Erie vs. Nationwide Auto Insurance in 2026 (Head-to-Head Review)

When you compare Erie vs. Nationwide auto insurance, you’ll see both companies have high ratings for customer satisfaction. As for Nationwide vs. Erie insurance rates, Erie’s starting price of $32 per month is cheaper than Nationwide’s $63 monthly rate. However, Nationwide Insurance is available in more states.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Published Insurance Expert

Melanie Musson is the fourth generation in her family to work in the insurance industry. She grew up with insurance talk as part of her everyday conversation and has studied to gain an in-depth knowledge of state-specific car insurance laws and dynamics as well as a broad understanding of how insurance fits into every person’s life, from budgets to coverage levels. She also specializes in sustai...

Melanie Musson

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Brad Larson

Updated August 2025

1,883 reviews

1,883 reviewsCompany Facts

Minimum Coverage

A.M. Best Rating

Complaint Level

Pros & Cons

1,883 reviews

1,883 reviews 3,071 reviews

3,071 reviewsCompany Facts

Minimum Coverage

A.M. Best

Complaint Level

Pros & Cons

3,071 reviews

3,071 reviewsComparing Erie vs. Nationwide auto insurance can be tricky because both companies offer excellent customer service and affordable rates.

Erie vs. Nationwide Auto Insurance Rating

| Rating Criteria |  | |

|---|---|---|

| Overall Score | 4.3 | 4.4 |

| Business Reviews | 4.5 | 4.5 |

| Claim Processing | 4.3 | 3.5 |

| Company Reputation | 4.5 | 4.5 |

| Coverage Availability | 3.5 | 5.0 |

| Coverage Value | 4.6 | 4.3 |

| Customer Satisfaction | 2.2 | 2.0 |

| Digital Experience | 4.0 | 4.5 |

| Discounts Available | 4.7 | 5.0 |

| Insurance Cost | 4.7 | 4.5 |

| Plan Personalization | 4.5 | 4.5 |

| Policy Options | 5.0 | 4.7 |

| Savings Potential | 4.7 | 4.7 |

| Erie Review | Nationwide Review |

Erie Insurance is significantly cheaper and gets fewer complaints. While Nationwide auto insurance reviews are mostly positive, it gets a slightly better score simply because it’s available in more states. However, both providers are considered some of the best auto insurance companies for paying claims.

- With a starting rate of $32 per month, Erie Insurance is cheaper than Nationwide

- Nationwide is available in more states than Erie

- Both companies receive positive reviews for customer service

Compare Erie vs. Nationwide car insurance below, including how much you might pay and what coverage options are available to you. Then, enter your ZIP code into our free comparison tool to see personalized quotes.

