Wawanesa Auto Insurance Review (2026)

Wawanesa auto insurance is cheap for many good drivers, but the company has received a lot of customer complaints.

Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Insurance and Finance Writer

Luke Williams is a finance, insurance, real estate, and home improvement expert based in Philadelphia, Pennsylvania, specializing in writing and researching for consumers. He studied finance, economics, and communications at Pennsylvania State University and graduated with a degree in Corporate Communications. His insurance and finance writing has been featured on Spoxor, The Good Men Project...

Luke Williams

Licensed Insurance Producer

Dani Best has been a licensed insurance producer for nearly 10 years. Dani began her insurance career in a sales role with State Farm in 2014. During her time in sales, she graduated with her Bachelors in Psychology from Capella University and is currently earning her Masters in Marriage and Family Therapy. Since 2014, Dani has held and maintains licenses in Life, Disability, Property, and Casualt...

Dani Best

Updated December 2024

If you’re searching for the best car insurance companies in California or Oregon, you may want to consider Wawanesa auto insurance. Wawanesa offers competitive car insurance rates to people with good driving records.

Unfortunately, Wawanesa coverage is only available in California and Oregon. If you live elsewhere, you’ll have to purchase auto insurance with another provider. Additionally, Wawanesa has received a significant number of customer complaints over the past few years.

What You Should Know About Wawanesa Insurance

Wawanesa has an A (Excellent) financial strength rating with A.M. Best. The company also has an A+ rating from the Better Business Bureau.

Unfortunately, Wawanesa auto insurance reviews from customers cite issues with customer service and the overall claims process. According to the National Association of Insurance Commissioners (NAIC), Wawanesa received more than the expected number of complaints from customers over the past three years.

If you’re considering purchasing a policy with Wawanesa, you may want to read customer reviews online to learn more about what past and present customers think of the company.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Wawanesa Insurance Coverage Options

Wawanesa offers the following coverage options to its policyholders:

- Bodily injury liability

- Property damage liability

- Comprehensive coverage

- Collision coverage

- Personal injury protection (Oregon only)

- Medical payments (California only)

- Uninsured motorist bodily injury

- Uninsured motorist property damage

- Uninsured motorist collision waiver (California only)

- Underinsured motorist bodily injury (California only)

- Vehicle manufacturer replacement parts

- Special vehicle equipment coverage

- Roadside assistance

- Car rental coverage

You can purchase a full coverage policy with Wawanesa, including collision and comprehensive coverages. Additionally, the company offers add-on options, such as roadside assistance and special equipment coverage, to help you customize your policy.

