Acceptance Auto Insurance Review (2026)

Acceptance car insurance is most well-known for offering non-standard insurance to high-risk drivers. Here’s everything you need to know about Acceptance auto insurance.

Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Managing Editor

Laura Kuhl holds a Master’s Degree in Professional Writing from the University of North Carolina at Wilmington. Her career began in healthcare and wellness, creating lifestyle content for doctors, dentists, and other healthcare and holistic professionals. She curated news articles and insider interviews with investors and small business owners, leading to conversations with key players in the le...

Laura Kuhl

Licensed Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. Eric is the CEO of C Street Media, a full-service marketing firm and the co-founder of ProperCents.com, a financial educat...

Eric Stauffer

Updated June 2025

Finding auto insurance as a high-risk driver can be difficult. As a high-risk driver, you may look for proper or cheaper coverage with a new company. If that’s the case, consider learning more about Acceptance car insurance.

Acceptance Insurance offers homeowners, renters, motorcycle, and life insurance coverage. However, the company is well-known for its non-standard auto insurance policies catering to those looking for high-risk auto insurance.

What You Should Know About Acceptance Insurance

Acceptance Insurance is a subsidiary of First Acceptance Corporation. First Acceptance Corp. has a B (fair) financial strength rating with A.M. Best with a stable outlook for the future. The company also has an A+ rating with the Better Business Bureau (BBB), though the BBB website lists several customer complaints.

If you’re considering a policy with Acceptance Insurance, you may want to consider its A.M. Best rating and customer complaints before doing so. Still, if you’re a high-risk driver seeking non-standard auto insurance, Acceptance may be a good option.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Acceptance Customer Service

Acceptance receives negative reviews for its customer service. The company received a complaint index score of 4.74 while the median score is 1. This means Acceptance is almost five times as likely to receive a complaint when compared to other auto insurance companies.

Acceptance policyholders frequently complain about the company’s claims process, the speed at which claims were handled, and the responsiveness of the claims investigators and adjusters.

How does Acceptance handle car insurance claims?

To file an auto insurance claim with Acceptance, you can call the phone number and speak with a company representative. But many customers mention that the claims process is neither smooth nor efficient.

According to some individuals, Acceptance adjusters will take days or even weeks to get back to people about the status of a claim. Such a delay in resolution has made many Acceptance policyholders, and many people who’ve been in car accidents with Acceptance policyholders, upset.

Acceptance Insurance Coverage Options

Acceptance Insurance could work for you if you’re looking for straightforward coverage — it offers fundamental policies for car insurance, including:

- Liability auto insurance coverage

- Bodily injury liability

- Uninsured/underinsured motorist coverage

- Personal injury protection (PIP) insurance

- Collision auto insurance

- Comprehensive auto insurance

- Medical payments coverage

- Roadside assistance

Unlike some companies specializing in non-standard insurance, Acceptance offers full coverage to specific policyholders. However, anyone interested in robust auto insurance policies with customizable possibilities may want to look elsewhere.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What is non-standard car insurance?

Non-standard car insurance companies offer high-risk insurance, which is typically necessary for high-risk drivers — most non-standard policies get sold to individuals with poor driving records or a history of car accidents.

Some of the everyday situations where a person would need a non-standard car insurance policy include:

- License suspension or revocation

- DUI charge

- DWI charge

- Excessive traffic violations

- Excessive speeding tickets

If you need non-standard coverage, expect to pay higher rates for liability-only policies. Also, while some providers may be willing to offer additional coverage options, other companies may not make collision or comprehensive coverage available.

Unfortunately, only 15 states offer Acceptance. If you don’t live in one of the states in which Acceptance operates, you’ll have to look at other insurance companies for auto insurance. However, if you do, you may want to consider purchasing a car insurance policy with Acceptance.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

What other types of insurance does Acceptance offer?

