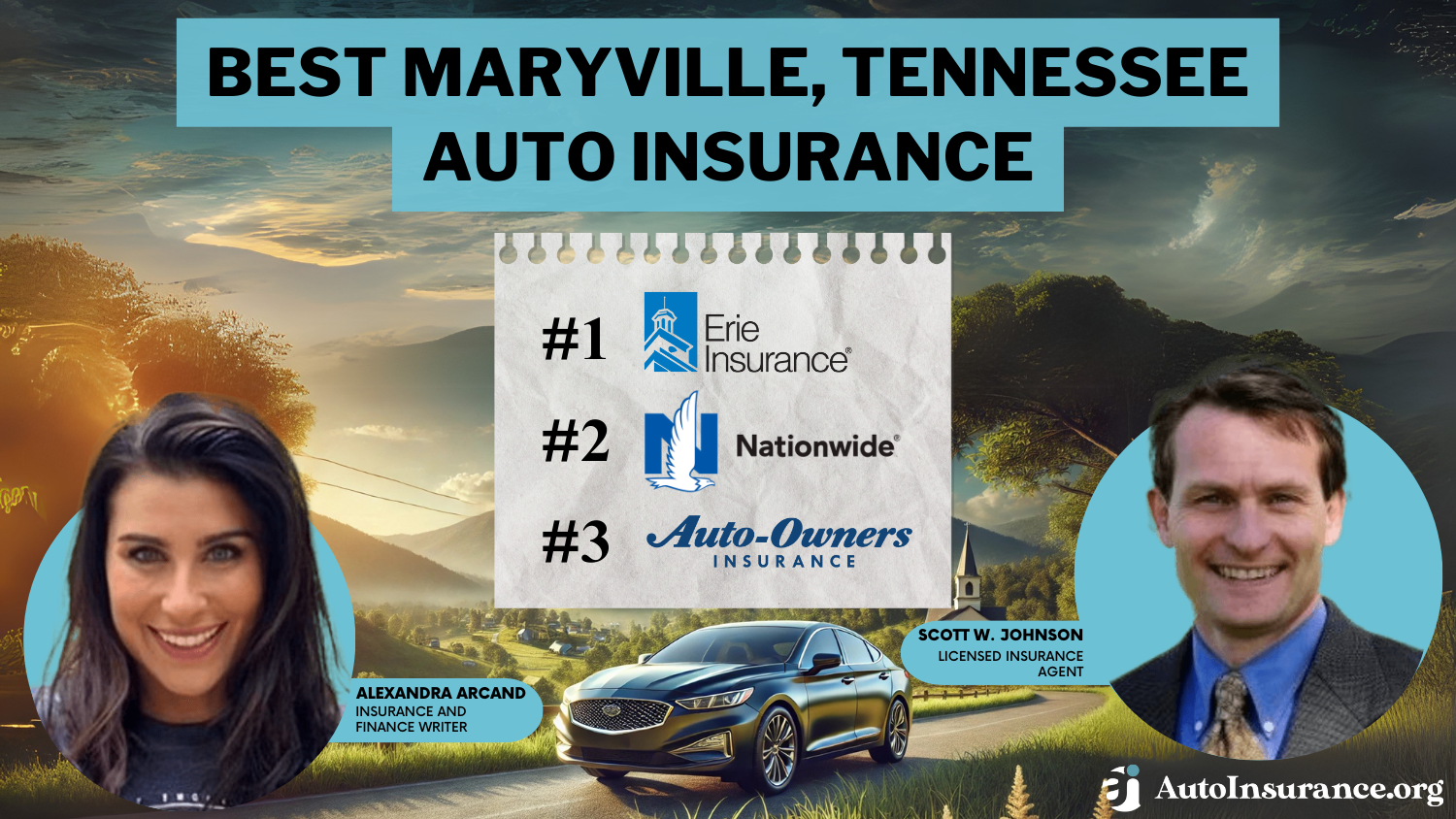

Best Maryville, Tennessee Auto Insurance in 2026 (Top 10 Companies Ranked)

