Elephant Auto Insurance Review in 2026 (Rates & Discounts Listed Here)

Our Elephant auto insurance review shows full coverage rates start at just $34 a month. Explore why Elephant leads the field with unmatched affordability and top-tier service quality. Uncover detailed insights into its superior customer satisfaction and robust performance metrics.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Insurance and Finance Writer

Luke Williams is a finance, insurance, real estate, and home improvement expert based in Philadelphia, Pennsylvania, specializing in writing and researching for consumers. He studied finance, economics, and communications at Pennsylvania State University and graduated with a degree in Corporate Communications. His insurance and finance writing has been featured on Spoxor, The Good Men Project...

Luke Williams

Licensed Insurance Agent

Kristen is a licensed insurance agent working in the greater Boston area. She has over 20 years of experience counseling individuals and businesses on which insurance policies best fit their needs and budgets. She knows everyone has their own unique needs and circumstances, and she is passionate about counseling others on which policy is right for them. Licensed in Massachusetts, New Hampshire,...

Kristen Gryglik

Updated January 2026

Elephant auto insurance review highlights that the company offers a range of coverage options, making it a standout choice. It’s particularly attractive for those seeking value combined with reliable service.

Elephant’s comprehensive policies cover various types of auto insurance, including liability, collision, and more, tailored to diverse needs. The coverage starts at just $97, offering affordability for basic insurance requirements.

Elephant Auto Insurance Rating

Rating Criteria

Overall Score 3.6

Business Reviews 3.5

Claim Processing 3.3

Company Reputation 4

Coverage Availability 2.5

Coverage Value 4

Customer Satisfaction 3.8

Digital Experience 3.5

Discounts Available 0

Insurance Cost 4.4

Plan Personalization 4

Policy Options 5

Savings Potential 2.9

As a top pick for affordability and coverage flexibility, car insurance elephant continues to impress with its robust offerings and customer satisfaction focus. If you’re searching for the best SR22 insurance, Elephant might also be a company to consider.

Begin comparing car insurance quotes elephant from Elephant auto insurance by entering your ZIP code above to get a car insurance quote elephant.

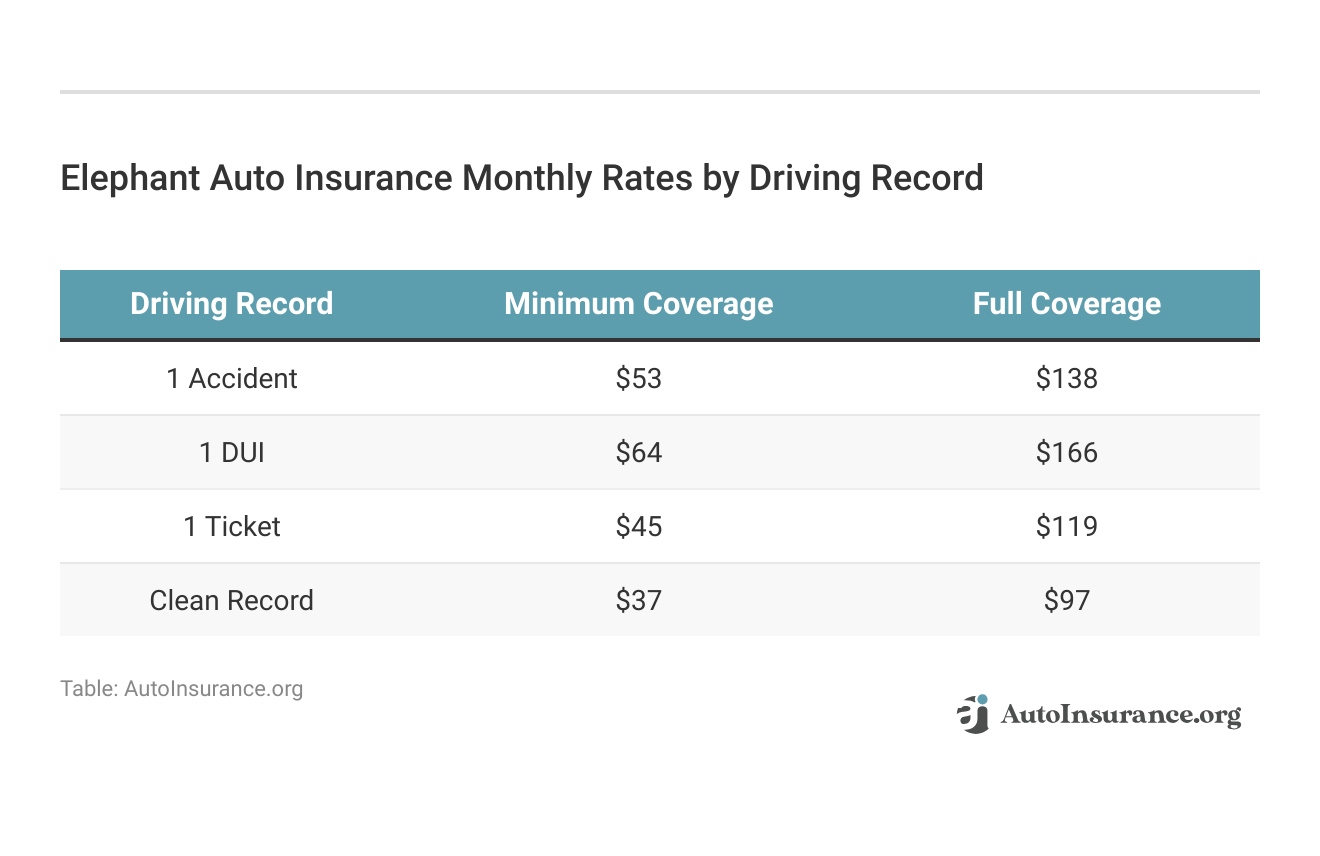

Driving Records and State Variance: Elephant Auto Insurance Rates

As mentioned earlier, the primary determinant for Elephant auto insurance rates is a clean driving record. Drivers with few or no infractions typically enjoy lower rates with Elephant. To understand what you might expect to pay with a clean slate, reference the rates outlined below.

