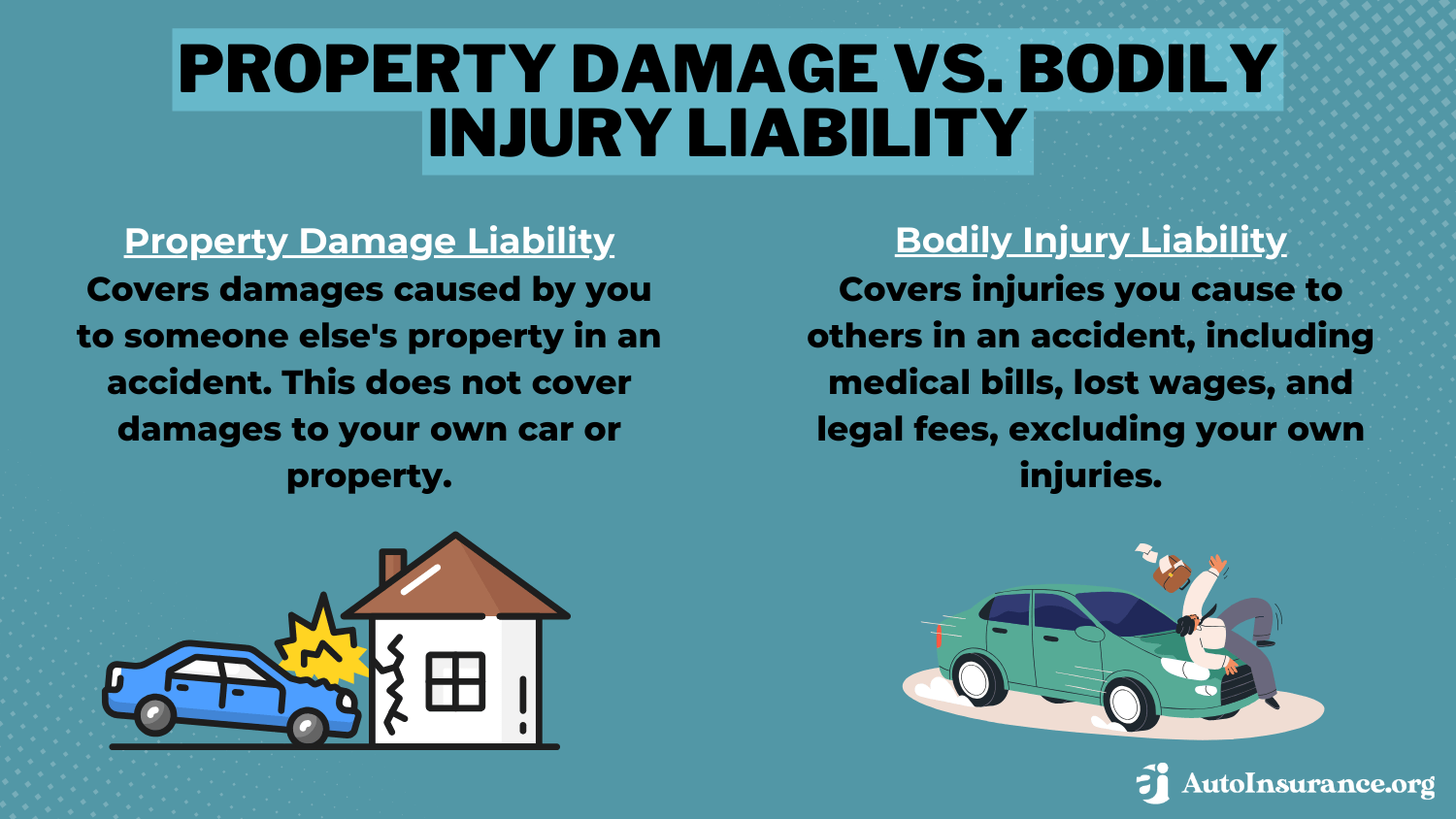

- Bodily Injury Liability: Louisiana drivers are required by law to purchase bodily injury liability insurance. This type of liability coverage makes it easier for you to be financially responsible for injuries that you cause to others because the benefits pay for other people’s medical bills or other expenses related to injuries.

