Best Longevity Auto Insurance Discounts in 2026 (Save up to 25% With These 10 Companies)

The best longevity auto insurance discounts from top companies like Allstate, Geico, and Progressive can save you up to 25% for staying with the same insurer. By maintaining continuous coverage, you unlock these discounts and other perks, ensuring long-term savings on your premiums.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Licensed Insurance Agent

Kristen is a licensed insurance agent working in the greater Boston area. She has over 20 years of experience counseling individuals and businesses on which insurance policies best fit their needs and budgets. She knows everyone has their own unique needs and circumstances, and she is passionate about counseling others on which policy is right for them. Licensed in Massachusetts, New Hampshire,...

Kristen Gryglik

Licensed Insurance Producer

Dani Best has been a licensed insurance producer for nearly 10 years. Dani began her insurance career in a sales role with State Farm in 2014. During her time in sales, she graduated with her Bachelors in Psychology from Capella University and is currently earning her Masters in Marriage and Family Therapy. Since 2014, Dani has held and maintains licenses in Life, Disability, Property, and Casualt...

Dani Best

Updated October 2024

The best longevity auto insurance discounts can save drivers up to 25% for maintaining continuous coverage with top companies like Allstate, Geico, and Progressive. These discounts can help lower your longevity insurance rates over time.

By staying with the same insurer, drivers can unlock even more benefits, such as bundled policy discounts. Learn how to qualify for these savings and compare the top options available to maximize your auto insurance discounts.

Our Top 10 Company Picks: Best Longevity Auto Insurance Discounts

| Company | Rank | Savings Potential | A.M. Best | Who Qualifies? | Required Length of Coverage |

|---|---|---|---|---|---|

| #1 | 25% | A | Long-term policyholders | 5+ years |

| #2 | 20% | B | Loyal customers | 3–5 years | |

| #3 | 20% | A+ | Long-time policyholders | 3+ years | |

| #4 | 15% | A++ | Long-term clients | 5+ years | |

| #5 | 15% | A+ | Customers with long-term policies | 3–5 years |

| #6 | 15% | A+ | Long-standing customers | 3–5 years | |

| #7 | 15% | A | Long-term policyholders | 5+ years | |

| #8 | 10% | A | Long-term clients | 3–5 years | |

| #9 | 10% | A++ | Long-time customers | 3+ years | |

| #10 | 10% | A++ | Members with long-term policies | 5+ years |

Make sure to compare quotes to get the most out of your discounts. By knowing your eligibility and stacking discounts, you can achieve even bigger savings.

Enter your ZIP code to compare auto insurance quotes and find the best rates today.

- The best longevity auto insurance discounts offer up to 25% savings for loyalty

- Continuous coverage unlocks more discounts and benefits with top insurers

- Save with discounts from companies like Allstate, Geico, and Progressive

Eligibility Criteria for Longevity Auto Insurance Discounts

To qualify for longevity auto insurance discounts, policyholders must demonstrate several years of uninterrupted coverage with the same insurer. This continuous coverage period often ranges from three to five years, depending on the provider. Additionally, many companies, such as State Farm loyalty discounts, offer rewards for continuous coverage.

Maintaining a clean driving record during this time is also crucial, as insurers prefer low-risk drivers when offering loyalty discounts. Consistently paying premiums on time and keeping your account in good standing enhances your eligibility.

In addition to the standard requirements, some insurers may allow you to qualify for a longevity discount even if you’ve switched providers, as long as you can prove your continuous coverage history and qualify for loyalty insurance.

Bundling multiple policies, such as home and auto insurance, or maintaining a multi-vehicle policy may also increase your overall discounts for customer loyalty, including the best multi-vehicle auto insurance discounts. It’s important to periodically check with your insurer to ensure you maximize your savings through available discounts, including lifespan discounts.

To qualify for a longevity discount, the customer may need proof of continuous auto insurance coverage for several years. When renewing your auto insurance policy, checking these potential discounts each year is a good idea. So, when does my auto insurance renew? Generally, companies must send renewal notices between 30 and 45 days before the policy expires.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Companies With Longevity Auto Insurance Discounts

