Progressive Auto Insurance Review for 2026 (Insider Report on Rates & Discounts)

Our Progressive auto insurance review found that rates start at an average of $56 per month, which is lower than many other companies. Aside from being affordable, Progressive also gets solid reviews. For example, the A.M. Best rating for Progressive is an A+, meaning the company is financially sound.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Insurance and Finance Writer

Merriya Valleri is a skilled insurance writer with over a decade of professional writing experience. Merriya has a strong desire to make understanding insurance an easy task while providing readers with accurate and up-to-date information. Merriya has written articles focusing on health, life, and auto insurance. She enjoys working in the insurance field, and is constantly learning in order to ...

Merriya Valleri

Licensed Insurance Agent

Jeff is a well-known speaker and expert in insurance and financial planning. He has spoken at top insurance conferences around the U.S., including the InsuranceNewsNet Super Conference, the 8% Nation Insurance Wealth Conference, and the Digital Life Insurance Agent Mastermind. He has been featured and quoted in Nerdwallet, Bloomberg, Forbes, U.S. News & Money, USA Today, and other leading fina...

Jeff Root

Updated July 2025

Our Progressive auto insurance review finds that Progressive is a great choice for drivers who want affordable coverage and a modern experience.

Progressive Auto Insurance Rating

| Rating Criteria | |

|---|---|

| Overall Score | 4.4 |

| Business Reviews | 4.0 |

| Claim Processing | 3.5 |

| Company Reputation | 4.5 |

| Coverage Availability | 5.0 |

| Coverage Value | 4.2 |

| Customer Satisfaction | 4.1 |

| Digital Experience | 4.5 |

| Discounts Available | 5.0 |

| Insurance Cost | 4.3 |

| Plan Personalization | 4.5 |

| Policy Options | 5.0 |

| Savings Potential | 4.5 |

Progressive’s strong set of digital tools makes learning how to manage your auto insurance policy easier than ever. With its long list of discounts and UBI program Snapshot, it’s also easy to find cheap Progressive rates.

However, some customers complain about Progressive’s customer service. In fact, Progressive struggles to retain policyholders and has low rates of customer loyalty.

- Progressive offers robust digital tools for a modern insurance experience

- While it earns high ratings, Progressive struggles with customer loyalty

- Progressive offers many discounts, including the UBI program Snapshot

Despite some hiccups with the customer service experience, Progressive is an excellent choice for auto insurance. Explore your coverage options in our Progressive auto insurance review below. Then, enter your ZIP code into our free comparison tool to compare Progressive with other companies.

Progressive Auto Insurance Rates Breakdown

In general, Progressive rates are mid-level compared to other companies. However, the rates you might see from Progressive depend on various factors.

Several factors affect your car insurance rates. Insurance companies look at your location, age, gender, driving history, and car’s make and model to set rates. Then, companies use unique formulas to determine what you’ll pay for insurance.

The difference in formulas is why comparing companies is vital — you might see much higher rates at one company than at another.

Progressive offers affordable rates for older people and drivers with a DUI. Teens will probably see much higher rates than other companies. However, the only way to see what a Progressive auto quote might look like for you is to request one. Luckily, it’s quite easy to get a quote from Progressive — simply visit the Progressive website and fill out the request form.

Getting a quote from Progressive is simple enough, but you should always compare quotes with multiple companies before you sign up for a policy. If you don’t want to take the time to get individual quotes, you can use a free quote-generating tool to look at multiple companies at once.

Progressive Auto Insurance Rates by Coverage

Although many factors affect your insurance, one of the biggest is how much insurance you want to buy. For example, the cheapest rates you can find come with your state’s minimum auto insurance requirements. Alternatively, you can buy full coverage to ensure your car is always protected, but you’ll see much higher rates.

There is a significant difference between minimum and full coverage, but Progressive tends to do well with both. It doesn’t offer the lowest prices, but rates are affordable. Choosing how much insurance you need is vital in shopping for coverage.

Minimum coverage is a good option for people on a tight budget with older cars they can afford to replace.

