Can someone file a claim on your auto insurance without you knowing?

While someone can attempt to make a claim on your auto insurance without you knowing, the good news is your insurance company will tell you if someone is making the effort to do so. Often, it's called a third-party claim.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Insurance and Finance Writer

Laura Gunn is a former teacher who uses her passion for writing and learning to help others make the best decisions regarding finance and insurance. After stepping away from the classroom, Laura used her skills to write across many different industries including insurance, finance, real estate, home improvement, and healthcare. Her experience in various industries has helped develop both her ...

Laura Gunn

Licensed Insurance Agent

Jimmy McMillan is an entrepreneur and the founder of HeartLifeInsurance.com, an independent insurance brokerage. His company specializes in insurance for people with heart problems. He knows personally how difficult it is to secure health and life insurance after a heart attack. Jimmy is a licensed insurance agent from coast to coast who has been featured on ValientCEO and the podcast Modern Li...

Jimmy McMillan

Updated October 2024

Getting into a car accident can be incredibly stressful, and it can be worse if you’re worried that another party is planning on making a claim against your car insurance.

Perhaps not as stressful as needing to settle a claim without insurance whatsoever, but that doesn’t happen as often. The good news is that you are always kept informed throughout the claims process and won’t be surprised. Comprehending why a third-party claim on car insurance is unlikely to occur without your knowledge starts with grasping how liability insurance operates. Understanding the mechanisms of liability insurance is essential to recognizing why it’s improbable for a false claim against my car insurance policy to be filed without my awareness.

- When someone files a car insurance claim with your car insurance company after an accident, the claim is called a third-party auto insurance claim

- Third-party auto insurance claims are the most common type of car insurance claims in the United States

- It’s highly unlikely that someone will file a claim on your auto insurance policy without you knowing

It Is Extremely Unlikely Someone Will Claim On Your Auto Insurance Without Your Knowledge

The first thing to remember is that in most cases you need to provide your insurance details after a collision. That means you already know that someone has your insurance information and intends to use it. You are also obligated to inform your insurance company of the incident. Hopefully, you’re lucky and your insurance provider offers accident forgiveness with your policy. The bottom line is that your insurance company is trusting you to let them know whenever you’ve been in an accident. Going off a baseless claim from someone else isn’t a smart move on their part.

Remember that your insurance company will almost always notify you about any claims made against your car insurance policy. Car insurance companies, as profit-driven entities, aim to minimize payouts and will only settle car accident insurance claims involving a third party if necessary.

They won’t simply pay out on a claim based on the word of another driver, even if that driver has a police report. After all, insurance companies don’t necessarily accept blame as it is declared by a police report. Unless they make a series of internal blunders, your insurance company will always contact you about a claim.

You might choose to settle your accident privately during roadside discussions. However, the other driver may later decide to file a claim with Direct Auto Insurance. In such a case, they will need your insurance details, and your insurer will promptly inform you if this happens. Additionally, you can always visit the Direct Auto Insurance office opening for assistance.

In the rare event that you are blindsided by a claim, it could be due to someone providing false information after a crash they were involved in. For this to happen, the other party would need to have your vehicle and insurance details. However, your insurance company will contact you for fault determination before proceeding with a third-party car insurance claim on your policy.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What is a third-party auto insurance claim?

A third-party car insurance claim involves another individual, not the policyholder, making a claim against your car insurance policy. If you are involved in a collision or a minor accident with another driver, they may file a claim with your auto insurance company if they believe they have a valid case. This process is part of the standard third-party car insurance claims procedure, which can also include collision claims made on my policy and rental car accidents made on my policy.

Unless you live in Virginia or New Hampshire, you’ll have to have liability insurance coverage to drive in the US. If you’re found to be at fault in an accident involving another driver, you’ll be responsible for paying for bodily injuries or damages to their car.

For that to happen, the other driver must file a third-party claim with your auto insurance company. This third-party insurance claim check can occur without me knowing, meaning someone made a claim on my car insurance without my awareness.

What happens when someone files a third-party claim?

Before someone files a third-party claim with your auto insurance company, that person will usually call their own insurance company. They will give their company the facts about the accident, and provide a police report showing that you were at fault.