Elephant Auto Insurance Monthly Rates by Age, Gender, & Coverage Level

Age & Gender Minimum Coverage Full Coverage

Age: 16 Female $177 $452

Age: 16 Male $187 $456

Age: 18 Female $144 $333

Age: 18 Male $160 $371

Age: 25 Female $45 $371

Age: 25 Male $46 $122

Age: 30 Female $42 $109

Age: 30 Male $43 $114

Age: 45 Female $37 $97

Age: 45 Male $37 $97

Age: 60 Female $34 $86

Age: 60 Male $35 $89

Age: 65 Female $36 $95

Age: 65 Male $36 $95

Conversely, any violations on your driving record can lead to increased premiums. Delivery receipt of any infractions can result in significant increases in rates. To understand how auto insurance companies check driving records and assess the impact on your rates. consider the specifics detailed in the following table.

Moreover, rates for Elephant auto insurance can differ considerably across different states, largely due to varying state insurance regulations and average costs. For instance, insurance costs in states with higher accident rates or more expensive claims could be greater, affecting overall premiums with Elephant.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What You Should Know About Elephant Auto Insurance

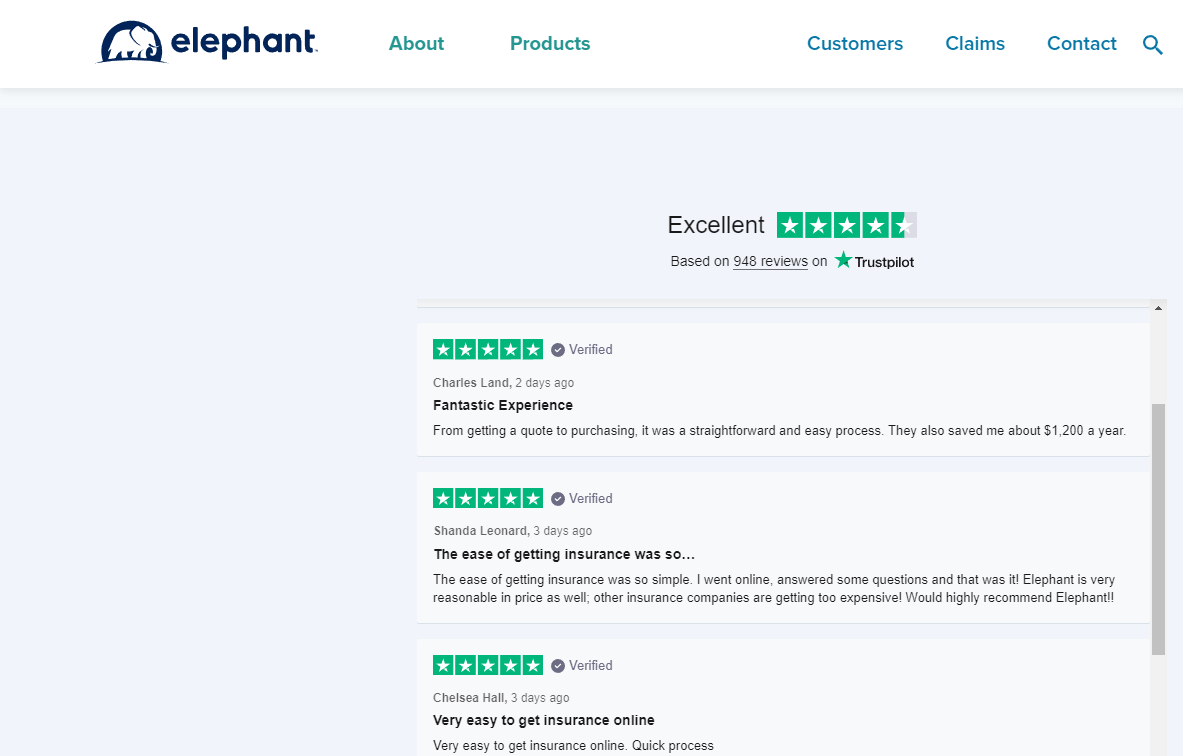

Elephant has an A+ (superior) financial strength rating with A.M. Best and an A+ rating with the Better Business Bureau. Unfortunately, the company has its fair share of customer complaints concerning claims handling. If you need to reach them, the Elephant auto insurance claims phone number is provided below.

Most Elephant insurance reviews discuss the company’s higher-than-average rates and low customer satisfaction, though some Elephant claims reviews note the company’s helpful customer service representatives. For example, contact elephant insurance via their customer service phone number.

