Aetna Auto Insurance Review for 2026 (+Rates & Coverage Options)

Aetna auto insurance review breaks down what you can expect—how much it costs, what it covers, and how it handles claims. Starting at $120 a month, Aetna offers solid basics but might fall short if you're looking for extras, especially if you need Amazon Flex insurance support.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Insurance Content Team Lead

Tonya Sisler has been a technical insurance writer for over five years. She uses her extensive insurance and finance knowledge to write informative articles that answer readers' top questions. Her mission is to provide readers with timely, accurate information that allows them to determine their insurance needs and choose the best coverage. Tonya currently leads a team of 10 insurance copywrite...

Tonya Sisler

Licensed Insurance Agent

Jeff is a well-known speaker and expert in insurance and financial planning. He has spoken at top insurance conferences around the U.S., including the InsuranceNewsNet Super Conference, the 8% Nation Insurance Wealth Conference, and the Digital Life Insurance Agent Mastermind. He has been featured and quoted in Nerdwallet, Bloomberg, Forbes, U.S. News & Money, USA Today, and other leading fina...

Jeff Root

Updated August 2025

This Aetna auto insurance review demonstrates how Aetna Inc. assists drivers with tech-savvy tools and easy-to-use claims tracking. One of the best benefits is their 24/7 online access to handle your policy and roadside assistance, which starts at $120 per month.

Aetna Auto Insurance Rating

| Rating Criteria |  |

|---|---|

| Overall Score | 3.8 |

| Business Reviews | 4 |

| Claim Processing | 3.5 |

| Company Reputation | 4 |

| Coverage Availability | 5 |

| Coverage Value | 3.8 |

| Customer Satisfaction | 2.5 |

| Digital Experience | 4.5 |

| Discounts Available | 2.5 |

| Insurance Cost | 3.6 |

| Plan Personalization | 4 |

| Policy Options | 4 |

| Savings Potential | 3.3 |

Aetna can be a good choice if you’re an Amazon Flex delivery driver seeking insurance or simply desire a hassle-free insurance experience.

The drivers can expect fewer discounts than bigger companies, but there’s a good tradeoff for consistent and simple support. Comparing a couple of quotes always makes sense.

- Save up to 10% with Aetna’s multi-policy auto insurance discount

- Amazon delivery drivers can access customized coverage at competitive rates

- Enjoy up to 20% in savings with unique discounts for safe driving and bundling

Looking for Aetna auto insurance quotes? While Aetna car insurance doesn’t exist, you can find cheap auto insurance quotes just by entering your ZIP code.

Aetna Auto Insurance Availability and Monthly Rate Comparison

While this Aetna auto insurance review may lead you to expect car insurance options, it’s important to clarify that Aetna Inc. is primarily a health insurance provider, not an auto insurer.

Founded in 1850, Aetna has a long history in the insurance industry and now operates in all 50 states. 2018 CVS acquired Aetna for around $69 billion, forming CVS Health. Despite its broad reach in health coverage, Aetna doesn’t offer personal or commercial car insurance policies.

