Can police check your auto insurance?

Police can check your auto insurance and its validity using an electronic system connected to the Department of Motor Vehicles, or DMV. Read on to learn more so you will always be prepared.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Corporate Paralegal

Brett Surbey is a corporate paralegal specializing in tax reorganizations and the creation of corporations so they can successfully navigate all aspects of their business and mitigate risks where necessary. He has assisted lawyers on a number of enigmatic transactions, including M&As, complex corporate succession plans, and amalgamations. In addition to his legal career, he is a known e...

Brett Surbey

Licensed Insurance Agent

Heidi works with top-rated insurance carriers to bring her clients the highest quality protection at the most competitive prices. She founded NoPhysicalTermLife.com, specializing in life insurance that doesn’t require a medical exam. Heidi is a regular contributor to several insurance websites, including FinanceBuzz.com, Insurist.com, and Forbes. As a parent herself, she understands the need ...

Heidi Mertlich

Updated December 2024

Before you drive, make sure you have insurance. If you’re stopped by law enforcement for any reason, they will first request your driver’s license and proof of insurance. To find affordable car insurance near me and the cheapest auto insurance, you can check if your car is insured by number plate.

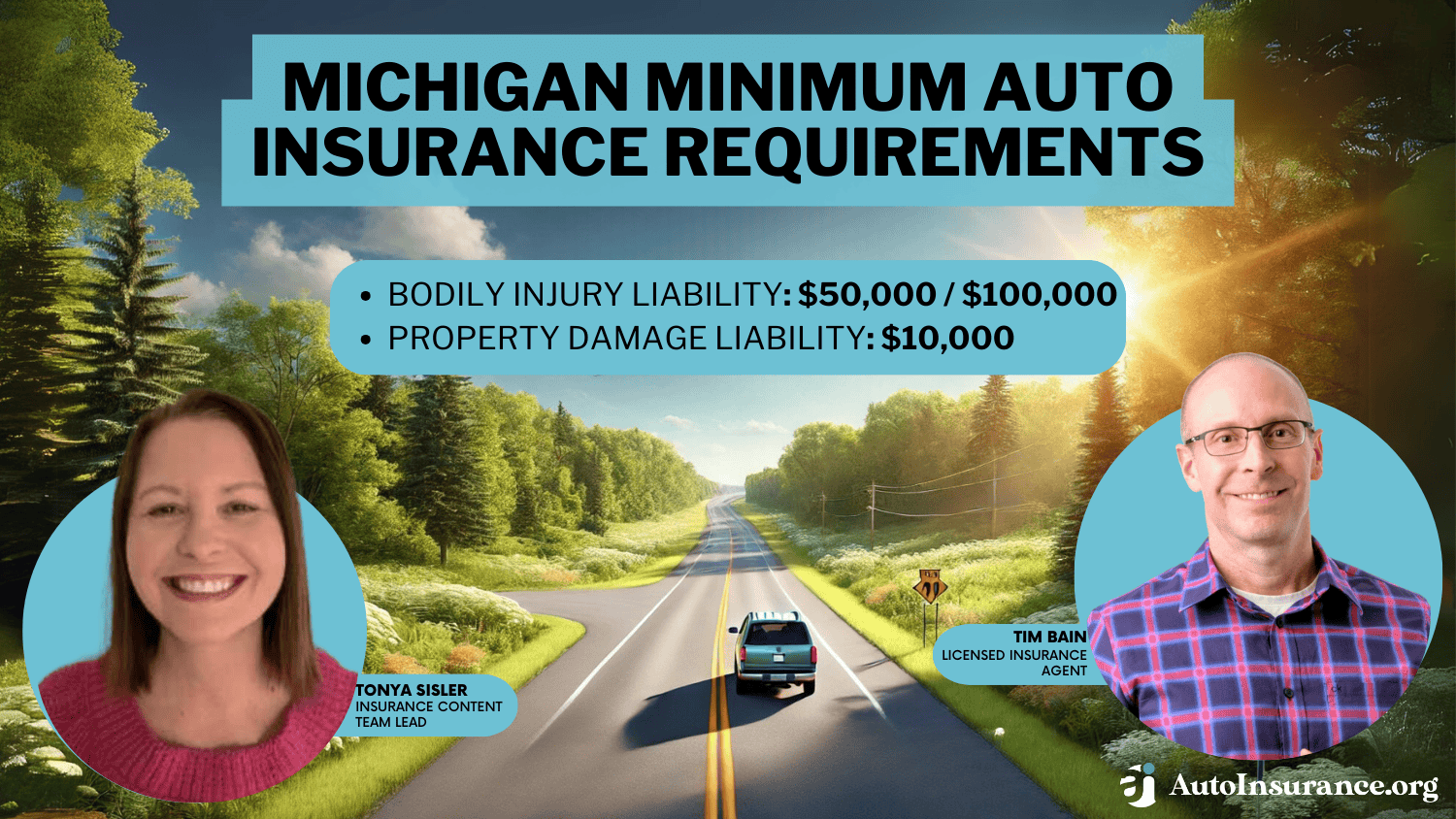

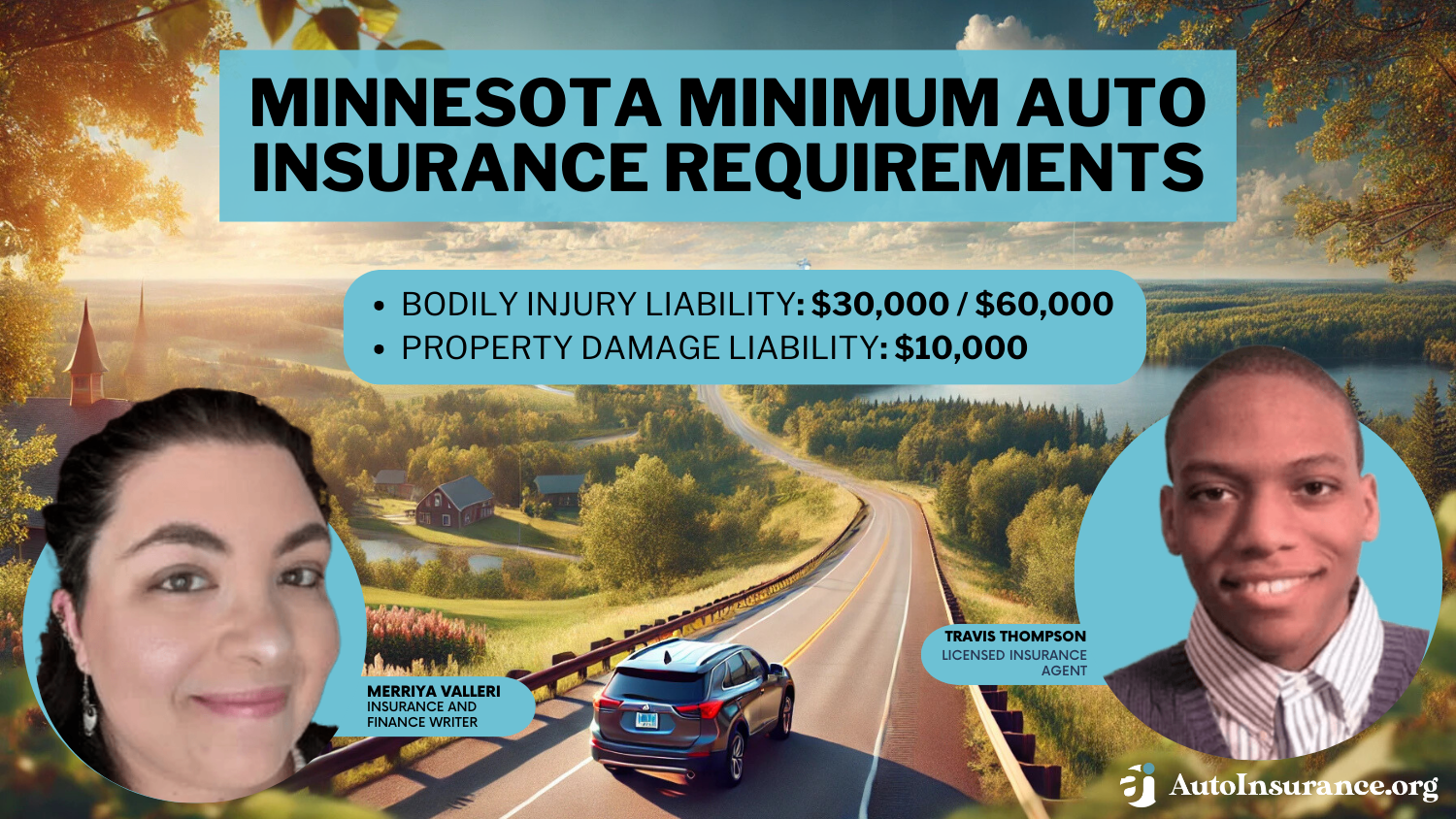

While selecting car insurance, ensure you choose a policy with the minimum coverage for your state. By doing so, you ensure you’re both protected in the event of an accident and compliant with state laws.

- You must carry proof of insurance with you whenever driving

