Best Cleveland, Texas Auto Insurance in 2026 (Find the Top 10 Companies Here)

The best Cleveland, Texas auto insurance providers are State Farm, Geico, and Progressive, offering affordable premiums and competitive rates starting at $65/mo. These top picks stand out for their reliable coverage, local agents, and budget-friendly plans tailored to Cleveland, Texas drivers.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Insurance and Finance Writer

Laura Gunn is a former teacher who uses her passion for writing and learning to help others make the best decisions regarding finance and insurance. After stepping away from the classroom, Laura used her skills to write across many different industries including insurance, finance, real estate, home improvement, and healthcare. Her experience in various industries has helped develop both her ...

Laura Gunn

Licensed Insurance Agent

Tim Bain is a licensed insurance agent with 23 years of experience helping people protect their families and businesses with the best insurance coverage to meet their needs. His insurance expertise has been featured in several publications, including Investopedia and eFinancial. He also does digital marking and analysis for KPS/3, a communications and marking firm located in Nevada.

Tim Bain

Updated October 2024

Company Facts

Full Coverage in Cleveland TX

A.M. Best

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviewsCompany Facts

Full Coverage in Cleveland TX

A.M. Best

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews

Company Facts

Full Coverage in Cleveland TX

A.M. Best

Complaint Level

Pros & Cons

The best Cleveland, Texas auto insurance providers are State Farm, Geico, and Progressive, known for offering the most competitive rates starting at $65/month.

These companies are top choices for their competitive auto insurance premiums, excellent customer service, and local agent support.

Our Top 10 Company Picks: Best Cleveland, Texas Auto Insurance

Company Rank Safe Driving Discount A.M. Best Best For Jump to Pros/Cons

#1 15% B Local Agents State Farm

#2 22% A++ Affordable Premiums Geico

#3 12% A+ Competitive Rates Progressive

#4 10% A+ Personalized Service Allstate

#5 15% A Bundling Options Liberty Mutual

#6 10% A+ Customizable Policies Farmers

#7 10% A+ Vanishing Deductible Nationwide

#8 8% A++ IntelliDrive Program Travelers

#9 12% A+ Customer Satisfaction Amica

#10 10% A++ Financial Stability Auto-Owners

This article compares these providers, helping you choose the best coverage for your needs. Discover how these options stand out in Cleveland, Texas.

To find out if you can get cheaper auto insurance rates, enter your ZIP code into our free quote tool above to instantly compare prices from various companies near you.

- State Farm stands out as the top pick for affordable premiums and reliable service

- Find the best Cleveland, Texas auto insurance with rates starting at $65/month

- Compare rates from top providers to find the most affordable coverage in Cleveland

#1 – State Farm: Top Overall Pick

Pros

- Local Agents: State Farm offers a network of local agents in Cleveland, Texas, making it easier for residents to get personalized service and support. Read more in our review of State Farm.

- Community Involvement: State Farm is actively involved in Cleveland, Texas, contributing to local events and initiatives which can be beneficial for community engagement.

- Reliable Coverage: Known for its strong customer service, State Farm provides reliable auto insurance coverage specifically suited to the needs of Cleveland, Texas drivers.

Cons

- Potentially Higher Premiums: State Farm’s premiums in Cleveland, Texas might be higher compared to some competitors, depending on individual risk factors.

- Limited Discounts: While offering good coverage, State Farm’s discount options in Cleveland, Texas may not be as extensive as those provided by other insurers.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Geico: Best for Affordable Premiums

Pros

- Affordable Premiums: Geico is known for offering some of the most affordable auto insurance premiums in Cleveland, Texas.

- Easy Online Quotes: Residents of Cleveland, Texas can quickly get and compare insurance quotes online through Geico’s user-friendly platform.

- Good Customer Service: Geico has a reputation for effective customer service, including support tailored to Cleveland, Texas drivers, which you can learn about in our Geico review.