Along with auto insurance, Acceptance offers the following insurance products:

- Homeowners insurance

- Renters insurance

- Life insurance

- Commercial insurance

- Pet insurance

- Motorcycle insurance

- Hospital indemnity insurance

If you choose another insurance product with the company, you may be able to save money by bundling your insurance coverages.

Acceptance Car Insurance: The Bottom Line

Acceptance auto insurance is a good fit for many non-standard drivers. However, if you have a questionable driving record and live in one of the states where Acceptance is available, you should reach out to the company to get a quote for coverage.

If you’re not a high-risk driver, you should look elsewhere to find the best car insurance companies in your area, as you’ll likely find more affordable rates elsewhere.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Acceptance Insurance Rates Breakdown

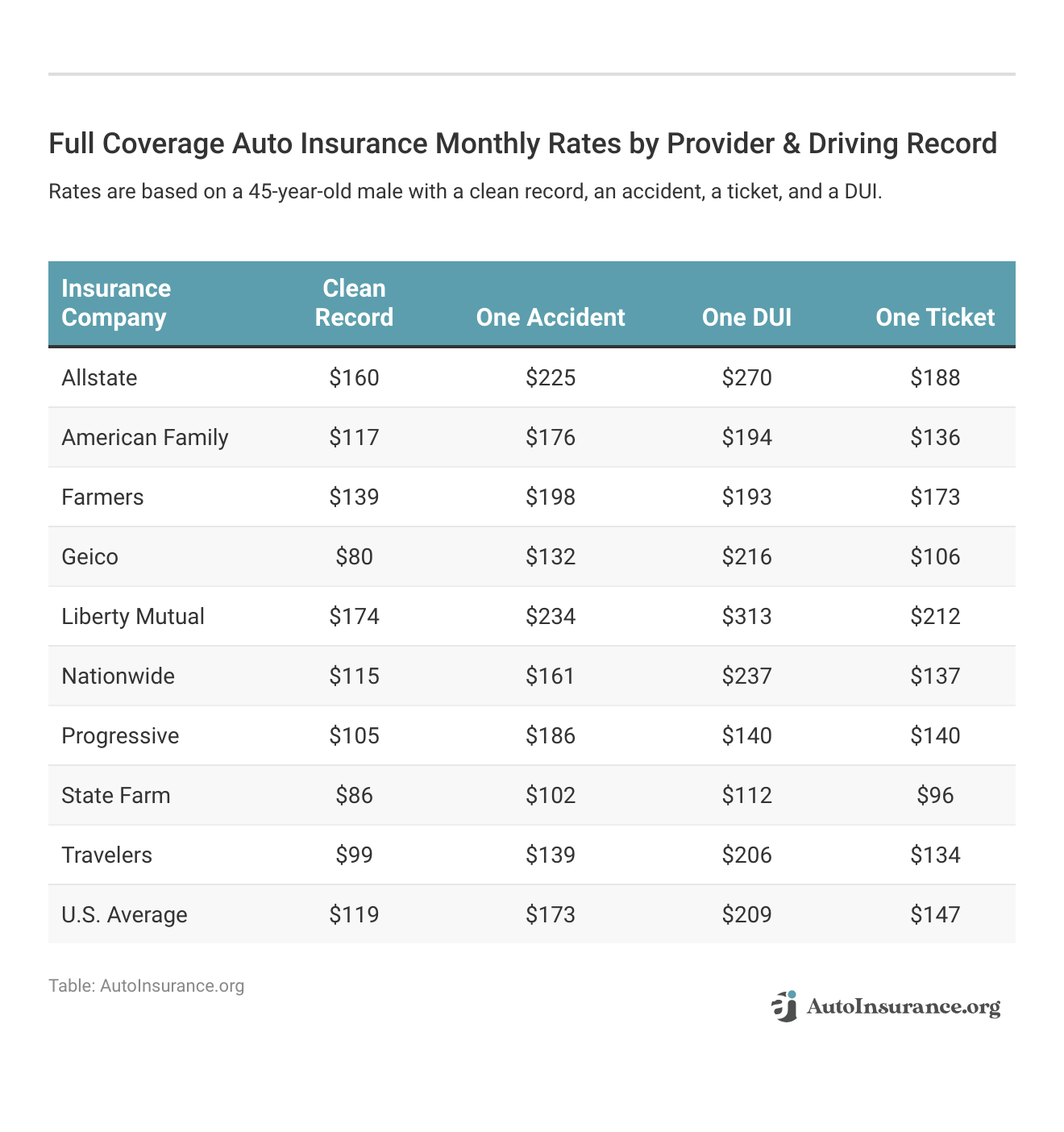

Rates with Acceptance insurance tend to be higher than competitors. The table below shows average rates for liability-only auto insurance coverage with other well-known auto insurance providers. Rates with Acceptance insurance may vary slightly depending on other factors, but these numbers should give you an idea.

Social Worker Auto Insurance Monthly Rates by Driving Record

| Insurance Company | Clean Record | One Ticket | One Accident | One DUI |

|---|---|---|---|---|

| $87 | $103 | $124 | $152 | |

| $62 | $73 | $94 | $104 |

| $76 | $95 | $109 | $105 | |

| $43 | $56 | $71 | $117 | |

| $96 | $116 | $129 | $178 |

| $63 | $75 | $88 | $129 | |

| $56 | $74 | $98 | $75 | |

| $47 | $53 | $57 | $65 | |

| $53 | $72 | $76 | $112 | |

| $32 | $36 | $42 | $58 |

Still, you never know how much you’ll pay for coverage until you get an Acceptance car insurance quote.

