LendingTree Review for 2026 (Trusted Insurance Quotes?)

This unbiased LendingTree review offers a balanced look at how the platform performs compared to similar tools, highlighting strengths and common user concerns. It’s best known for quick access to 40+ insurer quotes in under three minutes, though some users report frequent follow-up contact after submitting info.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Feature Writer

Rachel Bodine graduated from college with a BA in English. She has since worked as a Feature Writer in the insurance industry and gained a deep knowledge of state and countrywide insurance laws and rates. Her research and writing focus on helping readers understand their insurance coverage and how to find savings. Her expert advice on insurance has been featured on sites like PhotoEnforced, All...

Rachel Bodine

Licensed Agent & Financial Advisor

Schimri Yoyo is a financial advisor with active insurance licenses in seven states and over 20 years of professional experience. During his career, he has held roles at Foresters Financial, Strayer University, Minnesota Life, Securian Financial Services, Delaware Valley Advisors, Bridgemark Wealth Management, and Fidelity. Schimri is an educator eager to assist individuals and families in ach...

Schimri Yoyo

Updated April 2025

LendingTree makes it easy to get real-time quotes from over 40 insurers in under three minutes. You can filter by coverage type—like liability, collision, or full coverage—and even compare bundles that include home or renters insurance. It’s a simple way to explore rates quickly without creating an account.

LendingTree Rating

| Rating Criteria | |

|---|---|

| Overall Score | 4.3 |

| Customer Support | 4.3 |

| Discount Clarity | 4.2 |

| Ease of Use | 4.4 |

| Educational Resources | 4.3 |

| Provider Network | 4.1 |

| Quote Accuracy | 4.3 |

| Quote Speed | 4.4 |

| Savings Potential | 4.3 |

This unbiased LendingTree review finds that while it’s great for speed, it doesn’t handle underwriting, provide final pricing, or offer much insight into the insurers behind the quotes.

Keep reading to learn what info LendingTree asks for and how it works when you’re trying to get a quote from an auto insurance company.

- LendingTree is rated 4.3/5 for quick side-by-side insurance quotes

- Compare coverage options with LendingTree without creating an account

- Getting LendingTree auto insurance quotes doesn’t affect credit scores

Start comparing with AutoInsurance.org, which offers quotes from over 60 top-rated insurers in your area. Enter your ZIP code to see if you could be getting a better deal.

LendingTree: Pros & Cons

| Pros/Cons | |

|---|---|

| ✅ Pros | • Compare full, liability, or collision quotes by ZIP. • Get quotes from 40+ insurers in minutes. • Filter rates by ZIP and coverage type instantly. |

| ❌ Cons | • Users report follow-up calls from multiple insurers. • PCMag rated 3.3 for limited coverage control. |

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How the LendingTree Quote Tool Works and What You’ll Need

LendingTree makes insurance shopping pretty simple with its quick online tool. To get started, you’ll enter your ZIP code so the platform can show local rates.

Next, you’ll answer a few basic questions—things like your car’s make, model, year, how you use it, and whether it’s leased or financed. Your name, residence, date of birth, marital status, current insurance company, and a brief driving history, including any past infractions or claims, will also be requested.

After that, LendingTree shows you real-time quotes based on the coverage you’re looking for. It’s not a licensed insurance broker, but it works a lot like one by connecting you with offers from multiple insurers based on your profile. You can compare everything in one spot, but the actual policy comes from the provider you choose.

There’s no account required, and you’re not locked into anything. Plus, your info stays secure thanks to SHA-256 encryption.

Comparing Speed and Savings Across Top Insurance Tools

Here’s how the top platforms measure up in terms of speed, savings, and insurer variety. Insurify comes out ahead with the fastest quote time at just two minutes and the highest savings potential at 30%. It also connects users with up to 40 insurers per request.

LendingTree vs. NerdWallet vs. Insurify: Compare Top Insurance Sites

| Feature | |||

|---|---|---|---|

| Savings Potential | 25% | 20% | 30% |

| Annual Savings | $250 | $300 | $420 |

| Fastest Quote Time | 3 minutes | 5 minutes | 2 minutes |

| Providers Compared | 50+ | 700+ | 120+ |

| Customer Satisfaction | 90% | 89% | 94% |

LendingTree is quick at three minutes but has fewer insurers and slightly lower savings. NerdWallet offers broad access to insurers but takes longer to deliver quotes. If you’re wondering how long does it take to compare auto insurance quotes, these platforms show it can range from two to five minutes depending on the tool.