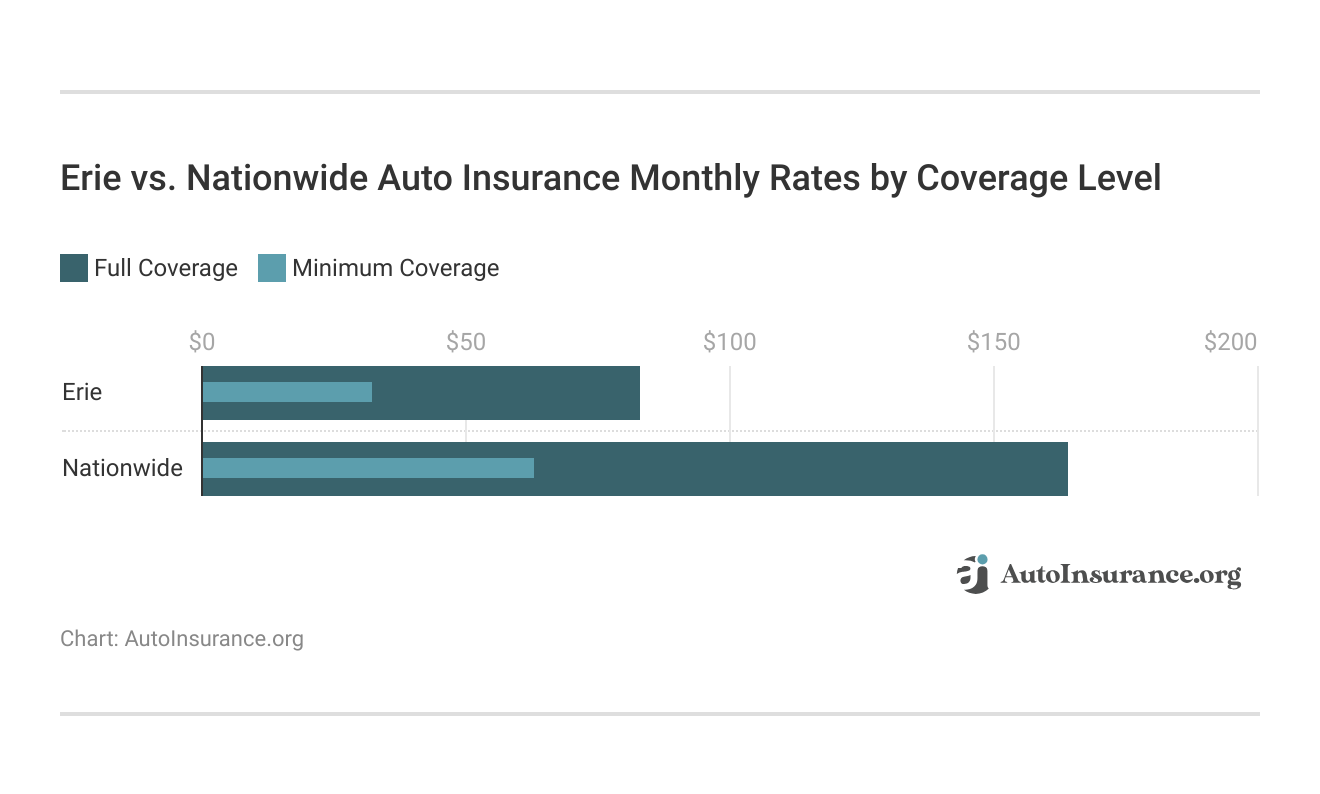

Erie vs. Nationwide Auto Insurance Cost

When you compare Erie vs. Nationwide auto insurance rates, you’ll notice that Erie Insurance is usually much cheaper. In fact, Erie Insurance is often one of the cheapest options on the market, and tops our list of the cheapest auto insurance companies.

Auto Insurance Monthly Rates by Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $32 | $83 |

| $63 | $164 | |

| $87 | $228 | |

| $62 | $166 |

| $76 | $198 | |

| $43 | $114 | |

| $56 | $150 | |

| $47 | $123 | |

| $76 | $141 | |

| $32 | $84 |

Even compared to other companies, Erie Insurance is still one of the cheapest options for coverage. The only company as cheap as Erie is USAA, but it has strict membership requirements. You can check out our USAA auto insurance review to see if you qualify for coverage.

The best company for you depends on your unique circumstances. For example, Nationwide is usually affordable for drivers with low credit scores.Dani Best Licensed Insurance Producer

Erie auto insurance quotes may be cheaper, but that doesn’t mean that Nationwide isn’t affordable. One crucial aspect of how much you’ll pay is the level of coverage you want.

If you want to pay the least amount possible, a minimum insurance policy may be right for you. If you want better protection, full coverage is the better option. Your premiums are also affected by your age and gender.

Erie vs. Nationwide Auto Insurance Monthly Rates by Age & Gender

| Age & Gender |  | |

|---|---|---|

| 16-Year-Old Female | $121 | $230 |

| 16-Year-Old Male | $136 | $279 |

| 30-Year-Old Female | $34 | $69 |

| 30-Year-Old Male | $35 | $76 |

| 45-Year-Old Female | $32 | $62 |

| 45-Year-Old Male | $32 | $63 |

| 60-Year-Old Female | $30 | $56 |

| 60-Year-Old Male | $31 | $59 |

As you can see, Erie Insurance is the cheapest company overall. However, many drivers don’t consider Erie Insurance for their coverage needs. The simple reason for this is that Erie Insurance is only available in 12 states. Nationwide may cost more, but there’s a better chance that it’s available where you live.

Erie vs. Nationwide Auto Insurance Rates by Driving Record

When it comes to Nationwide vs. Erie auto insurance based on driving records, Erie Insurance is cheaper on average.