Cons

- Limited Local Presence: Geico has fewer local offices in Cleveland, Texas, which might affect face-to-face customer support.

- Basic Coverage Options: Some Cleveland, Texas residents might find Geico’s coverage options less customizable compared to other providers.

#3 – Progressive: Best for Competitive Rates

Pros

- Competitive Rates: Progressive offers competitive rates for auto insurance in Cleveland, Texas, making it a cost-effective choice for many drivers.

- Flexible Coverage Options: With Progressive, Cleveland, Texas drivers can choose from a variety of coverage options to suit their specific needs. Find out more in our Progressive review.

- User-Friendly Tools: Progressive’s online tools and resources are particularly useful for Cleveland, Texas residents to compare and manage their insurance policies.

Cons

- Customer Service Variability: While rates are competitive, customer service experiences in Cleveland, Texas may vary based on individual interactions.

- Potential for Higher Rates with Add-Ons: Adding extra features or coverage options might result in higher premiums for Cleveland, Texas drivers.

#4 – Allstate: Best for Personalized Service

Pros

- Personalized Service: Allstate provides personalized service to Cleveland, Texas drivers, with local agents who understand the unique needs of the community.

- Various Discounts: Cleveland, Texas residents can benefit from a range of discounts offered by Allstate, including safe driver and multi-policy discounts.

- Local Expertise: Allstate’s local presence in Cleveland, Texas ensures that drivers receive tailored advice and support, which is covered in our Allstate review.

Cons

- Higher Premiums: Allstate’s premiums in Cleveland, Texas may be higher compared to some competitors.

- Complex Policy Options: The range of policy options can be overwhelming for some Cleveland, Texas drivers, requiring more time to choose the best fit.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Liberty Mutual: Best for Bundling Options

Pros

- Bundling Options: Liberty Mutual offers bundling discounts for Cleveland, Texas residents who choose to combine auto insurance with other policies, which you can check out in our Liberty Mutual review.

- Customizable Coverage: Drivers in Cleveland, Texas can customize their coverage to fit their specific needs, thanks to Liberty Mutual’s flexible options.

- Local Discounts: Liberty Mutual provides discounts specific to Cleveland, Texas, such as those for safe driving or having certain safety features in vehicles.

Cons

- Complex Claims Process: The claims process with Liberty Mutual may be more complex or slower for Cleveland, Texas drivers compared to other companies.

- Potentially Higher Premiums: The cost of premiums might be higher for Cleveland, Texas residents, especially without bundling multiple policies.

#6 – Farmers: Best for Customizable Policies

Pros

- Customizable Policies: Farmers offers a range of customizable auto insurance policies for Cleveland, Texas drivers, allowing them to tailor their coverage.

- Local Agents: With local agents in Cleveland, Texas, Farmers provides personalized service and advice for insurance needs, which you can read more about in our review of Farmers.

- Community Involvement: Farmers is involved in Cleveland, Texas community events and initiatives, reflecting a commitment to local engagement.

Cons

- Higher Premiums: Farmers may have higher premium rates in Cleveland, Texas compared to other insurers.

- Limited Discount Options: The range of available discounts might be more limited for Cleveland, Texas drivers.

#7 – Nationwide: Best for Vanishing Deductible

Pros

- Vanishing Deductible: Nationwide offers a vanishing deductible program, which benefits Cleveland, Texas drivers by reducing their deductible over time for safe driving.

- Comprehensive Coverage Options: Cleveland, Texas residents have access to a broad range of coverage options with Nationwide. For a complete list, read our Nationwide review.

- Strong Financial Stability: Nationwide’s strong financial stability provides peace of mind for Cleveland, Texas drivers regarding claims and coverage.

Cons

- Premiums Might Be Higher: The cost of auto insurance premiums in Cleveland, Texas could be higher with Nationwide, especially without taking advantage of discounts.

