10 Best Auto Insurance Companies in 2024

The best auto insurance companies are State Farm, Geico, and Progressive, with State Farm offering average rates as low as $76 per month. These top-rated auto insurance companies offer excellent coverage options and customer service. They also offer ways to save with ample discounts and robust UBI programs.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Kalyn Johnson

Insurance Claims Support & Sr. Adjuster

Kalyn grew up in an insurance family with a grandfather, aunt, and uncle leading successful careers as insurance agents. She soon found she has similar interests and followed in their footsteps. After spending about ten years working in the insurance industry as both an appraiser dispatcher and a senior property claims adjuster, she decided to combine her years of insurance experience with another...

Insurance Claims Support & Sr. Adjuster

UPDATED: Apr 8, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Apr 8, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

17,754 reviews

17,754 reviewsCompany Facts

Avg. Monthly Rate

A.M. Best Rating

Complaint Level

Pros & Cons

17,754 reviews

17,754 reviews 19,116 reviews

19,116 reviewsCompany Facts

Avg. Monthly Rate

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 13,126 reviews

13,126 reviewsCompany Facts

Avg. Monthly Rate

A.M. Best Rating

Complaint Level

Pros & Cons

13,126 reviews

13,126 reviewsState Farm, Geico, and Progressive take our top spots for the best auto insurance companies because they offer diverse coverage options, low rates, and solid customer service.

While doesn’t always have the cheapest auto insurance, State Farm is the overall best of the major auto insurance companies. State Farm has the highest-rated auto insurance because of its extensive network of agents, diverse coverage options, and the Drive Safe and Save program.

| Company | Rank | A.M. Best | NAIC Rating | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | A++ | 1.18 | Local Agents | State Farm | |

| #2 | A++ | 1.23 | Affordable Rates | Geico | |

| #3 | A+ | 1.45 | Tight Budgets | Progressive | |

| #4 | A+ | 2.7 | UBI Savings | Allstate | |

| #5 | A++ | 2.77 | Military Families | USAA | |

| #6 | A | 2.66 | Customizable Coverage | Liberty Mutual |

| #7 | A+ | 0.65 | Personalized Service | Nationwide |

| #8 | A | 0.73 | Discount Options | Farmers | |

| #9 | A++ | 0.11 | Safe Drivers | Travelers | |

| #10 | A | 0.43 | Customer Service | American Family |

Read on to explore the top-rated auto insurance companies and what they offer you. Then, use our free quote comparison tool to compare multiple companies and find the best rates for your needs.

- State Farm, Geico, and Progressive are the top auto insurers in America

- The best insurance includes low rates, discounts, and ample coverage options

- Compare car insurance quotes to find the best policy for your vehicle

#1 – State Farm: Top Pick Overall

Pros

- Extensive network of local agents: State Farm has a huge network of local agents ready to help drivers.

- Discount availability: With 13 discounts, State Farm offers convenient options most drivers can take advantage of to save. Read our State Farm auto insurance review to explore discount options.

- Financial stability: State Farm auto insurance reviews get great financial ratings, meaning you won’t have to worry about claims being paid.

- Coverage options: State Farm offers plenty of add-ons to customize your policy with, including roadside assistance plans and rideshare insurance.

Cons

- Rates can be high: Drivers with low credit scores should compare State Farm insurance rates with other companies as they’ll likely find lower prices.

- Limited online tools: State Farm offers a more personalized touch to its insurance. While that’s great for drivers looking for a traditional insurance experience, it’s not ideal for people who prefer to do things online.

- Mixed reviews: Some drivers love their State Farm experience, while others complain about the customer service and claims resolution process.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

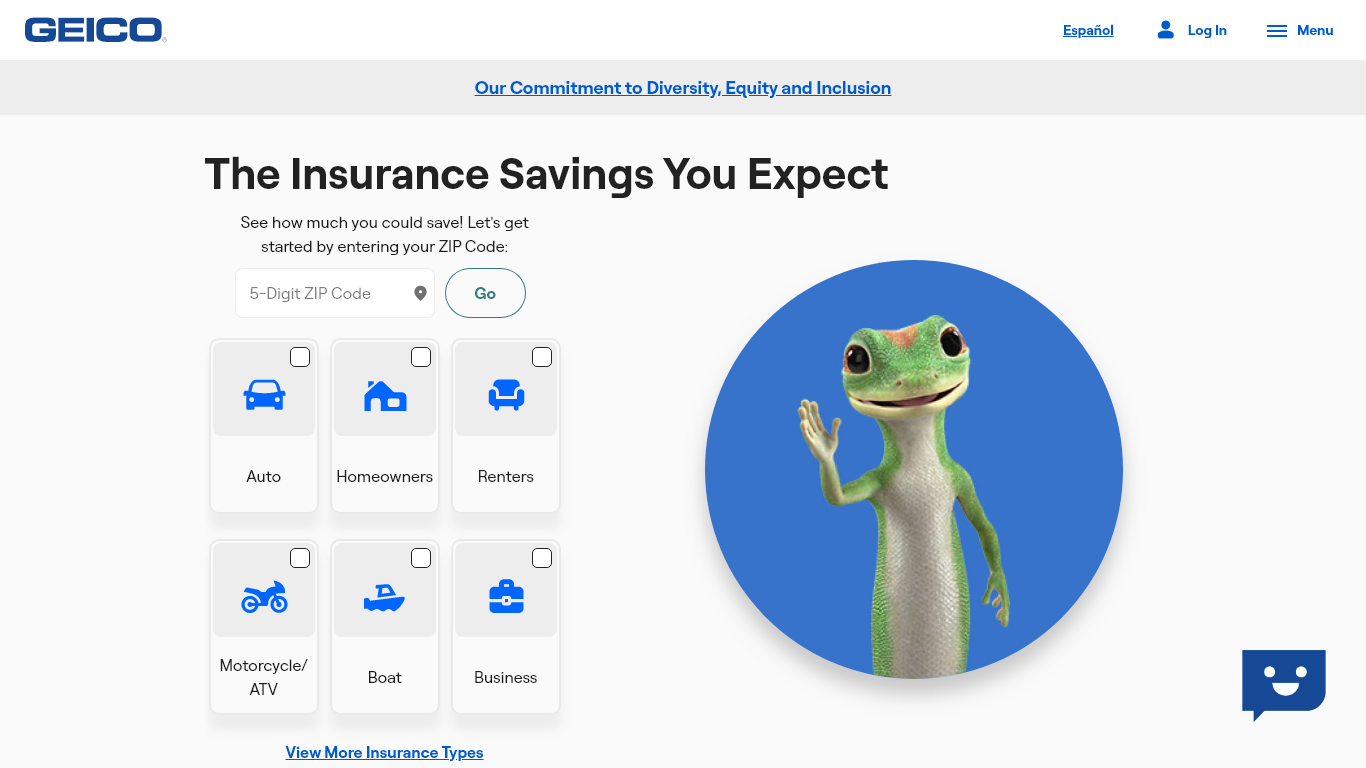

#2 – Geico: Best for Affordable Rates

Pros

- Convenient online tools: You can easily get quotes, sign up for coverage, manage your policy, and start claims on Geico’s website or mobile app.