Aetna Auto Insurance Monthly Rates by Age, Gender, & Coverage Level

| Age & Gender | Minimum Coverage | Full Coverage |

|---|---|---|

| 16-Year-Old Female | $390 | $630 |

| 16-Year-Old Male | $425 | $680 |

| 18-Year-Old Female | $320 | $525 |

| 18-Year-Old Male | $355 | $575 |

| 25-Year-Old Female | $180 | $340 |

| 25-Year-Old Male | $200 | $365 |

| 30-Year-Old Female | $160 | $300 |

| 30-Year-Old Male | $175 | $320 |

| 45-Year-Old Female | $132 | $270 |

| 45-Year-Old Male | $140 | $285 |

| 60-Year-Old Female | $120 | $240 |

| 60-Year-Old Male | $130 | $255 |

| 65-Year-Old Female | $125 | $230 |

| 65-Year-Old Male | $135 | $245 |

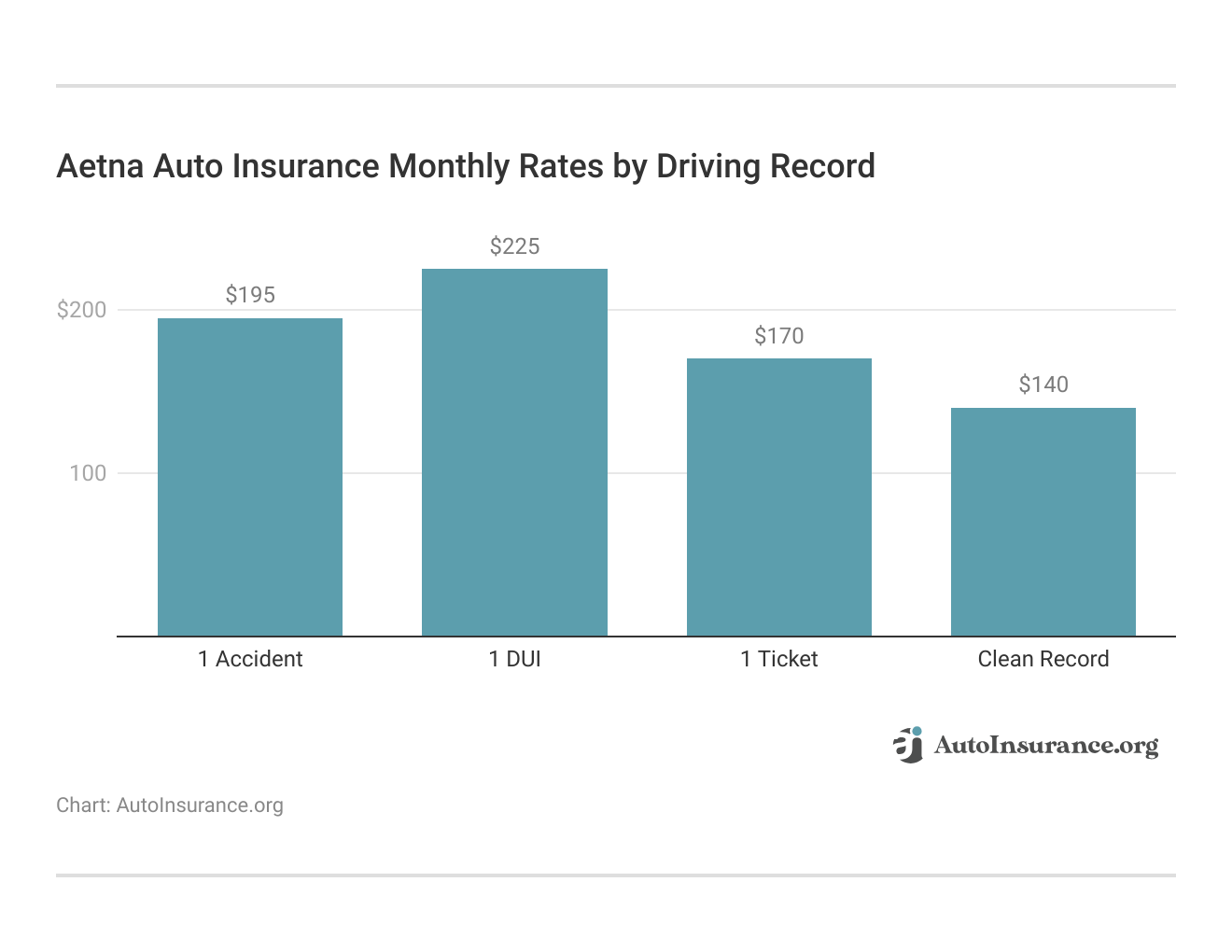

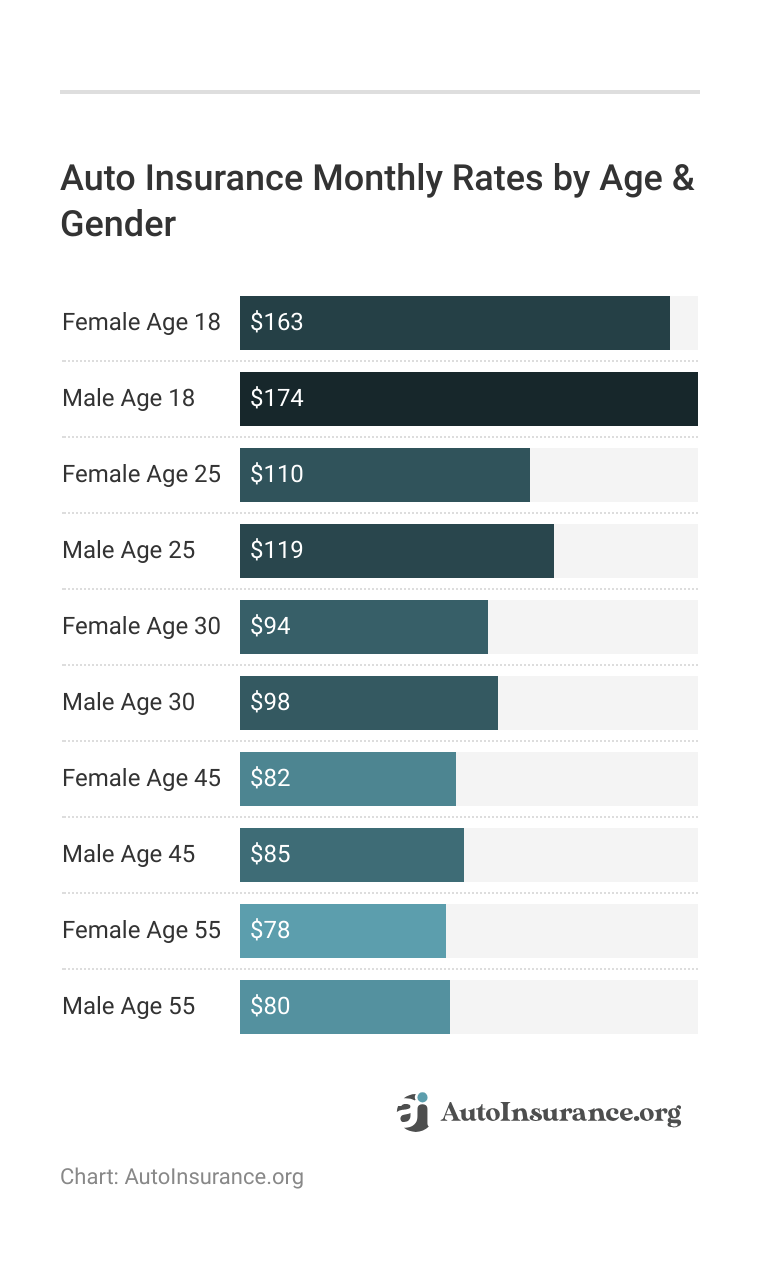

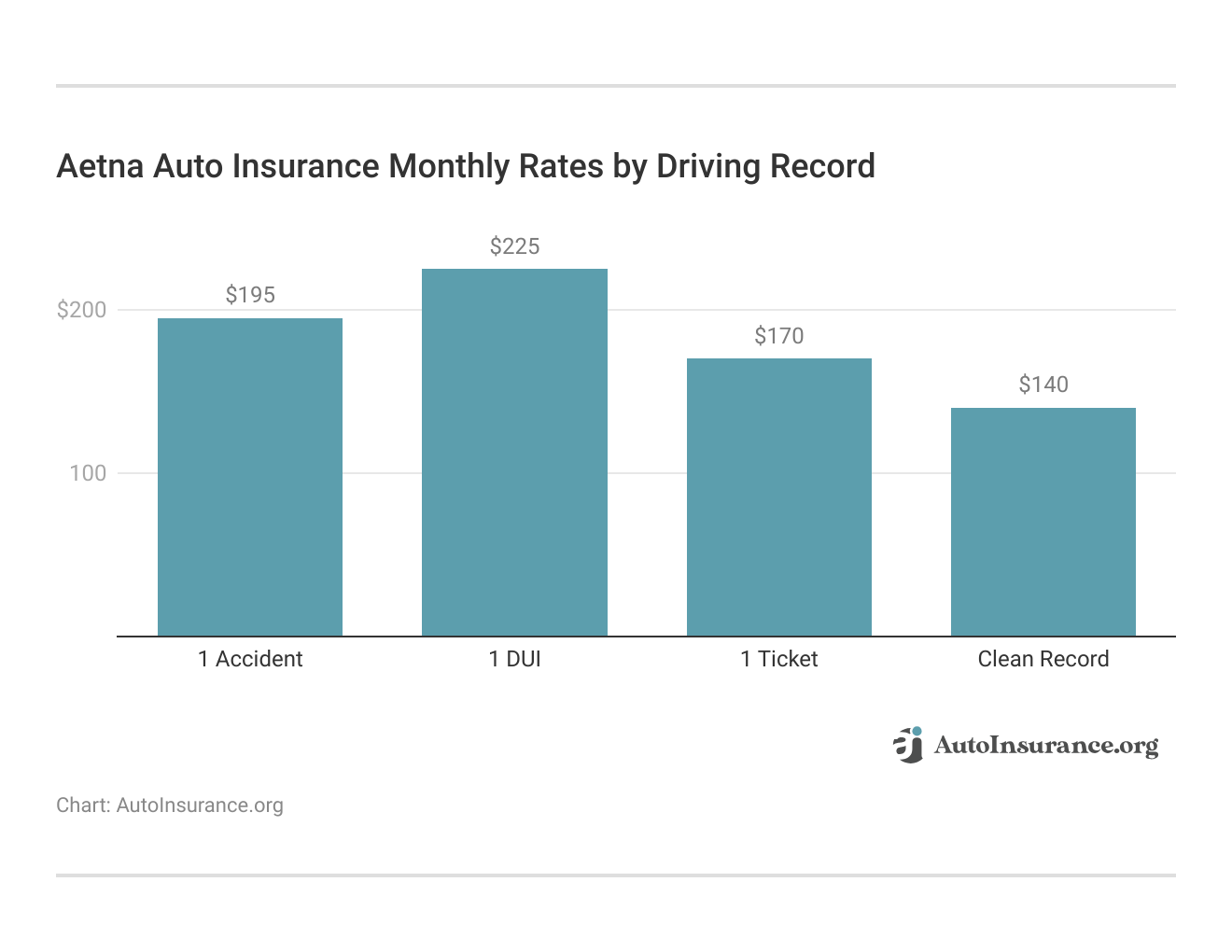

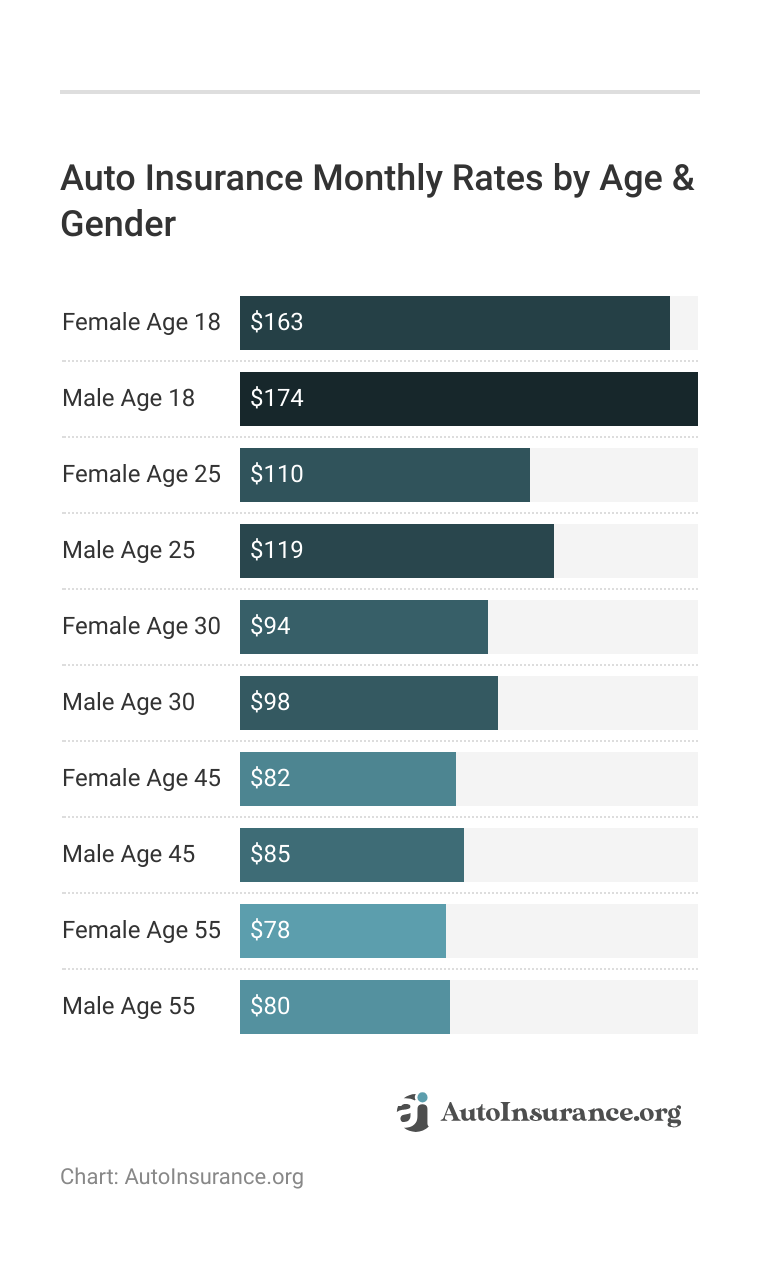

However, estimated monthly auto insurance rates labeled under Aetna’s name, such as $120 for minimum coverage for a 60-year-old female, may reflect third-party providers partnered with Aetna branding.

These rates vary widely by age, gender, and driving record, offering insight into potential costs if Aetna ever enters the auto insurance market.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Aetna Insurance Rates Breakdown

