North Carolina Minimum Auto Insurance Requirements in 2026 (Coverage NC Drivers Need)

North Carolina minimum auto insurance requirements are 30/60/25, meaning drivers must have $30,000 for bodily injury per person, $60,000 for all injured, and $25,000 for property damage. NC car insurance rates start at $13/mo, but comparing quotes can help you save on your car insurance premiums.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Managing Editor

Laura Kuhl holds a Master’s Degree in Professional Writing from the University of North Carolina at Wilmington. Her career began in healthcare and wellness, creating lifestyle content for doctors, dentists, and other healthcare and holistic professionals. She curated news articles and insider interviews with investors and small business owners, leading to conversations with key players in the le...

Laura Kuhl

Licensed Insurance Agent

Jeff is a well-known speaker and expert in insurance and financial planning. He has spoken at top insurance conferences around the U.S., including the InsuranceNewsNet Super Conference, the 8% Nation Insurance Wealth Conference, and the Digital Life Insurance Agent Mastermind. He has been featured and quoted in Nerdwallet, Bloomberg, Forbes, U.S. News & Money, USA Today, and other leading fina...

Jeff Root

Updated December 2024

North Carolina minimum auto insurance requirements are straightforward: you need at least $30,000 per person and $60,000 per accident for bodily injury, plus $25,000 for property damage.

These basic coverages help protect you and others in case of an accident. Progressive offers some of the most affordable rates for North Carolina drivers, starting at just $13 per month. USAA and Geico are also great options, providing competitive rates for solid coverage.

North Carolina Minimum Auto Insurance Requirements & Limits

| Coverage | Limits |

|---|---|

| Bodily Injury Liability | $30,000 per person / $60,000 per accident |

| Property Damage Liability | $25,000 per accident |

Whether you’re new to North Carolina or just want to save on your premiums, comparing quotes can help you find the best deal for your budget. Make sure you’re covered and legally protected on the road without breaking the bank by shopping around and looking at all your options.

Make sure you compare the best rates with our FREE quote tool above! Just enter your ZIP code and start comparing rates today.

- North Carolina requires 30/60/25 auto insurance coverage

- You must update your insurance within 30 days of becoming a NC resident

- Progressive offers the lowest rates, starting at $13/month for minimum coverage

North Carolina Minimum Coverage Requirements & What They Cover

North Carolina auto insurance laws require all drivers to carry minimum insurance coverage in NC, often referred to as 30/60/25. This means you need at least $30,000 per person, $60,000 per accident for bodily injury coverage, and $25,000 for property damage coverage.

Comparing car insurance quotes in North Carolina can help you find the best rates and ensure you meet the state's minimum coverage requirements.Michelle Robbins Licensed Insurance Agent

These same limits also apply to uninsured motorist bodily injury and property damage coverage, ensuring you’re protected if the other driver is uninsured. Under North Carolina car insurance rules, all insurance companies are legally required to provide quotes that meet these minimum requirements.

If you move to North Carolina, you must update your car insurance policy within 30 days of becoming a resident. However, if you’re just visiting or passing through the state, you only need to carry the minimum insurance required in your home state.

By following North Carolina auto insurance requirements, drivers can ensure they are properly covered and in compliance with the law, helping protect everyone on the road.

What to do When Financing or Leasing a Vehicle in North Carolina

If your car is financed through a lender or leased through a dealer, you must carry full coverage. There is never an option to carry only the minimum requirement for a car that’s owned by someone else. In this case, the car is owned by the financial institution to which you make your monthly car payment.

Every lender has different requirements, but all lenders require drivers to pay for full coverage. If you allow your coverage to lapse or drop it, the lender will find out. All lenders monitor the insurance policies of all cars they own, and they will issue a notice requiring you to purchase full coverage immediately.

If you do not purchase the appropriate policy by the deadline they provide, your lender purchases a policy for you. Lenders do not shop around for good rates, they do not apply for discounts, and they don’t care about your budget when they choose a policy for you.

Read more: When should I drop my full coverage auto insurance?

