Uninsured Motorist Property Damage (UMPD) Coverage in 2026 (Detailed Explanation)

Uninsured motorist property damage (UMPD) coverage ensures your property is covered if you’re hit by an uninsured driver. For just $30 per month, UMPD coverage protects against costly repairs, especially in states with high uninsured driver rates. Find the best uninsured motorist property damage companies today.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Managing Editor

Laura Kuhl holds a Master’s Degree in Professional Writing from the University of North Carolina at Wilmington. Her career began in healthcare and wellness, creating lifestyle content for doctors, dentists, and other healthcare and holistic professionals. She curated news articles and insider interviews with investors and small business owners, leading to conversations with key players in the le...

Laura Kuhl

Licensed Insurance Agent

Brandon Frady has been a licensed insurance agent and insurance office manager since 2018. He has experience in ventures from retail to finance, working positions from cashier to management, but it wasn’t until Brandon started working in the insurance industry that he truly felt at home in his career. In his day-to-day interactions, he aims to live out his business philosophy in how he treats hi...

Brandon Frady

Updated December 2024

Uninsured motorist property damage (UMPD) coverage is an important coverage to have for most drivers. Uninsured motorist property damage will cover your repair costs if a driver without car insurance damages your car or property.

Not all states require uninsured motorist property damage insurance, but you may want to consider buying it from the best auto insurance companies if you live in a state with multiple uninsured drivers.

Continue reading to learn more about uninsured motorist property damage insurance and which states require you to carry it. If you want to look into buying affordable UMPD insurance coverage today, use our free quote comparison tool to get started.

Get fast and cheap UMPD auto insurance coverage today with our quote comparison tool above.

- UMPD coverage protects you for just $30 per month, covering major repair costs

- If an uninsured driver hits your property, UMPD provides crucial protection

- Not all states require UMPD, but it’s vital in regions with uninsured motorists

Uninsured Motorist Property Damage Coverage Explained

Uninsured motorist property damage protects you if the at-fault driver can’t pay for your car or property damages because they don’t have auto insurance.

Usually, insurers sell the coverage as a package deal with underinsured motorist property damage, which kicks in when the driver’s insurance limits aren’t high enough to cover all property damage bills.

At only $30 per month, UMPD coverage is an affordable way to safeguard your property from uninsured motorists.Michelle Robbins Licensed Insurance Agent