On the other hand, full coverage is usually required when you have a car lease or loan. In general, a Progressive full coverage policy is a good idea for any driver, as long as it’s within your budget. Car insurance can be confusing, but there’s no need to stress — an insurance representative will help you determine how much coverage you need when you sign up for a policy.

Progressive Auto Insurance Rates for Teens

Age is one of the most significant factors affecting your car insurance rates. Auto insurance costs more for young drivers because they’re more likely to engage in risky driving behaviors. because they’re more likely to engage in risky driving behaviors.

Age is one of the most significant factors affecting your car insurance rates. Auto insurance costs more for young drivers because they’re more likely to engage in risky driving behaviors.

Progressive doesn’t usually offer the best auto insurance for teens, but it’s not the most expensive choice, either. Check below to see how much you might pay at Progressive.

Progressive Auto Insurance Monthly Rates for Teens

| Age & Gender | Minimum Coverage | Full Coverage |

|---|---|---|

| Female Age 16 | $439 | $1,143 |

| Male Age 16 | $467 | $1,161 |

| Female Age 18 | $399 | $943 |

| Male Age 18 | $423 | $957 |

Insurance for teens may be expensive, but your rates won’t stay high forever. As long as you keep your driving record clean, your rates will significantly reduce by the age of 25.

Progressive Auto Insurance for Seniors

Most senior drivers won’t see their rates significantly increase until they’re at least 65. Even then, you won’t pay rates nearly as high as teens. That’s especially true at Progressive, which is one of the best auto insurance companies for seniors.

Take a look below to see how much Progressive charges senior drivers.

Progressive Auto Insurance Monthly Rates for Seniors

| Age & Gender | Minimum Coverage | Full Coverage |

|---|---|---|

| Female Age 55 | $56 | $151 |

| Male Age 55 | $52 | $142 |

| Female Age 65 | $58 | $156 |

| Male Age 65 | $55 | $147 |

| Female Age 75 | $59 | $154 |

| Male Age 75 | $57 | $148 |

Senior drivers can also lower their insurance bills by taking advantage of Progressive’s Snapshot program, which offers savings for safe driving habits.

Progressive Auto Insurance Rates by Driving Record

Your driving record is one of the most important factors that determine how much you’ll pay for insurance. Accidents and traffic violations have a significant impact on your premiums. For example, a driver with a DUI can pay up to 3 times as much for coverage as a person with a clean record.

Fortunately, Progressive is an affordable option for drivers with a less-than-perfect driving record. Compare Progressive’s rates based on different driving records below.

Progressive Auto Insurance Monthly Rates by Driving Record

| Driving Record | Minimum Coverage | Full Coverage |

|---|---|---|

| Clean Record | $56 | $150 |

| One Accident | $98 | $265 |

| One DUI | $75 | $200 |

| One Ticket | $74 | $199 |

With its low rates, Progressive is one of the best companies for cheap auto insurance after a DUI, and drivers with speeding tickets or at-fault accidents also find low rates. You can also lower your monthly premium by signing up for Snapshot.

Progressive Rates for Drivers With Poor Credit

Many drivers don’t realize how credit scores affect auto insurance rates. Some states don’t allow insurance companies to factor credit checks, but most do. Consequently, car insurance will cost more with a low credit score.

Progressive Auto Insurance Monthly Rates by Credit Score

| Score | Rates |

|---|---|

| Good Credit | $136 |

| Fair Credit | $150 |

| Bad Credit | $190 |

As you can see, Progressive runs a little higher for drivers with lower credit scores. However, the difference is negligible enough that other factors might make your overall rate more appealing. You can also lower your rates by increasing your credit score.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