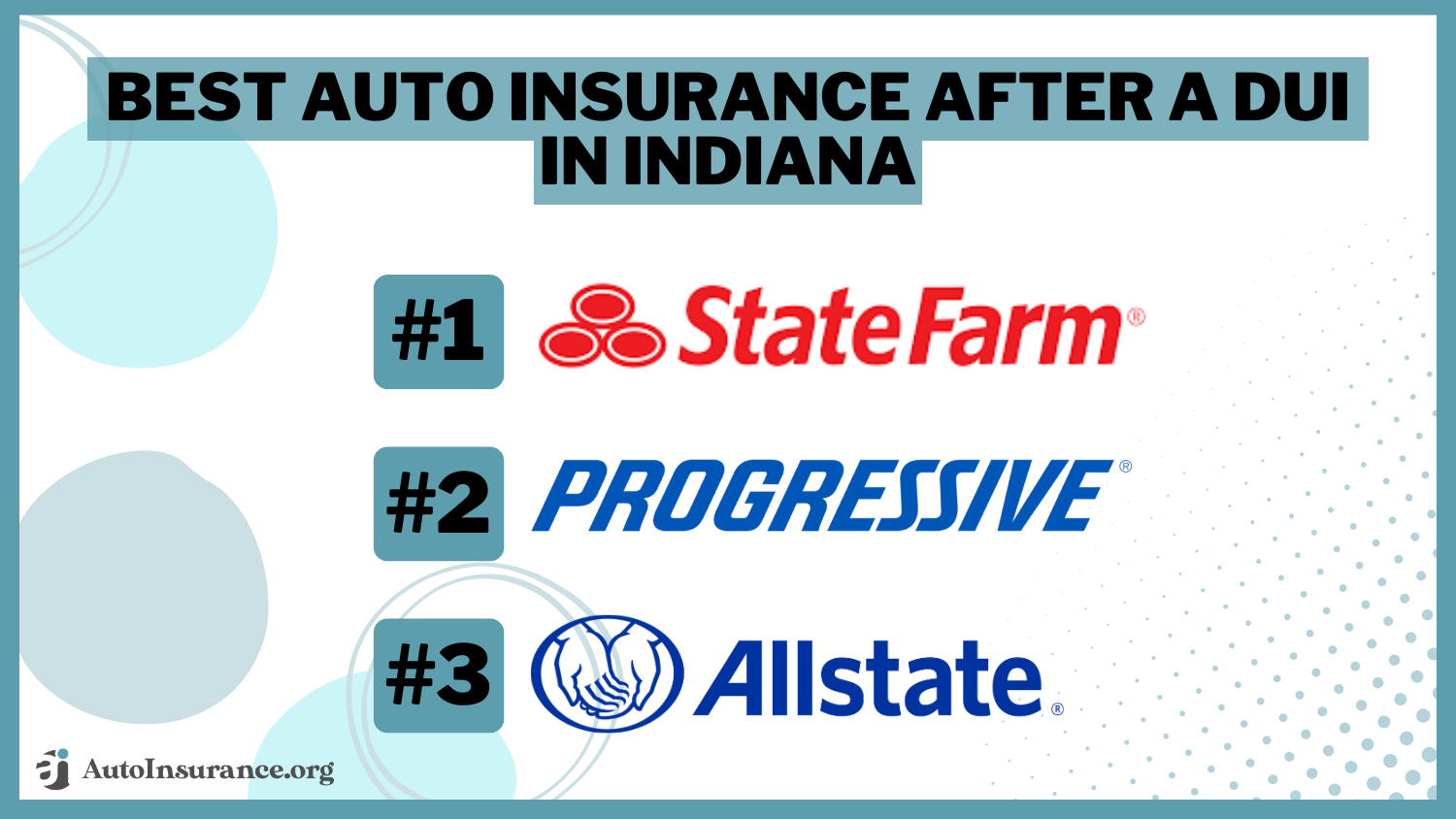

The best Maryville, Tennessee auto insurance options are Erie, Nationwide, and Auto-Owners. Erie offers reliable service at just $55 per month. Nationwide excels with diverse discounts, while Auto-Owners provides excellent claims support. These companies ensure you find the best car coverage in Maryville.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Insurance and Finance Writer

Alexandra Arcand is an outreach administrator and insurance expert located in North Central Ohio. She has a passion for writing, investing, and education. As an insurance content writer for over three years, Alexandra has first-hand experience in business finance, economics, and real estate. She leads an outreach writing team that specializes in travel, real estate, healthcare, law, finance, an...