- Limited Local Presence: Nationwide’s local office presence in Cleveland, Texas may be less extensive compared to other providers.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Travelers: Best for IntelliDrive Program

Pros

- IntelliDrive Program: Travelers’ IntelliDrive program helps Cleveland, Texas drivers save on premiums based on their driving behavior.

- Wide Range of Coverage Options: Cleveland, Texas drivers can choose from a variety of coverage options with Travelers, ensuring a fit for their needs.

- User-Friendly Tools: The online tools and mobile app provided by Travelers are beneficial for managing policies and claims from Cleveland, Texas. Read our Travelers review to learn what else is offered.

Cons

- Program Participation Required: To benefit from the IntelliDrive program, Cleveland, Texas drivers must participate in the telematics program, which might not appeal to everyone.

- Customer Service Variability: The quality of customer service can vary, potentially affecting Cleveland, Texas residents’ overall experience.

#9 – Amica: Best for Customer Satisfaction

Pros

- High Customer Satisfaction: Amica consistently receives high customer satisfaction ratings from Cleveland, Texas drivers.

- Competitive Rates: Cleveland, Texas residents often find Amica’s rates to be competitive for the coverage offered.

- Excellent Claims Service: Amica is known for its efficient and effective claims handling, benefiting Cleveland, Texas drivers. Discover our Amica review for a full list.

Cons

- Limited Local Presence: Amica may have fewer local offices in Cleveland, Texas, affecting face-to-face service availability.

- Discounts May Vary: The availability and amount of discounts offered by Amica can vary for Cleveland, Texas residents, potentially leading to higher costs for some.

#10 – Auto-Owners: Best for Financial Stability

Pros

- Financial Stability: Auto-Owners is known for its strong financial stability, providing reliable coverage for Cleveland, Texas drivers.

- Local Agents: With local agents available in Cleveland, Texas, Auto-Owners offers personalized service and support. Learn more in our Auto-Owners review.

- Comprehensive Coverage Options: Cleveland, Texas residents have access to a wide range of coverage options with Auto-Owners.

Cons

- Potentially Higher Premiums: Auto-Owners’ premiums in Cleveland, Texas might be higher compared to some competitors.

- Limited Discount Opportunities: The discounts available might not be as extensive for Cleveland, Texas drivers compared to other insurers.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Navigating Cleveland, Texas: A Comprehensive Guide to Auto Insurance Rates and Savings

Compare Cleveland, Texas auto insurance rates and discounts to find the best coverage. Our tables show monthly premiums for minimum and full coverage from top providers like Geico, State Farm, and Amica, and highlight available discounts to help you save. Expand your knowledge with our detailed guide, “Minimum Auto Insurance Requirements by State.”

Cleveland, Texas Auto Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $72 $160

Amica $67 $145

Auto-Owners $68 $148

Farmers $74 $170

Geico $65 $140

Liberty Mutual $73 $165

Nationwide $69 $150

Progressive $70 $155

State Farm $68 $150

Travelers $71 $155

Compare Cleveland, Texas auto insurance monthly rates by coverage level and provider. Geico offers the lowest minimum coverage at $65 and State Farm provides full coverage at $150. Rates vary by company, with options ranging from $67 to $74 for minimum coverage and $140 to $170 for full coverage.