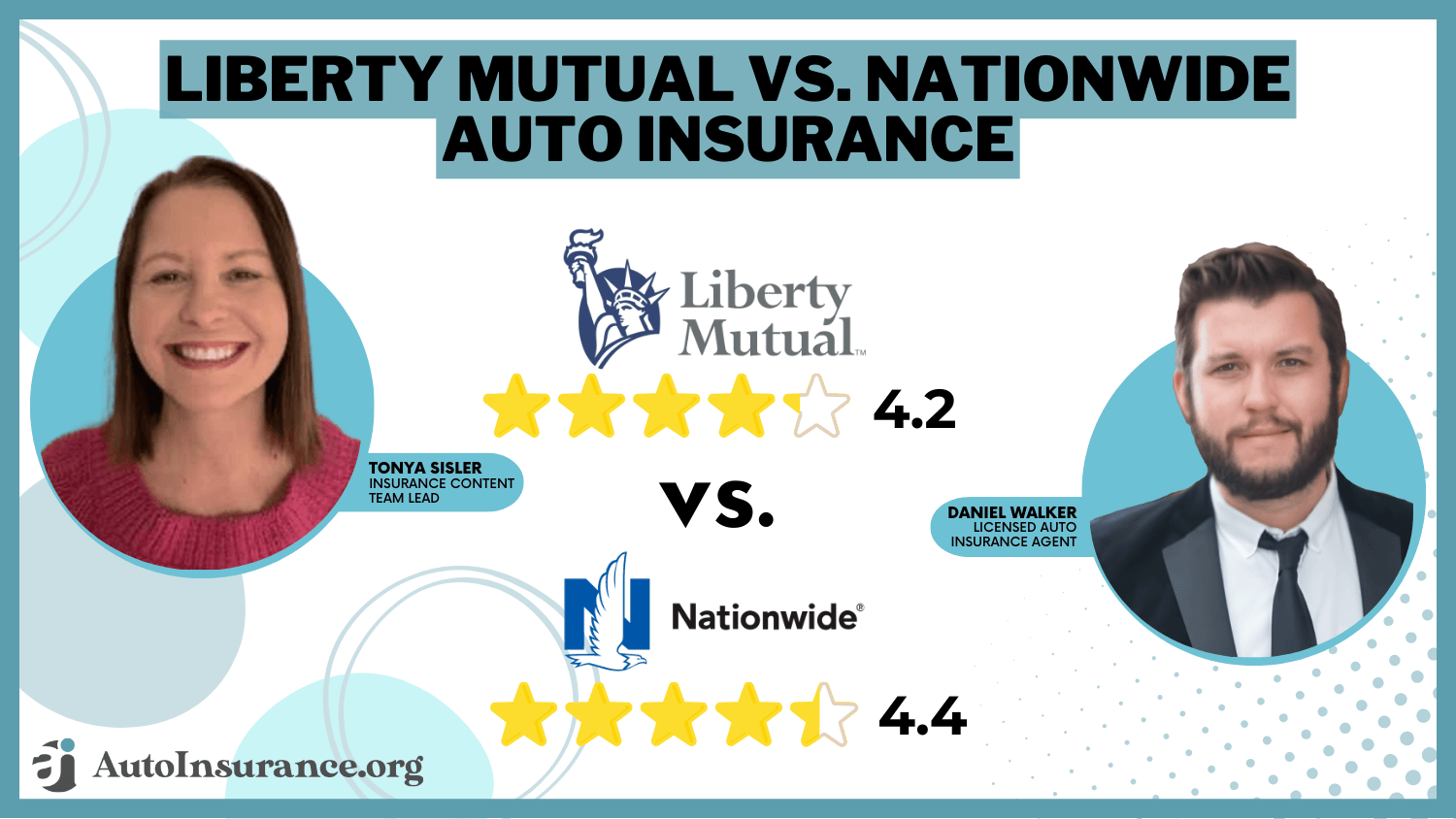

Compare Progressive Auto Insurance With Top Competitors

When it comes to its competitors, Progressive auto insurance rates are not bad. It’s not the cheapest auto insurance company on the block, but it’s not the most expensive either. Progressive’s average annual rates for an adult with a clean driving record are about mid-range when compared to the other top insurance companies in the U.S.

Comparing quotes is vital in getting the best insurance possible. Check below to see how Progressive competitors compare for auto insurance rates.