Erie vs. Nationwide Auto Insurance Monthly Rates by Driving Record

| Driving Record |  | |

|---|---|---|

| Clean Record | $32 | $63 |

| One Accident | $45 | $88 |

| One DUI | $60 | $129 |

| One Ticket | $38 | $75 |

One of the most important aspects of your car insurance premiums is your driving record, so it’s important to compare quotes if you get a serious infraction like a DUI, even if you already have a policy. Car insurance rates can skyrocket after something like a DUI, but you’ll probably find more affordable coverage elsewhere.

Read More: How Auto Insurance Companies Check Driving Records

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Erie vs. Nationwide Auto Insurance Coverage Options

One of the most important aspects to consider when you’re comparing Erie Insurance vs. Nationwide Insurance is what types of coverage each company offers. Most drivers find their needs met with the basic types of coverage, which both Erie and Nationwide sell. These include:

- Liability Insurance: Required in most states, liability auto insurance makes sure you can pay for damages and injuries you cause in an at-fault accident.

- Collision Insurance: Since liability only covers other cars, you’ll need collision insurance if you want to ensure your vehicle is covered for accidents.

- Comprehensive: Comprehensive auto insurance protects you from life’s unexpected events, like fires, falling objects, and theft.

- MedPay/Personal Injury Insurance: Depending on which state you live in, either MedPay or personal injury protection insurance covers your medical bills after an accident.

- Uninsured/Underinsured Motorist: Nearly 15% of Americans are driving without insurance, but you can protect yourself with uninsured/underinsured motorist coverage.

Whether you want the cheapest coverage possible or a full coverage policy, you can get everything you need with either Erie or Nationwide.

If you want to customize your coverage, you can find plenty of add-on options at each company. However, Erie auto insurance is often cheaper for full coverage and customized policies than Nationwide.

Customizing Erie vs. Nationwide Auto Policies

Despite being a smaller company, Erie offers competitive add-ons that many national providers don’t, like rideshare insurance. Take a look at Erie’s most popular add-ons:

- Rental Car Reimbursement: If you add rental car reimbursement coverage to your policy, Erie will cover the cost of a rental car when your vehicle is stuck at the mechanic’s after a covered incident.

- Rate Lock: If you elect to pay a little more for your insurance, Erie will guarantee that your rates won’t increase if you need to file a claim.

- Roadside Assistance: Erie offers one of the best roadside assistance plans, ensuring you have help with car emergencies like a flat tire or a dead battery.

- Rideshare: Work for a rideshare company like Lyft or Uber? Erie fills in the gaps of your coverage to make sure you’re always protected while working with rideshare insurance.

Erie auto insurance reviews also mention a unique program you can enroll in called Erie Auto Plus. Auto Plus includes multiple perks like increased coverage limits, death benefits, diminishing deductibles, and transportation expenses when you travel.

Like Erie, Nationwide offers roadside assistance and rental car reimbursement coverage. You can also get the following types of coverage only at Nationwide:

- Gap Coverage: Gap insurance pays the difference between what you owe on your car loan and what your vehicle is worth.

- Total Loss Deductible Waiver: If Nationwide declares your vehicle a total loss, you don’t have to pay your deductible to get it replaced.

- Vanishing Deductible: Nationwide’s vanishing deductible rewards drivers who don’t file a claim each year by reducing their total deductible.

Although adding more coverage to your policy is never a bad idea, you should only purchase what you think you might use. You can compare Erie vs. Nationwide auto insurance reviews to see that their add-ons are affordable, but increasing your coverage will result in higher monthly premiums.

Erie vs. Nationwide Auto Insurance Discounts

The best auto insurance discounts can help you save a significant amount on your monthly premiums. However, you’ll need to find which company offers the most discounts you qualify for. These are some of the most popular Erie auto insurance discounts.

Erie Insurance Discounts

| Discount | Maximum Savings | Who Qualifies |

|---|---|---|

| Youthful Driver | 20% | Young drivers under a certain age meeting Erie’s criteria |

| College Student | 20% | Full-time students living away from home without a vehicle |

| Safety Device | 10% | Drivers with approved safety equipment installed in their vehicle |

| Pay-In-Full | 15% | Policyholders who pay their premium in one lump sum |

| Driver Training | 5% | Drivers who complete an approved driver education course |

Although Erie doesn’t offer the longest list of discounts, many Erie car insurance reviews report finding affordable rates.