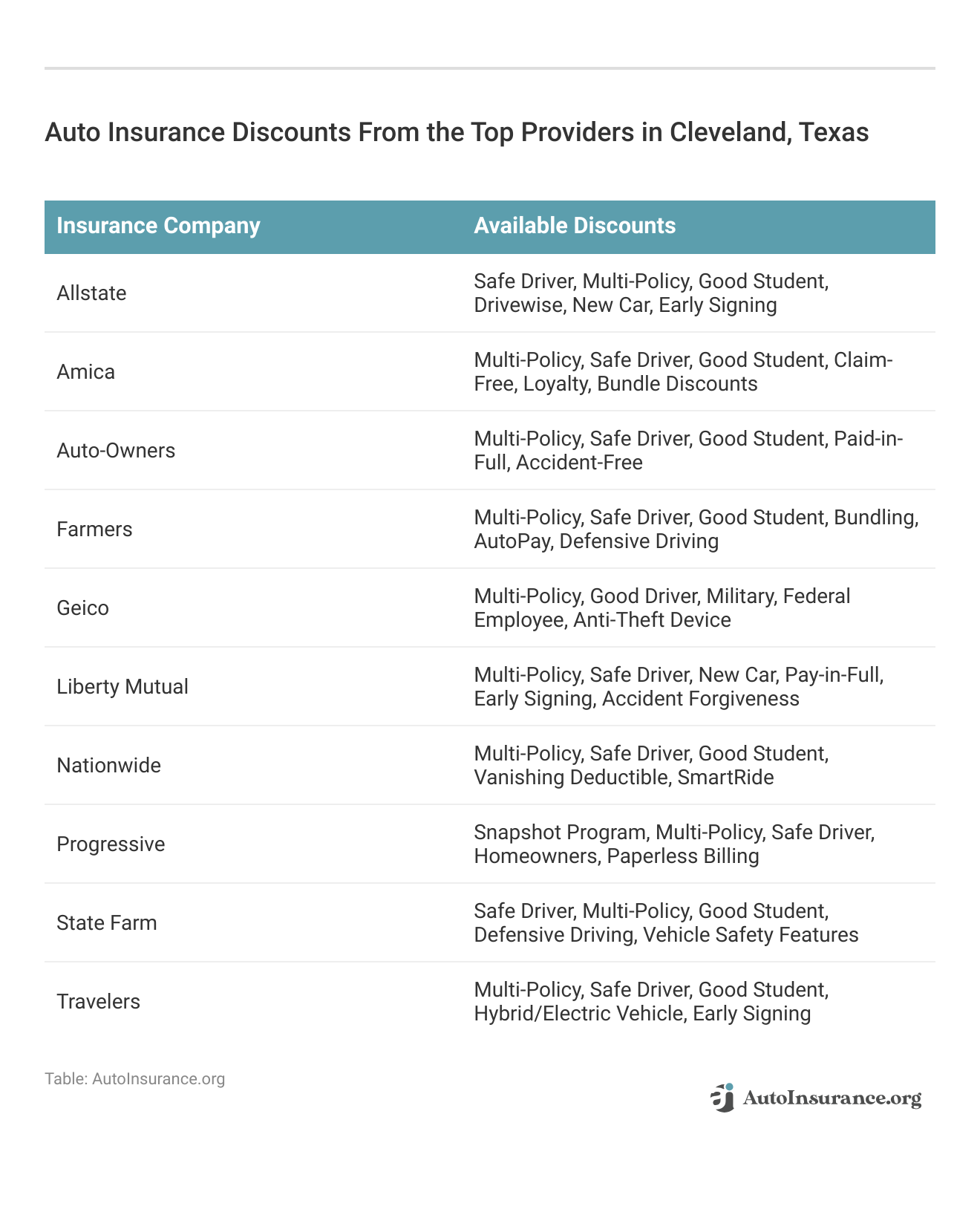

Explore auto insurance discounts from top providers in Cleveland, Texas. Our table highlights various discounts available for safe drivers, good students, multi-policy holders, and more from companies like Allstate, Amica, and State Farm. Discover how you can save on your premiums with options tailored to your needs.

Understanding the differences in auto insurance rates and discounts can help you make an informed decision and find the best coverage for your situation. Whether you prioritize low premiums or attractive discount opportunities, our comparison of Cleveland, Texas providers equips you with the essential information to choose the right policy.

Unlocking Auto Insurance Essentials: What Cleveland, TX Drivers Need to Know

In Cleveland, Texas, auto insurance laws mandate that drivers maintain at least the minimum required coverage to ensure financial responsibility in the event of an accident. The minimum auto insurance coverage required in Cleveland includes liability insurance with specific limits.