Wawanesa Insurance Rates Breakdown

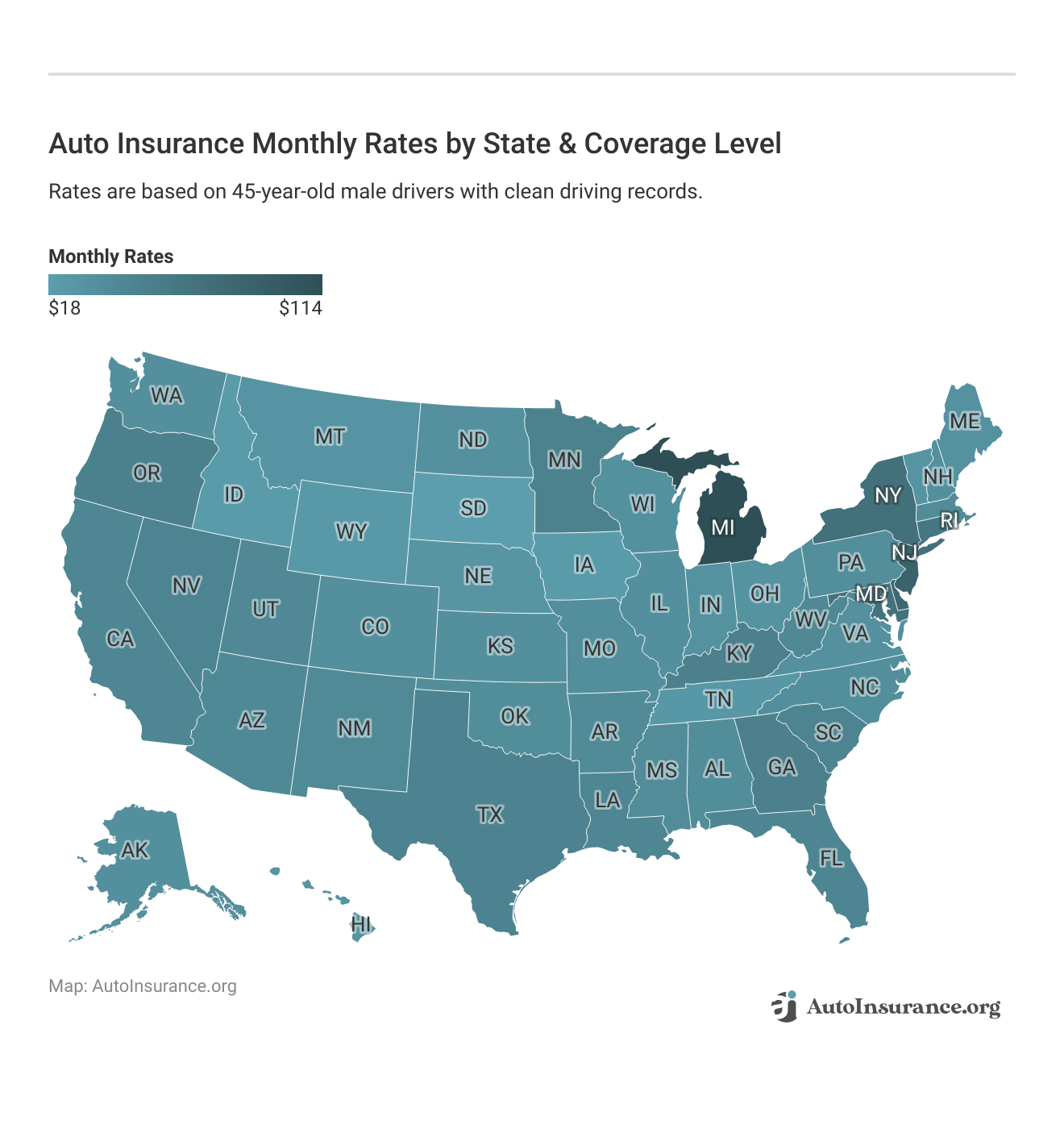

The average cost of a full coverage policy with Wawanesa is $1,599 annually, which is lower than the national average of $1,674 annually.

Liability-only coverage with Wawanesa costs around $652 annually, which is nearly $100 more than the national average.

You can get a Wawanesa car insurance quote online or over the phone to better understand how much you would pay for coverage. Your driving record and other factors will impact your insurance premiums.