Insurify also tops satisfaction scores, making it a strong choice for drivers who want fast, accurate results. While LendingTree is a good place to start, it may not provide as much variety in coverage or insurer detail as some drivers need. Taking time to explore each option can lead to better savings and a more customized policy.

LendingTree Reviews, Ratings & Customer Feedback

LendingTree reviews on Reddit reflect positive user sentiment. One user shared that they had a good experience using LendingTree, saying it was helpful to see multiple loan offers from BBB-accredited lenders when their own bank wouldn’t approve them.

Comment

byu/Kfinch92 from discussion

indebtfree

It’s a solid reminder that LendingTree can give you more options when traditional routes fall short. Here’s a closer look at what real users say about LendingTree. The ratings give a clear picture of what works well and what could be improved.

LendingTree vs. NerdWallet vs. Insurify: Third-Party Platform Customer Ratings

| Review Platform | |||

|---|---|---|---|

| 4.8 / 5 37k+ reviews | 4.8 / 5 115k+ reviews | 3.4 / 5 141 reviews |

|

| A+ | A+ | A+ | |

| NA | NA | 3.8 / 5 130+ reviews |

|

| 4.3 / 5 9k+ reviews | 4.5 / 5 29.9k reviews | 3.4 / 5 141 reviews |

|

| 3.3 / 5 | 4 / 5 | NA | |

| 4.2 / 5 14k+ reviews | 3.7 / 5 2k+ reviews | 4.7 / 5 2k+ reviews |

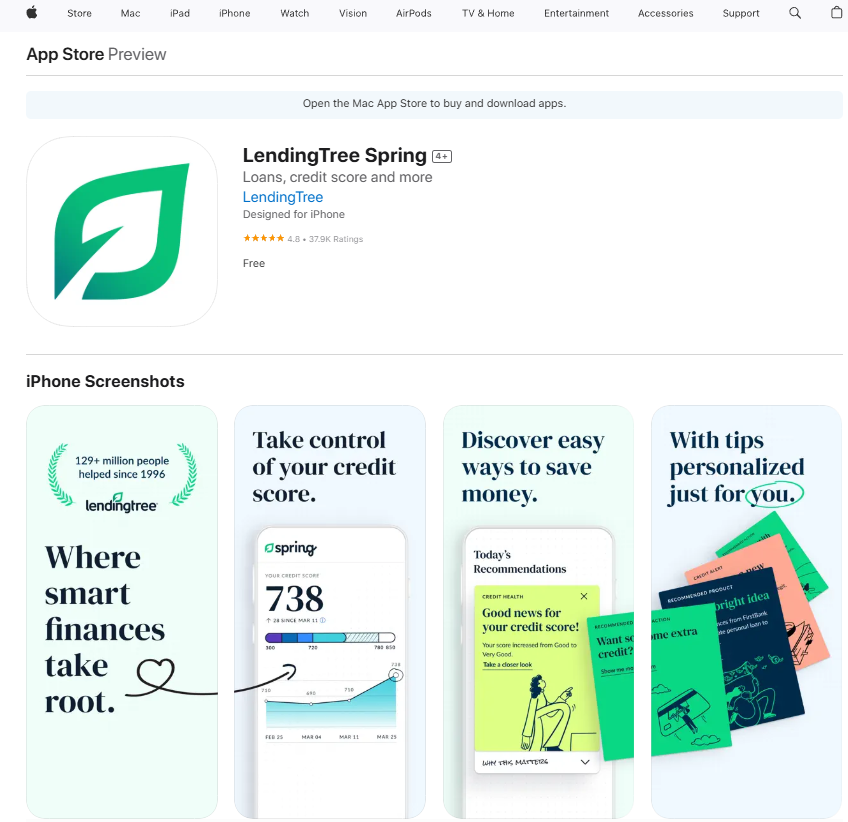

LendingTree scores a strong 4.8 on the App Store with over 37,000 reviews, showing users how fast and easy it is to get quotes. But its 3.3 from PCMag points to weak customization and limited details on insurers. NerdWallet also scores 4.8 but with more than 115,000 reviews, which shows stronger user trust and wider usage.