For bodily injury liability insurance, drivers must have coverage of at least $30,000 per person and $60,000 per accident. Additionally, property damage liability coverage must be a minimum of $25,000.

Tailored Auto Insurance in Cleveland, Texas: A Breakdown by Age, Gender, and Marital Status

In Cleveland, Texas, auto insurance rates differ widely based on age, gender, and insurance provider. Understanding these variations can help you find the most cost-effective coverage for your needs. For a comprehensive analysis, refer to our detailed guide titled “What are the recommended auto insurance coverage levels?“

Cleveland, Texas Auto Insurance Monthly Rates by Age, Gender & Provider

| Insurance Company | Age: 17 Female | Age: 17 Male | Age: 25 Female | Age: 25 Male | Age: 35 Female | Age: 35 Male | Age: 60 Female | Age: 60 Male |

|---|---|---|---|---|---|---|---|---|

| Allstate | $822 | $990 | $386 | $401 | $313 | $316 | $309 | $309 |

| American Family | $716 | $935 | $373 | $426 | $254 | $284 | $242 | $279 |

| Geico | $472 | $490 | $231 | $230 | $213 | $231 | $207 | $236 |

| Nationwide | $625 | $803 | $256 | $277 | $217 | $221 | $191 | $203 |

| Progressive | $962 | $1,082 | $262 | $270 | $218 | $209 | $195 | $198 |

| State Farm | $465 | $593 | $211 | $218 | $194 | $194 | $173 | $173 |

| USAA | $419 | $456 | $200 | $214 | $150 | $151 | $143 | $142 |

Auto insurance rates in Cleveland, Texas vary significantly by age, gender, and provider. For 17-year-olds, rates range from $419 with USAA to $962 with Progressive. For 25-year-olds, they span from $200 with USAA to $386 with Allstate.

State Farm stands out in Cleveland for its exceptional blend of affordability, strong coverage, and local agent support.Michelle Robbins Licensed Insurance Agent

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Navigating Auto Insurance for Teen Drivers in Cleveland, Texas: A Fresh Perspectiv

Finding cheap teen auto insurance in Cleveland, Texas is a challenge. Take a look at the annual teen auto insurance rates in Cleveland, Texas. Check out our ranking of the top providers: Companies With the Cheapest Teen Auto Insurance

Cleveland, Texas Teen Auto Insurance Monthly Rates by Age, Gender, & Provider

| Insurance Company | Age: 17 Female | Age: 17 Male |

|---|---|---|

| Allstate | $822 | $990 |

| American Family | $716 | $935 |

| Geico | $472 | $490 |

| Nationwide | $625 | $803 |

| Progressive | $962 | $1,082 |

| State Farm | $465 | $593 |

| USAA | $419 | $456 |

Smart Driving Coverage: Senior-Friendly Auto Insurance in Cleveland, Texas

When it comes to auto insurance for senior drivers in Cleveland, Texas, monthly rates can differ significantly depending on the insurance provider and gender. Understanding these variations can help seniors make informed choices and potentially save on their premiums.

Cleveland, Texas Senior Auto Insurance Monthly Rates by Age, Gender, & Provider

| Insurance Company | Age: 60 Female | Age: 60 Male |

|---|---|---|

| Allstate | $309 | $309 |

| American Family | $242 | $279 |

| Geico | $207 | $236 |

| Nationwide | $191 | $203 |

| Progressive | $195 | $198 |

| State Farm | $173 | $173 |

| USAA | $143 | $142 |

Driving Record-Based Auto Insurance Rates in Cleveland, Texas: What You Need to Know

Driving record has a big impact on your auto insurance rates. See the annual auto insurance rates for a bad record in Cleveland, Texas compared to the annual auto insurance rates with a clean record in Cleveland, Texas. Take a look at our list of the leading providers: Cheap Auto Insurance for a Bad Driving Record