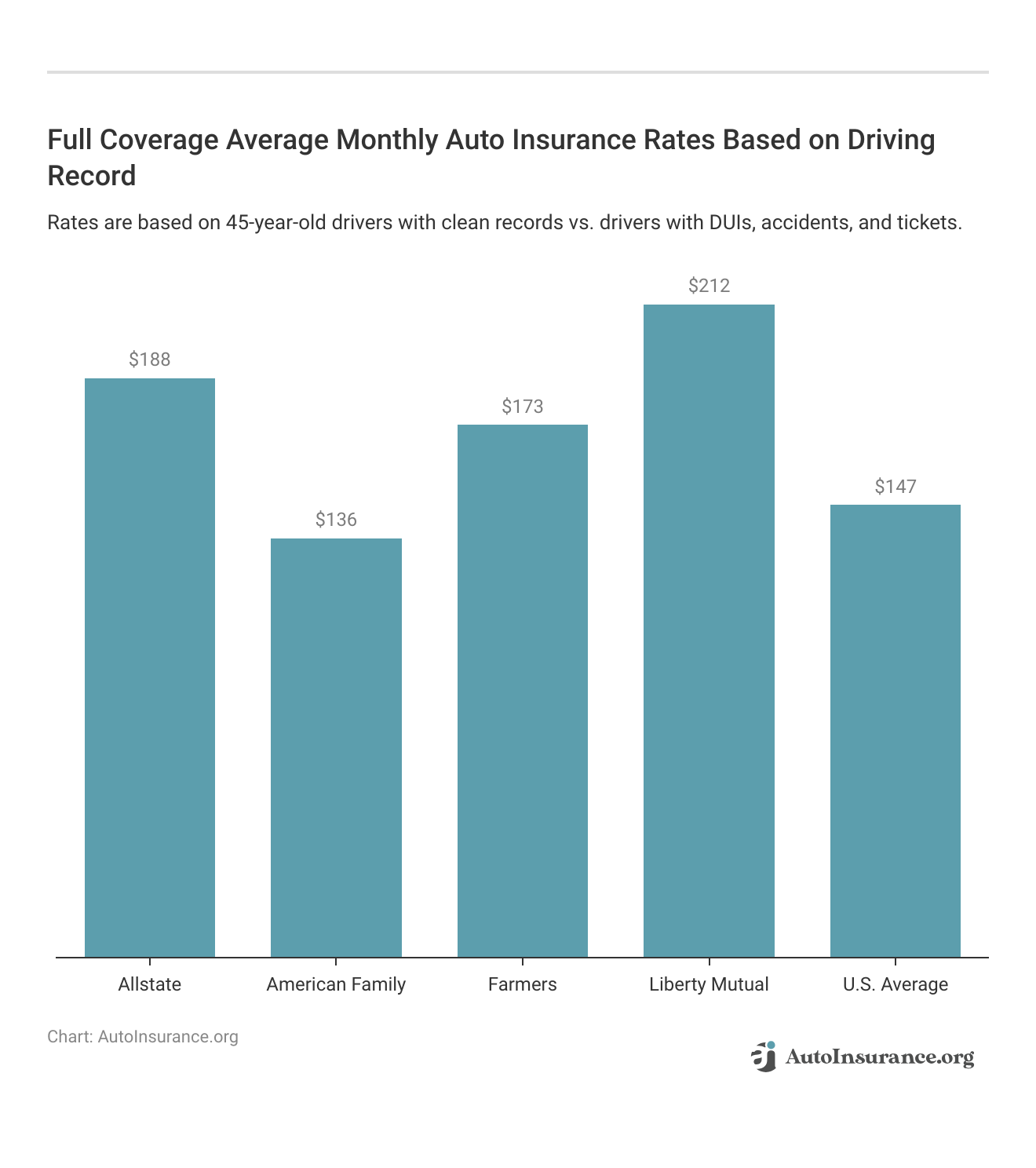

How does your driving record affect your rates?

As you might have expected, speeding tickets will increase your insurance rates.

Drivers may see an even larger rate increase after a car accident. See how the top insurance companies raise rates after an accident.

Drivers will see the largest increase in rates if they receive a DUI while driving under the influence. We’ve put together a list of companies that offer DUI insurance and what each charge.

You can get an idea of how much that will be by looking at the table below.

You can see why it pays to keep a clean driving record.

