Clearcover Auto Insurance Review for 2026 [See How Much You Can Save]

Clearcover auto insurance offers a minimum coverage option starting at just $21/mo, making it a top choice for budget-conscious drivers. The Clearcover auto insurance review highlights its swift, app-based claims processing, perfect for gig economy drivers needing fast, reliable coverage without hassle.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Maria Hanson grew up with a unique passion and understanding of both the automotive and insurance industries. With one grandfather in auto mechanics and another working in insurance, you could say automotive insurance is in her blood. Her love of research and finance serves her well in studying insurance trends and liability. Maria has expanded her scope of expertise to home, health, and life...

Maria Hanson

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Brad Larson

Updated December 2024

The Clearcover auto insurance review highlights its position as a standout choice for drivers seeking reliable coverage. Clearcover excels with its fast claim processing, often handling claims in minutes, which appeals to those seeking quick resolutions.

The company also caters to the needs of gig economy workers by offering specialized rideshare auto insurance coverage, making it an excellent option for Uber and Lyft drivers.

Clearcover Auto Insurance Rating

| Rating Criteria | |

|---|---|

| Overall Score | 3.7 |

| Business Reviews | 3.5 |

| Claim Processing | 4.5 |

| Company Reputation | 4.0 |

| Coverage Availability | 2.7 |

| Coverage Value | 3.7 |

| Customer Satisfaction | 3.4 |

| Digital Experience | 4.5 |

| Discounts Available | 4.0 |

| Insurance Cost | 3.8 |

| Plan Personalization | 4.0 |

| Policy Options | 3.1 |

| Savings Potential | 3.9 |

The streamlined, Clearcover app-based service enables policyholders to easily manage their insurance, further emphasizing the company’s focus on efficiency.

Clearcover blends simplicity and essential protection with these features, making it a strong contender for modern drivers looking for hassle-free auto insurance. Find an auto insurance company by entering your ZIP code into our free quote tool above.

- Clearcover boasts high customer ratings for fast claim processing

- Offers specialized rideshare coverage, ideal for gig economy drivers

- Easy-to-use app streamlines policy management and user experience

What You Should Know About Clearcover

Clearcover reviews suggest the company has a higher-than-average number of customer complaints. In addition, most Clearcover car insurance reviews note issues with the company’s claims handling process and no straightforward method of communication outside of the Clearcover insurance app.

While the company states Clearcover insurance claims are easy to file and some payouts happen within minutes, many customers say the process can be a bit of a headache.

If you’re considering purchasing an auto insurance premium policy with Clearcover, you may want to read some of the company’s reviews. Additionally, it’s important to note that J.D. Power does not rank the company and that there is not much information available online. See more details in our guide, “How to Evaluate Auto Insurance Quotes.”

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Age and Gender Impact on Clearcover Rates

Clearcover’s auto insurance rates fluctuate based on a driver’s age and gender, reflecting common industry pricing trends. These variations highlight how demographic factors influence insurance costs, making understanding how they affect your premiums crucial.

Clearcover Auto Insurance Monthly Rates by Age, Gender, & Coverage Level

| Age & Gender | Minimum Coverage | Full Coverage |

|---|---|---|

| Age: 16 Female | $120 | $320 |

| Age: 16 Male | $131 | $335 |

| Age: 18 Female | $97 | $236 |

| Age: 18 Male | $112 | $273 |

| Age: 25 Female | $28 | $77 |

| Age: 25 Male | $29 | $80 |

| Age: 30 Female | $26 | $71 |

| Age: 30 Male | $27 | $74 |

| Age: 45 Female | $23 | $63 |

| Age: 45 Male | $22 | $62 |

| Age: 60 Female | $20 | $55 |

| Age: 60 Male | $21 | $56 |

| Age: 65 Female | $23 | $62 |

| Age: 65 Male | $22 | $60 |

The table above reveals that younger drivers, particularly teenagers, face significantly higher rates. A 16-year-old male pays $131 monthly for minimum coverage, while a female of the same age pays slightly less, at $120.