Its 4.0 from PCMag backs up that it offers better financial tools and more complete comparisons. Insurify scores lower on mobile, but its 4.7 on TrustPilot shows users value the clean experience, fewer follow-up calls, and clearer quote details. It also stands out with a 3.8 on Clearsurance—something the others don’t have.

LendingTree reviews complaints on Reddit, though fewer in number, and mentions that users often feel overwhelmed by frequent calls after submitting their info. Some shared they weren’t expecting as much third-party contact, even though they liked the speed of the platform.

See More: Best Auto Insurance Companies According to Reddit

These scores indicate that while LendingTree is good at generating quotes, it leaves users without clear next steps or control over how their data is shared. That’s where AutoInsurance.org is different.

We don’t just help you compare quotes — we guide you through coverage options, explain available discounts, and provide insurer reliability insights, all without triggering a flood of third-party contact. Our goal is to make car insurance comparisons smarter, not harder.

LendingTree vs. NerdWallet

NerdWallet scores well on Google Play and PCMag, showing that users trust its financial tools and find the platform easy to use. However, when it comes to insurance specifically, its 3.7 TrustPilot rating suggests some users are looking for more detailed coverage comparisons and clearer insurer information.

LendingTree vs. NerdWallet: Third-Party Customer Ratings

| Review Platform | ||

|---|---|---|

| 4.8 / 5 37k+ reviews | 4.8 / 5 115k+ reviews |

|

| A+ | A+ | |

| 4.3 / 5 9k+ reviews | 4.5 / 5 29.9k reviews |

|

| 3.3 / 5 | 4 / 5 | |

| 4.2 / 5 14k+ reviews | 3.7 / 5 3k+ reviews |

LendingTree, on the other hand, gets solid app ratings—4.8 on the App Store and 4.3 on Google Play—which shows it’s easy to use and runs smoothly. That said, some users say the follow-up calls can get overwhelming, and the process after getting quotes isn’t always clear.

LendingTree reviews complaints on BBB often echo these concerns, mentioning aggressive outreach and uncertainty about which insurer is actually handling the policy.

Those kinds of details matter. A high app score is great, but it doesn’t always mean the full experience meets expectations. If you’re looking for more insight into NerdWallet’s features, the NerdWallet auto insurance review offers a closer look at how their quote process compares.

LendingTree vs. Insurify

If you’re deciding which platform to use, our Insurify insurance review offers a closer look at how its quoting process compares to others. Here’s how Insurify stacks up against LendingTree:

LendingTree vs. Insurify: Third-Party Customer Ratings

| Review Platform | ||

|---|---|---|

| 4.8 / 5 37k+ reviews | 3.4 / 5 141 reviews |

|

| A+ | A+ | |

| 4.3 / 5 9k+ reviews | 3.8 / 5 130+ reviews |

|

| 3.3 / 5 | 3.4 / 5 141 reviews |

|

| 4.2 / 5 14k+ reviews | NA |

Looking at mobile app ratings helps paint a picture of the user experience. LendingTree scores a solid 4.8 on the App Store and 4.3 on Google Play, which reflects how fast, clean, and easy the app is to use. It delivers quotes in just a few minutes and doesn’t require users to log in, which makes the process feel quick and low-pressure.

But while the app itself runs smoothly, some users say the experience shifts once they submit their info—often feeling like they’re passed along without much support or clarity. Insurify, on the other hand, holds a 3.4 rating on both app stores, suggesting the app interface may not be as polished.

Still, a lot of users say the process feels easier to navigate and way less pushy, especially after they’ve submitted a quote. That kind of transparency really matters if you want more control and fewer surprises along the way.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

LendingTree’s Corporate Structure and Acquisitions

LendingTree, LLC is fully owned by LendingTree, Inc., and has grown its reach by acquiring key companies along the way. It functions as a centralized online lending marketplace, helping users connect with multiple loan and insurance providers and easily compare online auto insurance companies through its network.

LendingTree Platform Overview

| Details | |

|---|---|

| Real-Time Quotes | Yes, for auto insurance |

| Average Quote Time | 3-10 minutes |

| Insurance Types Compared | Auto, home, renters, life. |

| Providers Compared | 25+ insurance companies. |

| Shares Contact Info | Yes; may share with partners |

| Customer Support | Online comparison tools, phone support available |

| Platform Focus | Loans, credit cards, mortgages, insurance |

In 2018, the company acquired QuoteWizard, an online insurance marketplace founded by Scott Peyree, and in 2017, it added MagnifyMoney to its portfolio—a financial comparison platform based in New York.