- An office has the right to stop your car during a routine check or if they suspect something is wrong

- If you’re stopped and fail to provide proof of your auto insurance, you will get a ticket for driving uninsured

How do officers check if your insurance is valid?

Nowadays, police officers have real-time systems to check if my car insurance is active and meets state requirements. This is crucial when you’re comparing auto insurance quotes in Florida or looking for cheap liability insurance near me.

One of the ways to do this is by running your vehicle’s license plates. Before even checking your driver’s license, a police officer can access a web portal and check the current status of your license and car insurance by entering your license plate number.

These electronic systems have the latest information on your car insurance because of the strong communication between insurance companies and the Department of Motor Vehicles, or DMV. Whenever you renew your insurance policy or change any details, the new information is updated in these electronic verification systems.

Therefore, the police can trust the data in these systems. Consequently, drivers cannot present invalid insurance documents without being detected and potentially receiving a ticket or worse. To check if you have tickets or need information related to the Affordable Care Act in Arizona, you can contact 410-768-7431.

Read more: How to Get a Police Auto Insurance Discount

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How can you get proof of insurance?

Once you purchase the best cheap car insurance, the insurance company will provide you with proof of coverage. Each time you renew, you’ll receive an updated card. You can check if your car is insured through the Dept of Driver Services.

We’ve provided a detailed explanation of how to get your car insurance certificate.