How much does Aetna Insurance cost? While the price isn’t always the deciding factor when it comes to choosing an auto insurance policy, it’s usually one of the most important.

Although Aetna Insurance does not offer auto insurance policies, you can look at the table below to get an idea of what you might pay for auto insurance depending on how much auto insurance you need.

The table shows average annual rates based on coverage levels.

Average Auto Insurance Rates by Coverage

| Coverage Types | Average Annual Auto Insurance Rates | Average Monthly Auto Insurance Rates |

|---|---|---|

| Comprehensive coverage | $150.36 | $12.53 |

| Collision coverage | $299.73 | $24.97 |

| Liability coverage | $516.39 | $43.03 |

| Total Full Coverage Cost | $954.99 | $79.58 |

These are just guidelines. Actual rates will depend on various factors such as age, driving history, auto theft rates in your area, and ZIP code.

If you’d like to check the crime rates where you live, you can visit the Federal Bureau of Investigations (FBI) online database.

Aetna Auto Insurance Ratings

Aetna Insurance does not offer auto insurance, but is a leading provider in the health insurance industry. The company has received multiple national awards. In 2008, Aetna won a Health Literacy Award from the Institute for Healthcare Advancement for its asthma health study. PayerView ranked it #1 among national health plans and #23 among the top 100 corporate citizens.

In 2009, Aetna became the preferred partner for health systems and hospitals nationwide and was recognized by DiversityInc for its community development work.

In 2010, Aetna received a J.D. Power award for customer service and was named International Provider of the Year. A.M. Best rated it A (Excellent). In 2011, Aetna was recognized for eliminating paper in its provider contracting process and for promoting ethnic and racial equality in its workforce. In 2018, CVS acquired Aetna, forming CVS Health.

Aetna Insurance Coverage Options

Before buying an auto insurance policy, determine how much coverage you need. If you’re financing a vehicle, your lender may require full coverage. Otherwise, you must carry at least your state’s minimum liability coverage.

Types of Auto Insurance Coverage

| Auto Coverage Type | Purpose of Coverage |

|---|---|

| Bodily injury liability | Part of your liability coverage that pays for medical bills if you've injured someone else in an automobile accident |

| Collision | Covers damage to your car after an automobile accident |

| Comprehensive | Covers damage to your car that happens when you're not driving |

| Personal injury protection | Covers medical expenses for you or your passengers after an automobile accident |

| Property damage liability | The other part of liability coverage that covers the cost of any property damage you've caused in an automobile accident |

| Uninsured/underinsured motorist | Covers the costs if you're in an automobile accident caused by a driver with little or no car insurance |

Additional coverage options are available if you want more than the minimum. Are you interested in Aetna car insurance rates? Aetna does not currently offer auto insurance, but the table above shows example rates and types of available coverage.

Although Aetna doesn’t provide auto insurance, it offers other plans, such as Medicare Supplement and dental coverage. Always compare quotes before buying a policy.

Aetna’s Available Bundling Options

Many insurance providers offer different bundling options. Bundling your insurance policies refers to purchasing multiple policies from the same company. If you want to know more about bundling, here is what an auto insurance specialist says about bundling rates.