As a larger provider, you might expect Nationwide to have more discounts available than Erie. However, when you compare Erie vs. Nationwide auto insurance reviews, you’ll see that Nationwide offers about the same number of discounts.

Nationwide Insurance Discounts

| Discount | Maximum Savings | Who Qualifies |

|---|---|---|

| Good Student | 15% | Full-time students with a B average or better |

| Defensive Driving Course | 10% | Drivers who complete an approved safety course |

| Safe Driver | 12% | Drivers with a clean record and no recent claims |

| Anti-Theft | 5% | Vehicles equipped with approved anti-theft devices |

| Paperless | 3% | Policyholders who opt for electronic statements and billing |

As you can see from the sample of discounts above, the availability of discounts can vary significantly between insurance providers. Picking a company with the most auto insurance discounts you qualify for can help you save.

Erie vs. Nationwide Usage-Based Insurance

On top of standard auto insurance discounts, both Erie Insurance and Nationwide of a usage-based insurance program. Erie offers YourTurn, which tracks your driving behaviors through a mobile app and offers a maximum discount of 30%.

Nationwide offers two usage-based insurance programs. SmartRide is a traditional UBI program, offering up to 40% off to safe drivers. Nationwide’s SmartMiles is a pay-per-mile auto insurance program. If you think a pay-per-mile program might be right for you, check out our Nationwide SmartMiles review.

Regardless of which insurance company you choose, you should make sure a UBI program is the right fit for you before you sign up. While Erie or Nationwide’s UBI programs can help you save, they’re not the best fit for drivers who are uncomfortable being tracked.

Erie vs. Nationwide Customer Reviews and Ratings

Deciding between Erie vs. Nationwide auto insurance pros and cons can be difficult because the companies are similarly rated. See how Erie and Nationwide compare with third-party rating companies.

Insurance Business Ratings & Consumer Reviews: Erie vs. Nationwide

| Agency |  | |

|---|---|---|

| Score: 733 / 1,000 Avg. Satisfaction | Score: 728 / 1,000 Avg. Satisfaction |

|

| Score: A+ Excellent Business Practices | Score: A+ Excellent Business Practices |

|

| Score: 82/100 Positive Customer Feedback | Score: 75/100 Positive Customer Feedback |

|

| Score: 0.60 Fewer Complaints Than Avg. | Score: 0.90 Fewer Complaints Than Avg. |

|

| Score: A+ Superior Financial Strength | Score: A+ Excellent Financial Strength |

With a few exceptions, Nationwide and Erie both receive about the same ratings. Erie does slightly better in customer service ratings, but the difference is small.

Since Erie has a small score from the NAIC, it receives slightly fewer customer complaints than Nationwide does.Heidi Mertlich Licensed Insurance Agent