Cleveland, Texas Auto Insurance Monthly Rates by Driving Record & Provider

| Insurance Company | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| Allstate | $373 | $577 | $600 | $373 |

| American Family | $399 | $509 | $446 | $399 |

| Geico | $245 | $325 | $270 | $316 |

| Nationwide | $302 | $302 | $449 | $342 |

| Progressive | $369 | $481 | $431 | $416 |

| State Farm | $247 | $283 | $334 | $247 |

| USAA | $175 | $258 | $304 | $201 |

In Cleveland, Texas, monthly auto insurance rates vary by driving record and provider. USAA has the lowest rates overall, starting at $175 for a clean record. Rates increase with infractions, such as a DUI, where USAA still offers competitive pricing at $304.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Understanding How a DUI Affects Auto Insurance Rates in Cleveland, Texa

Navigating auto insurance rates after a DUI in Cleveland, Texas can be challenging. Rates vary significantly between providers, reflecting the increased risk associated with a DUI conviction.

Childersburg, Alabama DUI Auto Insurance Cost

| Insurance Company | Monthly Rates |

|---|---|

| Allstate | $600 |

| American Family | $446 |

| Geico | $270 |

| Nationwide | $449 |

| Progressive | $431 |

| State Farm | $334 |

| USAA | $304 |

After a DUI in Cleveland, Texas, auto insurance rates vary: Allstate charges $600, Geico $270, and USAA $304, with other rates around $334 to $449 from different insurers. Review our list of the leading providers: Cheap Auto Insurance After a DUI

Understanding these differences can help you make an informed decision when choosing coverage. Be sure to compare rates from various insurers to find the best option for your needs.

Commute Impact: Uncovering the Hidden Factors That Shape Your Auto Insurance Rates

When it comes to auto insurance in Cleveland, Texas, the monthly rates can vary significantly depending on your annual mileage and the insurance provider you choose. Understanding these rates can help you make an informed decision about the best coverage for your needs.

Cleveland, Texas Auto Insurance Monthly Rates by Annual Mileage & Provider

| Insurance Company | 6,000 Miles | 12,000 Miles |

|---|---|---|

| Allstate | $469 | $493 |

| American Family | $439 | $439 |

| Geico | $283 | $294 |

| Nationwide | $349 | $349 |

| Progressive | $424 | $424 |

| State Farm | $278 | $278 |

| USAA | $231 | $237 |

Monthly auto insurance rates in Cleveland, Texas vary by provider and annual mileage. For 6,000 miles, rates range from $231 with USAA to $493 with Allstate. For 12,000 miles, the lowest rate is $237 with USAA, while the highest is $493 with Allstate. Deepen your knowledge with our resource, “How to Lower Your Auto Insurance Rates.”

Key Drivers of Auto Insurance Premiums in Cleveland, Texas: What You Need to Know

Understanding the factors that influence auto insurance rates in Cleveland, Texas can help you better manage your insurance costs. For a comprehensive overview, explore our detailed resource titled “Reasons Auto Insurance Costs More for Young Drivers.”

State Farm is the top choice for Cleveland drivers due to its unbeatable combination of competitive rates, reliable coverage, and excellent customer service.Dani Best Licensed Insurance Producer

Various elements, such as local auto theft rates, average commute times, and traffic congestion, play a significant role in determining premiums.

Cleveland Auto Theft

More theft means higher auto insurance rates because auto insurance companies are paying more in claims. According to the FBI’s annual Cleveland, Texas auto theft statistics, there have been 29 auto thefts in the city.

Cleveland Commute Time

Cities in which drivers have a longer average commute time tend to have higher auto insurance costs. The average Cleveland, Texas commute length is 28.7 minutes according to City-Data.

Cleveland Traffic

How does Cleveland, Texas rank for traffic? According to Inrix Cleveland, Texas is the 542nd most congested worldwide.