Elephant Auto Insurance consistently delivers exceptional value and customer satisfaction, making it a top choice for drivers seeking reliable and affordable coverage.Dani Best Licensed Insurance Producer

If you’re considering a policy with Elephant, learn how to get fast and free Elephant auto insurance quotes. Shop around after receiving a car insurance quote elephant to see what other companies have to offer.

Elephant Insurance Company Contact Information

Embarking on the journey of insurance inquiries and updates can seem daunting. To ease your path, we’ve compiled essential contact information for Elephant auto insurance, ensuring you can swiftly navigate their services from customer support to claims management.

- Elephant Auto Insurance Company Address: P.O. Box 5205 Glen Allen, VA 23058-5205

- Elephant Auto Customer Service: Elephant auto insurance Phone Number: 1-855-Elephant (1-855-354-7868)

- Elephant Car Insurance Phone Number: Claims Department Phone Number: 1-877-321-2096

- Elephant Auto Roadside Assistance: Elephant Insurance Roadside Assistance Phone Number: 1-877-321-9910

With this comprehensive contact information readily available, navigating interactions with Elephant auto insurance is simple and stress-free. Whether you’re exploring how to file an auto insurance claim, seeking roadside assistance, or managing your policy, these contact options for Elephant car insurance guarantee that assistance is just a phone call or click away.

Elephant Auto Insurance Coverage Options

Services offered by Elephant insurance include various types of insurance coverage. Elephant offers the standard full coverage types you’d expect most insurance providers to have, including:

Elephant Auto Insurance Coverage Options

| Coverage |

|---|

| Liability |

| Property damage liability |

| Medical payments |

| Uninsured/underinsured motorists |

| Personal injury protection |

| Collision |

| Comprehensive |

While some companies stop here, cheap car insurance Elephant provides additional coverage options to policyholders, such as:

- Roadside Assistance: Elephant roadside assistance covers towing and other necessities.

- Rental Reimbursement: This coverage pays for rental cars if you need one after an accident.

- Upgraded Accident Forgiveness: Elephant offers accident forgiveness to policyholders after three years, but you can purchase this add-on immediately with your new policy.

- Loan/Lease Payoff: Loan/lease payoff will pay up to 25% of the remaining balance if your vehicle gets totaled in an accident.

- Non-Owner Coverage: This add-on covers you if you borrow someone else’s car and get in an accident.

Not only does Elephant offer policies required by many states, but it also allows drivers to customize their policies with add-on coverages to get a cheap car insurance from Elephant auto insurance.

Also keep in mind that you can only purchase Elephant car insurance in Illinois, Indiana, Maryland, Ohio, Tennessee, Texas, and Virginia. If car insurance from Elephant isn’t what you need, check out their other services. Elephant car insurance company stands as a prominent player in the insurance industry, known for its reliable coverage and customer-centric approach.

With an impressive A.M. Best rating, Elephant insurance assures policyholders of its financial stability and commitment to service excellence. Offering modern convenience, the Elephant insurance app empowers users with easy access to policy management and assistance on the go. In the event of unforeseen circumstances, the Elephant insurance claims process is streamlined, ensuring prompt resolution and customer satisfaction.

Prospective clients can gain insights into the company’s performance and customer satisfaction through the Elephant insurance company reviews that are available. Elephant’s full coverage insurance is offered in eight U.S. states. You may want to consider the company or companies like Elephant if you’re searching for auto insurance.

It provides standard coverage, additional options, and many discount opportunities. Still, rates with Elephant are often higher than average, and the company has a fair number of complaints concerning how it handles claims.

Elephant Auto Insurance Pros and Cons

There are multiple pros to choosing Elephant auto insurance as your provider. Some of the key benefits include:

- Competitive Rates: Elephant offers rates starting at $130 per month, making it an affordable option for many drivers looking for quality insurance without breaking the bank.

- Comprehensive Coverage: From standard liability to full coverage auto insurance defined options, Elephant provides a broad array of insurance products, allowing for a high degree of policy customization.

- Discount Opportunities: Elephant offers several discount opportunities that can reduce premiums by up to 25%, making it financially appealing for qualifying customers.

However, there are also cons to consider when choosing Elephant auto insurance:

- Limited Availability: Elephant insurance services are only available in a select few states, which might be inconvenient for those living outside of its service areas.

- Customer Service Concerns: Some customers have expressed dissatisfaction with the claims handling and customer service, which could impact overall satisfaction.

Evaluating these pros and cons can help determine if Elephant auto insurance meets your specific needs and expectations as a driver.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Elephant Auto Insurance Rates Breakdown

An insightful look into how to lower your auto insurance rates reveals that premiums vary depending on a host of factors. Young drivers typically encounter higher rates reflecting their increased risk, whereas more mature drivers enjoy lower premiums due to their experience on the road.

Infractions such as accidents or speeding tickets can significantly bump up rates, emphasizing the importance of maintaining a clean driving record. The analysis also shows that rates can differ widely by state, influenced by local laws and average claim amounts, which Elephant auto insurance and Elephant breakdown cover take into account to tailor their pricing strategies effectively.

Elephant Rates Based on Age

Elephant teen driver rates, which are around 35% higher than the national average at $630.08 annually for girls and $675.25 for boys, illustrate the significant impact of auto insurance rates by age. This table includes rates for teen drivers based on gender from the top insurance companies.