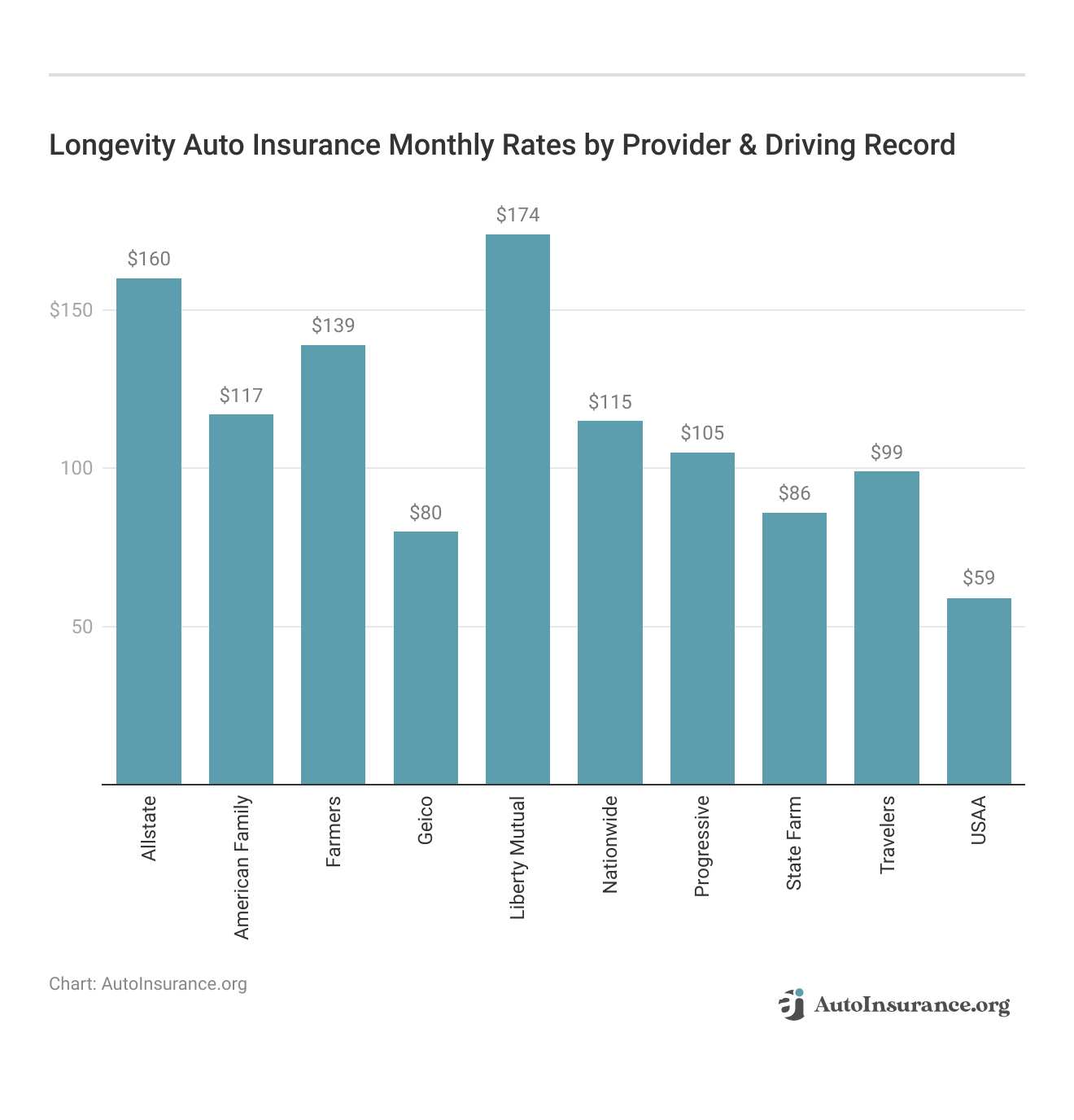

Several auto insurance companies offer discounts for various reasons. Longevity discounts are popular with the best auto insurance companies in the United States.

Allstate Longevity Auto Insurance Discount

You can find information about Allstate auto insurance discounts in our Allstate auto insurance review. This discount is under the Allstate discounts for auto insurance, a policy-based discount for continuous coverage.

The discount amount depends on the state where you live. Also, if you bundle home and auto insurance, you can save up to 25%. Learn more about how to save money by bundling policies and unlocking loyal customer discount.

Progressive Longevity Auto Insurance Discount

Progressive auto insurance discounts include this discount when you switch to Progressive after having three or more years of continuous coverage from another company. Geico marriage discount may also apply for couples seeking additional savings.

Additionally, Progressive loyalty discount is available to loyal customers who stay with Progressive for multiple years. You may also want to explore what are Progressive loyalty rewards for further savings.

Geico Longevity Auto Insurance Discount

Geico auto insurance discounts include a Geico loyalty discount and many others. The longer you stay with Geico, the higher the longevity discount.

Most auto insurance discounts help policyholders save around 10% on their monthly or annual rates. Since insurance companies often alter auto insurance rates and renewal discounts annually, these amounts are subject to change.