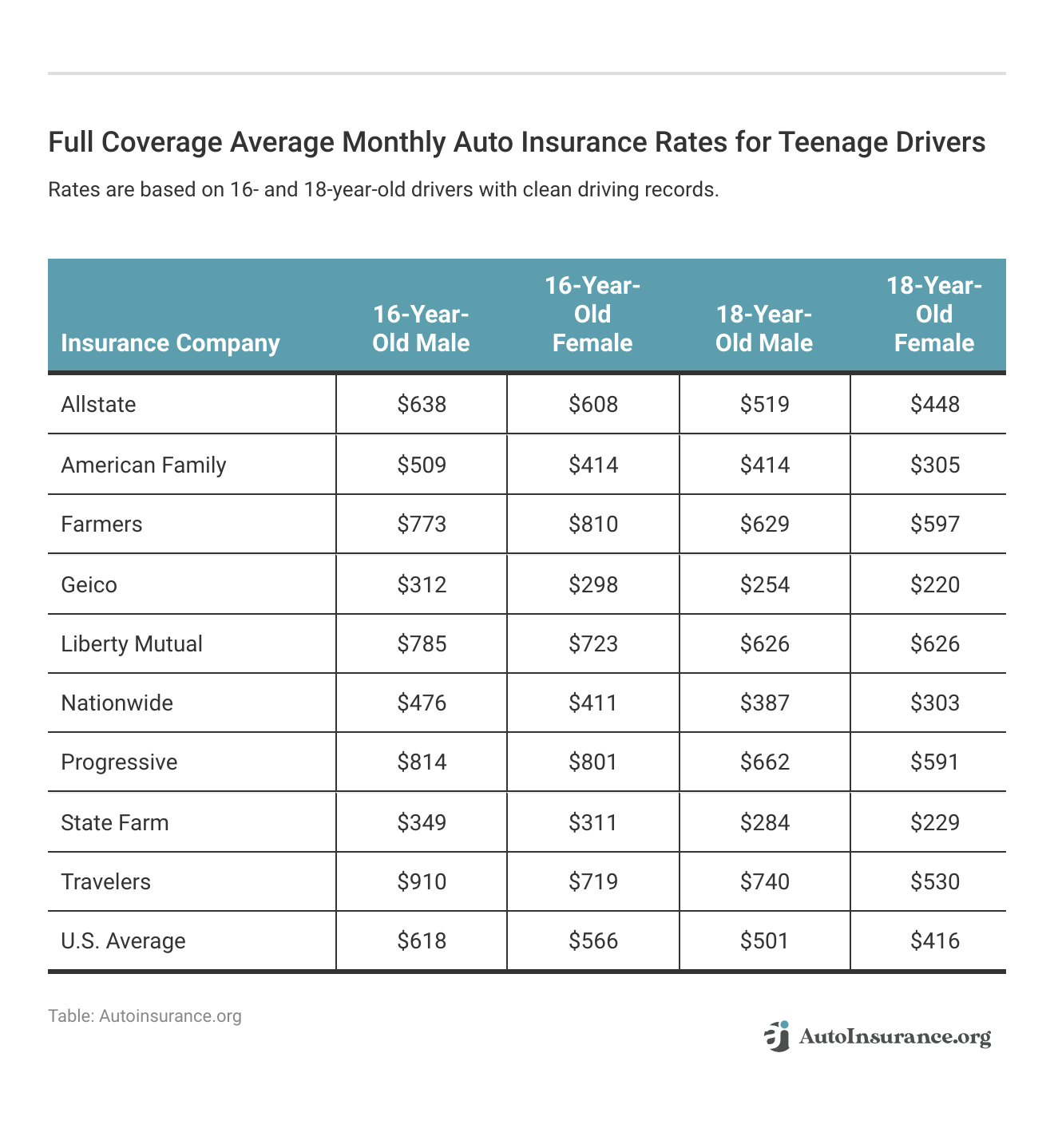

How does your age and credit score affect your car insurance rates?

Your age plays a significant factor in how much you pay for car insurance. A teenage driver is going to see higher rates because they’re new to the road and have very little experience.

You will see your rates begin to decrease when you turn 25 as long as you keep a clean driving record.