As drivers age, the rates decrease substantially; for example, a 30-year-old male pays $27 for minimum coverage compared to the higher teenage rates. Gender differences are also evident, albeit to a lesser extent, among older age groups.

Clearcover offers competitive full coverage rates starting at $62 per month, making it budget-friendly for many drivers.Michelle Robbins Licensed Insurance Agent

For instance, 45-year-old females pay $23 for minimum coverage, while males of the same age pay $22. These disparities underline the importance of considering age and gender when selecting the appropriate coverage level with Clearcover.

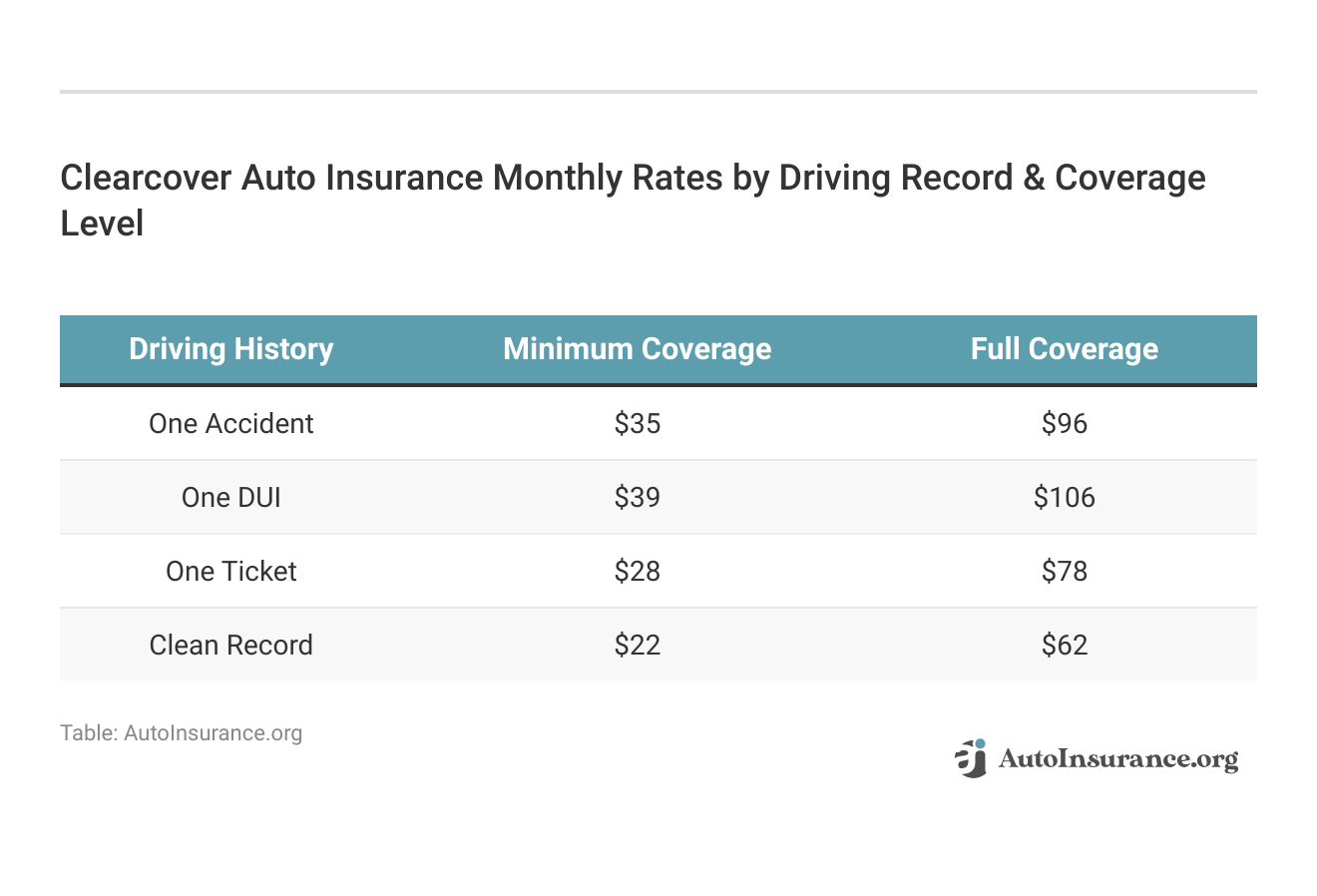

Driving history plays a crucial role in determining Clearcover’s auto insurance rates. Your monthly premiums can vary significantly if you have a clean record or past infractions. In our complete guide, “What are the recommended auto insurance coverage levels?”

Clearcover Insurance Rates Breakdown

Clearcover claims to offer affordable rates to its policyholders, but in most cases, the company’s average rates are much higher than the national average.

To find out how much you would pay for coverage with Clearcover, you’ll need to go to the company website and get a quote.

Clearcover Car Insurance for Teens

Teenagers pay the most expensive rates of anyone on average. Still, car insurance rates for teenagers with Clearcover are 35% higher than the national average for females and 27% higher for males.

Clearcover’s teen driver rates are more than double USAA’s rates for similar coverage. Our article "Auto Insurance for Men vs. Women" provides more information about this provider.

Clearcover Young Adult Car Insurance

Individuals often pay less for auto insurance premiums once they turn 25, as long as they have clean driving records.

But Clearcover rates for young adults are anywhere from 5% to 6% higher than the national average.

Clearcover’s rates for young adults are nearly $1,000 more annually than USAA’s.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Clearcover Car Insurance for Adults

Like previous examples, Clearcover’s car insurance rates for adults are higher than the national average. The company’s rates are double that of USAA’s for similar coverage.

Senior Driver Car Insurance With Clearcover

