Bodily Injury Liability (BIL) Auto Insurance Defined in 2025 (Coverage Breakdown)

Bodily injury liability auto insurance starts at an average of $18 per month, and is one half of the liability portion of your policy. BIL pays for injuries you cause to other drivers, passengers, and other pedestrians. Bodily injury coverage is required in most states, with the exception of Florida.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Licensed Insurance Agent

Brandon Frady has been a licensed insurance agent and insurance office manager since 2018. He has experience in ventures from retail to finance, working positions from cashier to management, but it wasn’t until Brandon started working in the insurance industry that he truly felt at home in his career. In his day-to-day interactions, he aims to live out his business philosophy in how he treats hi...

Brandon Frady

Licensed Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. Eric is the CEO of C Street Media, a full-service marketing firm and the co-founder of ProperCents.com, a financial educat...

Eric Stauffer

Updated October 2024

Bodily injury liability auto insurance covers health care expenses and lost wages for people you injure in an at-fault accident.

Most states require a minimum amount of both property damage and bodily injury liability coverage. Getting a liability-only auto insurance policy is your cheapest option for car insurance, but it doesn’t protect your car.

Read on to learn what bodily injury liability insurance covers and how much it costs. Then, enter your ZIP code into our free comparison tool above to see average bodily injury coverage costs in your area.

- Bodily injury liability insurance covers medical expenses for people you injure

- Most states require car insurance with bodily injury liability coverage

- Liability with bodily injury is your cheapest car insurance option

Bodily Injury Liability (BIL) Auto Insurance Definition

What is bodily injury liability auto insurance coverage? The definition of bodily liability coverage pays for the medical expenses of other drivers, passengers, and anyone else you injure in an at-fault accident.

If you cause an accident that causes injury to others, bodily injury liability auto insurance coverage pays for their medical expenses and any income they lost while recovering. However, it doesn’t cover your personal injuries, so you can’t file a bodily injury claim against your own insurance.

You may have noticed that insurance companies sell two types of liability insurance — bodily injury and property damage. Both types of coverage are required in most states and work similarly.

In short, bodily injury liability covers medical expenses, and property damage liability covers damage costs for an individual’s vehicle and/or property.

Note that bodily injury and property damage coverage are usually bundled. Most companies won't let you purchase either bodily injury or property damage.Ty Stewart Licensed Insurance Agent

The bottom line is that you are usually going to need liability insurance and it’s not all that expensive. You can also find affordable bodily injury coverage by looking at the best property damage liability auto insurance companies. Let’s move on to see which states require bodily injury liability insurance.

Bodily Injury Liability Insurance Rates

Now that you know what bodily injury means in insurance, your next step should be figuring out how much it costs. Finding cheap liability auto insurance coverage is usually simple – it’s one of the cheapest types of auto insurance you can buy.

Although auto liability coverage is affordable, you should still compare rates to find the best prices. Take a look below to see the average price of BIL insurance in your state.

Like other types of insurance, liability insurance rates are affected by a variety of factors. One of the most important is your driving record. Check the rates below to see how much bodily liability insurance might cost you based on your driving record.

Bodily Injury Liability Auto Insurance Rates by Driving Record| Driving Record | Monthly Rates |

|---|---|

| Clean Record | $40 |

| One Ticket | $50 |

| One Accident | $60 |

| One DUI | $90 |

These price discrepancies are why comparing rates is so important. You can get a personalized quote from most companies by visiting their homepage and filling out a request form.

If that sounds too time-consuming, you can fill out a quote-generating tool to get prices from most insurance companies available in your area.