Teen Full Coverage Auto Insurance Monthly Rates by Provider, Age, & Gender

| Insurance Company | Age: 16 Female | Age: 16 Male | Age: 18 Female | Age: 18 Male |

|---|---|---|---|---|

| $524 | $568 | $384 | $219 | |

| $516 | $562 | $377 | $215 | |

| $514 | $558 | $376 | $215 | |

| $407 | $441 | $298 | $169 | |

| $559 | $606 | $407 | $233 |

| $452 | $490 | $330 | $189 | |

| $500 | $542 | $366 | $208 | |

| $428 | $464 | $313 | $179 | |

| $484 | $526 | $352 | $202 |

As you navigate the complexities of auto insurance rates by age, this comparison should help you make an informed decision, especially for teen drivers.

data-media-max-width=”560″>

Ever wondered which age group is most prone to fatal car crashes? Our latest article delves into comprehensive data on this critical issue. Discover surprising insights and learn how we can create safer roads for everyone. #RoadSafety #CarAccidents 👉 https://t.co/lKToaI3lrP pic.twitter.com/NtFxrgHtX1

— AutoInsurance.org (@AutoInsurance) June 7, 2024

With a clear view of how different providers stack up, you can choose the insurance company that best meets your needs and budget.

Elephant Auto Insurance Rates for Adult and Senior Drivers

For adult drivers, Elephant rates are still higher than average. For females, the premium is around $1,842 annually, while for men, it’s about $1,836. While senior drivers can expect to pay around $300 to $400 more annually for coverage with Elephant. The table below shows the national average for senior drivers.

Senior Full Coverage Auto Insurance Monthly Rates by Provider, Age, & Gender

| Insurance Company | Age: 55 Male | Age: 55 Female | Age: 60 Male | Age: 60 Female | Age: 65 Male | Age: 65 Female |

|---|---|---|---|---|---|---|

| $213 | $214 | $220 | $220 | $220 | $221 | |

| $131 | $131 | $126 | $122 | $135 | $136 | |

| $313 | $311 | $292 | $305 | $323 | $321 | |

| $100 | $103 | $111 | $111 | $103 | $106 | |

| $377 | $377 | $438 | $438 | $389 | $389 |

| $160 | $158 | $154 | $146 | $166 | $163 |

| $126 | $137 | $129 | $125 | $130 | $141 | |

| $154 | $154 | $145 | $145 | $158 | $158 | |

| $152 | $156 | $147 | $144 | $156 | $159 |

| $184 | $188 | $171 | $170 | $190 | $194 |

Elephant insurance may work for you, especially if you’re looking for auto insurance for seniors, but it’s good to compare rates with other companies before making any commitments.

Elephant Rates With a Speeding Ticket

You can expect higher-than-average car insurance rates if you have one or more speeding tickets on your driving record. You can compare the top insurance companies’ rates after a speeding ticket below.

Full Coverage Auto Insurance Monthly Rates by Provider: One Ticket vs. Clean Record

| Insurance Company | One Ticket | Clean Record |

|---|---|---|

| $154 | $122 |

| $268 | $228 | |

| $194 | $166 |

| $150 | $124 | |

| $170 | $138 | |

| $100 | $83 |

| $247 | $198 | |

| $151 | $114 | |

| $302 | $248 |

| $196 | $164 | |

| $199 | $150 | |

| $137 | $123 | |

| $396 | $331 | |

| $194 | $161 |

| $192 | $141 | |

| $148 | $118 | |

U.S. Average | $203 | $165 |

With Elephant, rates are almost $500 higher than the national average and nearly $1,000 more annually than rates with State Farm, highlighting the need to explore auto insurance companies that don’t penalize for speeding tickets.

Elephant Auto Insurance Post-Accident Rates Analysis

After an accident, Elephant’s insurance rates increase to nearly 30% above the national average, presenting a significant surge compared to other leading insurance companies. Here’s a comparative look at monthly full coverage rates for drivers with one accident versus those with a clean record across various insurers:

Full Coverage Auto Insurance Monthly Rates: One Accident vs. Clean Record

| Insurance Company | Clean Record | One Accident |

|---|---|---|

| $147 | $208 |

| $175 | $250 | |

| $157 | $223 | |

| $171 | $245 | |

| $172 | $245 | |

| $136 | $195 | |

| $186 | $265 |

| $151 | $215 | |

| $166 | $239 | |

| $143 | $204 | |

| $144 | $205 |

| $160 | $229 | |

U.S. Average | $165 | $251 |

Elephant’s rates for drivers with an at-fault accident or more on their record are nearly double USAA’s rates. Elephant’s elevated rates post-accident underline the financial impact of driving mishaps on insurance premiums.

Elephant Car Insurance After a DUI

If you have a DUI on your record, you’ll definitely pay more for insurance. You could even have a hard time finding a company willing to offer you coverage, but we’ve put together a list of the top insurance companies that do offer DUI insurance.

Auto Insurance Monthly Rate Increases: Clean Record vs. One DUI

| Insurance Company | Clean Record | One DUI | Rate Increase |

|---|---|---|---|

| $87 | $152 | 75% | |

| $62 | $104 | 68% |

| $76 | $105 | 38% | |

| $43 | $117 | 172% | |

| $96 | $178 | 85% |

| $63 | $129 | 105% | |

| $56 | $75 | 34% | |

| $47 | $65 | 38% | |

| $53 | $112 | 111% | |

| $32 | $58 | 81% |

Elephant’s rates for people with a DUI, as DUI defined impacts insurance costs, are only around 2% higher than the national average at about $2,652 annually.