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Cheapest Car Insurance in North Carolina

If you’re looking for affordable coverage that meets the North Carolina insurance requirements, Progressive is the cheapest option, offering minimum car insurance in NC for just $13 per month. USAA is the second cheapest at $18 per month, and Geico comes in third at $30 per month.

13,285 reviews

13,285 reviewsCompany Facts

Min. Coverage in North Carolina

A.M. Best

Complaint Level

Pros & Cons

13,285 reviews

13,285 reviews 6,590 reviews

6,590 reviewsCompany Facts

Min. Coverage in North Carolina

A.M. Best

Complaint Level

Pros & Cons

6,590 reviews

6,590 reviews 19,116 reviews

19,116 reviewsCompany Facts

Min. Coverage in North Carolina

A.M. Best

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviewsThese providers ensure that drivers stay compliant with NCs’ car insurance laws, which require liability coverage for bodily injury and property damage, as well as uninsured motorist protection. Choosing one of these companies can help you meet the NC auto insurance requirements while keeping your costs low.

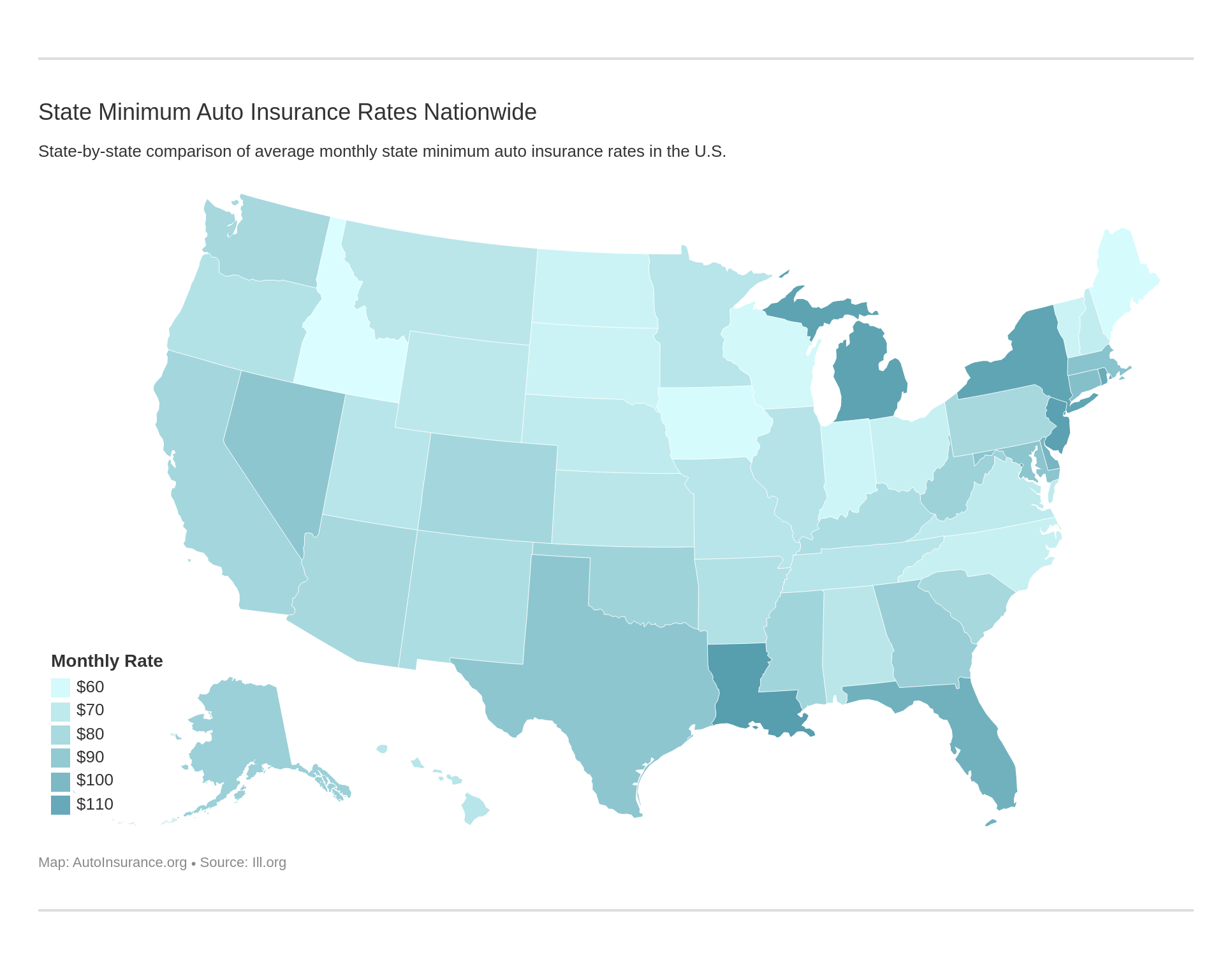

North Carolina Min. Coverage Auto Insurance Monthly Rates by City

| City | Rates |

|---|---|

| Asheville | $82 |

| Cary | $84 |

| Chapel Hill | $76 |

| Charlotte | $105 |

| Concord | $78 |

| Durham | $87 |

| Fayetteville | $90 |

| Gastonia | $86 |

| Greensboro | $80 |

| High Point | $83 |

| Jacksonville | $77 |

| Raleigh | $85 |

| Rocky Mount | $95 |

| Wilmington | $79 |

| Winston-Salem | $81 |

In North Carolina, state law requires all vehicles to carry minimum or full coverage auto insurance. This means having at least $30,000 per person and $60,000 per accident for bodily injury coverage, plus $25,000 for property damage.

With providers like Progressive, USAA, and Geico, you can find affordable plans that meet these legal North Carolina insurance requirements while protecting you and other drivers on the road.

Other Coverage Options to Consider in North Carolina

Besides the minimum requirement for liability insurance in North Carolina, there are other types of coverage you might want to think about. These can give you extra protection and go beyond the North Carolina car insurance minimums:

- Collision Coverage: Collision auto insurance coverage pays for repairs to your car if you hit another vehicle or object, no matter who’s at fault.

- Comprehensive Coverage: Comprehensive auto insurance coverage helps cover damages from things like theft, storms, or vandalism.