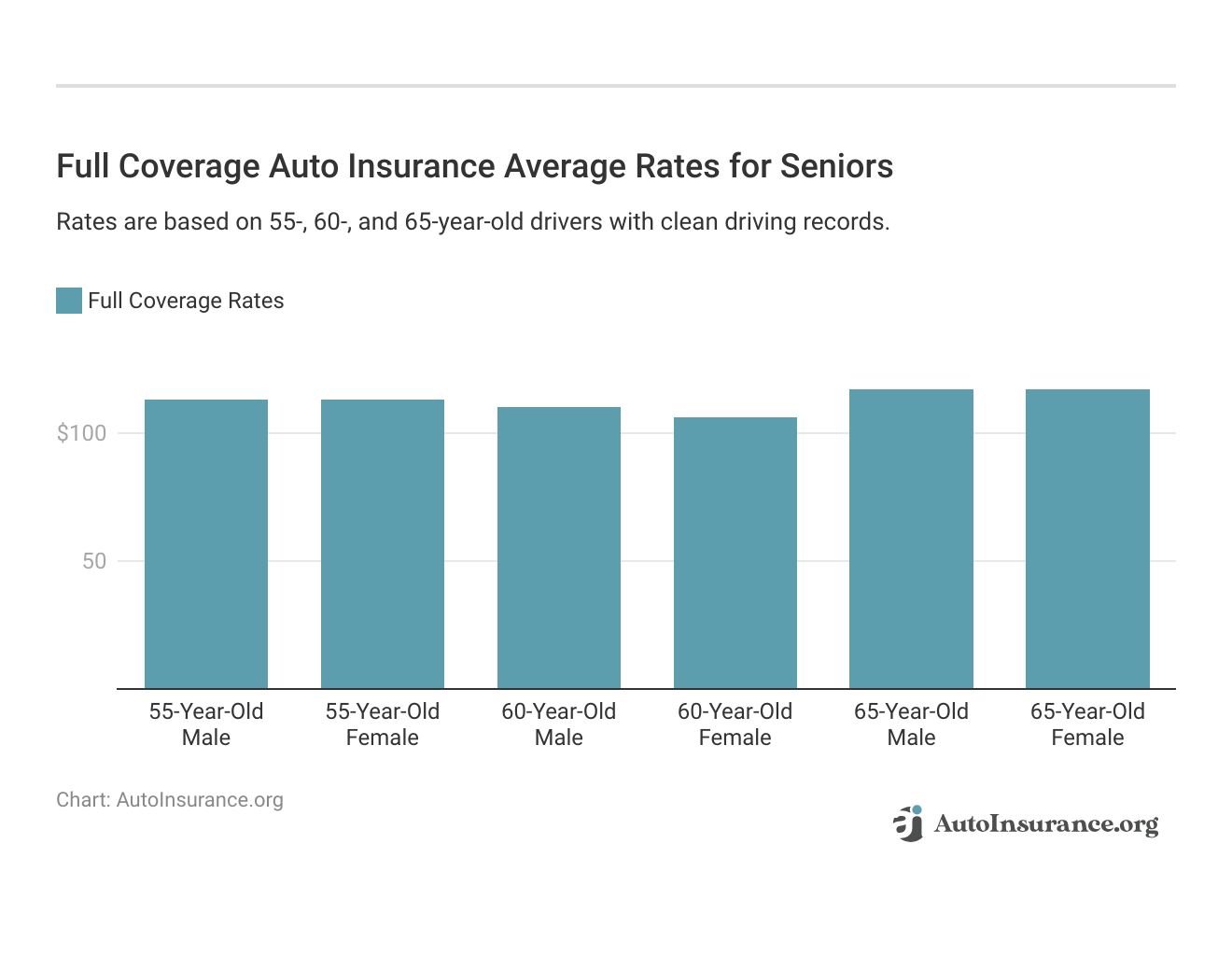

Once drivers turn 65 years old and are determined to be seniors, they can expect the rates to increase again.