Most states also permit proof of insurance in digital form. Therefore, if you’re stopped by law enforcement, you can present a digital insurance card on your smartphone. For affordable car insurance in Jacksonville, FL, or affordable car insurance in Florida, visit the Dept of Drivers License near you.

Also, consider downloading your insurance company’s app, if possible. Today, most companies allow you to access copies of your insurance cards online.

Another option is to keep your insurance company’s contact number handy so that, in case of an accident like DeSantis’ car accident where he didn’t have insurance at the time of the accident, they can send proof right away. This way, you can avoid issues and consider using daily car insurance for short-term coverage.

To stay compliant with California auto insurance laws and regulations and navigate the California auto insurance waiting period, it’s essential to be aware of California car insurance changes while also comparing auto insurance quotes in Ohio for a comprehensive understanding of different insurance options.

Consequences of Driving Uninsured

If you don’t have car insurance and still decide to get on the road, you are very likely to face serious consequences. This is because you are putting yourself as well as others’ lives at risk.

So, what happens if you get caught driving without insurance? That depends on where you live because state laws vary, and so do the penalties for driving uninsured.

For example, for your first offense in Alabama, you have to pay a $500 fine, could face imprisonment for up to three months, and see your license suspended (along with a $200 reinstatement of registration fee).

In Vermont, the penalties are less severe. Drivers will have to pay a fine of between $250 and $500, and their license will be suspended until they can provide proof of financial responsibility.