Progressive vs. Top Competitors: Auto Insurance Monthly Rates

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $87 | $228 | |

| $62 | $166 |

| $76 | $198 | |

| $43 | $114 | |

| $96 | $248 |

| $63 | $164 | |

| $56 | $150 | |

| $47 | $123 | |

| $53 | $141 | |

| U.S. Average | $61 | $165 |

As you can see, Progressive isn’t always the cheapest option. However, many drivers find that Progressive is the best choice for them because of its unique blend of discounts, Snapshot, and modernized policy management options.

Progressive Auto Insurance Options

Like most major companies, Progressive offers everything you need for a full coverage policy or a plan that meets the minimum requirements in your state. This includes:

- Liability Insurance: Liability coverage protects you from paying for damage you cause to people or property in an accident, but doesn’t cover your vehicle. Progressive offers some of the cheapest liability auto insurance.

- Comprehensive Insurance: To cover damage outside of accidents, you’ll need comprehensive auto insurance. Progressive comprehensive car insurance covers theft, vandalism, animal contact, fire, and weather damage.

- Collision Insurance: Collision coverage pays for repairs to your car after an accident, even if you’re the driver at fault. Progressive’s collision auto insurance pays for vet bills if your pet is injured in an accident.

- Uninsured/Underinsured Motorist: While most states require liability insurance, not all drivers follow the law. Uninsured/underinsured motorist coverage protects you from drivers with inadequate or no insurance.

- Personal Injury Protection/Medical Payments: Depending on the state you live in, you can buy either personal injury protection (PIP) insurance or Medical Payments. Both cover medical expenses after an accident.

The amount of insurance you’ll need depends on a variety of factors, like where you live and what type of car you drive.

Older, less valuable cars that you own outright probably only need minimum coverage. Minimum insurance policy requirements depend on the state you live in, but typically include at least liability coverage.Heidi Mertlich Licensed Insurance Agent

One more thing to keep in mind is that your insurance premiums are directly tied to how much coverage you want. The most coverage you buy, the higher your rates will be.

Progressive Auto Insurance Add-Ons

Aside from basic car coverage, there are plenty of optional insurance you can add to your Progressive auto insurance policy. When you buy car insurance from Progressive, you can add the following coverages:

- Custom Parts and Equipment Coverage: Standard insurance doesn’t pay for parts you add to your car, including stereos, paint jobs, or navigation systems. Progressive offers some of the best auto insurance for custom cars on the market.

- Gap Insurance: Also called loan/lease payoff, gap insurance pays the difference between what you owe on your loan and what your car is actually worth if you total your vehicle.

- Roadside Assistance: Progressive is one of the best auto insurance companies for roadside assistance because it offers help when you’re stranded with a flat tire, dead battery, or you need a tow.

- Rental Car Reimbursement: If your car is awaiting repairs after an accident, Progressive will cover your rental car. Rental car reimbursement usually offers between $40 and $60 a day for coverage.

- Rideshare Insurance: Drivers who work for rideshare companies can add this to their policies for better protection while working. The best rideshare auto insurance ensures you’re always covered.

According to Progressive auto insurance reviews, you’ll need to check with a representative to see which add-ons are available in your area. While the add-ons listed above are generally available everywhere, that’s not always the case.

Other Progressive Insurance Policies

Progressive might struggle with some customer complaints, but there’s no denying it offers a great selection of insurance. You can bundle your auto insurance with the following products:

- Boat and other personal watercrafts

- Classic car

- ATV/UTV, snowmobile, and motorcycle

- Homeowners, condos, or renters, and flood insurance

- RV/Trailer

Progressive quotes for these products are as easy as car insurance quotes. You can also earn a discount on both when you buy another policy from Progressive, and you can manage your coverages easily online.

Progressive Auto Insurance Discounts

According to Progressive auto reviews, there are plenty of auto insurance discounts to help you save. Take a look below to see how much you can save through Progressive’s discounts.