Alexandra Arcand

Licensed Insurance Agent

Scott W Johnson is an independent insurance agent in California. Principal Broker and founder of Marindependent Insurance Services, Scott brings over 25 years of experience to his clients. His Five President’s Council awards prove he uses all he learned at Avocet, Sprint Nextel, and Farmers Insurance to the benefit of his clients. Scott quickly grasped the unique insurance requirements of his...

Scott W. Johnson

Updated March 2025

Company Facts

Full Coverage in Maryville Tennessee

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage in Maryville Tennessee

A.M. Best

Complaint Level

Pros & Cons

Company Facts

Full Coverage in Maryville Tennessee

A.M. Best

Complaint Level

Pros & Cons

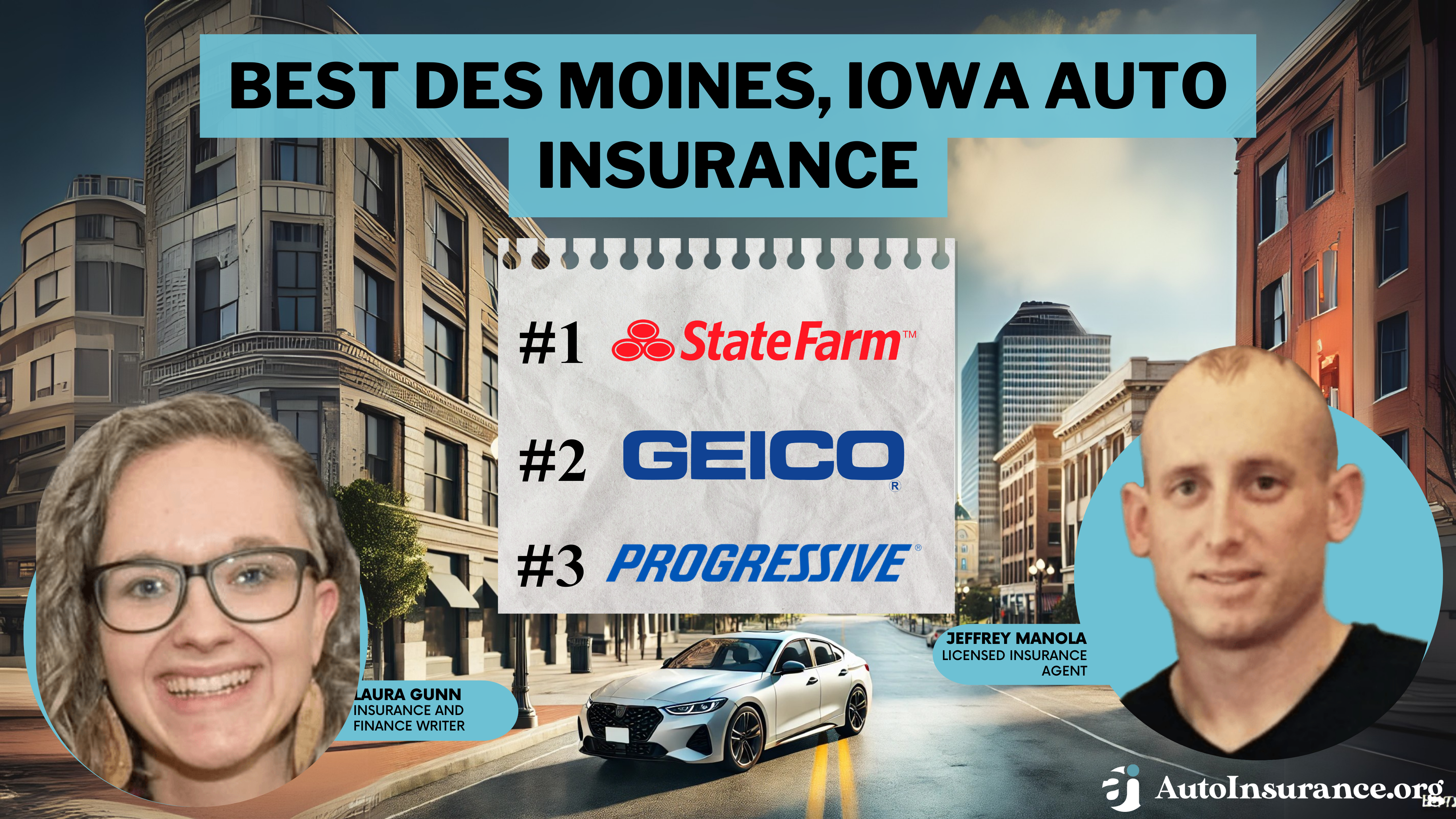

Our Top 10 Company Picks: Best Maryville, Tennessee Auto Insurance

Company Rank Bundling Discount A.M. Best Best For Jump to Pros/Cons

#1 10% A+ Reliable Service Erie

#2 25% A Diverse Discounts Nationwide

#3 20% A Excellent Claims Auto-Owners

#4 20% A+ Customer Satisfaction Amica

#5 8% A++ Military Focus USAA

#6 10% A++ Personalized Coverage American Family

#7 20% A Agent Network State Farm

#8 25% A+ Senior Expertise The Hartford

#9 12% A+ Coverage Variety Liberty Mutual

#10 20% B Competitive Pricing Progressive

These three companies offer the best options for securing your car insurance needs in Maryville. For additional details, explore our comprehensive resource titled “Auto Insurance Coverage”

See how much you’ll pay for car insurance by entering your ZIP code above into our free comparison tool.

- Erie offers reliable auto insurance service and top rates in Maryville, Tennessee

- Nationwide excels in providing diverse discounts tailored to Tennessee drivers

- Auto-Owners offers exceptional claims support and comprehensive car coverage

#1 – Erie: Top Overall Pick

Pros

- Top-Rated Coverage: Erie provides the best Maryville, Tennessee auto insurance with reliable service and comprehensive coverage.

- Competitive Rates: Erie offers competitive rates, ensuring value for money in Maryville, Tennessee.

- Reliable Service: Erie showcases reliable service for the best Maryville, Tennessee auto insurance, consistently meeting customer needs with dependable support. Discover our Erie review for more details.

Cons

- Limited Local Agents: Erie may have fewer local agents in Maryville, Tennessee, which could impact personalized service.

- Coverage Flexibility: Erie’s coverage options may be less flexible compared to some competitors in Maryville, Tennessee.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Nationwide: Best For Diverse Discounts

Pros