- Uninsured/Underinsured Motorist Coverage: Uninsured/underinsured motorist coverage protects you if the other driver doesn’t have enough insurance to pay for damages.

- Roadside Assistance: Best roadside assistance covers services like towing or jump-starting your car when you’re stranded.

- Rental Car Reimbursement: Rental car reimbursement coverage helps pay for a rental if your car is in the shop after an accident.

While North Carolina’s minimum insurance requirements cover the basics, these options can give you more peace of mind. Make sure your policy follows North Carolina car insurance regulations, and talk to Providers like Progressive, USAA, or Geico to find the right coverage for you.

Penalties for Driving Without Insurance in North Carolina

If you’re caught driving without insurance in North Carolina, the penalties get worse with each offense. From increasing fines to license suspensions and even jail time, here’s what you need to know about the consequences of driving uninsured.

- Penalties for First Offenses: Your license and registration are suspended for 30 days. You’ll pay a $50 civil penalty fine and a $50 reinstatement fee and need to show proof of valid insurance. You might also get probation for 1 to 45 days.

- Penalties for Second Offenses: Your license and registration are suspended for 30 days again. This time, you’ll pay a $100 civil penalty fine and a $50 reinstatement fee and show proof of insurance. You could face probation or jail time for 1 to 45 days.

- Penalties for Subsequent Offenses: Your license and registration are suspended for 30 days once more. The civil penalty fine jumps to $150, plus the $50 reinstatement fee. You’ll need proof of insurance, and jail time or probation for 1 to 45 days becomes much more likely.

Driving without auto insurance in North Carolina comes with serious penalties that only get worse each time. Fines, license suspensions, and even jail time are real risks. The best way to avoid all this is to follow North Carolina car insurance requirements and keep a valid insurance policy. It’s simple and keeps you safe on the road.

Read more: Best Auto Insurance Discounts

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Finding the Best Minimum Auto Insurance Policy in North Carolina

Finding the best minimum auto insurance policy in North Carolina is simple if you know North Carolina car insurance requirements. Driving without coverage is a costly mistake, especially when the average car insurance cost in the U.S. is about $907 per year.