For example, you can purchase your auto insurance policy as well as your life insurance from the same company if you choose. Most insurance companies offer a discount of anywhere from 5-25 perdent if you choose to bundle. Check out the video below to learn about the pros and cons of bundling your insurance policies.

Many companies also offer multi-car discounts. You can think of this as a way of bundling as well, but in this case, you’re buying auto insurance for multiple vehicles. Auto insurance companies offer up to a 25 percent multi-car discount on combined policies.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Aetna Discounts Available

Generally, your auto insurance discount options through the company depend on what each provider offers, but many discounts are standard throughout the industry.

The table below shows some of the most common auto insurance discounts available, an estimate of how much money each can save you, and the major auto insurance companies that offer the discount.

Standard Auto Insurance Discounts Offered by Major Companies

| Discounts Offered | Average Savings | Available With |

|---|---|---|

| Low mileage/Low usage discount | Up to 20% | State Farm, Allstate, Travelers, Nationwide, Progressive |

| Defensive driving discount | 10%–15% | State Farm, Geico, Allstate, Travelers, Nationwide, Progressive, Farmers |

| Safe driver discount | 10% | State Farm, Geico, Allstate, Travelers, Nationwide, Progressive, Liberty Mutual, State National |

| Military and federal employee discount | 8%–15% | Geico, Esurance, USAA |

| Good student discount | 5%–25% | State Farm, Geico, Allstate, Travelers, Nationwide, Progressive, Liberty Mutual, State National |

| Senior/Mature driver discount | 5%–10% | Geico, Allstate, Liberty Mutual, State National |

| Homeowner discount | 3% | State Farm, Geico, Allstate, Travelers, Nationwide, Progressive, Farmers |

While Aetna does not offer auto insurance policies, you can find Aetna insurance quotes that offer a series of Discover Discounts that can help you save money on your healthcare. As you can see, it is always best to check with your insurance provider to see what insurance discounts are available to you.

What You Should Know About Aetna

Aetna helps individuals and businesses attain financial and health security by offering high-quality, cost-effective healthcare access. The company has become a leader in the healthcare system by working with hospitals, doctors, public officials, patients, employers, and others.

Aetna strives to offer resources to help people make better choices about how they take care of their health. These resources include access to health information and convenient tools to help make well-informed choices about health-related risks.

Keep reading this Aetna review to learn more about Aetna insurance. What is Aetna’s availability by state? Aetna offers health insurance coverage in all 50 states.

Canceling Your Aetna Auto Insurance Policy

What should you do if you need to cancel your policy? You can watch the video below to understand what to expect should you need to cancel your auto insurance policy.

If you’re thinking about canceling your Aetna Insurance policy, it’s important to understand how the process works. Below are key points on cancellation, refunds, and what to expect.

- No Cancellation Fee: Aetna Insurance does not charge a cancellation fee if you decide to cancel your policy.

- Refund on Auto Insurance: Depending on your policy type and cancellation timing, you may receive a partial refund on auto insurance if canceled mid-cycle.

- Cancellation Process: You can cancel anytime by contacting your insurance agent, who will inform you of the effective date and any refund details.

- Cancellation Timing: Policies can be canceled at any point, and excess premiums will be refunded according to the terms.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Filing an Aetna Health Insurance Claim

Filing a claim with Aetna for medical, dental, vision, or life insurance is simple. Policyholders can file by phone or through the Aetna insurance login for faster online submissions. The Aetna customer service phone number supports claims inquiries and guidance for medical, vision, dental, and life insurance claims.

Aetna – Member Submitted Claims Process

byu/chickeneater89 inHealthInsurance

Online access allows users to submit claims, track status, and review coverage without paper forms or phone calls. Aetna emphasizes responsive customer support across all services. Policyholders can contact Aetna directly for help with the portal or claim issues.

How to Make an Aetna Auto Insurance Claim

Looking for the Aetna car insurance company to make a claim? Since Aetna Insurance does not offer auto insurance, its claims system works slightly differently than most auto insurance claims, so it’s important to know how to file an insurance claim with Aetna.

Watch the video below to understand your expectations during the claims process. This video pertains to auto insurance claims.

As is the case with most health insurance companies, after a visit with your doctor, your insurance company will send you a bill for whatever part of the medical service you received that it will not cover.