- Affordable rates: Geico is a top-rated auto insurance company for many reasons, but one of the biggest is that it consistently offers low rates.

- Specialty discounts: Originally founded to provide car insurance for government employees, Geico offers specialty discounts for federal workers. Read about Geico’s other discounts in our Geico auto insurance review.

Cons

- Fewer local agents: Geico focuses more on its online experience, so drivers looking for person-to-person help will have a harder time getting in touch.

- High rates for high-risk drivers: Geico is usually affordable, but high-risk drivers will probably find better rates elsewhere.

#3 – Progressive: Best for Drivers on a Budget

Pros

- Snapshot: Safe drivers can save by signing up for Snapshot, Progressive’s UBI program.

- Name Your Price Tool: Enter your monthly insurance budget into Progressive’s Name Your Price tool to get a list of coverage options that fit.

- Low rates for high-risk drivers: High-risk drivers looking to save might find the lowest rates with Progressive.

- Loyalty discounts: Progressive offers increasing loyalty discounts, depending on how long you’ve been a customer. Learn about other discount options in our Progressive auto insurance review.

Cons

- Large rate increases after accidents: Most insurance companies increase rates after an at-fault accident, but the increase is more significant at Progressive.

- Snapshot can increase rates: Unlike many UBI programs, Snapshot can increase your insurance rates if you don’t drive safely.

#4 – Allstate: Best for UBI Savings

Pros

- Drivewise: Drivewise can save you up to 40% on your insurance. Read our Allstate Drivewise review to see if it’s a good fit for your driving. Alternatively, low-mileage drivers should explore our Allstate Milewise review.

- Wide network of agents: Allstate has one of the largest networks of local agents in the country, meaning it’s easy to find help when you need it.

- Extra coverage options: You’ll have plenty of customization options when you shop at Allstate. Explore what Allstate offers in our Allstate auto insurance review.

Cons

- Higher rates: Allstate car insurance rates are typically more expensive than many of its competitors.

- Below-average customer ratings: Although it’s one of the largest insurance providers in the country, Allstate insurance reviews score below the national average.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#5 – USAA: Best for Military Members

Pros

- Low rates: Regardless of where you live, USAA is almost always the cheapest insurance option. Learn how USAA offers such low rates in our USAA auto insurance review.

- Specialized coverage: USAA’s purpose is serving military members and their families. To that aim, USAA offers special coverage and discounts meant specifically for the military.

- Superior customer service: USAA consistently receives high marks for its customer service experience.

Cons

- Membership eligibility: Only active and retired military members and their families are eligible for USAA membership.

- Limited discounts: USAA offers fewer discounts than many of its competitors.

#6 – Liberty Mutual: Best for Customizable Coverage

Pros

- Unique coverage options: Liberty Mutual offers a variety of ways to customize your coverage, including better car replacement and original parts replacement. Explore other coverage options with our Liberty Mutual auto insurance review.

- Excellent discounts: Liberty Mutual offers 17 ways to save on your insurance, including a hard-to-find alternative energy discount.

- Easy-to-use website: Many customers praise Liberty Mutual for making it easy and convenient to manage their policies online.

Cons

- Average customer service: Liberty Mutual’s customer reviews are mixed, with some complaining about their experiences with representatives.

- Rates can be high for some drivers: High-risk drivers will likely find cheaper rates with another company.

#7 – Nationwide: Best for Personalized Service

Pros

- On Your Side review: Car insurance can be confusing, but Nationwide has you covered with the On Your Side review. A representative will evaluate your current coverage once a year to make sure you’re not paying for insurance you don’t need.

- Vanishing Deductible: Nationwide offers the Vanishing Deductible program, which reduces your deductible by $100 for every year you spend claims-free.

- Plenty of discounts: Nationwide offers a respectable 11 discounts to help drivers save. Popular choices include safe driving and good student discounts.

Cons

- Limited availability: Despite its name, Nationwide does not sell insurance in all 50 states.

- Average rates: While Nationwide isn’t the most expensive option on the market, it’s also not the cheapest. See how much you might pay in our Nationwide auto insurance review.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#8 – Farmers: Best Discount Selection

Pros

- Signal app: Download the Signal app and enroll in this UBI program to save up to 30%.

- Impressive number of discounts: With a whopping 23 available discounts, Farmers offers a way for almost every driver to save.

- Excellent coverage options: If there’s room in your budget, Farmers offers a variety of optional coverages like customized equipment insurance.

Cons

- Not available in all states: Although it manages policies in all 50 states, you won’t be able to purchase new auto coverage in Florida.

- Lacking customer loyalty: Despite offering excellent coverage options, Farmers struggles to keep its customers. Read more customer reviews in our Farmers auto insurance review.

#9 – Travelers: Best for Safe Drivers

Pros

- IntelliDrive: Save up to 30% on your policy by signing up for IntelliDrive and regularly practicing safe driving habits.

- Flexible coverage options: There are plenty of ways to customize your Travelers policy, including rideshare and gap insurance. Explore all your add-on options in our Travelers auto insurance review.

- Claims Forgiveness: Travelers offer two add-ons that forgive at-fault accidents, which prevents your rates from increasing.

Cons

- Limited availability: Travelers is only available in 42 states.

- Average rates: Travelers’ insurance rates stay relatively close to the national average. It’s not the most expensive option, but you’ll also find cheaper rates elsewhere.