Clearcover’s car insurance rates for senior drivers are 6% higher than the national average for females and 9% higher for males.

Clearcover’s rates for senior drivers are nearly $600 more yearly than Geico’s rates for similar coverage.

Clearcover Insurance Coverage Options

Clearcover offers the standard options for auto insurance, plus a few more add-ons for extra protection. Clearcover’s insurance coverages include the following:

- Liability

- Property Damage Liability

- Collision

- Comprehensive

- Personal Injury Protection

- Medical Payments

- Uninsured/Underinsured Motorist

- Rideshare

- Roadside Assistance

Some car insurance companies are unwilling to offer coverage to people who drive for rideshare services like Uber or Lyft. Clearcover claims to offer affordable rideshare coverage options to its policyholders.

Learn more about our latest announcement via @ITI_Insurtech https://t.co/yN05Otbzlu

— Clearcover (@clearcover) October 3, 2023

The company only allows people to purchase six-month policies, and Clearcover evaluates each person’s driving record at each renewal. So, if you haven’t had an accident, your rates will remain the same or even decrease. But if you’ve been in a wreck or filed a claim, you may find that your rates have increased.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Clearcover Auto Insurance: A Comprehensive Look at Pros and Cons

Clearcover stands out for its seamless digital experience and fast, efficient claims process. Its rideshare coverage options make it an excellent choice for gig economy drivers.

- Rideshare Coverage: Tailored policies for Uber and Lyft drivers set Clearcover apart from many competitors.

- User-Friendly App: The mobile-first approach allows users to manage everything from policy updates to claims easily.

- Fast Claims Processing: Clearcover’s swift claims payouts, sometimes within minutes, appeal to drivers looking for quick resolutions.

- All-Digital Experience: Clearcover eliminates paperwork by handling everything through its streamlined app and website.

Clearcover excels in digital efficiency, making it perfect for those who prefer tech-driven solutions.

Comment

byu/KaySlay_AllDay from discussion

inCar_Insurance_Help

While Clearcover shines in digital innovation, it falls short in pricing and availability. The lack of bundling options can make it less attractive for families or homeowners seeking multi-policy discounts.