When a service is not paid for, it is called a denied claim. With Aetna Insurance, if you disagree with a decision made on a denied claim, you are able to appeal the decision in writing and possibly get an independent doctor to review your claim. This is often referred to as an external review.

Aetna Auto Insurance Consumer Ratings and Financial Strength

Aetna Inc. is renowned for its reasonable customer satisfaction and financial health. Based on current statistics, it boasts high ratings on numerous key review websites, which speak volumes about its reliable service and assistance.

Aetna Auto Insurance Business Ratings & Consumer Reviews

| Agency |  |

|---|---|

| Score: 835/1,000 Avg. Satisfaction |

|

| Score: A+ Excellent Customer Service |

|

| Score: 70/100 Avg. Customer Satisfaction |

|

| Score: 0.75 Fewer Complaints Than Avg. |

|

| Score: A Excellent Financial Strength |

These grades point to Aetna’s A+ customer service rating and an “A” rating by A.M. Best, verifying its sound financial support. Aetna remains a stable and responsive insurance company with fewer complaints than most and strong consumer sentiment.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Pros and Cons of Aetna

Pros

- Excellent Financial Stability: Aetna’s A rating from A.M. Best shows strong financial health.

- High Customer Satisfaction: Aetna ranks well with an A+ satisfaction score and 835/1,000 from J.D. Power.

- Low Complaint Ratio: Consumer Reports notes a complaint score of 0.75—better than average.

Cons

- No Auto Insurance Products: Aetna doesn’t offer personal or commercial car insurance.

- Limited Cross-Coverage Options: There are no bundled policies with auto insurance available.

Other Types of Aetna Insurance and Coverage

While Aetna is best known for its health plans, it also offers several other types of insurance and services that support a wide range of healthcare and financial needs. Here’s a closer look at Aetna’s additional offerings, including dental, life, supplemental insurance, and member support services.

- Aetna Dental Insurance: Aetna offers dental insurance plans that cover preventive care, fillings, root canals, and bridges. Policyholders have access to a network of dental providers, and plan details like deductibles and co-pays vary by location.

- Aetna as Supplemental Insurance: Aetna provides Medicare Supplement Insurance (Medigap) to cover copayments, coinsurance, and deductibles not included in Original Medicare (Part A and Part B). These standardized plans reduce out-of-pocket costs, with benefits varying by location.

- Life Insurance Policies with Aetna: Aetna’s life insurance options include term and whole-life policies. Term policies offer coverage for a fixed period, while whole-life policies provide lifetime coverage with a potential cash value component.

- Aetna Member Services: Aetna Member Services offers support for managing policy details, claims, and benefits through a secure online portal that is available 24/7. The customer service team can assist with benefit explanations, claims questions, and provider access. The service also includes wellness programs and preventive care information.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Wrapping Up the Aetna Auto Insurance Insight

If you’ve been looking for Aetna automobile insurance, the good news is that Aetna Inc., a well-known healthcare company, no longer issues personal or commercial automobile insurance policies. That being said, the following guide dove into essential figures such as prospective monthly premiums based on age and driving record to let you compare similar companies’ likely rates.

Aetna’s well-established credibility—proven by an A+ customer satisfaction rating, 835/1,000 J.D. Power score, and robust financial support—explains why some hope the company will venture into the auto insurance market one day. For now, motorists can utilize this data to compare highly rated carriers and shop intelligently, utilizing reliable quote resources.

You could be saving more on car insurance. Compare personalized quotes from trusted providers instantly—just enter your ZIP code to get started.

Frequently Asked Questions

What do Aetna employees have to say?

Aetna offers a number of career opportunities for students, recent grads, and experienced professionals. The job types available include behavioral health, actuarial, global opportunities, customer service and claims, finance, and human resources.

One of the reasons that Aetna and the people working for Aetna are successful is because the company is focused on key core values. These core values include employee engagement, integrity, accountability and excellence, and value and quality service.

Aetna believes it is important to balance both a career and personal life, so the company offers many flexible work arrangements. These include part-time, temporary positions, personal, medical, family, and military leave, and telework.

Aetna Insurance offers a number of benefits including life insurance, health insurance, wellness, disability/paid time off, retirement, and savings.

Other benefits include support services such as financial wellness, community involvement, tuition assistance programs for employees, qualified transportation benefits, employee referral program, employee discounts, and direct deposit for paychecks.