#10 – American Family: Best for Customer Service

Pros

- Excellent customer service: American Family has a reputation for providing excellent customer service.

- Bundling discounts: Earn a discount by purchasing other American Family products with your auto policy, like homeowners insurance.

- KnowYourDrive: Safe drivers can save up to 30% by enrolling in American Family’s KnowYourDrive program.

Cons

- Availability limited: American Family sells insurance in just 19 states. Find out if you can purchase a policy in your state in our American Family auto insurance review.

- Lacking online tools: American Family focuses more on the traditional method of selling insurance through representatives and lacks many of the online options its competitors offer.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Best Auto Insurance Companies Rates

While many factors affect which company has the best auto insurance, prices always play a significant role. Check below to see the average rates for minimum insurance from the most reputable car insurance companies.

| Insurance Company | 16-Year-Old Male With a Clean Record | 16-Year-Old Female With a Clean Record | 18-Year-Old Male With a Clean Record | 18-Year-Old Female With a Clean Record | 25-Year-Old Male With a Clean Record | 25-Year-Old Female With a Clean Record | 30-Year-Old Male With a Clean Record | 30-Year-Old Female With a Clean Record | 45-Year-Old Male With a Clean Record | 45-Year-Old Female With a Clean Record | 45-Year-Old Male With a DUI | 45-Year-Old Female With a DUI | 45-Year-Old Male With an Accident | 45-Year-Old Female With an Accident | 45-Year-Old Male With a Ticket | 45-Year-Old Female With a Ticket | 55-Year-Old Male With a Clean Record | 55-Year-Old Female With a Clean Record | 60-Year-Old Male With a Clean Record | 60-Year-Old Female With a Clean Record | 65-Year-Old Male With a Clean Record | 65-Year-Old Female With a Clean Record |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Allstate | $260 | $237 | $223 | $193 | $72 | $69 | $67 | $64 | $61 | $62 | $106 | $107 | $87 | $88 | $72 | $73 | $58 | $58 | $60 | $59 | $60 | $61 |

| American Family | $207 | $161 | $178 | $131 | $55 | $46 | $51 | $43 | $44 | $43 | $73 | $72 | $66 | $65 | $51 | $51 | $41 | $41 | $40 | $40 | $43 | $43 |

| Farmers | $317 | $317 | $271 | $258 | $68 | $66 | $64 | $61 | $53 | $53 | $74 | $74 | $76 | $77 | $66 | $66 | $50 | $50 | $50 | $47 | $52 | $52 |

| Geico | $125 | $114 | $107 | $93 | $35 | $36 | $32 | $32 | $30 | $30 | $82 | $83 | $50 | $50 | $39 | $39 | $28 | $28 | $29 | $28 | $30 | $30 |

| Liberty Mutual | $325 | $283 | $279 | $231 | $83 | $72 | $77 | $67 | $68 | $66 | $125 | $123 | $91 | $89 | $81 | $80 | $64 | $63 | $64 | $60 | $66 | $65 |

| Nationwide | $195 | $161 | $167 | $131 | $57 | $52 | $53 | $48 | $44 | $43 | $90 | $89 | $61 | $61 | $53 | $52 | $41 | $41 | $41 | $39 | $43 | $43 |

| Progressive | $327 | $308 | $281 | $251 | $54 | $52 | $50 | $48 | $39 | $41 | $52 | $55 | $69 | $73 | $52 | $55 | $37 | $39 | $36 | $35 | $38 | $41 |

| State Farm | $146 | $124 | $125 | $101 | $42 | $39 | $39 | $36 | $33 | $33 | $45 | $45 | $40 | $40 | $37 | $37 | $31 | $31 | $30 | $30 | $33 | $33 |

| Travelers | $362 | $274 | $310 | $223 | $44 | $40 | $40 | $37 | $37 | $37 | $78 | $78 | $53 | $53 | $51 | $50 | $35 | $35 | $35 | $35 | $37 | $36 |

| USAA | $102 | $96 | $88 | $78 | $32 | $30 | $30 | $28 | $22 | $22 | $41 | $41 | $29 | $30 | $25 | $26 | $21 | $21 | $21 | $21 | $22 | $22 |

Unsure about insurance requirements in your state? A representative at any of the best auto insurance companies will know exactly how much coverage you need to legally drive. However, you should consider more coverage if you can afford it - minimum insurance leaves your car unprotected.Kalyn Johnson Insurance Claims Support & Sr. Adjuster

Check below to compare full coverage rates from the best car insurance companies.

| Insurance Company | 16-Year-Old Male With a Clean Record | 16-Year-Old Female With a Clean Record | 18-Year-Old Male With a Clean Record | 18-Year-Old Female With a Clean Record | 25-Year-Old Male With a Clean Record | 25-Year-Old Female With a Clean Record | 30-Year-Old Male With a Clean Record | 30-Year-Old Female With a Clean Record | 45-Year-Old Male With a Clean Record | 45-Year-Old Female With a Clean Record | 45-Year-Old Male With a DUI | 45-Year-Old Female With a DUI | 45-Year-Old Male With an Accident | 45-Year-Old Female With an Accident | 45-Year-Old Male With a Ticket | 45-Year-Old Female With a Ticket | 55-Year-Old Male With a Clean Record | 55-Year-Old Female With a Clean Record | 60-Year-Old Male With a Clean Record | 60-Year-Old Female With a Clean Record | 65-Year-Old Male With a Clean Record | 65-Year-Old Female With a Clean Record |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Allstate | $638 | $608 | $519 | $448 | $190 | $181 | $176 | $168 | $160 | $162 | $270 | $270 | $225 | $228 | $188 | $190 | $152 | $153 | $154 | $150 | $157 | $158 |

| American Family | $509 | $414 | $414 | $305 | $147 | $124 | $137 | $116 | $117 | $115 | $194 | $192 | $176 | $174 | $136 | $135 | $111 | $109 | $105 | $104 | $114 | $113 |

| Farmers | $773 | $810 | $629 | $597 | $180 | $172 | $167 | $160 | $139 | $139 | $193 | $193 | $198 | $198 | $173 | $173 | $131 | $132 | $128 | $120 | $136 | $136 |

| Geico | $312 | $298 | $254 | $220 | $93 | $97 | $87 | $90 | $80 | $80 | $216 | $220 | $132 | $134 | $106 | $105 | $76 | $76 | $74 | $73 | $78 | $78 |