Progressive Auto Insurance Discounts

| Discount Name | Savings Potential | Description |

|---|---|---|

| Automatic Payments Discount | 5% | Save by setting up automatic payments |

| Bundling Discount | 12% | Bundle auto with home or renters insurance |

| Continuous Coverage Discount | 15% | Get a discount for maintaining coverage |

| Good Student Discount | 10% | Available for students with good grades |

| Homeowners Discount | 10% | Discount for owning a home |

| Multi-Car Discount | 25% | Save when insuring more than one vehicle |

| Online Quote Discount | 7% | Discount for getting a quote online |

| Paperless Discount | 3% | Go paperless and save on your premium |

| Paid-in-Full Discount | 10% | Pay your policy in full to receive savings |

| Sign Online Discount | 8% | Sign your policy documents online |

| Student Away From Home Discount | 7% | For students who live far from home |

| Teen Driver Discount | 10% | Discount for adding a teen driver |

Most discounts apply to your account automatically, including discounts for being a loyal customer and having a teen driver. Others, like the Progressive good student discount, require that you submit proof.

Progressive Usage-Based Insurance

Getting cheap usage-based insurance (UBI) is a great way to earn additional savings, so long as you’re a safe driver. Most major insurance companies offer UBI, and Progressive is no different – it offers Snapshot.

Snapshot offers a maximum discount of 30% in return for tracking your driving habits. It compiles information on things like speeding, hard braking, the time of day you drive, and how many miles you put on your car.

Most UBI programs don’t raise your rates if your driving habits won’t earn you a discount. Snapshot is one of the few that does raise premiums.Eric Stauffer Licensed Insurance Agent

It’s not common for Snapshot to raise rates, but you should still seriously consider whether a UBI program is right for you before you sign up. To see if it’s right for you, check out our Progressive Snapshot review.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Progressive Auto Insurance Customer Reviews

Progressive car insurance reviews paint an overall positive image of the company. While there are certainly complaints made against it, Progressive’s affordable rates and strong digital tools make it a popular choice.

This ‘whistleblower’ isn’t much for protecting his identity, but he is for protecting your wallet with AutoQuote Explorer® from Progressive. pic.twitter.com/oBPAwpH6Ua

— Progressive (@progressive) July 19, 2024

While Progressive auto insurance ratings have plenty of positive customer reviews, some drivers are less than enthused. One common complaint is that Progressive rates seem to increase without cause after every renewal period, as you can see with this frustrated Reddit user.

While there are many factors causing insurance rates to increase, many Progressive policyholders share this Reddit user’s concerns.

A final point frequently discussed is the Progressive car insurance customer service experience. While most drivers agree that the mobile app is helpful, many find calling the Progressive auto insurance phone number for help difficult and irritating. Still, Progressive is good enough that it makes our list of auto insurance companies with the best customer service.

Progressive Auto Insurance Business Reviews

Whether you’re learning how to get auto insurance for the first time or have had coverage for 50 years, looking at business reviews is always a good place to start your search for a policy.

Check below to see how third-party rating companies review Progressive.

Progressive Insurance Business Ratings & Consumer Reviews

| Agency | |

|---|---|

| Score: 832 / 1,000 Avg. Satisfaction |

|

| Score: A+ Excellent Financial Strength |

|

| Score: 1.11 More Complaints Than Avg. |

|

| Score: 72/100 Avg. Customer Feedback |

|

| Score: A+ Superior Financial Strength |

These ratings contain helpful information for potential policyholders. For example, the A.M. Best rating for Progressive is an A+, which means you won’t have to worry about your claims being paid.

Progressive Auto Insurance Pros and Cons

You’ve seen throughout this review that Progressive has its positives and negatives, like any other company. However, it can be helpful to have a quick list to compare when you’re shopping for coverage. When you shop at Progressive, you get access to the following pros:

- Snapshot and Other Discounts: Progressive makes it easy to save with its generous discounts, including the UBI program Snapshot.

- Affordable Rates: Whether you look at insurance rates by car model at Progressive or need cheap high-risk auto insurance, Progressive is usually an affordable choice.

- Modern Insurance Experience: With a focus on modernized service, drivers typically love Progressive’s innovative and easy-to-use digital tools.