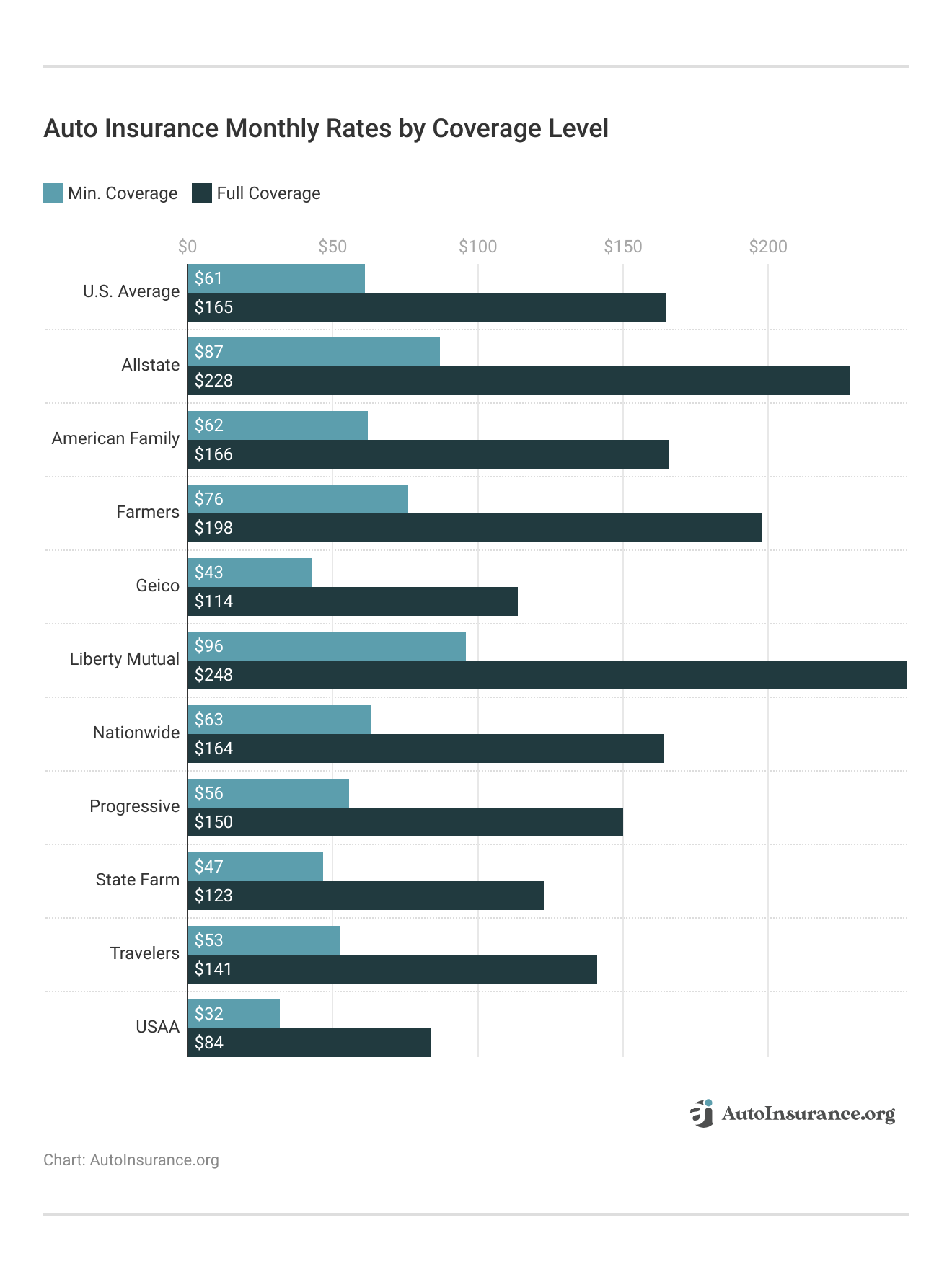

If you are trying to decide between cheap full coverage auto insurance and minimum liability auto insurance coverage, take a look at the chart below. You can compare the average annual full vs. minimum auto insurance premium coverage for some of the top U.S. auto insurance companies.

Uninsured motorist property damage coverage is also usually sold alongside uninsured motorist (UM) coverage, which pays for your medical bills if the other driver doesn’t have liability insurance to pay them.

What is Covered by Uninsured Motorist Property Damage Coverage

What is the meaning of UMPD? What is uninsured/underinsured motorist coverage? Uninsured/underinsured motorist coverage, or UMPD, covers any car or property damages caused by another driver who can’t pay your bills.

So whether you get rear-ended by another driver or a driver crashes into your fence, uninsured motorist property damage ensures your repairs get covered if the other driver doesn’t have insurance. Some situations that uninsured motorist property damage covers are listed below:

- Driver Sideswipes Your Car in a Parking Lot

- Driver Rear-Ends You

- Driver Crashes Into Your Fence and Damages it

Your uninsured motorist property damage has coverage limits detailed in your policy. For example, your uninsured motorist property damage may only cover up to $20,000 of damages — anything beyond you’ll have to pay out of pocket.

Your auto insurance company may also have auto insurance deductibles (read our “What is a good deductible for auto insurance?” for more details) for this coverage, which is the amount you agree to pay after an accident. So if you have a $500 deductible and $1,500 of damages, your car insurance company will only give you $1,000 for property damage repairs.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

States That Require Uninsured Motorist Property Damage Coverage

The minimum auto insurance required in each state varies, but numerous states require drivers to carry uninsured motorist property damage insurance. Look at the table below to see which states require uninsured motorist property damage coverage and the minimum limits for each state.

Uninsured Motorist Coverage Limits Required by State

State UM or UM/UIM Required Coverage Limits

Connecticut UM/UIM Bodily injury coverage $25,000 per person, $50,000 per accident

District of Columbia UM Bodily injury coverage of at least $25,000 per person, $50,000 per accident

Property damage coverage of at least $5,000 per accident, subject to a $200 deductible

Illinois UM/UIM Bodily injury coverage of at least $25,000 per person, $50,000 per accident

Maine UM/UIM Bodily injury coverage of at least $50,000 per person, $100,000 per accident

Maryland UM/UIM Bodily injury coverage of at least $30,000 per person, $60,000 per accident

Property damage coverage of at least $15,000 per accident

Massachusetts UM/UIM Bodily injury coverage of at least $20,000 per person, $40,000 per accident

Minnesota UM/UIM Bodily injury coverage of at least $25,000 per person, $50,000 per accident

Missouri UM Bodily injury coverage of at least $25,000 per person, $50,000 per accident

Nebraska UM/UIM Bodily injury coverage of at least $25,000 per person, $50,000 per accident

New Hampshire UM/UIM Bodily injury coverage of at least $25,000 per person, $50,000 per accident

New Jersey UM/UIM Drivers can choose to add coverage

New York UM/UIM Bodily injury coverage of at least $25,000 per person, $50,000 per accident

North Carolina UM/UIM Bodily injury coverage of at least $30,000 per person, $60,000 per accident

Property damage coverage of at least $25,000 per accident

North Dakota UM/UIM Bodily injury coverage of at least $25,000 per person, $50,000 per accident

Oregon UM/UIM Bodily injury coverage of at least $25,000 per person, $50,000 per accident