| Liberty Mutual | $785 | $723 | $626 | $626 | $215 | $187 | $200 | $174 | $174 | $171 | $313 | $309 | $234 | $231 | $212 | $208 | $165 | $162 | $159 | $148 | $170 | $167 |

| Nationwide | $476 | $411 | $387 | $303 | $150 | $136 | $136 | $124 | $115 | $113 | $237 | $234 | $161 | $159 | $137 | $135 | $109 | $107 | $104 | $99 | $112 | $111 |

| Progressive | $814 | $801 | $662 | $591 | $146 | $141 | $136 | $131 | $105 | $112 | $140 | $148 | $186 | $196 | $140 | $148 | $100 | $106 | $95 | $92 | $103 | $109 |

| State Farm | $349 | $311 | $284 | $229 | $111 | $101 | $103 | $94 | $86 | $86 | $112 | $112 | $102 | $102 | $96 | $96 | $82 | $82 | $76 | $76 | $84 | $84 |

| Travelers | $910 | $719 | $740 | $530 | $116 | $107 | $108 | $99 | $99 | $98 | $206 | $204 | $139 | $138 | $134 | $133 | $94 | $93 | $90 | $89 | $97 | $96 |

| USAA | $249 | $245 | $203 | $180 | $85 | $80 | $79 | $74 | $59 | $59 | $108 | $109 | $78 | $79 | $67 | $68 | $56 | $56 | $53 | $53 | $57 | $58 |

You’ll notice that there’s a significant price difference between minimum and full coverage insurance. While minimum insurance is your cheapest coverage option, experts agree that most drivers benefit from more protection.

The Best Auto Insurance Companies for Your Needs

The annual economic cost of car accidents in the United States is an estimated $242 billion. Here are a few relevant auto insurance statistics provided by the National Highway Traffic Safety Administration:

- Average automobile liability claim for property damage: $3,231

- Average liability claim for bodily injury: $15,443

- Average collision insurance claim: $3,144

- Average comprehensive insurance claim: $3,144

There are numerous auto insurance companies of varying types and sizes, so choosing the best insurance for a vehicle may be just as risky as driving without insurance.

It turns out that the best auto insurance companies from 2015 are still the leading insurance companies today. However, only 10 auto insurance companies dominate 72% of the national private passenger auto insurance market.

Even more unbelievable is that only four of these 10 auto insurance companies share 51% of the same market.

We aren’t here to tell you which company to choose, but we are here to inform you of nearly every aspect to consider when making your choice. For this reason, we list the companies in alphabetical order.

- Auto Insurance Company Reviews

- GM Auto Insurance Review (2024)

- Western Mass Auto Insurance Review (2024)

- Root Auto Insurance Review (2024)

- Insurify Auto Insurance Review (2024)

- American Auto Insurance Review (2024)

- Hugo Auto Insurance Review (2024)

- NYCM Auto Insurance Review (2024)

- Texas Farm Bureau Auto Insurance Review (2024)

- State Auto Insurance Review (2024)

- Mile Auto Insurance Review (2024)

- Freeway Auto Insurance Review (2024)

- CURE Auto Insurance Review (2024)

- TruStage Auto Insurance Review (2024)

- Kemper Auto Insurance Review (2024)

- Safety Auto Insurance Review (2024)

- Auto Insurance America Company Review (2024)

- The Hanover Car Insurance Review 2024

- NJM Car Insurance Review 2024

- Go Auto Insurance Review 2024

- Chubb Auto Insurance Review (2024)

- Fred Loya Auto Insurance Review (2024)

- Dairyland Auto Insurance Review (2024)

- MAPFRE Auto Insurance Review (2024)

- Wawanesa Auto Insurance Review (2024)

- Georgia Farm Bureau Auto Insurance Review (2024)

- Encompass Auto Insurance Review (2024)

- Bristol West Auto Insurance Review (2024)

- Country Financial Auto Insurance Review (2024)

- Shelter Auto Insurance Review (2024)

- Metromile Auto Insurance Review (2024)

- The Hartford Auto Insurance Review (2024)

- Liberty Mutual Auto Insurance Review (2024)

- National General Auto Insurance Review (2024)

- Erie Auto Insurance Review (2024)

- Costco Auto Insurance Review (2024)

- Auto-Owners Auto Insurance Review (2024)

- AAA Auto Insurance Review (2024)

- Mercury Auto Insurance Review (2024)

- Direct Auto Auto Insurance Review (2024)

- Progressive Auto Insurance Review (2024)

- The General Auto Insurance Review (2024)

- Amica Auto Insurance Review (2024)

- Best Mobile Apps for Auto Insurance (2024)

- Geico DriveEasy Review (2024)

- Meemic Auto Insurance Review (2024)

- Liberty Mutual App Review (2024)

- Does Geico offer gap insurance? (2024)

- Metropolitan Property and Casualty Auto Insurance Review (2024)

- Geico Defensive Driving Course Review (2024)

- Old Dominion Auto Insurance Review (2024)

- Navy Federal Auto Insurance Review (2024)

- GAINSCO Auto Insurance Review (2024)

- SECURA Auto Insurance Review (2024)

- Rivian Auto Insurance Review (2024)

- Inshur Auto Insurance Review (2024)

- Noblr Auto Insurance Review (2024)

- Clearcover Auto Insurance Review (2024)

- Oscar Auto Insurance Review (2024)

- Safeco RightTrack Review (2024)

- Farmers Signal Review (2024)

- USAA SafePilot Review (2024)

- Liberty Mutual RightTrack Review (2024)

- Centauri Auto Insurance Review (2024)

- Plymouth Rock Auto Insurance Review (2024)

- Dollar-a-Day Auto Insurance in New Jersey (2024)

- Sentry Auto Insurance Review (2024)

- National Union Auto Insurance Review (2024)

- Ohio Casualty Auto Insurance Review (2024)

- Ocean Harbor Auto Insurance Review (2024)

- IFA Auto Insurance Review (2024)

- National Casualty Auto Insurance Review (2024)

- Universal Auto Insurance Review (2024)

- Tri-State Auto Insurance Review (2024)

- Trumbull Auto Insurance Review (2024)