Elephant Rates for People With Poor Credit

If you have a low credit score, you could pay around 7% more for insurance with Elephant than the national average.

Auto Insurance Monthly Rates by Credit Score

| Insurance Company | Good Credit | Fair Credit | Bad Credit |

|---|---|---|---|

| $78 | $90 | $105 | |

| $52 | $60 | $70 | |

| $56 | $64 | $76 |

| $74 | $85 | $100 | |

| $55 | $63 | $74 | |

| $82 | $94 | $111 |

| $64 | $74 | $86 | |

| $71 | $82 | $96 | |

| $59 | $68 | $80 | |

| $70 | $81 | $95 |

While 7% may not sound like a lot, understanding how credit scores affect auto insurance rates shows that it equates to hundreds of dollars annually you could save with another company.

Elephant Auto Insurance: A Closer Look at Minimum Coverage Costs

Elephant’s rates for minimum car insurance coverage is around $1,782 annually. With the national average around $1,463, Elephant’s rates are almost 22% higher. Let’s compare this to the top insurance companies.

Minimum Coverage Auto Insurance Rates by Provider

| Insurance Company | Monthly Rates |

|---|---|

| $87 | |

| $62 | |

| $53 | |

| $76 | |

| $43 | |

| $96 |

| $63 |

| $56 | |

| $47 | |

| $53 | |

| $32 | |

| U.S. Average | $61 |

Elephant’s minimum coverage rates are nearly $700 more per year than rates for similar coverage with Geico.

Elephant Auto Insurance: Analyzing the Cost of Full Coverage

A full coverage policy with Elephant costs around $2,059 per year. Take a look at the table below for rates for full coverage insurance with the top companies in the country.

Minimum vs. Full Coverage Monthly Insurance Rates by Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $87 | $228 | |

| $62 | $166 | |

| $47 | $124 | |

| $53 | $138 | |

| $76 | $198 | |

| $43 | $114 | |

| $96 | $248 |

| $63 | $164 |

| $56 | $150 | |

| $47 | $123 | |

| $53 | $141 | |

| $32 | $84 | |

| U.S. Average | $65 | $170 |

Elephant’s full coverage rates are 27% higher than the national average and nearly $800 more than Geico’s full coverage auto insurance rates.

Elephant Insurance Discounts Available

Elephant Insurance provides a variety of discounts that can help policyholders reduce their premiums. Among these are several key auto insurance discounts to ask for:

List of Elephant Auto Insurance Discounts

| Discount Name |

|---|

| Multi-Policy Discount |

| Online Quote Discount |

| Paid-In-Full Discount |

| Paperless Discount |

| E-Signature Discount |

| Multi-Car Discount |

| Good Driver Discount |

| Good Student Discount |

| Homeowner Discount |

| Work From Home Discount |

Engaging with an Elephant representative could enable you to save up to 25% on your auto insurance coverage. It’s worth discussing your eligibility for any of these discounts to capitalize on potential savings.

If you’re looking to cut costs on your auto insurance, make sure to inquire about these discounts. A conversation with an Elephant agent can help you identify which discounts you qualify for and how much you could save. Make your insurance more affordable by leveraging the discounts Elephant offers.

Smart Savings With Elephant

Explore the range of discounts Elephant Auto Insurance offers to help you reduce your insurance costs effectively, including how to save money by bundling insurance policies:

Elephant Auto Insurance Discounts by Savings Potential

| Discount Name | Savings Potential |

|---|---|

| Multi-Car | 46% |

| Early Bird | 10% |

| Multi-Policy | 12% |

| Pay in Full | 15% |

| Electronic Signature | 18% |

| Paperless | 3% |

| Online Quote | 3% |

| Homeowners | 17% |

| Claims-Free | 20% |

| Good Student | 13% |

| Work-from-Home | 22% |

By tapping into these discounts, you can significantly lower your Elephant Auto Insurance premiums. From students to homeowners, these reductions cater to a wide range of drivers. Discuss these opportunities with an Elephant representative to ensure you’re getting the best possible rate.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Snapshot of Elephant Auto Insurance Ratings

Elephant Auto Insurance garners strong financial reliability with A+ ratings from both the Better Business Bureau and A.M. Best, yet shows room for improvement in customer service with a 3.0/5 from J.D. Power and a higher than average complaint index of 2.27 from NAIC.

Elephant Business Ratings

| Agency | |

|---|---|

| Score: 795 / 1,000 Avg. Satisfaction |

|

| Score: B Financial Stability |

|

| Score: 68/100 Mixed Customer Feedback |

|

| Score: 1.10 Avg. Complaints |

|

| Score: B++ Good Financial Strength |

These ratings highlight Elephant’s strong financial foundation and areas for customer service improvement, assisting prospective customers in making well-informed choices among the best auto insurance companies for their coverage requirements.

Deciphering the Value of Elephant Auto Insurance

Elephant insurance, like many auto insurance companies, offers competitive rates and flexible coverage options, highlighted by discounts and customizable policy features. However, its mixed reviews on customer service and claims handling are notable.

Comparing Elephant with top-rated insurers could help ensure the best fit for your needs. If Elephant’s offerings align well with your requirements and budget, it might be a viable option. Still, it’s prudent to engage in comprehensive comparison shopping to secure the most favorable deal.