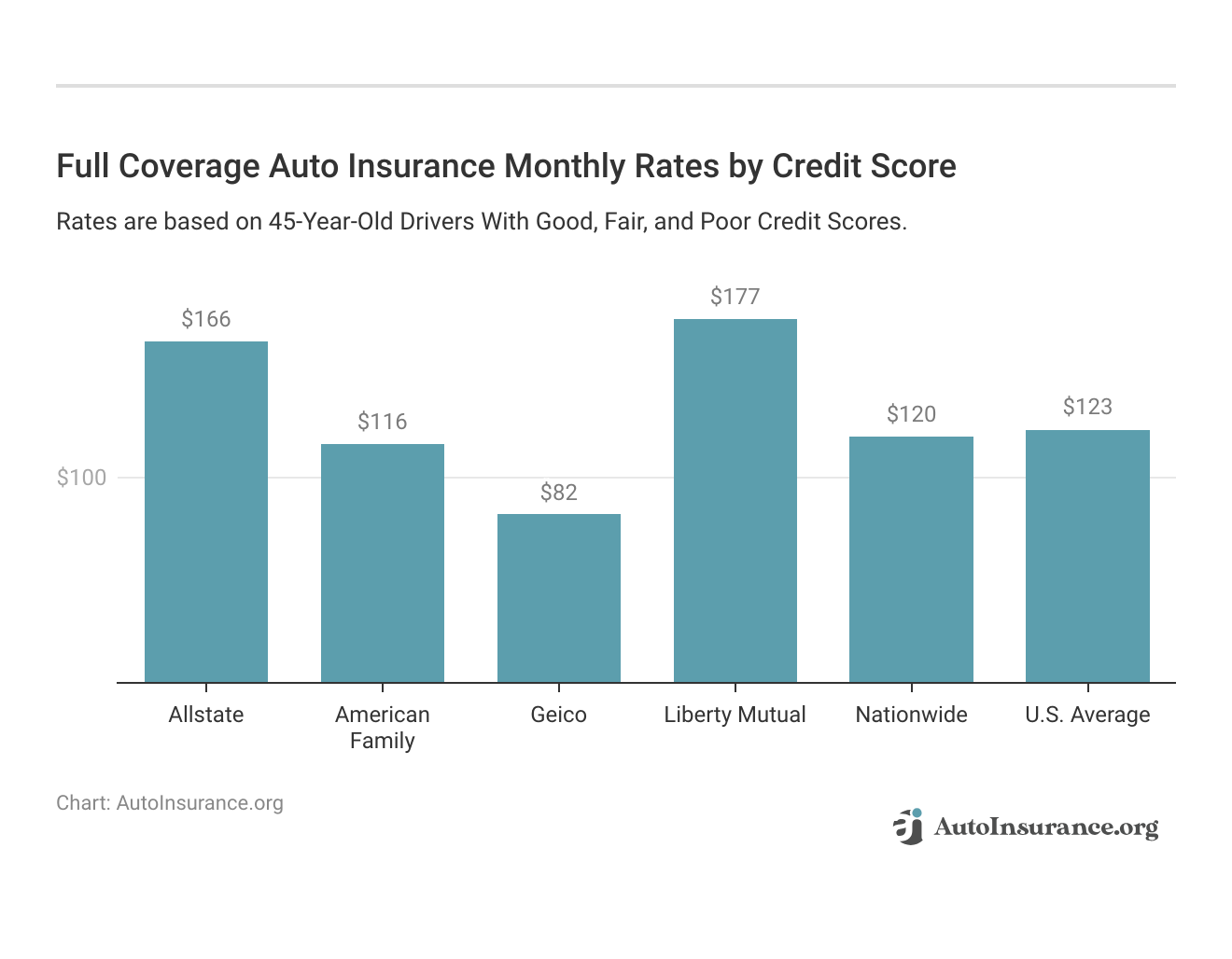

There are many factors that affect auto insurance rates since insurance companies use different information to assess each driver’s accident risk. Some of the most common factors impacting car insurance rates include:

- Age

- Gender

- Marital status

- ZIP code

- Driving history

- Credit score

- Car make and model

- Coverage types

To get an idea of how these factors can affect your auto insurance rates, let’s take a look at comparative rates from some of the top auto insurance companies in the U.S.

Acceptance Insurance Discounts Available

Acceptance offers several auto insurance discounts to its policyholders. Some of the company’s most popular discounts include:

- Military discount

- Multi-car discount

- Multi-policy discount

- Policy renewal discount

- Autopay discount

- Paperless discount

- Homeowner discount

- Paid-in-full discount

- Usage-based insurance discount

- Advance quote discount

- Online quote discount

- Defensive driving discount

- Good student discount

- Good driver discount

- Low-mileage discount

Acceptance automatically applies discounts to policyholders’ accounts if they qualify for savings. Still, you can call and speak with an Acceptance representative to see how much you could save on your car insurance coverage with one or more of the discounts listed above.

Frequently Asked Questions

How do you get an insurance quote from Acceptance?

To get a quote, you can visit the Acceptance website or call 866-480-9107.

What states offer Acceptance auto insurance?

Acceptance is available in the following states:

- Alabama

- Arizona

- California

- Florida

- Georgia

- Illinois

- Indiana

- Mississippi

- Missouri

- Ohio

- Pennsylvania

- South Carolina

- Tennessee

- Texas

- Virginia

How can I file a claim with Acceptance?

Policyholders who need to report a claim can call 800-779-2103 or email [email protected] for assistance.

Does Acceptance have an app?

Acceptance does not have an app to help policyholders file claims, check the status of a claim, or access policy information. Instead, customers will have to speak to a representative with the company for information or assistance.

What is Acceptance Insurance known for?

Acceptance Insurance is well-known for offering non-standard insurance to high-risk drivers.

What is the financial strength rating of Acceptance Insurance?

Acceptance Insurance has a B (fair) financial strength rating with A.M. Best.

How is Acceptance’s customer service rated?

Acceptance receives negative reviews for its customer service, with a complaint index score almost five times higher than the median.

Are Acceptance insurance rates competitive?

Rates with Acceptance insurance tend to be higher than competitors, according to average rate comparisons.

What types of insurance does Acceptance offer?

In addition to auto insurance, Acceptance offers homeowners, renters, motorcycle, and life insurance coverage.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.