Auto insurance rates in Cleveland, Texas are shaped by a combination of local conditions, including vehicle theft statistics, commuting patterns, and traffic congestion. By staying informed about these influencing factors, you can make more strategic decisions regarding your auto insurance and potentially find ways to reduce your overall costs.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Finding the Best Auto Insurance Quotes in Cleveland, Texas

For the best auto insurance in Cleveland, Texas, consider top providers like State Farm, Geico, and Progressive. These companies are known for competitive rates and reliable coverage, starting around $65 per month. Key factors affecting insurance rates include coverage levels, age, driving record, credit history, and ZIP code.

To get the best deal, compare quotes from multiple insurers and look for discounts. Minimum coverage requirements in Cleveland are $30,000 per person for bodily injury, $60,000 per accident, and $25,000 for property damage. To gain profound insights, consult our extensive guide titled “How long does an accident stay on your record?“

You can find affordable auto insurance no matter what your driving record looks like by entering your ZIP code below in our free quote comparison tool.

Frequently Asked Questions

What are the minimum auto insurance liability requirements in Cleveland, Texas?

In Cleveland, Texas, the minimum auto insurance liability requirements are 30/60/25. This means you need at least $30,000 in bodily injury liability per person, $60,000 per accident, and $25,000 for property damage liability.

How can I get auto insurance quotes in Cleveland, Texas?

To get auto insurance quotes in Cleveland, Texas, you can use online comparison tools by entering your ZIP code. This will allow you to compare quotes from various insurance providers in the area and find the best rates for your needs.

Then, enter your ZIP code below into our free comparison tool to see which companies have the cheapest rates in your area.

What factors affect auto insurance rates in Cleveland, Texas?

Auto insurance rates in Cleveland, Texas are influenced by factors such as your driving record, age, credit history, ZIP code, coverage level, and vehicle type. Local factors like traffic conditions and auto theft rates can also impact your premiums.

To expand your knowledge, refer to our comprehensive handbook titled “How Auto Insurance Companies Check Driving Records.”

How does my driving record affect my auto insurance in Cleveland, Texas?

Your driving record significantly impacts your auto insurance rates in Cleveland, Texas. A clean driving record typically results in lower premiums, while violations such as speeding tickets or accidents can lead to higher rates.

Can I get affordable auto insurance in Cleveland, Texas if I have a DUI on my record?

Finding affordable auto insurance in Cleveland, Texas with a DUI on your record can be challenging. However, comparing quotes from multiple insurers and looking for specialized high-risk insurance providers can help you find the best available rates.

Are there discounts available for auto insurance in Cleveland, Texas?

Yes, many auto insurance providers in Cleveland, Texas offer discounts for factors such as safe driving, good student status, bundling policies, and low annual mileage. Be sure to ask your insurance agent about available discounts to reduce your premiums.

For a thorough understanding, refer to our detailed analysis titled “How to Save Money by Bundling Insurance Policies.”

How does my credit history impact my auto insurance rates in Cleveland, Texas?

Your credit history can affect your auto insurance rates in Cleveland, Texas. Generally, individuals with good credit scores may receive lower premiums, while those with poor credit might face higher rates due to perceived risk.

What should I look for when comparing auto insurance quotes in Cleveland, Texas?

When comparing auto insurance quotes in Cleveland, Texas, consider coverage levels, premiums, deductibles, customer service, and any discounts offered. Make sure the coverage meets your needs and that you are getting the best value for your money.

How can I find the best auto insurance provider in Cleveland, Texas?

To find the best auto insurance provider in Cleveland, Texas, compare quotes from multiple companies, check customer reviews, and review the provider’s financial stability and claims handling. Top providers in the area often include State Farm, Geico, and Progressive.

To delve deeper, refer to our in-depth report titled “How to File an Auto Insurance Claim.”

Is it important to have more than the minimum liability coverage in Cleveland, Texas?

While the minimum liability coverage meets state requirements, it may not be sufficient to cover all potential expenses in the event of an accident. Consider purchasing higher liability limits to better protect yourself financially in case of a serious incident.

You can also enter your ZIP code below into our free comparison tool to start comparing rates now.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.