Stop overpaying for auto insurance. Enter your ZIP code below to find out if you can get a better deal.

Frequently Asked Questions

How can I get a quote for coverage from Elephant?

Go to the company website to receive an online quote. The company will ask for information about you and your vehicle.

How can I cancel an Elephant car insurance policy?

The way that you can cancel your Elephant Insurance policy is to call 877-321-2095 directly. Make sure you look into the details of your policy before you cancel your Elephant Insurance.

What other insurance does Elephant offer?

Elephant Insurance doesn’t just offer car insurance. In addition to car insurance, Elephant offers homeowners, condo, renters, umbrella, life, motorcycle, and off-road vehicle insurance.

For additional details, explore our comprehensive resource titled “Understanding Auto Insurance,” and gain valuable insights in just one click.

Who owns Elephant insurance?

Elephant Insurance is a direct-to-consumer insurance company offering a variety of insurance products with a focus on auto insurance. Elephant Auto Insurance is a subsidiary of Admiral Group PLC based in the United Kingdom.

Is Elephant auto insurance a reputable company?

Elephant Auto Insurance is generally considered a reputable company. They have been in operation for several years and have a strong presence in the insurance industry. However, it’s always recommended to do thorough research and read customer reviews before making a decision. Elephant Insurance is a good option for a variety of coverage needs.

Get started on comparing full coverage auto insurance rates by entering your ZIP code below.

How can I file a claim with Elephant?

Navigating through unexpected events can be daunting, but with Elephant Insurance, filing a claim is made simple and efficient. The Elephant Insurance claims phone number is readily available, connecting you to dedicated professionals who are committed to guiding you through every step of the claims process.

You can file a claim by calling 844-937-5353. When you call, have your policy number ready and be prepared to provide specific information about the incident.

To delve deeper, refer to our in-depth report titled “How to File an Auto Insurance Claim” for a straightforward guide.

What types of coverage does Elephant auto insurance offer?

Elephant Auto Insurance offers a range of coverage options, including liability coverage, collision coverage, comprehensive coverage, uninsured/underinsured motorist coverage, personal injury protection (PIP), and more. They also provide optional add-ons such as roadside assistance and rental car reimbursement.

Elephant Insurance does not offer RV insurance options. Elephant Insurance Company also does not provide Elephant-specific motorcycle insurance.

How can I get a quote from Elephant auto insurance?

To get a quote from Elephant Auto Insurance, you can visit their official website or contact their customer service directly. On their website, you’ll typically find a quote form where you can provide the necessary details about your vehicle, driving history, and coverage needs to receive an estimate. While Elephant does not offer pet insurance, Elephant does offer multi-car insurance discounts.

Once you have a policy you can contact the Elephant Car Insurance number to access and inquire about details, changes or other needs.

What states does Elephant insurance cover?

The various types of Elephant insurance are offered in the following states: Illinois, Indiana, Maryland, Ohio, Tennessee, Texas, and Virginia. You can get an Elephant car insurance quote directly on the homepage of the Elephant Insurance Company website.

To learn more, explore our comprehensive resource on insurance titled “Auto Insurance Rates by State,” and discover how your location affects premiums.

What factors can affect my Elephant auto insurance premium?

Several factors can influence your premium with Elephant Auto Insurance. These factors may include your age, gender, location, driving record, type of vehicle, coverage limits, deductibles, and any discounts you may be eligible for. It’s important to provide accurate information during the quoting process to receive an accurate premium estimate. To get quote for Elephant Insurance, visit their website.

Why is Elephant insurance so cheap?

Does Elephant insurance cover rental cars?

How do I get a quote for homeowners insurance from Elephant insurance?

How Good is Elephant insurance?

Does Elephant insurance offer SR22?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

What is Elephant insurance?

Go to the company website to receive an online quote. The company will ask for information about you and your vehicle.

The way that you can cancel your Elephant Insurance policy is to call 877-321-2095 directly. Make sure you look into the details of your policy before you cancel your Elephant Insurance.

What other insurance does Elephant offer?

Elephant Insurance doesn’t just offer car insurance. In addition to car insurance, Elephant offers homeowners, condo, renters, umbrella, life, motorcycle, and off-road vehicle insurance.

For additional details, explore our comprehensive resource titled “Understanding Auto Insurance,” and gain valuable insights in just one click.

Who owns Elephant insurance?

Elephant Insurance is a direct-to-consumer insurance company offering a variety of insurance products with a focus on auto insurance. Elephant Auto Insurance is a subsidiary of Admiral Group PLC based in the United Kingdom.

Is Elephant auto insurance a reputable company?

Elephant Auto Insurance is generally considered a reputable company. They have been in operation for several years and have a strong presence in the insurance industry. However, it’s always recommended to do thorough research and read customer reviews before making a decision. Elephant Insurance is a good option for a variety of coverage needs.

Get started on comparing full coverage auto insurance rates by entering your ZIP code below.

How can I file a claim with Elephant?

Navigating through unexpected events can be daunting, but with Elephant Insurance, filing a claim is made simple and efficient. The Elephant Insurance claims phone number is readily available, connecting you to dedicated professionals who are committed to guiding you through every step of the claims process.

You can file a claim by calling 844-937-5353. When you call, have your policy number ready and be prepared to provide specific information about the incident.