In general, if you drive without proper car insurance in many states you run a risk of:

- Being cited for a misdemeanor and ordered a mandatory court appearance

- Paying a fine for driving uninsured

- Having to provide current proof of insurance before being allowed to drive again

- Submitting an SR-22 for future insurance verification

- Paying towing, storage, and impound fees for your vehicle

However, if you are from New Hampshire you do not have to worry about these penalties as it is the only state where car insurance isn’t required.

Can Police Check Your Auto Insurance?

Police officers can promptly verify your auto insurance at a traffic stop due to advancements in technology and integration with state DMV databases. This capability enables them to swiftly confirm the legitimacy of your vehicle insurance, crucial for handling cases like a crash without insurance, understanding if custom license plates are legal, and guiding the need for a defense lawyer for car accidents or finding a defensive driving course near you.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How Police Verify Auto Insurance at Traffic Stops

Real-Time Electronic Verification:

At a traffic stop, the first documents an officer typically requests are your driver’s license and proof of insurance. Today, police use electronic systems connected directly to state DMV records, enabling them to check if your auto insurance is valid almost instantaneously. This system allows officers to enter your vehicle’s license plate number into a mobile device or in-car computer to retrieve your insurance status.

Automated License Plate Recognition (ALPR):

In many states, police vehicles equipped with ALPR technology can scan the license plates of vehicles on the road. This technology checks the plates against a database that includes up-to-date insurance status, helping officers identify uninsured vehicles without needing to stop them.

Ensure Your Insurance Details Are Up-to-Date

The accuracy of electronic insurance checks relies on the continuous communication between insurance companies and the DMV. Whenever there is a renewal or any change in your insurance policy, your insurer updates this information, which is then reflected in the DMV’s records. This means that the data accessed by police during a stop is always current, minimizing the risk of discrepancies.

What To Do If You’re Asked for Proof of Insurance

If asked, you should be able to show proof of insurance either as a physical insurance card or digitally on your smartphone, as most states, including California, now accept digital proofs. This verification can quickly confirm your insurance status, even if there are discrepancies in the electronic data. If you’re looking for information like Denton County jail records, details about digital license plates in California, the cost of digital plates, or dirt cheap car insurance options, it’s important to stay informed and compliant with insurance requirements.

Consequences of Invalid Insurance Details

If the electronic verification or your provided proof indicates that your insurance is invalid, you could incur penalties such as fines or suspension of your vehicle registration. To avoid these consequences, it’s crucial to keep your insurance information accurate and up-to-date in the DMV system. For those seeking the best insurance in Arizona or needing 7-day temp tags, make sure to search for reliable automobile insurance near you.

Consider Using Digital Insurance Cards

Most insurance providers offer an app that allows you to access your insurance card digitally. This can be particularly handy if you forget your physical card. However, always make sure that digital proof is accepted in your state.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Understanding Police Capabilities in Insurance Verification

Police have the capability to instantly verify your auto insurance through a centralized database linked to the DMV. This system shows them whether your insurance is active, expired, or non-existent whenever they run your license plate during traffic stops or at checkpoints.

Advanced Tools Used by Police for Insurance Verification

Police use Automatic License Plate Recognition (ALPR) systems in their vehicles to scan license plates and cross-reference them with insurance databases. This technology supports law enforcement in ensuring insurance compliance and helps identify vehicles involved in crimes or other legal issues.

What Drivers Should Know About Police Insurance Checks

Lacking valid insurance can lead to immediate penalties such as fines, vehicle impoundment, and driver’s license suspension, with penalties increasing for repeat offenses. Understanding these risks is essential for all drivers.

Preventive Measures to Avoid Penalties

Keep your insurance information up-to-date. Ensure your auto insurance details are current in the DMV records by regularly communicating with your insurance provider to report any changes in your policy.

How to Ensure Your Insurance Details are Accurate in DMV Records

Frequently update any changes to your insurance policy with your provider and verify your vehicle’s insurance status via your state’s DMV website to prevent discrepancies during police stops. This is particularly important when seeking auto insurance quotes in Georgia, understanding automotive insurances, and knowing the average car insurance cost.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Using Digital Proof of Insurance

Digital insurance cards are legally accepted in most states and can be displayed on your smartphone. This provides a convenient way to always have proof of insurance without needing physical documents.

