Post

PostCan you buy auto insurance on the weekend?

If you’re looking to buy a new or used car and have a busy schedule, you may only be able to do this on the weekend or outside of traditional office hours. The dealership may extend longer hours to ...

Secured with SHA-256 Encryption

Post

PostIf you’re looking to buy a new or used car and have a busy schedule, you may only be able to do this on the weekend or outside of traditional office hours. The dealership may extend longer hours to ...

Post

PostHow you buy a car directly from an insurance company is by participating in insurance auto auctions that sell totaled or salvaged title vehicles. Research auction platforms like Copart or IAAI, regist...

Post

PostThe way you insure a commercial truck for personal use involves assessing your usage, checking insurance requirements, contacting your insurer, obtaining quotes, and selecting the right coverage. If y...

Post

PostA common question is “Can I get car insurance if I owe another company?” The answer is yes, you can switch companies while still owing another company. If you are worried about owing money...

Post

PostDo auto insurance companies need your Social Security number? In most states, auto insurance companies require your Social Security number (SSN). However, you can still get car insurance without a Soc...

Post

PostDo auto insurance companies check where you live? Companies do check where you live, as there are a number of factors most companies use to determine clients’ car insurance rates, and a person’s a...

Post

PostCar insurance is generally designed for the individual vehicle, but there are a lot of different factors that go into your car insurance premiums, including: how many cars you own your driving history...

Post

PostHow you switch auto insurance companies is by first assessing your coverage needs, reviewing any cancellation fees, comparing quotes, purchasing a new policy, and then canceling your old policy and up...

Post

PostWhen looking for car insurance, one question some people ask is “Do insurance companies check police reports?. There are many reasons people worry about insurance background checks. Perhaps they...

Post

PostWhile auto insurance is usually billed a month in advance, most providers write policies in six-month increments. The prepayment serves as a safeguard in the event a policyholder needs to file a claim...

Post

PostState Farm stands out as the best auto insurance for drivers with a Canadian license, offering comprehensive protection with rates starting as low as $123 per month. Partnering with USAA and Geico, th...

Post

PostNo matter where you live in the U.S., you can buy insurance for someone else’s car. While all states in the U.S. have their own unique set of auto insurance laws, no state legally prevents indiv...

Post

PostInsurance companies don’t require a drug test for a client to obtain auto insurance. An insurer for an automobile policy will also never request a drug test when you file a claim. So if you were...

Post

PostHow you change auto insurance when moving out of state involves several key steps. First contact your current insurer, understand new insurance laws, compare quotes, ask about discounts, cancel or tra...

Post

PostCar insurance is a unique product offered by an insurance carrier. Customers drive what is offered by car insurance carriers due to the immense competition that exists in the marketplace. You as a con...

Post

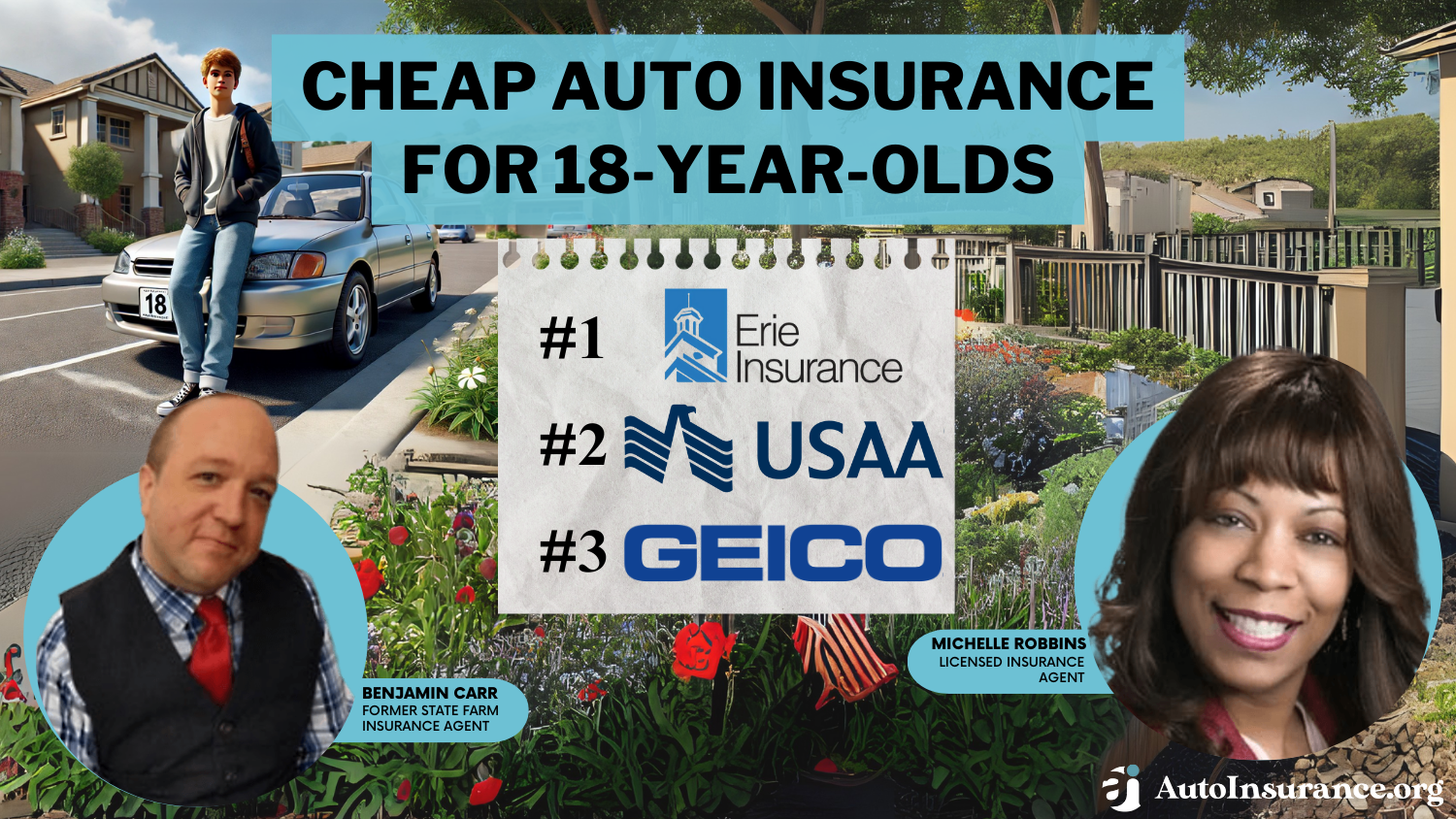

PostThe top providers of cheap auto insurance for 18-year-olds are Erie, USAA, and Geico. Erie ranks first for offering teen driver discounts and consistently low complaint levels. USAA caters to military...

Post

PostCan an auto insurance company deny you coverage? Yes, they can, especially if you are a high-risk driver. People who can’t get insurance with one or more companies may have poor driving histories, b...

Post

PostWhen shopping around for auto insurance, you may have encountered a request for employment verification. This may have you wondering, do car insurance companies check your employment and can auto insu...

Post

PostAuto insurance is one of the few forms of financial protection that you’re required to pay for when you own a car. While state officials typically require vehicle owners to insure their personal...

Post

PostHow much do car insurance agents make? Usually, auto insurance agents make around 10%-15% in commission, and the average annual salary is $49,840. The primary work of insurance agents is to sell one o...

Related Topics

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.