- Diamond Auto Insurance Review (2024)

- Axa Auto Insurance Review (2024)

- Imperial Auto Insurance Review (2024)

- IDS Auto Insurance Review (2024)

- PEMCO Auto Insurance Review (2024)

- Utica Mutual Company Auto Insurance Review (2024)

- MetLife Auto Insurance Review (2024)

- Kaiser Permanente Auto Insurance Review (2024)

- Equity Auto Insurance Review (2024)

- HSBC Auto Insurance Review (2024)

- Northwestern Mutual Auto Insurance Review (2024)

- Spartan Auto Insurance Review (2024)

- Maryland Casualty Auto Insurance Review (2024)

- Elephant Auto Insurance Review (2024)

- Tower Hill Auto Insurance Review (2024)

- AIG Auto Insurance Review (2024)

- Protective Auto Insurance Review (2024)

- Germania Auto Insurance Review (2024)

- Fremont Auto Insurance Review (2024)

- Essentia Auto Insurance Review (2024)

- Hastings Mutual Auto Insurance Review (2024)

- Say Auto Insurance Review (2024)

- Nationwide Auto Insurance Review (2024)

- Geico Auto Insurance Review (2024)

- American Automobile Auto Insurance Review (2024)

- Allmerica Financial Alliance Auto Insurance Review (2024)

- Country-Wide Auto Insurance Review (2024)

- AIS Auto Insurance Review (2024)

- Good2Go Auto Insurance Review (2024)

- Markel Auto Insurance Review (2024)

- USAA Auto Insurance Review (2024)

- Economy Premier Assurance Auto Insurance Review (2024)

- Mercer Auto Insurance Review (2024)

- Hiscox Auto Insurance Review (2024)

- AssuranceAmerica Auto Insurance Review (2024)

- Travelers Auto Insurance Review (2024)

- State Farm Auto Insurance Review (2024)

- Young America Auto Insurance Review (2024)

- UnitedHealthcare Auto Insurance Review (2024)

- MassMutual Auto Insurance Review (2024)

- Cigna Auto Insurance Review (2024)

- The Zebra Auto Insurance Review (2024)

- Hippo Auto Insurance Review (2024)

- Citizens Auto Insurance Review (2024)

- Lemonade Auto Insurance Review (2024)

- NerdWallet Auto Insurance Review (2024)

- Tesla Auto Insurance Review (2024)

- Voyage Auto Insurance Review (2024)

- Zurich Auto Insurance Review (2024)

- Wesco Auto Insurance Review (2024)

- Sompo Japan Auto Insurance Review (2024)

- Rodney D. Young Auto Insurance Review (2024)

- Praetorian Auto Insurance Review (2024)

- Old Republic Auto Insurance Review (2024)

- Ohio Security Auto Insurance Review (2024)

- National Assurance Auto Insurance Review (2024)

- Chartis Auto Insurance Review (2024)

- America First Auto Insurance Review (2024)

- UAIC Auto Insurance Review (2024)

- AIU Auto Insurance Review (2024)

- Responsive Auto Insurance Review (2024)

- LM General Auto Insurance Review (2024)

- ICM Insurance Company Auto Insurance Review (2024)

- Great Northern Auto Insurance Review (2024)

- First National Insurance Group Auto Insurance Review (2024)

- Everest Auto Insurance Review (2024)

- Clearwater Select Auto Insurance Review (2024)

- American States Preferred Auto Insurance Review (2024)

- American Economy Auto Insurance Review (2024)

- Centennial Auto Insurance Review (2024)

- Qualitas Compania de Seguros Auto Insurance Review (2024)

- General Security National Auto Insurance Review (2024)

- Economy Fire and Casualty Auto Insurance Review (2024)

- Berkley Insurance Company Auto Insurance Review (2024)

- The Standard Auto Insurance Review (2024)

- Sparta Auto Insurance Review (2024)

- Senate Auto Insurance Review (2024)

- United Security Auto Insurance Review (2024)

- Valley Forge Auto Insurance Review (2024)

- American Alternative Insurance Corporation (AAIC) Auto Insurance Review (2024)

- Aetna Auto Insurance Review (2024)

- National Motor Club Auto Insurance Review (2024)

- Meritplan Auto Insurance Review (2024)

- Security National Auto Insurance Review (2024)

- Santa Fe Auto Insurance Review (2024)

- OneBeacon Auto Insurance Review (2024)

- Infinity Auto Insurance Review (2024)

- US Agencies Direct Auto Insurance Review (2024)

- Metropolitan Lloyd’s Auto Insurance Review (2024)

- ACE Seguros Auto Insurance Review (2024)

- Global Auto Insurance Review (2024)

- Ag Workers Mutual Auto Insurance Review (2024)

- State National Auto Insurance Review (2024)

- Viking Auto Insurance Review (2024)

- TravCo Auto Insurance Review (2024)

- Peachtree Auto Insurance Review (2024)

- Ana Compania De Seguros Auto Insurance Review (2024)

- American Commerce Auto Insurance Review (2024)

- AA Auto Insurance Review (2024)

- Sagamore Auto Insurance Review (2024)

- Safeway Auto Insurance Review (2024)

- Worth Casualty Company Auto Insurance Review (2024)

- Unigard Auto Insurance Review (2024)

- Trustgard Auto Insurance Review (2024)

- SafeAuto Auto Insurance Review (2024)

- Colonial Penn Auto Insurance Review (2024)

- Omaha Indemnity Auto Insurance Review (2024)

- Ohio Indemnity Auto Insurance Review (2024)

- Occidental Auto Insurance Review (2024)

- Texas Farmers Auto Insurance Review (2024)

- Superior Auto Insurance Review (2024)

- Star Auto Insurance Review (2024)

- Response Auto Insurance Review (2024)

- Republic Auto Insurance Review (2024)

- Ranchers and Farmers Auto Insurance Review (2024)

- Plaza Company Auto Insurance Review (2024)

- Permanent General Auto Insurance Review (2024)

- Pennsylvania National Auto Insurance Review (2024)

- Peak Auto Insurance Review (2024)

- Omni Auto Insurance Review (2024)

- Northbrook Auto Insurance Review (2024)

- North American Auto Insurance Review (2024)

- NGM Auto Insurance Review (2024)

- New South Auto Insurance Review (2024)