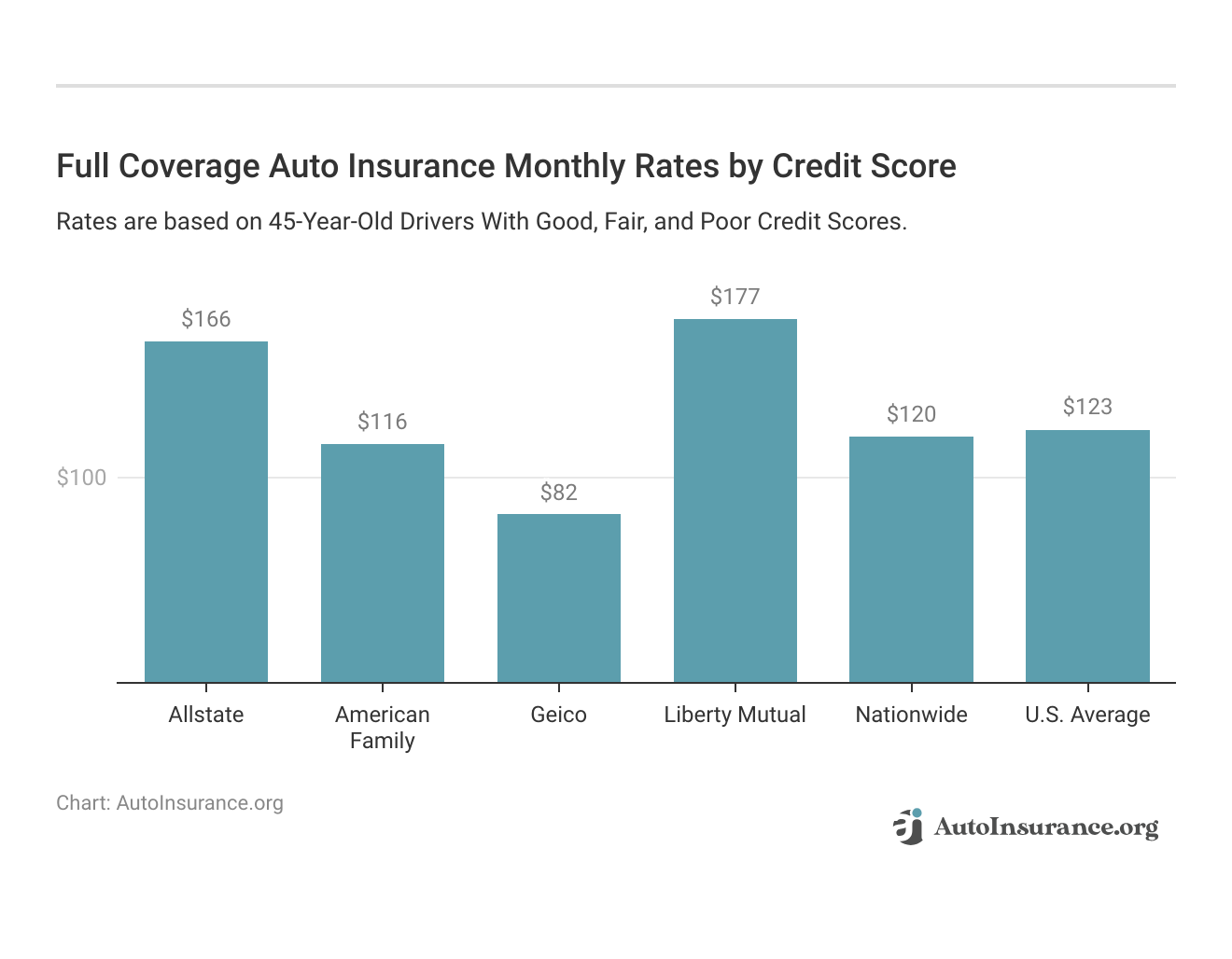

Your credit score can also impart your car insurance rates. Not all insurance companies look at credit scores but the ones that do see drivers with poor credit to be high risk. Take a look at how your rates fluctuate depending on your credit score.

With so many factors influencing your insurance rates, it is always recommended that you get at least three quotes from three different insurance companies before making your decision.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Wawanesa Insurance Discounts Available

California drivers can apply for the following six auto insurance discounts with Wawanesa:

- Good driver

- Multi-car

- Loyalty

- Multi-policy

- Mature driver course

- Affinity groups

If you live in Oregon, Wawanesa offers even more discounts:

- Driver training

- Insurance score

- Mature driver course

- Multi-car

- Vehicle recovery system

- Automatic payments

- Loyalty

- Military

- Multi-policy

- Continuous insurance

Discounts can help you save a significant amount on your car insurance coverage. If you believe you may qualify for one or more discounts in your state, check with a Wawanesa representative to see how much you could save.

Frequently Asked Questions

How can I get a car insurance quote from Wawanesa?

Wawanesa offers quotes over the phone or via the company website.

Where does Wawanesa offer coverage?

Wawanesa only sells insurance products in California and Oregon.

How can I file a claim with Wawanesa?

You can submit a claim with Wawanesa over the phone or on the company website.

Can I customize my coverage with Wawanesa Insurance?

Yes, Wawanesa Insurance allows policyholders to customize their coverage. In addition to standard coverage options, they offer additional features like roadside assistance, special equipment coverage, and car rental coverage. You can work with a Wawanesa representative to tailor your policy to your specific needs.

Does Wawanesa Insurance offer roadside assistance?

Yes, Wawanesa Insurance offers roadside assistance as an optional coverage. This service can provide assistance for common roadside issues like flat tires, dead batteries, and towing.

How does a driving record affect insurance rates with Wawanesa?

Your driving record plays a significant role in determining your insurance rates with Wawanesa. Traffic violations, accidents, or a DUI can result in higher rates. Maintaining a clean driving record can help keep your premiums lower.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.