On the other hand, Progressive has plenty to look out for. Before you sign up for a policy, consider the following drawbacks:

- Low Customer Loyalty: Progressive struggles to retain its customers, especially when it comes to its customer service satisfaction.

- Unexpected Rate Increases: Many customers report that their premiums increase unexpectedly, even though they hadn’t filed a claim.

If you’re looking for cheap car insurance that you can manage online and have access to plenty of add-ons, Progressive might be the right choice for you. However, if stellar customer service experiences are your primary requirement, you may want to look elsewhere.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

See if Progressive Auto Insurance is Right for You Today

Progressive is an excellent choice for drivers with less-than-perfect driving records or who want to manage their policy entirely online. You’ll also find ample discount opportunities and excellent add-ons at Progressive, which make crafting the perfect policy easy.

While Progressive is an excellent insurance company, you should always compare rates. Learning how to evaluate auto insurance quotes is a crucial step in finding affordable coverage. Enter your ZIP code into our free comparison tool below to see auto insurance rates in your area.

Frequently Asked Questions

Who should buy Progressive insurance?

Progressive is a solid choice for most drivers but is especially suited for high-risk drivers with a DUI on their record. Regardless of your situation, it’s worth getting a quote from Progressive. If you’re trying to figure out how to lower your auto insurance rates, a Progressive quote is a good place to start.

How do you get a quote from Progressive?

Getting a car insurance quote from Progressive is simple — you can get a quote on the mobile app, online, or by phone.

How do you pay for your insurance with Progressive?

There are six easy ways to make a Progressive insurance payment: through the app, online, by text, mail, automatic payments, or the Progressive car insurance phone number.

Can you cancel your Progressive car insurance online?

No, but learning how to cancel Progressive auto insurance is simple. You can cancel by speaking with a representative by phone, email, or mail.

Does Progressive cover rental cars?

While Progressive won’t pay for it, your personal insurance policy applies to any car you rent. So, for example, if you have collision and comprehensive insurance on your standard policy, you’ll have the same coverage on your rental car.

Additionally, you can buy rental reimbursement, and Progressive will cover up to $60 a day for a temporary vehicle.

Is Snapshot worth it?

It depends on how you drive. If you’re a safe, low-mileage driver, you might get a sizable discount on your insurance. However, if you drive late at night, spend a lot of time behind the wheel, or have unsafe driving habits, Snapshot might end up costing you instead.

How does Progressive compare to other companies?

Progressive is an average company compared to its competitors. Progressive’s rates are similar to the national average but might be cheaper for some drivers. Progressive auto insurance customer service falls behind, though.

Is Progressive insurance good?

Progressive is considered a good insurance company, particularly for drivers looking for affordable coverage and strong digital tools. However, it might not be the best choice for teens.

What factors can affect the cost of my auto insurance with Progressive?

Several factors can influence the cost of your auto insurance policy with Progressive. Common factors include your driving record, the type of vehicle you drive, your age and gender, your location, your credit history, and the coverage options you select.

Progressive utilizes its own rating system, so it’s best to contact Progressive Auto Insurance directly or obtain a quote to get accurate pricing based on your specific circumstances. If you’d prefer to compare quotes from multiple companies at once, enter your ZIP code into our free comparison tool today.

Is Geico better than Progressive?

Geico and Progressive are pretty evenly matched when it comes to overall quality, so it depends on the cost and type of coverage you’re looking for. For example, Geico is your best bet if getting the cheapest rate is your priority, while Progressive is better when it comes to discount programs and rates for high-risk drivers. Explore your options in our Geico auto insurance review.

What is Progressive Direct insurance?

Is Progressive Direct legit?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Is Progressive insurance reliable?

Progressive is a solid choice for most drivers but is especially suited for high-risk drivers with a DUI on their record. Regardless of your situation, it’s worth getting a quote from Progressive. If you’re trying to figure out how to lower your auto insurance rates, a Progressive quote is a good place to start.

Getting a car insurance quote from Progressive is simple — you can get a quote on the mobile app, online, or by phone.

How do you pay for your insurance with Progressive?

There are six easy ways to make a Progressive insurance payment: through the app, online, by text, mail, automatic payments, or the Progressive car insurance phone number.