- Flexible Coverage Options: Nationwide offers adaptable coverage options in Maryville, customized to meet diverse needs.

- Diverse Discounts: Nationwide presents a wide range of diverse discounts for the best Maryville, Tennessee auto insurance, highlighting significant savings opportunities for policyholders. Explore our Nationwide review for a full breakdown.

- Solid Customer Service: Nationwide is known for good customer service and support in Maryville, Tennessee.

Cons

- Higher Standard Rates: Without discounts, Nationwide’s standard rates in Maryville might be higher than those of other providers.

- Claims Process Speed: Nationwide’s claims process can be slower than some competitors in Maryville, Tennessee.

#3 – Auto-Owners: Best For Excellent Claims

Pros

- Extensive Discounts: Nationwide offers a range of diverse discounts, making it a strong choice for cost-effective auto insurance in Maryville, Tennessee.

- Flexible Coverage Options: Nationwide offers flexible coverage options in Maryville, tailored to meet diverse needs.

- Excellent Claims: Auto-Owners exhibits excellent claims support for the best Maryville, Tennessee auto insurance, demonstrating a commitment to efficient and effective claim resolutions. Check out our Auto-Owners review for more information.

Cons

- Higher Standard Rates: In Maryville, Nationwide’s standard rates might be higher compared to other providers without discounts.

- Claims Process Speed: Nationwide’s claims process can be slower than some competitors in Maryville, Tennessee.

#4 – Amica: Best For Customer Satisfaction

Pros

- Customer Satisfaction: Amica flaunts high customer satisfaction for the best Maryville, Tennessee auto insurance, spotlighting its exceptional service and client care. Read our Amica review to learn more.

- Tailored Coverage: Amica provides personalized coverage options designed to fit individual needs in Maryville.

- Strong Service Quality: Amica offers excellent customer service and support in Maryville.

Cons

- Higher Premium Costs: Amica’s premiums in Maryville may be higher than those of some other auto insurance providers.

- Limited Discounts: Amica offers fewer discount options in Maryville.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – USAA: Best For Military Focus

Pros

- High-Quality Coverage: USAA provides premium, customized coverage for military needs in Maryville.

- Military Focus: USAA highlights a strong military focus in the best Maryville, Tennessee auto insurance, presenting specialized benefits for military members and their families. View our USAA review for further insights.

- Outstanding Service: USAA is renowned for exceptional customer service in Maryville, particularly for military affiliates.