To delve deeper, refer to our in-depth report titled “How to File an Auto Insurance Claim” for a straightforward guide.

What types of coverage does Elephant auto insurance offer?

Elephant Auto Insurance offers a range of coverage options, including liability coverage, collision coverage, comprehensive coverage, uninsured/underinsured motorist coverage, personal injury protection (PIP), and more. They also provide optional add-ons such as roadside assistance and rental car reimbursement.

Elephant Insurance does not offer RV insurance options. Elephant Insurance Company also does not provide Elephant-specific motorcycle insurance.

How can I get a quote from Elephant auto insurance?

To get a quote from Elephant Auto Insurance, you can visit their official website or contact their customer service directly. On their website, you’ll typically find a quote form where you can provide the necessary details about your vehicle, driving history, and coverage needs to receive an estimate. While Elephant does not offer pet insurance, Elephant does offer multi-car insurance discounts.

Once you have a policy you can contact the Elephant Car Insurance number to access and inquire about details, changes or other needs.

What states does Elephant insurance cover?

The various types of Elephant insurance are offered in the following states: Illinois, Indiana, Maryland, Ohio, Tennessee, Texas, and Virginia. You can get an Elephant car insurance quote directly on the homepage of the Elephant Insurance Company website.

To learn more, explore our comprehensive resource on insurance titled “Auto Insurance Rates by State,” and discover how your location affects premiums.

What factors can affect my Elephant auto insurance premium?

Several factors can influence your premium with Elephant Auto Insurance. These factors may include your age, gender, location, driving record, type of vehicle, coverage limits, deductibles, and any discounts you may be eligible for. It’s important to provide accurate information during the quoting process to receive an accurate premium estimate. To get quote for Elephant Insurance, visit their website.

Why is Elephant insurance so cheap?

Does Elephant insurance cover rental cars?

How do I get a quote for homeowners insurance from Elephant insurance?

How Good is Elephant insurance?

Does Elephant insurance offer SR22?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

What is Elephant insurance?

Elephant Insurance doesn’t just offer car insurance. In addition to car insurance, Elephant offers homeowners, condo, renters, umbrella, life, motorcycle, and off-road vehicle insurance.

For additional details, explore our comprehensive resource titled “Understanding Auto Insurance,” and gain valuable insights in just one click.

Elephant Insurance is a direct-to-consumer insurance company offering a variety of insurance products with a focus on auto insurance. Elephant Auto Insurance is a subsidiary of Admiral Group PLC based in the United Kingdom.

Is Elephant auto insurance a reputable company?

Elephant Auto Insurance is generally considered a reputable company. They have been in operation for several years and have a strong presence in the insurance industry. However, it’s always recommended to do thorough research and read customer reviews before making a decision. Elephant Insurance is a good option for a variety of coverage needs.

Get started on comparing full coverage auto insurance rates by entering your ZIP code below.

How can I file a claim with Elephant?

Navigating through unexpected events can be daunting, but with Elephant Insurance, filing a claim is made simple and efficient. The Elephant Insurance claims phone number is readily available, connecting you to dedicated professionals who are committed to guiding you through every step of the claims process.

You can file a claim by calling 844-937-5353. When you call, have your policy number ready and be prepared to provide specific information about the incident.

To delve deeper, refer to our in-depth report titled “How to File an Auto Insurance Claim” for a straightforward guide.

What types of coverage does Elephant auto insurance offer?

Elephant Auto Insurance offers a range of coverage options, including liability coverage, collision coverage, comprehensive coverage, uninsured/underinsured motorist coverage, personal injury protection (PIP), and more. They also provide optional add-ons such as roadside assistance and rental car reimbursement.

Elephant Insurance does not offer RV insurance options. Elephant Insurance Company also does not provide Elephant-specific motorcycle insurance.

How can I get a quote from Elephant auto insurance?

To get a quote from Elephant Auto Insurance, you can visit their official website or contact their customer service directly. On their website, you’ll typically find a quote form where you can provide the necessary details about your vehicle, driving history, and coverage needs to receive an estimate. While Elephant does not offer pet insurance, Elephant does offer multi-car insurance discounts.

Once you have a policy you can contact the Elephant Car Insurance number to access and inquire about details, changes or other needs.

What states does Elephant insurance cover?

The various types of Elephant insurance are offered in the following states: Illinois, Indiana, Maryland, Ohio, Tennessee, Texas, and Virginia. You can get an Elephant car insurance quote directly on the homepage of the Elephant Insurance Company website.

To learn more, explore our comprehensive resource on insurance titled “Auto Insurance Rates by State,” and discover how your location affects premiums.

What factors can affect my Elephant auto insurance premium?

Several factors can influence your premium with Elephant Auto Insurance. These factors may include your age, gender, location, driving record, type of vehicle, coverage limits, deductibles, and any discounts you may be eligible for. It’s important to provide accurate information during the quoting process to receive an accurate premium estimate. To get quote for Elephant Insurance, visit their website.

Why is Elephant insurance so cheap?

Does Elephant insurance cover rental cars?

How do I get a quote for homeowners insurance from Elephant insurance?

How Good is Elephant insurance?

Does Elephant insurance offer SR22?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

What is Elephant insurance?

Elephant Auto Insurance is generally considered a reputable company. They have been in operation for several years and have a strong presence in the insurance industry. However, it’s always recommended to do thorough research and read customer reviews before making a decision. Elephant Insurance is a good option for a variety of coverage needs.