- Netherlands Auto Insurance Review (2024)

- National Unity Auto Insurance Review (2024)

- National Specialty Auto Insurance Review (2024)

- National Continental Auto Insurance Review (2024)

- National Automotive Company Auto Insurance Review (2024)

- National American Auto Insurance Review (2024)

- Milemeter Auto Insurance Review (2024)

- Mid-Century Auto Insurance Review (2024)

- MIC General Auto Insurance Review (2024)

- MGA Auto Insurance Review (2024)

- Lone Star Auto Insurance Review (2024)

- KnightBrook Auto Insurance Review (2024)

- Kentucky National Auto Insurance Review (2024)

- Interinsurance Exchange Auto Insurance Review (2024)

- Integon Auto Insurance Review (2024)

- Hudson Insurance Group Auto Insurance Review (2024)

- Home State Auto Insurance Review (2024)

- Freedom Auto Insurance Review (2024)

- Foremost Auto Insurance Review (2024)

- First Nonprofit Auto Insurance Review (2024)

- Columbia Auto Insurance Review (2024)

- Evergreen Auto Insurance Review (2024)

- Heartland Auto Insurance Review (2024)

- HCC Auto Insurance Review (2024)

- Haulers Auto Insurance Review (2024)

- Hallmark Auto Insurance Review (2024)

- Guideone Auto Insurance Review (2024)

- Great West Auto Insurance Review (2024)

- Great Divide Auto Insurance Review (2024)

- Gateway Auto Insurance Review (2024)

- First Liberty Auto Insurance Review (2024)

- First Financial Auto Insurance Review (2024)

- Fireman’s Auto Insurance Review (2024)

- Financial Indemnity Auto Insurance Review (2024)

- Diamond State Auto Insurance Review (2024)

- Dealers Assurance Auto Insurance Review (2024)

- Consolidated Auto Insurance Review (2024)

- Cherokee Auto Insurance Review (2024)

- Armed Forces Auto Insurance Review (2024)

- Anthem Auto Insurance Review (2024)

- CEM Auto Insurance Review (2024)

- California Casualty Auto Insurance Review (2024)

- Bankers Auto Insurance Review (2024)

- American Standard Auto Insurance Review (2024)

- AutoOne Auto Insurance Review (2024)

- Anchor General Auto Insurance Review (2024)

- AmGUARD Auto Insurance Review (2024)

- Amex Auto Insurance Review (2024)

- American National Auto Insurance Review (2024)

- American Modern Auto Insurance Review (2024)

- American Manufacturers Auto Insurance Review (2024)

- American Interstate Auto Insurance Review (2024)

- American Hallmark Auto Insurance Review (2024)

- American Farmers and Ranchers Auto Insurance Review (2024)

- Berkshire Hathaway Auto Insurance Review (2024)

- American Casualty Auto Insurance Review (2024)

- American Bankers Auto Insurance Review (2024)

- American Access Auto Insurance Review (2024)

- AMCO Auto Insurance Review (2024)

- All American Auto Insurance Review (2024)

- Unitrin Direct Auto Insurance Review (2024)

- Safeco Auto Insurance Review (2024)

- Prudential Auto Insurance Review (2024)

- John Hancock Auto Insurance Review (2024)

- Hagerty Auto Insurance Review (2024)

- GMAC Auto Insurance Review (2024)

- Farmers Auto Insurance Review (2024)

- Humana Auto Insurance Review (2024)

- Farm Bureau Auto Insurance Review (2024)

- Esurance Auto Insurance Review (2024)

- Deerbrook Auto Insurance Review (2024)

- Blue Cross Blue Shield Auto Insurance Review (2024)

- Aflac Auto Insurance Review (2024)

- AARP Auto Insurance Program from The Hartford Review (2024)

- 21st Century Auto Insurance Review (2024)

- Conseco Auto Insurance Review (2024)

- American Family Auto Insurance Review (2024)

- Allstate Auto Insurance Review (2024)

- Allied Auto Insurance Review (2024)

- Allianz Auto Insurance Review (2024)

- ACE Auto Insurance Review (2024)

- Acuity Auto Insurance Review (2024)

- Access Auto Insurance Review (2024)

- Acceptance Auto Insurance Review (2024)

- Abba Auto Insurance Review (2024)

- Comparing Insurance Providers

- 10 Best Auto Insurance Companies According to Reddit in 2024

- AAA vs. AARP Auto Insurance (2024)

- AAA vs. State Farm Auto Insurance 2024

- AAA vs. Geico Car Insurance Comparison

- Esurance vs. Progressive Auto Insurance Comparison

- USAA vs. Geico Auto Insurance Comparison

- Esurance vs. Geico Auto Insurance Comparison

- Liberty Mutual vs. Geico Car Insurance Comparison

- Does my auto insurance cover rental cars? (2024)

- Progressive vs. Travelers Auto Insurance (2024)

- State Farm vs. USAA Auto Insurance (2024)

- Progressive vs. USAA Auto Insurance (2024)

- State Farm vs. Travelers Auto Insurance (2024)

- Geico vs. State Farm Auto Insurance (2024)

- Allstate vs. Travelers Auto Insurance (2024)

- Allstate vs. Liberty Mutual Auto Insurance (2024)

- Allstate vs. Progressive Auto Insurance (2024)

- Nationwide vs. State Farm Auto Insurance (2024)

- Nationwide vs. Progressive Auto Insurance (2024)

- Liberty Mutual vs. Travelers Auto Insurance (2024)

- Geico vs. Travelers Auto Insurance (2024)

- Farmers vs. State Farm Auto Insurance (2024)

- Liberty Mutual vs. State Farm Auto Insurance (2024)

- Liberty Mutual vs. Progressive Auto Insurance (2024)

- Liberty Mutual vs. Nationwide Auto Insurance (2024)

- Geico vs. USAA Auto Insurance (2024)

- Farmers vs. USAA Auto Insurance (2024)

- American Family vs. State Farm Auto Insurance (2024)

- American Family vs. Progressive Auto Insurance (2024)

- American Family vs. Geico Auto Insurance (2024)

- Farmers vs. Nationwide Auto Insurance (2024)

- Farmers vs. Geico Auto Insurance (2024)

- Allstate vs. Geico Auto Insurance (2024)

- Allstate vs. Farmers Auto Insurance (2024)

- State Farm vs. Allstate Auto Insurance (2024)

- Geico vs. Progressive Auto Insurance Review (2024)

- CVS Auto Insurance Review (2024)

Factors That Determine The Best Auto Insurance Company

Several factors determine the success of an auto insurance company. One definition of success is the length of time a company has been in business. Keep this in mind in our summaries of the top car insurance companies.