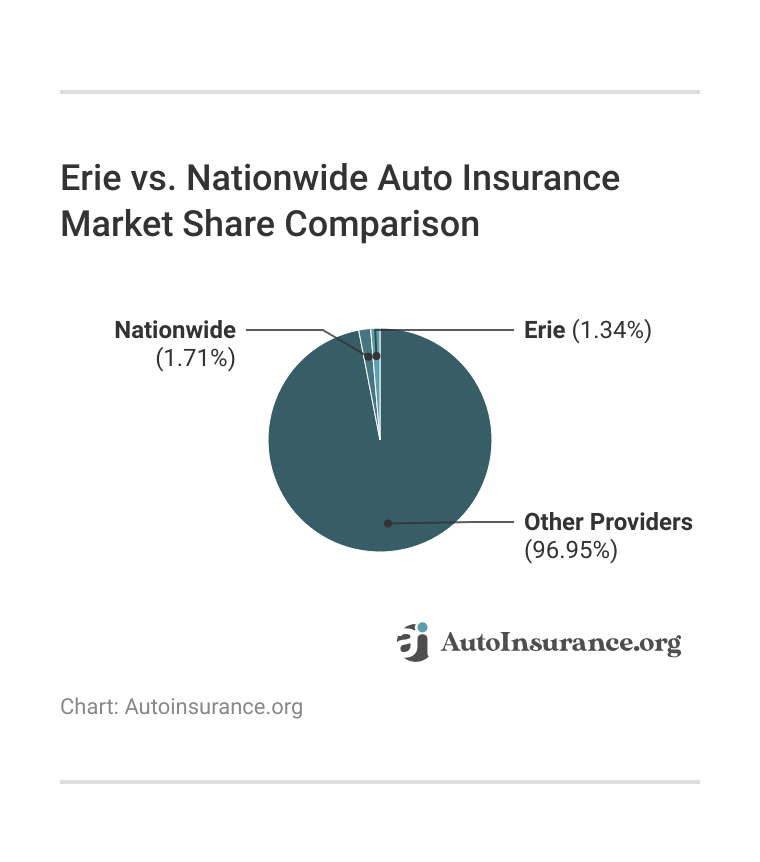

However, there is one area in which Nationwide has a distinct advantage — its size. If you want flexible coverage in more states, Nationwide is the better choice.

Nationwide’s overall market share isn’t that much bigger than Erie’s, but it is available in 30 more states. This gives drivers peace of mind when traveling out of state, and you are less likely to have to switch providers if you move to another state with Nationwide coverage.

Erie Insurance Pros & Cons

So, what do actual customers think of Erie and Nationwide? It’s easy to find positive Erie car insurance reviews. For example, take a look at this Reddit thread to see what people are saying.

Most comments by Reddit users in this thread were positive, with several people commenting on a satisfactory experience with filing claims:

- High Claims Satisfaction: Erie is among the top three companies for claims satisfaction in J.D. Power surveys, with fewer complaints than other insurers (Learn More: Auto Insurance Companies With the Best Customer Service).

- Rate Lock Guarantee: Erie won’t raise rates after an accident, ticket, claim, or annual renewal unless you add a driver, new vehicle, or move to another state.

- Varied Policy Options: Drivers can choose from a long list of policy add-ons that includes rental reimbursement and rideshare coverage for delivery drivers.

Erie has multiple positive customer reviews, but it isn’t without its shortcomings. Some drivers avoid Erie Insurance due to the following:

- Limited Availability: Erie car insurance is only sold in 12 states, while Nationwide is available in 48.

- Less Digital Convenience: The Erie insurance app and website are not as streamlined as some of its national competitors, including Nationwide.

If Erie car insurance is available in your state, it is worth checking out and comparing quotes. Otherwise, you may have better luck with a larger insurer, especially if you travel or move around a lot.

Nationwide Insurance Pros & Cons

As for Nationwide car insurance reviews, customers have mixed feelings. Many praise Nationwide for its customer service, affordability, and claims service.

Low-mileage drivers with pay-as-you-go policies also praise its usage-based policy options. More ways Nationwide stands out are:

- Above-Average Customer Service: Even though Erie is ranked higher, Nationwide still outperforms other national insurers like Geico and Allstate in claims handling and customer satisfaction.

- On Your Side Review: Nationwide will review your auto insurance policy every year to ensure the coverage you have still fits your lifestyle or if you need to reduce or add coverages.

- Unlimited Minor Accident Forgiveness: Adding this to your Nationwide policy stops your rates from going up after a fender bender, no matter how many you may have per year.

However, there are numerous reports that Nationwide drops customers for seemingly no reason. Other reasons you may not want to buy Nationwide auto insurance include:

- Rate Increases: Nationwide is likely to charge more than other companies after an accident, claim, or DUI.

- Smaller Discounts: Nationwide auto insurance discount amounts are smaller than at other companies, especially for students and drivers who pay their annual policies in full.

It is worth comparing quotes from Nationwide if you have a clean driving record. High-risk drivers with accidents or claims will likely find better rates somewhere else.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Compare Erie vs. Nationwide Auto Insurance Quotes Today

With great customer service reviews, affordable rates, and tons of coverage options, trying to decide between Erie vs. Nationwide car insurance can be tricky. Both companies deserve consideration, especially if you’re trying to keep your insurance rates down.

Now that you’ve compared Erie vs. Nationwide auto insurance, your next step should be to evaluate auto insurance quotes at other companies. When you’re ready, enter your ZIP code into our free comparison tool to see personalized rates in your area.