In cases where someone filed a false insurance claim against me, their insurance company might instruct the other driver to submit their claim directly to my insurance provider. However, in most situations, the insurance companies collaborate with each other throughout the third-party car insurance claim process. This helps ensure that any false car accident claim filed against you is properly reviewed and addressed.

Your auto insurance company will take everything into account, including witness statements, the police report, and whatever other information you or the other driver provide.

Your insurance company’s decision about who’s at fault may or may not match with the police department’s determination of fault. If that turns out to be the case, the other driver will be asked to file a claim against his or her insurance company.

However, they’ll still pay the claim if it determines that you really were responsible for the damage.

Insurance Claims Without Your Knowledge: The Bottom Line

As you learned earlier, the chances of someone claiming on your auto insurance policy without telling you are almost zero.

Regardless, it’s always best to make sure you have the proper car insurance coverage in place so that no matter what happens, you can have peace of mind knowing you’re covered for a variety of circumstances.

Frequently Asked Questions

What are the potential reasons someone might try to file a claim on my auto insurance without my knowledge?

There are several potential reasons someone might attempt to file a claim on your auto insurance without your knowledge, including fraudulent activities, seeking compensation for damages they caused, or attempting to take advantage of your insurance coverage.

How can I protect myself from someone filing a fraudulent claim on my auto insurance?

To protect yourself from someone filing a fraudulent claim on your auto insurance:

- Safeguard your insurance information and policy details.

- Regularly review your insurance statements and policy documents for any discrepancies.

- Immediately report any suspicious activity or unauthorized claims to your insurance company.

What should I do if I suspect someone has filed a claim on my auto insurance without my knowledge?

If you suspect someone has filed a claim on your auto insurance without your knowledge, take the following steps:

- Contact your insurance company immediately and inform them of your suspicions.

- Provide any relevant information or evidence you may have regarding the unauthorized claim.

- Cooperate with your insurance company’s investigation and provide any requested documentation.

Can my auto insurance company pay out a claim without my consent or knowledge?

In most cases, insurance companies require policyholders to provide consent and authorize claim payments. However, it’s important to carefully review your insurance policy terms and conditions to understand the specific provisions regarding claim processing and payments.

Will an unauthorized claim affect my auto insurance rates?

An unauthorized claim on your auto insurance may potentially affect your insurance rates, depending on the circumstances and your insurance company’s policies. Fraudulent claims or excessive claims activity can result in premium increases or even policy cancellation.

Can I dispute a claim filed on my auto insurance without my knowledge?

Yes, if a claim has been filed on your auto insurance without your knowledge and you believe it to be unauthorized or fraudulent, you can dispute it with your insurance company. Provide them with any evidence or information that supports your claim of unauthorized activity.

Should I involve law enforcement if someone files a claim on my auto insurance without my knowledge?

If you suspect fraudulent activity or believe that someone has filed a claim on your auto insurance without your knowledge, you may consider involving law enforcement. Contact your local authorities to report the incident and provide them with any relevant information or evidence.

Can someone file a claim using my car insurance information without my knowledge?

Yes, it is possible for someone to make a claim on my car insurance without me being informed. However, your insurance company will usually notify you if a claim is filed against your policy.

Will my insurance company notify me if a claim is made against my policy?

Yes, your insurance company will notify you if a claim is made against your policy. They are required to inform you of any claims that could impact your coverage.

How can I determine if someone has filed an insurance claim against me?

To determine if someone has filed an insurance claim against you, contact your insurance company directly. They can provide you with information about any claims related to your policy.

What steps should I take if someone files a claim against my car insurance?

Can someone submit a claim on my car insurance without having my personal details?

What are the methods to find out if a claim has been filed against me?

Can an insurance company add a driver to my policy without my consent?

Am I able to file a claim on another person’s insurance policy?

Can I switch my car insurance provider if I have an active claim?

Can other insurance companies access my claims history?

Is it possible for someone to obtain my car insurance details without my permission?

Can someone report me for a car accident using only my license plate number?

Can I file a claim if I do not have the other driver’s insurance information?

Can I make a claim on someone’s insurance using just their license plate number?

If someone files a claim against my insurance, will I be responsible for any costs?

What is the process for filing a claim against someone else’s car insurance policy?

How do I initiate a claim against another person’s insurance policy?

What are the consequences if someone makes a claim against my car insurance?

What happens if a claim is filed against my auto insurance policy?