Can you cancel your Progressive car insurance online?

No, but learning how to cancel Progressive auto insurance is simple. You can cancel by speaking with a representative by phone, email, or mail.

Does Progressive cover rental cars?

While Progressive won’t pay for it, your personal insurance policy applies to any car you rent. So, for example, if you have collision and comprehensive insurance on your standard policy, you’ll have the same coverage on your rental car.

Additionally, you can buy rental reimbursement, and Progressive will cover up to $60 a day for a temporary vehicle.

Is Snapshot worth it?

It depends on how you drive. If you’re a safe, low-mileage driver, you might get a sizable discount on your insurance. However, if you drive late at night, spend a lot of time behind the wheel, or have unsafe driving habits, Snapshot might end up costing you instead.

How does Progressive compare to other companies?

Progressive is an average company compared to its competitors. Progressive’s rates are similar to the national average but might be cheaper for some drivers. Progressive auto insurance customer service falls behind, though.

Is Progressive insurance good?

Progressive is considered a good insurance company, particularly for drivers looking for affordable coverage and strong digital tools. However, it might not be the best choice for teens.

What factors can affect the cost of my auto insurance with Progressive?

Several factors can influence the cost of your auto insurance policy with Progressive. Common factors include your driving record, the type of vehicle you drive, your age and gender, your location, your credit history, and the coverage options you select.

Progressive utilizes its own rating system, so it’s best to contact Progressive Auto Insurance directly or obtain a quote to get accurate pricing based on your specific circumstances. If you’d prefer to compare quotes from multiple companies at once, enter your ZIP code into our free comparison tool today.

Is Geico better than Progressive?

Geico and Progressive are pretty evenly matched when it comes to overall quality, so it depends on the cost and type of coverage you’re looking for. For example, Geico is your best bet if getting the cheapest rate is your priority, while Progressive is better when it comes to discount programs and rates for high-risk drivers. Explore your options in our Geico auto insurance review.

What is Progressive Direct insurance?

Is Progressive Direct legit?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Is Progressive insurance reliable?

There are six easy ways to make a Progressive insurance payment: through the app, online, by text, mail, automatic payments, or the Progressive car insurance phone number.

No, but learning how to cancel Progressive auto insurance is simple. You can cancel by speaking with a representative by phone, email, or mail.

Does Progressive cover rental cars?

While Progressive won’t pay for it, your personal insurance policy applies to any car you rent. So, for example, if you have collision and comprehensive insurance on your standard policy, you’ll have the same coverage on your rental car.

Additionally, you can buy rental reimbursement, and Progressive will cover up to $60 a day for a temporary vehicle.

Is Snapshot worth it?

It depends on how you drive. If you’re a safe, low-mileage driver, you might get a sizable discount on your insurance. However, if you drive late at night, spend a lot of time behind the wheel, or have unsafe driving habits, Snapshot might end up costing you instead.

How does Progressive compare to other companies?

Progressive is an average company compared to its competitors. Progressive’s rates are similar to the national average but might be cheaper for some drivers. Progressive auto insurance customer service falls behind, though.

Is Progressive insurance good?

Progressive is considered a good insurance company, particularly for drivers looking for affordable coverage and strong digital tools. However, it might not be the best choice for teens.

What factors can affect the cost of my auto insurance with Progressive?

Several factors can influence the cost of your auto insurance policy with Progressive. Common factors include your driving record, the type of vehicle you drive, your age and gender, your location, your credit history, and the coverage options you select.

Progressive utilizes its own rating system, so it’s best to contact Progressive Auto Insurance directly or obtain a quote to get accurate pricing based on your specific circumstances. If you’d prefer to compare quotes from multiple companies at once, enter your ZIP code into our free comparison tool today.

Is Geico better than Progressive?

Geico and Progressive are pretty evenly matched when it comes to overall quality, so it depends on the cost and type of coverage you’re looking for. For example, Geico is your best bet if getting the cheapest rate is your priority, while Progressive is better when it comes to discount programs and rates for high-risk drivers. Explore your options in our Geico auto insurance review.