- No Bundling: Clearcover does not offer discounts for bundling auto and home insurance, unlike other major providers (To learn more, see our “How to Save Money by Bundling Insurance Policies”).

- Higher Rates: Drivers may face higher premiums than industry giants like Geico or USAA.

- Limited Availability: Clearcover is unavailable in all states, limiting its accessibility to many potential customers.

Despite its higher rates and limited offerings, Clearcover’s digital-first approach and efficient claims process make it a solid choice for tech-savvy, single-policy drivers.

Clearcover Insurance Business Ratings & Consumer Reviews

With an unwavering focus on business integrity and consumer satisfaction, agencies consistently rise above the competition. Their notable performance in financial strength, consumer feedback, and overall operational excellence sets them apart in a crowded marketplace.

Clear Cover Business Ratings & Consumer Reviews

| Agency | |

|---|---|

| Score: 835 / 1,000 Avg. Satisfaction |

|

| Score: A+ Excellent Business Practices |

|

| Score: 82/100 Positive Customer Feedback |

|

| Score: 0.45 Fewer Complaints Than Avg. |

|

| Score: A Excellent Financial Strength |

The exceptional scores in satisfaction, financial strength, and customer feedback illustrate these agencies' profound impact on the industry. Their ability to deliver consistent value through responsible business practices and reliable financial backing positions them as leaders in their field.

Read more: How to File an Auto Insurance Claim

Stop overpaying for auto insurance. Enter your ZIP code below to find out if you can get a better deal.

Frequently Asked Questions

Does Clearsurance offer other types of insurance?

Clearsurance only offers car insurance, though the company has partnered with Hippo to offer homeowners insurance. Delve deeper into our detailed guide titled, “How to Get a Homeowners Auto Insurance Discount.”

Is Clearcover insurance available in Utah?

Yes, Clearcover insurance is available to residents of Utah. If you’re looking to lower your auto insurance premiums, enter your ZIP code into our free quote comparison tool below to compare your rates against the top insurers.

What are Clearcover customer service hours?

Clearcover customer service is available 24/7 through their mobile app for claims and support.

How can I file a claim with Clearcover?

The best way to file an insurance claim with Clearcover is to use the company’s mobile app.

Can I manage my Clearcover Auto Insurance policy online?

Yes, Clearcover Auto Insurance provides an online platform and mobile app where you can manage your policy. You can access your policy documents, make payments, update your personal information, and handle other policy-related tasks conveniently. Find out more by reading our guide titled, “Do auto insurance companies check where you live?”

Are there any discounts available with Clearcover Auto Insurance?

Yes, Clearcover offers various discounts to help you save on your auto insurance. These discounts may include safe driver discounts, multi-car discounts, and discounts for bundling auto and home insurance policies.

What is the Clearcover insurance phone number?

The Clearcover insurance phone number is 855-444-1875.

Is Clearcover insurance good?

Yes, Clearcover insurance is known for its fast claims processing and user-friendly app, making it a good choice for tech-savvy drivers.

What states does Clearcover insurance cover?

Clearcover insurance is available in Alabama, Arizona, California, Georgia, Illinois, Indiana, Kentucky, Louisiana, Maryland, Mississippi, Missouri, Nebraska, Ohio, Oklahoma, Pennsylvania, Texas, Utah, Virginia, West Virginia, and Wisconsin. Discover more by checking out our guide titled, “Why does auto insurance vary from state to state?”

Does Clearcover offer roadside assistance?

Yes, Clearcover offers optional roadside assistance coverage for situations like flat tires, dead batteries, or lockouts.

Does Clearcover cover rental cars?

What is Clearcover’s A.M. Best rating?

What services are offered by Clearcover?

What is Clearcover insurance rating?

Does Clearcover offer home insurance?

How can I contact Clearcover insurance customer service?

Is Clearcover insurance available in California?

How can I make a Clearcover insurance payment?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.