Bodily Injury Liability Auto Insurance Requirements

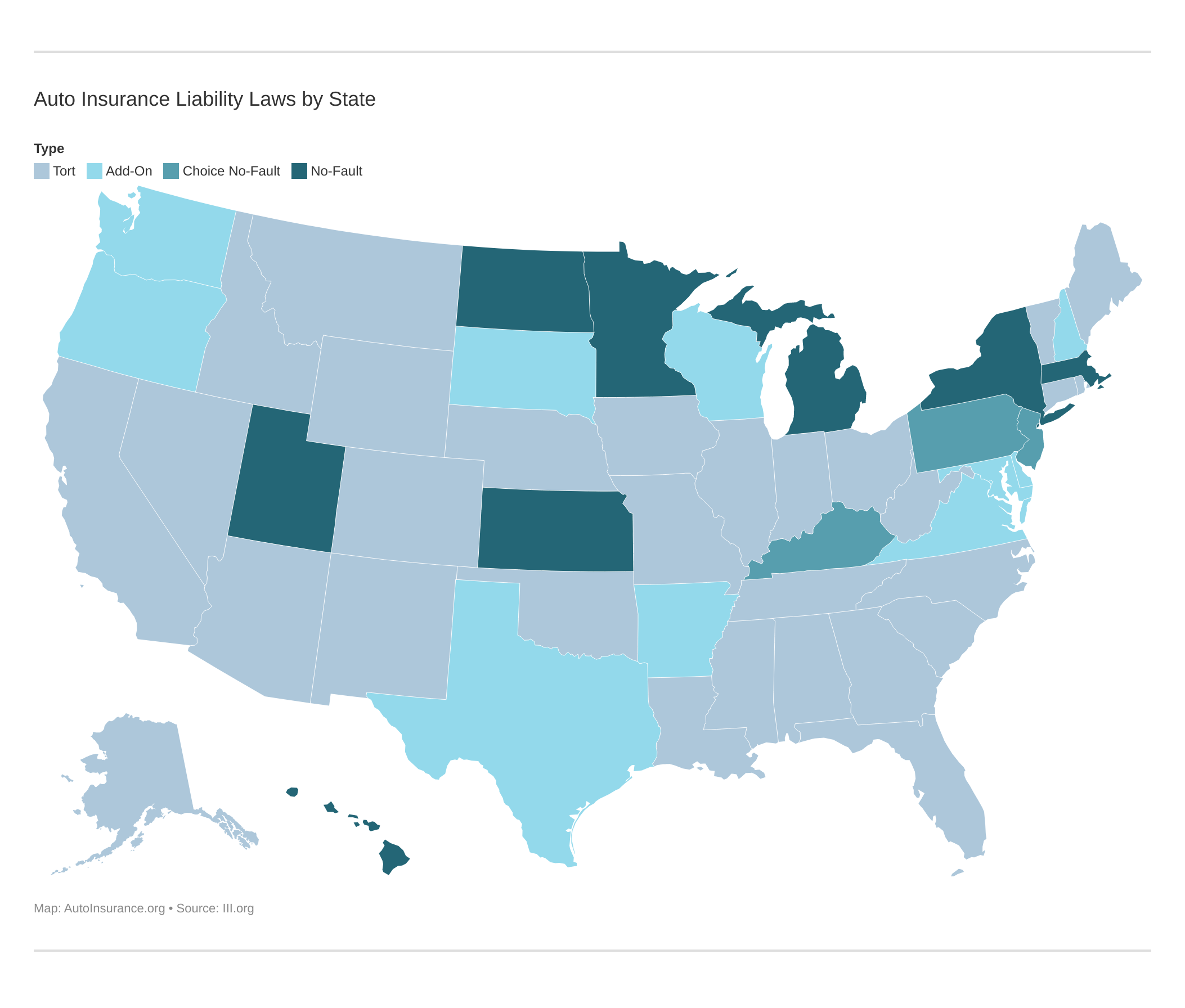

Interestingly, every state except Florida requires BIL insurance, and all 50 states and Washington D.C. require property damage liability. They require both types of liability insurance just in case you’re involved in an at-fault accident.