Cons

- Eligibility Restrictions: USAA’s services are limited to military members and their families, excluding other drivers in Maryville, Tennessee.

- Limited Local Presence: USAA may have fewer local branches in Maryville, Tennessee, affecting in-person interactions.

#6 – American Family: Best For Personalized Coverage

Pros

- Customizable Policies: American Family’s policies can be customized to fit unique needs in Maryville, Tennessee.

- Dedicated Agents: American Family provides dedicated agents in Maryville, delivering personalized service to meet individual needs.

- Personalized Coverage: American Family parades personalized coverage options for the best Maryville, Tennessee auto insurance, featuring tailored plans to meet individual needs. See our American Family review for details.

Cons

- Higher Premiums: American Family’s premiums can be higher compared to some competitors in Maryville, Tennessee.

- Limited Discounts: The discount offerings in Maryville may be more limited.

#7 – State Farm: Best For Agent Network

Pros

- Extensive Agent Network: State Farm demonstrates a broad agent network for the best Maryville, Tennessee auto insurance, manifesting extensive local expertise and support. Learn more in our State Farm review for more information.

- Reliable Coverage: State Farm offers reliable and comprehensive auto insurance coverage in Maryville, Tennessee.

- Local Expertise: State Farm’s local agents in Maryville offer valuable expertise and guidance.

Cons

- Variable Rates: State Farm’s rates can vary significantly by location, including Maryville, Tennessee.

- Slower Claims Process: State Farm’s claims process in Maryville may be slower compared to other providers.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – The HartFord: Best For Senior Expertise

Pros

- Strong Customer Service: The Hartford provides responsive and personalized customer support, demonstrating their dedication to client satisfaction in Maryville.

- Senior Expertise: The Hartford showcases senior expertise in the best Maryville, Tennessee auto insurance, highlighting specialized coverage and services for older drivers, which is featured in our Hartford review for a comprehensive look.

- Comprehensive Benefits: The Hartford provides comprehensive benefits for older drivers in Maryville, Tennessee.

Cons

- Limited Coverage for Younger Drivers: The Hartford’s coverage options in Maryville might not be ideal for younger drivers.

- Higher Premiums for Non-Seniors: Premiums may be higher for non-senior drivers in Maryville.

#9 – Liberty Mutual: Best For Coverage Varierty

Pros

- Customizable Policies: Liberty Mutual’s policies can be customized to meet various needs in Maryville, Tennessee.

- Coverage Variety: Liberty Mutual showcases extensive coverage variety in Maryville, Tennessee auto insurance, offering a range of options to meet diverse needs, as highlighted in our Liberty Mutual review.

- Versatile Plans: Liberty Mutual provides versatile plans to fit different preferences in Maryville.

Cons

- Higher Premiums: Liberty Mutual’s rates can be higher compared to some other providers in Maryville, Tennessee.

- Less Competitive Discounts: Discount options in Maryville may not be as competitive.

#10 – Progressive: Best For Competitive Pricing

Pros

- Variety of Coverage Options: Progressive offers a range of coverage options to suit different budgets in Maryville, Tennessee.

- Effective Online Tools: Progressive’s online tools in Maryville assist in comparing rates and securing the best deals.

- Competitive Pricing: Progressive presents competitive pricing for Maryville, Tennessee auto insurance, featuring some of the lowest rates available, which is spotlighted in our Progressive review.

Cons

- Less Personalized Service: Progressive’s customer service may not be as personalized compared to other providers in Maryville, Tennessee.

- Limited Premium Flexibility: In Maryville, Progressive’s coverage options may not include certain features offered by competitors.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Minimum Auto Insurance in Maryville, Tennessee

Erie stands out as the top choice for the best Maryville, Tennessee auto insurance, offering reliable service and comprehensive coverage at competitive ratesKristen Gryglik Licensed Insurance Agent

The Best Maryville, Tennessee Auto Insurance Companies

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| American Family | $61 | $138 |

| Amica | $70 | $150 |

| Auto-Owners | $65 | $145 |

| Erie | $55 | $133 |

| Liberty Mutual | $75 | $160 |

| Nationwide | $60 | $140 |

| Progressive | $73 | $153 |

| State Farm | $67 | $146 |

| The Hartford | $72 | $155 |

| USAA | $50 | $125 |

Best Maryville, Tennessee Auto Insurance by Age, Gender, and Marital Status

Gender can also influence rates, with young males generally paying more than their female counterparts. Marital status plays a role as well, with married individuals often receiving lower rates due to lower risk profiles. By assessing these variables, drivers in Maryville, Tennessee can better understand and secure the most suitable and cost-effective auto insurance options tailored to their personal circumstances.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Best Maryville, Tennessee Auto Insurance By Driving Record

The best Maryville, Tennessee auto insurance by driving record can help you secure lower premiums by rewarding a clean driving history. Insurers often adjust rates based on your driving record, with discounts for those who drive safely.