What are the potential outcomes if I do not respond to a car insurance claim?

Will my insurance company advocate on my behalf in the event of a claim?

What is the process for filing a Geico third-party claim?

How can I contact Nationwide Insurance for assistance?

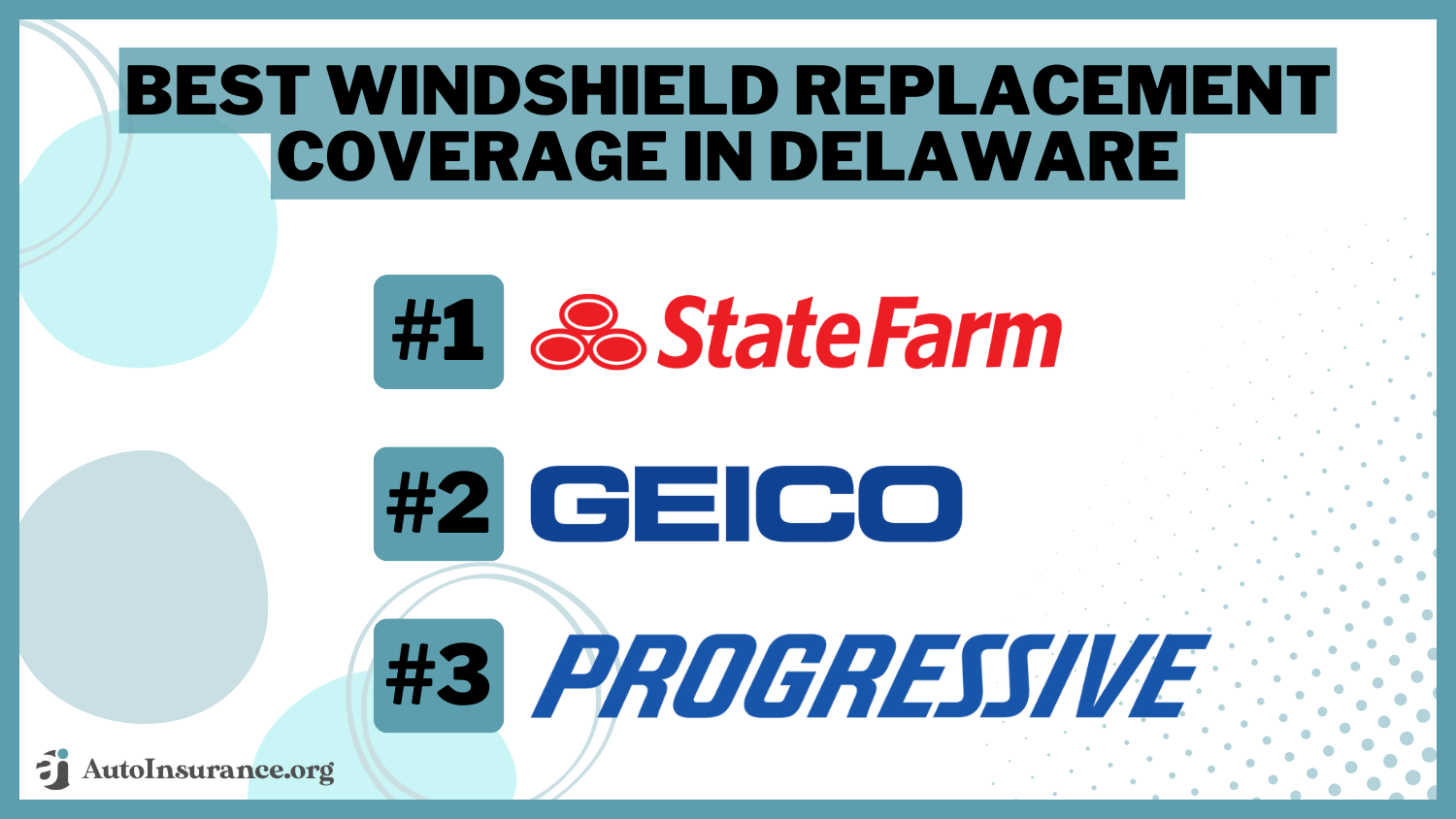

How do State Farm third-party claims work?

How do I file a claim with Tesla Insurance?

What is the procedure to file a third-party claim with Allstate Insurance?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.