Get started on comparing full coverage auto insurance rates by entering your ZIP code below.

Navigating through unexpected events can be daunting, but with Elephant Insurance, filing a claim is made simple and efficient. The Elephant Insurance claims phone number is readily available, connecting you to dedicated professionals who are committed to guiding you through every step of the claims process.

You can file a claim by calling 844-937-5353. When you call, have your policy number ready and be prepared to provide specific information about the incident.

To delve deeper, refer to our in-depth report titled “How to File an Auto Insurance Claim” for a straightforward guide.

What types of coverage does Elephant auto insurance offer?

Elephant Auto Insurance offers a range of coverage options, including liability coverage, collision coverage, comprehensive coverage, uninsured/underinsured motorist coverage, personal injury protection (PIP), and more. They also provide optional add-ons such as roadside assistance and rental car reimbursement.

Elephant Insurance does not offer RV insurance options. Elephant Insurance Company also does not provide Elephant-specific motorcycle insurance.

How can I get a quote from Elephant auto insurance?

To get a quote from Elephant Auto Insurance, you can visit their official website or contact their customer service directly. On their website, you’ll typically find a quote form where you can provide the necessary details about your vehicle, driving history, and coverage needs to receive an estimate. While Elephant does not offer pet insurance, Elephant does offer multi-car insurance discounts.

Once you have a policy you can contact the Elephant Car Insurance number to access and inquire about details, changes or other needs.

What states does Elephant insurance cover?

The various types of Elephant insurance are offered in the following states: Illinois, Indiana, Maryland, Ohio, Tennessee, Texas, and Virginia. You can get an Elephant car insurance quote directly on the homepage of the Elephant Insurance Company website.

To learn more, explore our comprehensive resource on insurance titled “Auto Insurance Rates by State,” and discover how your location affects premiums.

What factors can affect my Elephant auto insurance premium?

Several factors can influence your premium with Elephant Auto Insurance. These factors may include your age, gender, location, driving record, type of vehicle, coverage limits, deductibles, and any discounts you may be eligible for. It’s important to provide accurate information during the quoting process to receive an accurate premium estimate. To get quote for Elephant Insurance, visit their website.

Why is Elephant insurance so cheap?

Does Elephant insurance cover rental cars?

How do I get a quote for homeowners insurance from Elephant insurance?

How Good is Elephant insurance?

Does Elephant insurance offer SR22?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

What is Elephant insurance?

Elephant Auto Insurance offers a range of coverage options, including liability coverage, collision coverage, comprehensive coverage, uninsured/underinsured motorist coverage, personal injury protection (PIP), and more. They also provide optional add-ons such as roadside assistance and rental car reimbursement.

Elephant Insurance does not offer RV insurance options. Elephant Insurance Company also does not provide Elephant-specific motorcycle insurance.

To get a quote from Elephant Auto Insurance, you can visit their official website or contact their customer service directly. On their website, you’ll typically find a quote form where you can provide the necessary details about your vehicle, driving history, and coverage needs to receive an estimate. While Elephant does not offer pet insurance, Elephant does offer multi-car insurance discounts.

Once you have a policy you can contact the Elephant Car Insurance number to access and inquire about details, changes or other needs.

What states does Elephant insurance cover?

The various types of Elephant insurance are offered in the following states: Illinois, Indiana, Maryland, Ohio, Tennessee, Texas, and Virginia. You can get an Elephant car insurance quote directly on the homepage of the Elephant Insurance Company website.

To learn more, explore our comprehensive resource on insurance titled “Auto Insurance Rates by State,” and discover how your location affects premiums.

What factors can affect my Elephant auto insurance premium?

Several factors can influence your premium with Elephant Auto Insurance. These factors may include your age, gender, location, driving record, type of vehicle, coverage limits, deductibles, and any discounts you may be eligible for. It’s important to provide accurate information during the quoting process to receive an accurate premium estimate. To get quote for Elephant Insurance, visit their website.

Why is Elephant insurance so cheap?

Does Elephant insurance cover rental cars?

How do I get a quote for homeowners insurance from Elephant insurance?

How Good is Elephant insurance?

Does Elephant insurance offer SR22?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

What is Elephant insurance?

The various types of Elephant insurance are offered in the following states: Illinois, Indiana, Maryland, Ohio, Tennessee, Texas, and Virginia. You can get an Elephant car insurance quote directly on the homepage of the Elephant Insurance Company website.

To learn more, explore our comprehensive resource on insurance titled “Auto Insurance Rates by State,” and discover how your location affects premiums.

Several factors can influence your premium with Elephant Auto Insurance. These factors may include your age, gender, location, driving record, type of vehicle, coverage limits, deductibles, and any discounts you may be eligible for. It’s important to provide accurate information during the quoting process to receive an accurate premium estimate. To get quote for Elephant Insurance, visit their website.

Why is Elephant insurance so cheap?

Does Elephant insurance cover rental cars?

How do I get a quote for homeowners insurance from Elephant insurance?

How Good is Elephant insurance?

Does Elephant insurance offer SR22?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

What is Elephant insurance?

How do I get a quote for homeowners insurance from Elephant insurance?

How Good is Elephant insurance?

Does Elephant insurance offer SR22?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

What is Elephant insurance?

Does Elephant insurance offer SR22?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

What is Elephant insurance?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.