Understanding how insurance providers determine rates based on your driving record is crucial for securing the best prices. Explore which companies offer the most competitive rates tailored to your driving history to get the best Maryville, Tennessee auto insurance.

Best Maryville, Tennessee Auto Insurance Rates By ZIP Code

What affects auto insurance rates in Maryville, Tennessee?

Factors that affect auto insurance rates in Maryville, Tennessee include your driving record, vehicle type, and local area. Your credit score and history of claims also impact the cost of premiums.

Erie stands out as the top choice for best Maryville, Tennessee auto insurance, offering unmatched reliability and excellent coverage at competitive rates.Dani Best Licensed Insurance Producer

Additionally, the types of coverage you choose and the discounts offered by insurers can influence the rates. Knowing these factors helps you secure the best Maryville, Tennessee auto insurance tailored to your situation.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Compare Maryville, Tennessee Auto Insurance Quotes

When you compare Maryville, Tennessee auto insurance quotes, you gain insight into various coverage options and pricing from different providers. This process helps identify the best rates and policies suited to your needs, ensuring you get the most value for your money.

By evaluating multiple quotes, you can make an informed decision and secure affordable auto insurance. Always review each provider’s offerings to find the best Maryville, Tennessee auto insurance that meets your requirements.

To delve deeper, refer to our in-depth report titled “Where to Compare Auto Insurance Rates”

Before you buy Maryville, Tennessee auto insurance, make sure you have compared rates from multiple companies. Enter your ZIP code below to get free Maryville, Tennessee auto insurance quotes.

Frequently Asked Questions

What is the best insurance to have in Tennessee?

The best insurance to have in Tennessee varies based on your needs, but Erie, Nationwide, and Auto-Owners are top picks for their comprehensive coverage and competitive rates.

Finding cheap car insurance quotes is easy. Just enter your ZIP code into our free comparison tool below to instantly compare quotes near you.

What is the average price for car insurance in Tennessee?

The average monthly price for car insurance in Tennessee is around $130, with prices typically ranging between $120 and $140 depending on various factors such as coverage level and driving history.

What kind of car insurance do I need in Tennessee?

In Tennessee, you need at least the state-required minimum liability coverage, but many opt for full coverage auto insurance in Tennessee to ensure better protection.

Do I need proof of insurance to register a car in Tennessee?

Yes, you need proof of insurance to register a car in Tennessee. Without it, you won’t be able to legally register your vehicle.

What is the minimum insurance in Tennessee?

The minimum insurance in Tennessee is liability coverage of 25/50/15, which covers $25,000 per person for bodily injury, $50,000 per accident, and $15,000 for property damage.

Take the first step toward cheaper car insurance rates. Enter your ZIP code below to see how much you could save.

How does insurance work in Tennessee?

Insurance in Tennessee operates on a fault-based system, meaning the at-fault driver’s insurance pays for damages. Proof of coverage is required to drive legally. To gain further insights, consult our comprehensive guide titled “What is auto insurance?”

What is full coverage insurance in Tennessee?

Full coverage insurance in Tennessee includes liability, collision, and comprehensive coverage, offering broader protection against various types of damages.

How to insure a car in Tennessee?

To insure a car in Tennessee, compare car insurance quotes in Maryville from multiple providers, choose a policy that fits your needs, and purchase it to ensure legal and financial protection.

Is car insurance expensive in Tennessee?

Car insurance in Tennessee can be moderately priced, with factors like location, driving record, and vehicle type affecting rates. Using discount car insurance options can reduce costs. For additional details, explore our comprehensive resource titled “Best Tennessee Auto Insurance”

Does insurance follow the car or the driver in Tennessee?

In Tennessee, insurance generally follows the car. This means if someone else drives your insured vehicle, your policy typically covers any damages.

Ready to find cheaper car insurance coverage? Enter your ZIP code below to begin.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.