- Property Damage Liability: It is also a legal requirement for Louisiana drivers to be responsible for property damage and

Buying car insurance in Louisiana is a necessity, but you need to know what type of coverage to buy and how much of each type you need. Your policy will include a coverage limit for each type of insurance that you purchase.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Cheapest Car Insurance in Louisiana

USAA is the most wallet-friendly, with getting a high 4.8 score for customer satisfaction. State Farm follows next, giving reliable coverage and has a 4.3 rating. Geico, rating 4.5 stars, is good for saving money and gives budget options for many needs.

6,590 reviews

6,590 reviewsCompany Facts

Min. Coverage in Louisiana

A.M. Best

Complaint Level

Pros & Cons

6,590 reviews

6,590 reviews 18,157 reviews

18,157 reviewsCompany Facts

Min. Coverage in Louisiana

A.M. Best

Complaint Level

Pros & Cons

18,157 reviews

18,157 reviews 19,116 reviews

19,116 reviewsCompany Facts

Min. Coverage in Louisiana

A.M. Best

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviewsThe table below shows monthly auto insurance rates in different cities of Louisiana, giving an easy way to see cost variations by place. With prices between $78 and $98, drivers can understand how premiums change based on their location.

Monthly Auto Insurance Rates for Minimum Coverage in Louisiana by City

| City | Rates |

|---|---|

| Alexandria | $82 |

| Baton Rouge | $95 |

| Bossier City | $88 |

| Covington | $84 |

| Houma | $86 |

| Kenner | $91 |

| Lafayette | $89 |

| Lake Charles | $87 |

| Mandeville | $83 |

| Metairie | $92 |

| Monroe | $90 |

| New Orleans | $98 |

| Opelousas | $85 |

| Ruston | $80 |

| Shreveport | $93 |

| Slidell | $81 |

| Sulphur | $79 |

| Thibodaux | $78 |

While you may have plans to buy extra or optional coverage types and increase your limits to enjoy great protection from your insurance policy, you need to confirm that your coverage complies with Louisiana’s auto insurance requirements. Louisiana’s car insurance minimums include:

- Bodily injury liability coverage of $15,000 per person

- Bodily injury liability coverage of $30,000 per accident

- Property damage liability insurance of $25,000 per accident

Louisiana’s minimum liability insurance enables drivers to be financially responsible for damages you cause while driving, and this can help you to avoid possibly being sued for damages. There are some instances when Louisiana’s liability insurance coverage requirements may not apply to you.

For example, there are special situations for stored vehicles, commercial vehicles, and more, and you should analyze the special insurance requirements for these situations in Louisiana before you buy your insurance policy. Explore how to find the cheapest liability-only auto insurance in your area.

Penalties for Driving Without Insurance in Louisiana

If state officials determine that you have not complied with Louisiana’s car insurance laws, you may be subject to penalties that include:

- Removal of your license plates from the vehicle

- Getting your vehicle impounded

The three primary reasons why you may need to show proof of auto coverage in this state are for vehicle registration, if you are in an accident, or if you are pulled over by law enforcement officials. See how auto insurance laws vary and what they mean for you.

Other Coverage Options to Consider in Louisiana

The table details optional Louisiana coverages—medical payments, collision, and comprehensive—that protect against incidents not covered by basic liability insurance.

- Personal Injury Protection (PIP) / Medical Payments: Louisiana makes its drivers take financial responsibility for the cost of other people’s medical expenses, but medical payments coverage for your own expenses is optional. You can choose if you want to add this type of coverage to your policy and what limit you desire if you do add it.

- Collision: Property damage liability insurance in Louisiana pays for vehicle expenses for other people if you cause the accident, but you will need collision or comprehensive insurance to pay for your own vehicle’s repairs or replacement.

- Comprehensive: A collision is only one of several types of events that could damage or destroy your vehicle. Comprehensive insurance pays for repair work or a full replacement for a wide range of events, including theft, severe weather damage, and more.

- Uninsured and Underinsured Motorist Coverage: Louisiana drivers can choose to add uninsured or underinsured motorist coverage to their policy as well. It will cover damage caused by someone without insurance.