Frequently Asked Questions

Is Erie auto insurance any good?

Yes, Erie is considered a good choice for auto insurance. Most customers report satisfaction with any claims they file and with the company’s customer service. Erie is also usually one of the cheapest providers.

Is Erie better than Nationwide auto insurance?

When you compare Nationwide vs. Erie insurance, you’ll notice that these companies get similar ratings for things like customer satisfaction. However, Erie insurance rates tend to be lower, but Nationwide is available in more states.

Is Erie auto insurance cheaper than Nationwide?

While it depends on the driver, Erie is typically cheaper than Nationwide. No matter which types of auto insurance you want to purchase, Erie is likely to be cheaper than Nationwide.

How much does Nationwide auto insurance cost?

Nationwide insurance rates depend on the driver, but you can get rates starting as low as $63 per month for a minimum insurance policy.

Is Nationwide cheaper than Geico auto insurance?

No, Nationwide is more expensive on average than Geico. To see how much you might pay for Geico car insurance, check out our Geico auto insurance review.

Is Nationwide or Progressive cheaper?

Although there are many factors that affect your auto insurance rates, Nationwide tends to be more expensive than Progressive on average.

Are Erie and Progressive the same company?

While they are both popular, affordable choices for car insurance, Progressive and Erie are not the same company.

How many states is Erie Insurance in?

Erie sells insurance in 12 states: Illinois, Indiana, Kentucky, Maryland, New York, North Carolina, Ohio, Pennsylvania, Tennessee, Virginia, West Virginia, and Wisconsin. Enter your ZIP code to see the cheapest insurance company in your state.

Does Erie Insurance cover rental cars?

Yes, as long as you have comprehensive insurance in your regular policy, Erie will automatically cover short-term rental cars.

Is Allstate or Erie auto insurance better?

It depends on your unique needs and circumstances. Allstate is a highly rated company for many reasons, but it shines brightest with its full coverage policies. However, Erie Insurance is significantly cheaper on average than Allstate. To learn more, take a look at our Allstate auto insurance review.

Does Nationwide offer gap insurance?

Why is Erie auto insurance so cheap?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Does Erie have a diminishing deductible?

Yes, Erie is considered a good choice for auto insurance. Most customers report satisfaction with any claims they file and with the company’s customer service. Erie is also usually one of the cheapest providers.

When you compare Nationwide vs. Erie insurance, you’ll notice that these companies get similar ratings for things like customer satisfaction. However, Erie insurance rates tend to be lower, but Nationwide is available in more states.

Is Erie auto insurance cheaper than Nationwide?

While it depends on the driver, Erie is typically cheaper than Nationwide. No matter which types of auto insurance you want to purchase, Erie is likely to be cheaper than Nationwide.

How much does Nationwide auto insurance cost?

Nationwide insurance rates depend on the driver, but you can get rates starting as low as $63 per month for a minimum insurance policy.

Is Nationwide cheaper than Geico auto insurance?

No, Nationwide is more expensive on average than Geico. To see how much you might pay for Geico car insurance, check out our Geico auto insurance review.

Is Nationwide or Progressive cheaper?

Although there are many factors that affect your auto insurance rates, Nationwide tends to be more expensive than Progressive on average.

Are Erie and Progressive the same company?

While they are both popular, affordable choices for car insurance, Progressive and Erie are not the same company.

How many states is Erie Insurance in?

Erie sells insurance in 12 states: Illinois, Indiana, Kentucky, Maryland, New York, North Carolina, Ohio, Pennsylvania, Tennessee, Virginia, West Virginia, and Wisconsin. Enter your ZIP code to see the cheapest insurance company in your state.

Does Erie Insurance cover rental cars?

Yes, as long as you have comprehensive insurance in your regular policy, Erie will automatically cover short-term rental cars.

Is Allstate or Erie auto insurance better?

It depends on your unique needs and circumstances. Allstate is a highly rated company for many reasons, but it shines brightest with its full coverage policies. However, Erie Insurance is significantly cheaper on average than Allstate. To learn more, take a look at our Allstate auto insurance review.

Does Nationwide offer gap insurance?

Why is Erie auto insurance so cheap?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Does Erie have a diminishing deductible?