Understand Local Insurance Laws

Being knowledgeable about your state’s auto insurance laws can help you navigate interactions with police more effectively. Always prepare by having easy access to your digital and physical proof of insurance for any traffic stops.

The Bottom Line: Can police check your auto insurance?

Yes, the police can check your auto insurance, and you never know quite when that might happen.

It is always best to buy auto insurance as early as you can. This won’t just reduce the chances of paying a huge fine and losing your license but also ensure you are driving responsibly.

If you don’t have active auto insurance, you will most likely get a ticket and even face some heavy penalties.

Frequently Asked Questions

Can the police check if I have auto insurance?

Yes, police officers have the authority to check whether or not you have valid auto insurance during a traffic stop or as part of routine enforcement activities.

How do police officers check if I have auto insurance?

Police officers can determine your auto insurance status through databases or electronic verification systems. These methods enable them to swiftly confirm whether your vehicle is insured. For more information, visit azdot.gov/mandatoryinsurance. It’s essential to have insurance to avoid issues, especially in the event of an accident with an uninsured driver. Ensure you have affordable auto insurance to stay compliant and protected.

What information do I need to provide to the police officer regarding my auto insurance?

If requested by a police officer, you will typically need to provide the following information related to your auto insurance:

- Insurance company name

- Policy number

- Effective dates of coverage

- Proof of insurance document (such as an insurance card or digital proof)

What happens if I don’t have valid auto insurance when pulled over by the police?

Can I show electronic proof of insurance to the police officer?

In many jurisdictions, electronic proof of insurance is acceptable. This includes displaying digital insurance cards on your smartphone or other electronic devices. However, it’s important to check the specific laws and regulations in your area to ensure compliance.

What should I do if I forgot my proof of insurance at home?

If you forgot to carry proof of insurance with you, some jurisdictions may allow you to provide the necessary documentation to the police department or courthouse within a specified timeframe to avoid penalties. Check with your local authorities to understand the procedures and requirements.

Can police officers randomly check my auto insurance without cause?

In certain areas, police officers might perform random or regular insurance checks to ensure drivers comply with the law. However, the specific regulations and procedures for these random checks can differ depending on the location. For more details, you can refer to resources like the CA DMV insurance inquiry, and for specifics on Arizona, visit azmvdnow.gov. It’s important to understand these rules, especially considering the serious consequences of being involved in an accident without insurance.

Can police officers check the auto insurance status of any vehicle on the road?

Generally, police officers have the authority to check the auto insurance status of any vehicle on the road, whether or not they have a specific reason to do so. This helps ensure that all drivers are complying with insurance requirements.

How can I avoid issues with the police regarding auto insurance?

To avoid issues with the police regarding auto insurance:

- Always carry proof of insurance with you when operating a vehicle.

- Ensure your auto insurance policy is valid and up to date.

- Renew your policy on time to avoid any lapses in coverage.

- Notify your insurance company promptly of any changes or updates to your policy or coverage.

Can police immediately see if I have insurance when they pull me over?

Yes, police can access real-time data from their in-vehicle systems or portable devices to check if your vehicle is insured by entering your license plate number into their system.

What happens if my insurance information is not up-to-date when the police check?

Can police check the details of my insurance policy?

Do all police cars have the capability to check insurance status instantly?

How accurate are the police’s methods of checking insurance?

Can I show digital proof of insurance to the police?

What should I do if I’m pulled over but forgot to carry my insurance card?

Can police issue a ticket based solely on electronic insurance verification results?

Can police directly access my insurance details during a stop?

How do automatic systems help police check insurance more efficiently?

What should I do if asked for insurance but I only have digital proof?

How often do police verify insurance during traffic stops?

Can police tell if my insurance is expired just by running my plates?

What happens if my insurance information is not updated in the DMV system?

Can police call my insurance company during a traffic stop?

Can a cop see if you have insurance by running your plates?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.