Louisiana drivers looking for added protection can choose optional coverages like Medical Payments or Personal Injury Protection for personal medical expenses, as well as collision, comprehensive, and uninsured motorist coverage to safeguard against accidents, weather damage, or uninsured drivers.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Louisiana Auto Insurance Minimums vs. Recommended Coverage

Violating the car insurance laws in Louisiana can have noteworthy results in your life, and you understandably want to buy coverage today to prevent these consequences from affecting you.

If you live near the state line, you may spend a lot of time driving 🚗in a state you don’t reside in🏡. Does that affect insurance? Find out our recommendations for what to do as an out-of-state driver👉: https://t.co/tgh1ve6RrO pic.twitter.com/bA1wOXpxPw

— AutoInsurance.org (@AutoInsurance) November 6, 2024

Shopping for a new car insurance policy is easy to do when you request quotes online, but before you get to this step, you must decide how much insurance to buy.

The minimum liability car insurance requirements in Louisiana should be met if you want to avoid legal issues related to insurance, but you also should consider the advantages associated with buying optional coverage types and increasing your limits.

After all, all expenses are your responsibility regardless of whether your insurance benefits pay for them or not. Find out what are the recommended auto insurance coverage levels for optimal safety.

Carrying Only the Minimum Car Insurance in Louisiana

Driving without insurance even a single time in Louisiana can have expensive and devastating consequences for you, so you may need to shop around and set up coverage as soon as possible today. After you take this step, you can request quotes online for the coverage types and limits you have selected. Uncover the best sites for where to buy auto insurance online today.

With rates as low as $30 a month, Louisiana’s minimum coverage is budget-friendly for basic protection.Laura Berry Former Licensed Insurance Producer

While you need to compare rates today to set up your policy without delay, you should also compare rates every six months. By taking this step, you can identify lower rates that may be available to you in the future through other providers. Enter your ZIP code below to begin comparing car insurance rates right away. You might be surprised by how much you can save!

Frequently Asked Questions

What is the minimum auto insurance coverage in Louisiana?

Louisiana requires minimum liability coverage, which includes $15,000 per person and $30,000 per accident for bodily injury, plus $25,000 for property damage. Understand when to buy more than minimum auto insurance based on your needs.

What is full coverage auto insurance in Louisiana?

Full coverage in Louisiana typically includes liability, collision, and comprehensive coverage, protecting against damage to both your vehicle and others in accidents.

What is proof of auto insurance in Louisiana?

Proof of auto insurance in Louisiana can be shown via an insurance card, digital insurance proof, or other official documentation from your insurer. Explore your auto insurance options by entering your ZIP code into our free comparison tool below today.

Why is Louisiana car insurance so high?

Louisiana’s car insurance rates are higher due to factors like frequent weather events, a high rate of uninsured drivers, and elevated accident claim costs.

What is the lowest form of required car insurance in Louisiana?

The lowest form of car insurance in Louisiana is minimum liability coverage, meeting the 15/30/25 requirements set by the state. Discover practical tips on how to lower your auto insurance rates today.

What is the lowest category for car insurance in Louisiana?

The lowest category of car insurance in Louisiana is basic liability insurance, which covers damages or injuries you cause to others.

What is the cheapest car insurance in Louisiana?

The cheapest car insurance in Louisiana often comes from companies like Southern Farm Bureau and USAA, with rates averaging around $26 per month for minimum coverage.

What happens if you don’t have car insurance in Louisiana?

Without car insurance in Louisiana, you may face fines, license suspension, vehicle impoundment, and liability for accident damages.

Does Louisiana require uninsured motorist coverage?

Uninsured motorist coverage is not required in Louisiana, but insurers must offer it as an option, which drivers can choose to decline in writing. See if uninsured motorist property damage coverage is right for your needs.

What is the average monthly cost of auto insurance in Louisiana?

The average cost of auto insurance in Louisiana is about $64.65 per month, depending on coverage and location factors.

Is Louisiana an at-fault or no-fault state for auto insurance?

Did Louisiana car insurance go up?

How much does liability coverage cost in Louisiana?

Can you register a car in Louisiana without insurance?

How many days can you legally go without insurance in Louisiana?

Can you go to jail for not having insurance in Louisiana?

Can you sue an uninsured driver in Louisiana?

What is Louisiana’s 3-year rule for insurance?

Do you need full coverage on a financed car in Louisiana?

Can you have out-of-state car insurance if you live in Louisiana?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.