While it depends on the driver, Erie is typically cheaper than Nationwide. No matter which types of auto insurance you want to purchase, Erie is likely to be cheaper than Nationwide.

Nationwide insurance rates depend on the driver, but you can get rates starting as low as $63 per month for a minimum insurance policy.

Is Nationwide cheaper than Geico auto insurance?

No, Nationwide is more expensive on average than Geico. To see how much you might pay for Geico car insurance, check out our Geico auto insurance review.

Is Nationwide or Progressive cheaper?

Although there are many factors that affect your auto insurance rates, Nationwide tends to be more expensive than Progressive on average.

Are Erie and Progressive the same company?

While they are both popular, affordable choices for car insurance, Progressive and Erie are not the same company.

How many states is Erie Insurance in?

Erie sells insurance in 12 states: Illinois, Indiana, Kentucky, Maryland, New York, North Carolina, Ohio, Pennsylvania, Tennessee, Virginia, West Virginia, and Wisconsin. Enter your ZIP code to see the cheapest insurance company in your state.

Does Erie Insurance cover rental cars?

Yes, as long as you have comprehensive insurance in your regular policy, Erie will automatically cover short-term rental cars.

Is Allstate or Erie auto insurance better?

It depends on your unique needs and circumstances. Allstate is a highly rated company for many reasons, but it shines brightest with its full coverage policies. However, Erie Insurance is significantly cheaper on average than Allstate. To learn more, take a look at our Allstate auto insurance review.

Does Nationwide offer gap insurance?

Why is Erie auto insurance so cheap?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Does Erie have a diminishing deductible?

No, Nationwide is more expensive on average than Geico. To see how much you might pay for Geico car insurance, check out our Geico auto insurance review.

Although there are many factors that affect your auto insurance rates, Nationwide tends to be more expensive than Progressive on average.

Are Erie and Progressive the same company?

While they are both popular, affordable choices for car insurance, Progressive and Erie are not the same company.

How many states is Erie Insurance in?

Erie sells insurance in 12 states: Illinois, Indiana, Kentucky, Maryland, New York, North Carolina, Ohio, Pennsylvania, Tennessee, Virginia, West Virginia, and Wisconsin. Enter your ZIP code to see the cheapest insurance company in your state.

Does Erie Insurance cover rental cars?

Yes, as long as you have comprehensive insurance in your regular policy, Erie will automatically cover short-term rental cars.

Is Allstate or Erie auto insurance better?

It depends on your unique needs and circumstances. Allstate is a highly rated company for many reasons, but it shines brightest with its full coverage policies. However, Erie Insurance is significantly cheaper on average than Allstate. To learn more, take a look at our Allstate auto insurance review.

Does Nationwide offer gap insurance?

Why is Erie auto insurance so cheap?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Does Erie have a diminishing deductible?

While they are both popular, affordable choices for car insurance, Progressive and Erie are not the same company.

Erie sells insurance in 12 states: Illinois, Indiana, Kentucky, Maryland, New York, North Carolina, Ohio, Pennsylvania, Tennessee, Virginia, West Virginia, and Wisconsin. Enter your ZIP code to see the cheapest insurance company in your state.

Does Erie Insurance cover rental cars?

Yes, as long as you have comprehensive insurance in your regular policy, Erie will automatically cover short-term rental cars.

Is Allstate or Erie auto insurance better?

It depends on your unique needs and circumstances. Allstate is a highly rated company for many reasons, but it shines brightest with its full coverage policies. However, Erie Insurance is significantly cheaper on average than Allstate. To learn more, take a look at our Allstate auto insurance review.

Does Nationwide offer gap insurance?

Why is Erie auto insurance so cheap?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Does Erie have a diminishing deductible?

Yes, as long as you have comprehensive insurance in your regular policy, Erie will automatically cover short-term rental cars.

It depends on your unique needs and circumstances. Allstate is a highly rated company for many reasons, but it shines brightest with its full coverage policies. However, Erie Insurance is significantly cheaper on average than Allstate. To learn more, take a look at our Allstate auto insurance review.

Does Nationwide offer gap insurance?

Why is Erie auto insurance so cheap?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Does Erie have a diminishing deductible?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Does Erie have a diminishing deductible?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.