Another way to define the success of an insurance company is by how others rate them. Customer satisfaction is essential, especially for people changing from their current insurers.

After a long commitment to one car insurance company, you would expect quick and efficient service when you need it. After all, you are buying a service, and your insurer should make its service worth your time and money.

If you are involved in an accident, being put on hold for 10 minutes, or being told by a machine that an agent will get back to you as soon as possible, only to find they never take the call can be frustrating.

Each of the companies we cover below has excellent customer ratings, not just for auto insurance but for their other products.

Our third standard focuses on the companies with the highest market share, as those insurers consistently rank higher for customer service and claims paid. In addition, most insurance shoppers frequently overlook financial strength, which is a significant factor.

After all, signing up with a financially unstable company may mean that by the time you’re involved in an accident and file a claim, the company may be facing bankruptcy and be unable to pay out.

Finally, the cost of the policy is also a significant factor to consider. Review the rates we’ve provided to determine which companies offer lower rates than others. However, the only way you’ll know for sure is by seeking out an actual quote.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

The Best Auto Insurance Rates By Driver

Not just laws affect your rates; many companies offer better and more affordable coverage depending on many other factors.

The following sections will discuss national average monthly rates for the top 10 auto insurance companies based on demographics. If you are looking for the best coverage for drivers over 50 or the best coverage for younger drivers, we have that information below.

Now, let’s look at some of the best-ranked auto insurance companies.

- Best Auto Insurance by Drivers

- Best Auto Insurance for Good Drivers in 2024 (Top 10 Companies Ranked)

- Auto Insurance Rates for Married vs. Single Drivers

- 10 Best Auto Insurance Companies for Women (2024)

- Cheap Auto Insurance After a DUI in 2024 (Top 10 Low-Cost Companies)

- Best Auto Insurance for New Drivers in 2024 (Find the Top 9 Providers Here)

- Best Auto Insurance for Amputees in 2024 (Our Top 8 Picks)

- Best Auto Insurance for Low-Income Drivers in 2024 (Our Top 10 Picks)

- Cheap Auto Insurance for Low-Income Families in 2024 (Save With These 10 Companies!)

- 10 Best Auto Insurance Companies for Drivers With Bad Credit (2024)

- 8 Best Auto Insurance Companies for Drivers With Speeding Tickets (2024)

- 10 Best Auto Insurance Companies for High-Risk Drivers in 2024

- 10 Best Auto Insurance Companies for College Students in 2024

- Best Auto Insurance for Military Families and Veterans in 2024 (Our Top 10 Companies Ranked)

- 10 Best Auto Insurance Companies for Married Couples in 2024

- 10 Best Auto Insurance Companies for Telecommuters in 2024

- 10 Best Eco-Friendly Auto Insurance Companies in 2024

- Best Auto Insurance for Cancer Patients in 2024 (Our Top 10 Picks)

- Best Auto Insurance for Millennials in 2024 (Find the Top 10 Providers Here)

- Best Auto Insurance for the Wealthy in 2024 (Save With These 10 Companies)

- Cheap Auto Insurance for Families With Multiple Drivers in 2024 (Save With These 8 Companies!)

- Cheap Auto Insurance for Learner’s Permit Drivers in 2024 (Save With These 10 Companies!)

- Cheap Auto Insurance for Infrequent Drivers in 2024 (Top 9 Low-Cost Companies)

- Auto Insurance for Different Types of Drivers (2024)

- Best Auto Insurance for Drivers With Multiple Sclerosis in 2024 (Our Top 8 Companies Ranked)

- Cheap Auto Insurance for Volunteers in 2024 (Save With These 8 Companies!)

- Best Auto Insurance for Immigrants in 2024 (Our Top 10 Picks)

- Best Auto Insurance for Drivers with Dementia in 2024 (10 Expert Favorites)

- 8 Best Auto Insurance Companies for Impaired Drivers in 2024

- Cheap Auto Insurance for Temporary Residents (2024)

- Cheap Auto Insurance When Homeless in 2024 (Save With These 10 Companies!)

- Cheap Auto Insurance for Graduate Students in 2024 (Find the Top 10 Providers Here)

- Cheap Auto Insurance for Single Moms in 2024 (Save With These 8 Companies!)

- Best Auto Insurance for Drivers with Epilepsy in 2024 (Top 10 Companies)

- Cheap Auto Insurance for Disabled Drivers in 2024

- Cheap Auto Insurance for Teens of Divorced Parents in 2024 (Top 9 Companies Ranked)

- Best Auto Insurance for a Student Away at College in 2024 (Big Savings With These 8 Companies)

- Best Auto Insurance for International Drivers in 2024 (Save With These 10 Companies)

- Cheap Auto Insurance for SSI Recipients in 2024 (Save With These 8 Companies!)

- Cheap Auto Insurance for Snowbirds in 2024

- Best Auto Insurance for Unmarried Couples 2024 (Top 8 Companies Ranked)

- Best Auto Insurance When You Drive for Work

- Is it possible to have a rideshare car rental?

- What are the Lyft vehicle requirements?

- What are the Uber car requirements?