What is Progressive Direct insurance?

Is Progressive Direct legit?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Is Progressive insurance reliable?

While Progressive won’t pay for it, your personal insurance policy applies to any car you rent. So, for example, if you have collision and comprehensive insurance on your standard policy, you’ll have the same coverage on your rental car.

Additionally, you can buy rental reimbursement, and Progressive will cover up to $60 a day for a temporary vehicle.

It depends on how you drive. If you’re a safe, low-mileage driver, you might get a sizable discount on your insurance. However, if you drive late at night, spend a lot of time behind the wheel, or have unsafe driving habits, Snapshot might end up costing you instead.

How does Progressive compare to other companies?

Progressive is an average company compared to its competitors. Progressive’s rates are similar to the national average but might be cheaper for some drivers. Progressive auto insurance customer service falls behind, though.

Is Progressive insurance good?

Progressive is considered a good insurance company, particularly for drivers looking for affordable coverage and strong digital tools. However, it might not be the best choice for teens.

What factors can affect the cost of my auto insurance with Progressive?

Several factors can influence the cost of your auto insurance policy with Progressive. Common factors include your driving record, the type of vehicle you drive, your age and gender, your location, your credit history, and the coverage options you select.

Progressive utilizes its own rating system, so it’s best to contact Progressive Auto Insurance directly or obtain a quote to get accurate pricing based on your specific circumstances. If you’d prefer to compare quotes from multiple companies at once, enter your ZIP code into our free comparison tool today.

Is Geico better than Progressive?

Geico and Progressive are pretty evenly matched when it comes to overall quality, so it depends on the cost and type of coverage you’re looking for. For example, Geico is your best bet if getting the cheapest rate is your priority, while Progressive is better when it comes to discount programs and rates for high-risk drivers. Explore your options in our Geico auto insurance review.

What is Progressive Direct insurance?

Is Progressive Direct legit?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Is Progressive insurance reliable?

Progressive is an average company compared to its competitors. Progressive’s rates are similar to the national average but might be cheaper for some drivers. Progressive auto insurance customer service falls behind, though.

Progressive is considered a good insurance company, particularly for drivers looking for affordable coverage and strong digital tools. However, it might not be the best choice for teens.

What factors can affect the cost of my auto insurance with Progressive?

Several factors can influence the cost of your auto insurance policy with Progressive. Common factors include your driving record, the type of vehicle you drive, your age and gender, your location, your credit history, and the coverage options you select.

Progressive utilizes its own rating system, so it’s best to contact Progressive Auto Insurance directly or obtain a quote to get accurate pricing based on your specific circumstances. If you’d prefer to compare quotes from multiple companies at once, enter your ZIP code into our free comparison tool today.

Is Geico better than Progressive?

Geico and Progressive are pretty evenly matched when it comes to overall quality, so it depends on the cost and type of coverage you’re looking for. For example, Geico is your best bet if getting the cheapest rate is your priority, while Progressive is better when it comes to discount programs and rates for high-risk drivers. Explore your options in our Geico auto insurance review.

What is Progressive Direct insurance?

Is Progressive Direct legit?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Is Progressive insurance reliable?

Several factors can influence the cost of your auto insurance policy with Progressive. Common factors include your driving record, the type of vehicle you drive, your age and gender, your location, your credit history, and the coverage options you select.

Progressive utilizes its own rating system, so it’s best to contact Progressive Auto Insurance directly or obtain a quote to get accurate pricing based on your specific circumstances. If you’d prefer to compare quotes from multiple companies at once, enter your ZIP code into our free comparison tool today.

Geico and Progressive are pretty evenly matched when it comes to overall quality, so it depends on the cost and type of coverage you’re looking for. For example, Geico is your best bet if getting the cheapest rate is your priority, while Progressive is better when it comes to discount programs and rates for high-risk drivers. Explore your options in our Geico auto insurance review.

What is Progressive Direct insurance?

Is Progressive Direct legit?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Is Progressive insurance reliable?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Is Progressive insurance reliable?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.