Weighing the Benefits of Longevity Auto Insurance Discounts

To make a fair comparison when shopping for auto insurance, compare the rates after all possible discounts apply, including longevity insurance quotes, to determine the best deal.

To make a fair comparison when shopping for auto insurance, compare the rates after all possible discounts apply to determine the best deal. Learning how to manage your auto insurance policy and choose the best option is important when assessing the cost of your coverage.

Just because an insurance company offers a substantial longevity auto insurance discount doesn’t mean the rate will be lower than another company.

For example, State Farm loyalty rewards and Nationwide insurance loyalty rewards may differ, but it’s essential to compare them to see which offers the most savings after applying any loyalty discount reserved. Doing the math on any policy before you purchase auto insurance is essential.

Key Factors in Auto Insurance Discounts for Loyal Customers

The amount of time you must pay the higher rate until you qualify for a longevity auto insurance discount is something to consider. If it takes five years to earn a discount and you pay a higher rate, it may take you considerable time before the long-term policyholder discount begins to recover the amount you spent on higher rates in the previous years.

There’s no guarantee that the same discounts will exist in the future. An insurance company may change its discount programs at any time, and all insurance companies assess the factors that affect auto insurance rates differently.

Longevity discounts are great, but focus on securing the best rate first. Think of the discount as a bonus, not a guarantee.Brandon Frady Licensed Insurance Producer

One way to prepare for this is to seek the best rate for an auto insurance policy without relying on any potential longevity discount for auto insurance. Then, if you ultimately qualify for a loyalty discount, you’ll be pleasantly surprised by the extra savings.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Maximizing Your Savings Through Longevity Discounts

Longevity auto insurance discounts provide a great opportunity to save on your premiums while maintaining continuous coverage. By staying with the same insurer and meeting eligibility criteria, you can unlock discounts of up to 25% from top companies like Allstate, Geico, and Progressive. Take advantage of Progressive loyalty or other customer loyalty auto insurance discount programs to get the most out of your policy.

However, it’s essential to weigh these benefits against other available offers to ensure you’re getting the best overall deal. Comparing quotes regularly, considering bundling options, and keeping your coverage history clean are all key steps to maximizing your long-term savings. Enter your ZIP code to explore your best options today and start saving.

Frequently Asked Questions

What is a longevity auto insurance discount?

Longevity auto insurance discounts offer insurance savings for staying with the same company for a specific period, usually three to five years. Auto insurance discounts for long-time customers can save drivers up to 25%. If you’re curious about how to qualify for a longevity auto insurance discount, contact a representative with your insurance company.

What are the benefits of a longevity discount on auto insurance?

The benefits of maintaining continuous auto insurance coverage include eligibility for discounts, rewards, and the ability to maintain affordable auto insurance premiums.

How does policy longevity affect auto insurance rates?

Longevity affects your auto insurance rates because it shows loyalty, qualifies you for discounts, and reduces the insurance company’s risk to insure you.

Which insurance companies offer longevity auto insurance discounts?

Allstate, Geico auto insurance, and Progressive auto insurance offer longevity discounts, allowing policyholders to save up to 20% on their policy for staying with the same company for three to five years.

Can bundling policies increase my longevity discount?

Bundling your auto insurance with other policies, such as home or renters insurance, may enhance your overall discount. Some of the best companies for bundling home and auto insurance offer additional savings, which can be combined with longevity discounts to maximize your premium savings.

How do I apply for a longevity auto insurance discount?

Contact your insurance provider to apply for a longevity auto insurance discount and inquire about their specific requirements. You may need to provide proof of continuous coverage, and depending on the provider, discounts may apply automatically once you’ve maintained coverage for the required time.

Can I qualify for a longevity discount if I switch insurance companies?

Yes, some insurance companies offer a longevity discount even if you’ve recently switched providers, as long as you can demonstrate a history of continuous coverage. Ensure to provide documentation of your prior insurance when applying for the discount.

How do longevity discounts differ between insurance companies?

Longevity discounts can vary in amount and requirements depending on the insurance company. While some companies offer up to 25% savings, others may offer lower or higher percentages. Knowing where to compare auto insurance rates and each company’s discount structure and policies is important to find the best deal for your situation. Enter your ZIP today using our free tool to get started on getting your auto insurance.

Does a longevity discount increase the longer I stay with my insurer?

In many cases, yes. Some insurers offer tiered loyalty programs, with the longevity discount increasing. For example, staying with the same insurer for ten years might yield a higher discount than staying with them for just five years.

Are there restrictions on receiving a longevity discount?

Yes, most insurers require that you maintain a clean driving record and pay your premiums on time to qualify for longevity discounts. Major traffic violations or policy lapses could disqualify you from receiving this discount, even if you’ve had long-term coverage.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.