Why would my provider cancel my auto insurance policy?

Your auto insurance provider may cancel your policy if you do any of the following:

- Get your driver’s license suspended or revoked

- Lie during the application process

- Fail to pay your auto insurance premium

Your auto insurance company may also choose not to renew your policy if it determines you to be a high-risk driver.

What kinds of questions should I be prepared for when purchasing my auto insurance policy?

When you apply for an auto insurance policy, you will be asked a series of demographic questions such as your name, age, sex, etc. You will also be asked a variety of other questions aimed at assessing your risk as a driver.

Some of the things the insurance company will want to know about are your financial background, the type of vehicle you’re insuring, and whether or not you’ve had any tickets or accidents in the past.

Once this information is collected, the insurance company uses this data to assess your risk as a driver and to determine your policy rates. This is known as the underwriting process.

By using this method of risk evaluation, auto insurance companies are able to reduce their chances of losing money on issued policies. Through this process, the insurer can determine your risk factors and decide if they want to insure you, and if so, at what rate.

Does Aetna Insurance offer SR-22 insurance?

Since Aetna does not offer auto insurance policies, they also do not offer SR-22 auto insurance policies. If you’ve had more than your fair share of traffic citations, automobile accidents, and/or auto insurance claims, you may be considered a high-risk driver. Normally, those who need high-risk auto insurance are required to purchase SR-22 insurance, which isn’t available through all companies, so it may take some looking around to find coverage.

The filing fee to get SR-22 insurance is only $15–$35, but the increase in rates for SR-22 insurance when compared to rates for drivers without any driving violations on their records is steep.

Rate increases for driving violations that result in a driver being forced to carry SR-22 insurance can be as much as $541/mo.

How does adding drivers to my auto insurance policy affect my rates?

Adding another driver to your auto insurance policy means that your car will be spending more time on the road, as multiple people will be driving it. That alone is enough to raise your rates, but adding someone else to your auto insurance policy also means that your rates will be affected by that driver’s perceived risk, as well.

For example, adding a teenager to your policy can raise your auto insurance rates drastically since teenage drivers are inexperienced and auto insurance companies see them as high-risk drivers, whereas adding your spouse might not raise your rates quite as much.

There are restrictions as to who you can add to your auto insurance policy. Most companies will only allow you to add people in the same household to your policy. Always talk to your insurance provider about adding new drivers, as a claim filed involving a driver that isn’t on your policy will be denied.

Does Aetna offer auto insurance coverage?

No, Aetna Insurance does not sell personal or commercial auto insurance coverage.

Is Aetna Insurance available in all 50 states?

Yes, Aetna offers health insurance coverage in all 50 states.

Are there cancellation fees for Aetna Insurance policies?

Aetna Insurance does not charge a cancellation fee for policies.

How do I cancel my Aetna Insurance policy?

You can cancel your policy by contacting your insurance agent and informing them of your decision to cancel.

What discounts are available with Aetna Insurance?

While Aetna does not offer auto insurance, they provide Discover Discounts that can help you save money on healthcare.

Is Aetna good insurance?

What is the Aetna car insurance phone number?

Is there Aetna supplemental insurance?

Are there Aetna life insurance policies?

What is the best medical insurance?

What is the A.M. Best rating for Aetna?

What is the best medical insurance in the Philippines?

What are the US top 5 health insurance companies?

What is AAA Insurance’s A.M. Best rating?

What does A.M. Best mean in insurance?

What is the highest A.M. Best insurance rating?

How much is comprehensive car insurance in the Philippines?

What is the no. 1 HMO in the Philippines?

Which company gives the best medical insurance?

Which private health insurance is best?

Who is the richest insurance company?

Who is the largest medical insurance company?

What is a good insurance rating?

Which company is AAA rated?

Is AAA rating better than AA?

Who is the best auto insurance?

What is Allianz’s A.M. Best rating?

What is the A.M. Best rating for Auto-Owners Insurance?

What is the rating of AXA insurance?

How can I find the rating of an insurance company?

How is my best rating determined?

Which medical cover is best?

Which company gives the best medical insurance?

Which private health insurance is best?

What is the best HMO card in the Philippines?

What is the most expensive health insurance?

Which health insurance has the highest claim rate?

What are the top health insurance in the Philippines?

Should you get health insurance in the Philippines?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.