The good news is NC’s auto insurance laws allow you to shop around for affordable policies. You can save around 5% if you pay the full premium upfront instead of making monthly payments.

The North Carolina auto insurance requirements for minimum liability coverage include specific coverage amounts for bodily injury liability and property damage liability.

Read more 👉 https://t.co/6mKhwWmgtW#Cumberland #Fayetteville #Relocation #BodilyInjuryLiability

— Eastern NC Explorer (@ENCExplorer) December 8, 2023

Understanding the minimum insurance requirements for NC drivers is important because they keep you legal on the road. The minimum insurance amounts needed to drive in North Carolina include liability coverage for accidents. Putting them under the same policy can earn you a multi-car discount if you have more than one car.

Read more: How Credit Scores Affect Auto Insurance Rates

Knowing the rules and taking advantage of savings allows you to meet North Carolina car insurance requirements without spending too much.

You can afford insurance in North Carolina, but you cannot afford to go without insurance. Don’t miss out on our free quote tool below! Just enter your ZIP code and start comparing rates now!

Frequently Asked Questions

What are the minimum auto insurance requirements in North Carolina?

In North Carolina, the minimum auto insurance requirements include:

- $30,000 bodily injury liability coverage per person

- $60,000 bodily injury liability coverage per accident

- $25,000 property damage liability coverage per accident

What does bodily injury liability coverage mean?

Bodily injury liability coverage provides financial protection if you cause an accident that results in injuries or death to other people. It helps cover the affected individual’s medical expenses, rehabilitation costs, lost wages, and legal expenses. To lower your auto insurance premiums, enter your ZIP code into our free quote comparison tool to compare your rates against the top insurers.

What does property damage liability coverage mean?

Property damage liability coverage provides financial protection if you cause damage to someone else’s property in an accident. It covers the repair or replacement costs of the damaged property, such as vehicles, buildings, or other structures.

Read more: When to Buy More Than Minimum Auto Insurance

Are these minimum coverage limits sufficient?

The minimum coverage limits required by North Carolina law provide a basic level of financial protection. However, they may not be sufficient to cover all expenses in a severe accident fully. It’s recommended to consider higher coverage limits to protect your assets and future earnings adequately.

Is it mandatory to have uninsured/underinsured motorist coverage in North Carolina?

While uninsured/underinsured motorist coverage is not mandatory in North Carolina, insurance companies must offer it to policyholders. This coverage protects you if you’re involved in an accident with a driver who lacks insurance or has insufficient coverage to compensate for your injuries or property damage.

What other types of auto insurance coverage should I consider?

In addition to the minimum requirements, you may want to consider other types of auto insurance coverage, such as:

- Collision coverage: Covers the cost of repairing or replacing your vehicle if it’s damaged in a collision, regardless of fault.

- Comprehensive coverage: Covers non-collision-related damage to your vehicle, such as theft, vandalism, fire, or natural disasters.

- Medical payments coverage: Pays for medical expenses resulting from injuries sustained in an accident, regardless of fault.

- Personal injury protection (PIP): Similar to medical payments coverage, PIP provides broader coverage for medical expenses, lost wages, and other related costs.

Can I drive without insurance in North Carolina?

No, it is illegal to drive without insurance in North Carolina. All registered vehicles must have at least the minimum required liability insurance coverage. Failure to comply with this requirement can result in penalties, fines, license suspension, and even vehicle impoundment.

What is the minimum auto insurance coverage in North Carolina?

The minimum auto insurance coverage in North Carolina is 30/60/25, which means drivers must have $30,000 for bodily injury per person, $60,000 for bodily injury per accident, and $25,000 for property damage.

What are the car insurance laws in North Carolina?

The car insurance laws in North Carolina require drivers to have liability insurance that includes bodily injury and property damage coverage. All insurance providers in the state must offer policies that meet these minimum requirements.

Read more: Bodily Injury Liability (BIL) Auto Insurance

What are the minimum auto insurance requirements in North Carolina?

The minimum auto insurance requirements in North Carolina are $30,000 for bodily injury per person, $60,000 per accident for bodily injury, and $25,000 for property damage.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.