South Carolina UM Bodily injury coverage of at least $25,000 per person, $50,000 per accident

Property damage coverage of at least $25,000 per accident, subject to a $200 deductible

South Dakota UM/UIM Bodily injury coverage of at least $25,000 per person, $50,000 per accident

Vermont UM/UIM Bodily injury coverage of at least $50,000 per person, $100,000 per accident

Property damage coverage of at least $10,000 per accident, subject to a $150 deductible

Virginia UM/UIM Bodily injury coverage of at least $25,000 per person, $50,000 per accident

Property damage coverage of at least $20,000 per accident, subject to a $200 deductible

West Virginia UM Bodily injury coverage of at least $25,000 per person, $50,000 per accident

Property damage coverage of at least $25,000 per accident

Wisconsin UM Bodily injury coverage of at least $25,000 per person, $50,000 per accident

Some states requiring drivers to carry the highest amounts of property damage uninsured motorist coverage include North Carolina, South Carolina, and West Virginia.

Remember that drivers need both underinsured and uninsured motorist coverage in most states.

States That Don’t Require Uninsured Motorist Property Damage Insurance

In all other states, uninsured motorist property damage insurance is optional. While you aren’t required to carry uninsured motorist property damage insurance in these states, we recommend carrying it if you can afford it. Otherwise, you’re responsible for accident bills if a driver doesn’t have insurance.

How to Find the Right Uninsured Motorist Property Damage Insurance

Uninsured motorist property damage insurance pays for any car or property damages if the other driver doesn’t have insurance. Not all states require this auto insurance coverage, but it can be helpful, even if your state doesn’t require it. Find the best uninsured and underinsured motorist (UM/UIM) coverage.

Ready to take your driving test🚗? If you pass, do you have car insurance so you can drive home? Check out 👀our guide to the top 10 companies for brand-new drivers👉: https://t.co/zriRdzFimG pic.twitter.com/IXTNYucAQb

— AutoInsurance.org (@AutoInsurance) July 25, 2024

Drivers should shop around for quotes to find the best rates on uninsured motorist property damage insurance. Use our free quote comparison tool to find your area’s best car insurance rates. If you’re looking to lower your UMPD auto insurance premium, enter your ZIP code into our free quote comparison tool below to compare your rates against the top insurers.

Frequently Asked Questions

What is uninsured motorist property damage (UMPD) coverage?

If a hit-and-run driver or an uninsured driver causes an accident that damages your car, uninsured motorist property damage (UMPD) coverage, an optional auto insurance coverage, will protect you. It covers the repair or replacement costs of your vehicle up to the limits of the coverage, minus any auto insurance deductibles.

What is a UMPD deductible?

A UMPD deductible is the amount you pay out of pocket before your uninsured motorist property damage coverage kicks in to cover the repair costs.

What does “uninsured” mean?

“Uninsured” refers to a person or a vehicle that does not have active insurance coverage. In the context of auto insurance, it means that the driver or the auto does not have the required liability insurance, which is typically mandated by law to cover damages or injuries caused to others in the event of an accident.

What is the difference between uninsured motorist property damage vs. collision?

Uninsured motorist property damage covers repairs if an uninsured driver damages your vehicle, while collision coverage applies to damages from any accident, regardless of fault. Find the best UMPD auto insurance near you by entering your ZIP code into our free quote tool below.

Do I need uninsured motorist property damage if I have collision coverage?

Yes, uninsured motorist property damage covers situations where the at-fault driver has no insurance, while collision coverage handles accidents regardless of fault.

What is the difference between uninsured motorist vs collision?

Uninsured motorist coverage pays for damages when the other driver lacks insurance, whereas collision coverage covers damages to your car regardless of who caused the accident. Find out more about at-fault accidents.

Can I have uninsured motorist property damage without collision?

Yes, you can have uninsured motorist property damage without collision coverage to specifically cover damage from uninsured drivers.

Do I need uninsured motorist property damage if I have collision?

Yes, uninsured motorist property damage is still useful even if you have a a collision, as it covers damages caused by an uninsured driver without increasing your collision claim.

What is uninsured motorist property damage at Progressive?

If an uninsured driver strikes your car, Progressive’s uninsured motorist property damage coverage offers flexible deductible options to cover the repair costs. Discover more by checking out our Progressive auto insurance review.

What is an uninsured motorist property damage deductible?

An uninsured motorist property damage deductible is the amount you must pay before your insurance covers the remaining costs of repairs caused by an uninsured driver.

What is the meaning of motorist insurance?

What is the full meaning of UIM?

What is the difference between PIP and uninsured motorists?

What are uninsured liabilities?

How do you calculate underinsurance?

What is property and motor vehicle insurance?

What is uninsured motorist property damage?

Do drivers need uninsured motorist property damage insurance?

What is the difference between uninsured motorist coverage vs. collision coverage?

Is UMPD coverage mandatory?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.