What’s an at-fault accident🚘? Can you be at fault if you live in a no-fault state🇺🇸? https://t.co/27f1xf131D has the info you need to clear things up. Find out what you need here👉: https://t.co/LWLZy8nIWK pic.twitter.com/SuFnzANtes

— AutoInsurance.org (@AutoInsurance) September 4, 2023

So, why Florida? Florida minimum auto insurance requirements include personal injury protection (PIP) since it’s a no-fault state. With that being said, no matter who caused the accident, their own personal injury protection covers them in Florida.

Unsure of how much auto bodily injury liability insurance you need? When you request a quote, you can select state minimum requirements for the cheapest policy.Kristen Gryglik Licensed Insurance Agent

If you were to listen to the majority of experts, what you would need is coverage amounts of $100,000 for one individual and $300,000 for the accident. A lot of states require only $25,000/$50,000, though. With that being said, it may not be enough.

Just because you have this BIL insurance coverage amount, or your state’s particular minimum, doesn’t mean you are truly, fully covered. If you cause an accident and your insurance doesn’t cover you fully, you’re essentially opening yourself up to lawsuits.

The premiums paid would pale in comparison to the ramifications of a lawsuit. So, depending on where you live and how likely an accident is, it’s best to raise your coverage level.

Get Cheap Bodily Injury Liability Auto Insurance Coverage Today

Finding affordable bodily injury liability insurance should be easy since average rates start at $18 monthly. BIL insurance covers medical expenses and lost wages for other drivers in at-fault accidents, so you can’t file a bodily injury claim against your own insurance. Read more about how to manage your auto insurance policy.

For bodily injury liability insurance quotes, enter your ZIP code into our helpful tool below. Then, get rates for bodily injury liability coverage from insurers in your area.

Frequently Asked Questions

What does bodily injury liability mean in auto insurance?

Bodily injury insurance’s definition includes the payment of medical expenses and lost wages of other drivers, passengers, and other people in accidents you cause. Most states require you to carry this coverage.

Does bodily injury liability cover me?

Bodily injury liability insurance doesn’t cover your medical expenses or lost wages. Bodily injury insurance covers only injuries to other parties. However, it protects you from lawsuits after an at-fault accident.

How much bodily injury insurance is included in full coverage?

You must meet your state minimum auto insurance requirements for bodily injury and carry other coverages such as collision and comprehensive to have full coverage.

Do you have to have bodily injury insurance in Florida?

Florida auto insurance doesn’t require bodily injury liability coverage unless you were convicted of a traffic violation.

What is the difference between bodily injury liability (BIL) and personal injury protection (PIP)?

BIL auto insurance covers the medical expenses of the person who didn’t cause the accident. Personal injury protection (PIP) auto insurance helps pay for your own medical bills after an accident.

What is the max you can get from an auto accident liability settlement?

The average property damage liability claim is about $3,500 but it all depends on the extent of the accident’s damage. Read more about the best property damage liability (PDL) auto insurance companies.

When should you get liability-only auto insurance?

If the cost of comprehensive and collision exceeds 10% of your vehicle’s value, get liability-only coverage. If you need a cheap policy, enter your ZIP code into our free comparison tool to find the lowest rates in your area.

What happens if I exceed my bodily injury coverage limits?

If the costs associated with injuries in an accident exceed your bodily injury coverage limits, you may be personally responsible for the additional expenses. So, it’s important to carefully consider your BIL coverage limits and potentially consider umbrella insurance to provide extra liability protection.

What happens if I don’t have bodily injury coverage?

You could get sued for the other drivers’ medical expenses if you don’t carry bodily injury liability auto insurance. Driving without auto insurance is also illegal and could lead to consequences, including fines, license suspension, and jail time.

Does bodily injury cover pain and suffering?

Yes, the best auto insurance companies consider pain and suffering when settling bodily injury liability claims.

How do I choose the appropriate bodily injury liability (BIL) coverage limits?

What does bodily injury liability not cover?

Can you file a bodily injury claim against your own insurance?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.