LendingTree Customer support is available by phone at 1-704-541-5351 or by emailing [email protected] for questions about services or product offerings.

AutoInsurance.org Delivers Real Rates Without the Hassle

When comparing insurance platforms, it’s not just about how fast you get quotes—it’s about how useful those quotes are. LendingTree is great for speed but often falls short in terms of transparency, insurer details, and post-quote experience. If you’ve ever felt overwhelmed by follow-up calls or unsure which provider is the best fit, you’re not alone.

That’s where AutoInsurance.org does things differently. It connects you with over 60 top-rated insurers, delivers quotes in under two minutes, and gives you 25% more coverage options per request. Enter your ZIP code now to get started.

Drivers using the platform report saving up to 40% more and an average of $540 per year on full coverage.

With a 98% satisfaction rate, it’s trusted by people who want more clarity and control during the process. If you’re wondering where to compare auto insurance rates without the hassle, this is a platform built to make the process easier. You can compare accurate monthly rates, see insurer quality, and feel confident without getting bombarded by third-party sales calls.

Get Fast and Secure Insurance Quotes With LendingTree

Our LendingTree review found that it’s a fast and easy tool for checking rates from more than 40 insurers in just a few minutes. One big plus is you can get real-time quotes without needing to create an account. The downside is you’ll likely get follow-up calls or emails from third-party partners after entering your info.

It’s a solid choice for drivers who want quick comparisons and aren’t ready to commit to one provider right away. What really stands out is its 4.8 out of 5.0 rating from over 37,000 App Store users, showing people appreciate how fast and user-friendly the platform is.

To get the best deal from the best insurance companies, it’s always smart to compare multiple insurance companies online and get real-time quotes from top companies before making a decision.

Ready to find a better deal on auto insurance? AutoInsurance.org connects you with over 60 top-rated insurers and delivers fast, real-time quotes in under two minutes. With more coverage options per request and higher average savings, it’s a smarter way to compare. Enter your ZIP code to get started.

Frequently Asked Questions

What is LendingTree?

LendingTree, Inc. is an online marketplace that allows you to compare real-time quotations from more than 40 lenders and insurers in less than three minutes.

Which platform is better for saving money between, LendingTree vs. AutoInsurance.org?

AutoInsurance.org is better for saving money, helping users save an average of $540 per year with 40% more in savings and 25% more coverage options per request. It also connects you with over 60 top-rated insurers and avoids excessive follow-up.

How trustworthy is LendingTree?

LendingTree, LLC is BBB-accredited, protects your personal data with SHA-256 encryption, and has a 4.8 out of 5.0 App Store rating from 37,000+ users, showing strong consumer trust (Read More: How to Check if an Auto Insurance Company is Legitimate).

Is LendingTree insurance any good?

Yes, LendingTree insurance is effective for comparing auto, home, and renters policies, offering ZIP-based filters and coverage options like liability auto insurance, collision coverage, or bundled packages.

Does a LendingTree loan hurt your credit?

Using LendingTree to check rates triggers only a soft credit pull, so your credit score won’t be affected unless you move forward with a lender and formally apply.

What credit score do you need for LendingTree?

LendingTree doesn’t require a minimum credit score. It matches you with lenders offering insurance or loans tailored to various credit levels, from excellent to fair or rebuilding.

Is LendingTree a good loan company?

LendingTree isn’t a direct lender, but it connects you to trusted partners, including BBB-accredited lenders, so you can get multiple auto insurance quotes, compare monthly payments, and pick a loan or policy that fits your budget.

How fast does LendingTree deposit money?

While LendingTree doesn’t issue loans directly, most partner lenders can fund approved loans as fast as the next business day, depending on their process and your bank.

How does LendingTree work?

LendingTree lets you compare real-time quotes from over 40 insurers in under 3 minutes using your ZIP code, vehicle details, and coverage type without needing to create an account.

Is LendingTree a spammy site?

Not exactly, but many users report receiving frequent calls or emails from third-party insurance partners after submitting their information, especially if they request multiple companies to evaluate auto insurance quotes and compare coverage options.

Is LendingTree free?

Is LendingTree a scam?

What can you learn from LendingTree reviews for auto loans?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.