- Marco’s Pizza Auto Insurance: Rates & Requirements (2024)

- Papa Gino’s Pizzeria Auto Insurance: Rates & Requirements (2024)

- Hungry Howie’s Pizza Auto Insurance: Rates & Requirements (2024)

- Godfather’s Pizza Auto Insurance: Rates & Requirements (2024)

- Auto Insurance for Charities (2024)

- DoorDash Auto Insurance: Rates & Requirements (2024)

- Instacart Auto Insurance: Rates & Requirements (2024)

- Uber Eats Auto Insurance: Rates & Requirements (2024)

- EatStreet Auto Insurance: Rates & Requirements (2024)

- Papa John’s Auto Insurance: Rates & Requirements (2024)

- Cheap Taxi Auto Insurance in 2024

- FreshDirect Auto Insurance: Rates & Requirements (2024)

- Shipt Auto Insurance: Rates & Requirements (2024)

- Walmart Delivery Auto Insurance: Rates & Requirements (2024)

- Panera Bread Auto Insurance: Rates & Requirements (2024)

- Jimmy John’s Auto Insurance: Rates & Requirements (2024)

- Pizza Hut Auto Insurance: Rates & Requirements (2024)

- Domino’s Pizza Auto Insurance: Rates & Requirements (2024)

- Bite Squad Auto Insurance: Rates & Requirements (2024)

- Postmates Auto Insurance: Rates & Requirements (2024)

- Caviar Courier Auto Insurance: Rates & Requirements (2024)

- Amazon Flex Auto Insurance: Rates & Requirements (2024)

- GrubHub Auto Insurance: Rates & Requirements (2024)

- Best Auto Insurance for Dealerships in 2024 (Top 10 Companies Ranked)

- Best Rideshare Auto Insurance in 2024 (Find the Top 10 Providers Here)

- Best Auto Insurance by Occupation

- Best Auto Insurance for First Responders in 2024 (Our Top 10 Picks)

- Best Auto Insurance for Firefighters (Our Top 9 Picks for 2024)

- Cheap Foster Care Auto Insurance in 2024 (Save With These 10 Companies!)

- Best Auto Insurance for Real Estate Agents in 2024 (Top 8 Companies Ranked)

- Cheap Auto Insurance for Postal Employees in 2024 (Big Savings With These 9 Companies!)

- Best Auto Insurance for Engineers in 2024 (Top 9 Companies Ranked)

- Best Auto Insurance for Nurses in 2024 (Save With These 8 Companies)

- Best Auto Insurance for Diplomats in 2024 (Your Guide to The Top 8 Providers)

- Best Auto Insurance for Federal Employees in 2024 (Top 10 Companies Ranked)

- Best Auto Insurance for Emergency Service Workers (EMS) in 2024 (Top 10 Companies Ranked)

- Cheap Auto Insurance for Mechanics in 2024 (Big Savings With These 8 Companies!)

- Cheap Auto Insurance for Government Employees in 2024 (Big Savings With These 10 Companies!)

- Cheap Auto Insurance for Home Care Workers in 2024 (Save With These 10 Companies!)

- Cheap Auto Insurance for Union Members in 2024 (10 Most Affordable Companies)

- Best Auto Insurance for Law Enforcement in 2024 (Big Savings With These 9 Companies!)

- Best Auto Insurance for Retirees in 2024 (Top 8 Companies Ranked)

- Best Auto Insurance for Doctors (2024)

- Cheap Auto Insurance for Bus Drivers in 2024 (Save With These 9 Companies!)

- Best Auto Insurance for Clergy in 2024 (Our Top 8 Picks)

- 8 Best Auto Insurance Companies for State Employees in 2024

- Best Auto Insurance for Social Workers in 2024 (Save Big With These 10 Companies!)

The Best Auto Insurance Rates by Gender

Statistically, males are more likely to take risks than females. For that reason, they typically see higher car insurance rates.

The following table compares the average annual rates from the top 10 auto insurance companies by gender. We have removed teenage drivers from the table below since their age heavily influences their rates rather than gender. Find out about male and female auto insurance rates below.

| Age and Gender | Minimum Coverage | Full Coverage |

|---|---|---|

| 16-Year-Old Female | $220 | $566 |

| 16-Year-Old Male | $252 | $618 |

| 30-Year-Old Female | $49 | $128 |

| 30-Year-Old Male | $53 | $139 |

| 45-Year-Old Female | $46 | $119 |

| 45-Year-Old Male | $45 | $119 |

| 55-Year-Old Female | $43 | $113 |

| 55-Year-Old Male | $43 | $113 |

| 65-Year-Old Female | $45 | $117 |

| 65-Year-Old Male | $45 | $117 |

All but two companies charge from $3 to $23 more monthly to insure a male driver than a female driver.

Progressive charges pennies more for females than males. Surprisingly, Geico charges almost $2 a month more for females. Add Geico to your list if you’re a male and you’re worried about your gender affecting your auto insurance rates.

Remember that some states have already outlawed auto insurance rates based on gender:

- California, Hawaii, Massachusetts, Montana, Pennsylvania, North Carolina, and Michigan have barred auto insurance companies from determining rates based on gender. (Read More: Auto Insurance Companies Pulling Out of California)

- Montana was one of the first states to outlaw determining rates based on gender and marital status. The law came into effect in 1985.

- In July 2020, Michigan passed a new law prohibiting insurance carriers from determining rates based on anything but driving record, age, vehicle a driver chooses to drive, and location.

Keep a close eye on your state legislation because it may not be too long before other states start to follow suit.

The Best Auto Insurance Rates by Marital Status

Getting married can lower your auto insurance rates. The savings come from bundling multiple policies or adding more than one vehicle to the same auto insurance policy.

In the table below, we compare average monthly rates from the top 10 companies based on marital status. Once again, we removed teenage drivers from the table below since their age more heavily influences their rates than their marital status.

| Insurance Company | Single Adult | Married Adult |

|---|---|---|

| Allstate | $291 | $125 |

| American Family | $208 | $165 |

| Farmers | $250 | $176 |

| Geico | $193 | $177 |

| Liberty Mutual | $353 | $177 |

| Nationwide | $232 | $189 |

| Progressive | $227 | $191 |

| State Farm | $204 | $206 |

| Travelers | $201 | $254 |

| U.S. Average | $233 | $197 |

If you are single, Geico, Travelers, and USAA provide the best rates. If you are married, then Allstate, American Family, and Farmers provide the best rates.

Interestingly, not all companies give married couples a break. Drivers who get married while holding a policy with State Farm, Travelers, and USAA will see an increase in auto insurance rates.

Geico and State Farm have very similar rates for single and married people, with a difference of as little as $2 a month.

Read More: Best Insurance Providers for Married Couples

The Best Auto Insurance Rates by Credit Score

Depending on your state, your credit score might heavily impact your auto insurance rates. People with poor credit sometimes pay two to three times more than people with good credit.

Ultimately, you will be the one to decide which car insurance company best serves your needs. However, to help you make that choice, you may first need to determine the target audience for each company. To that end, we’ve gathered pertinent data about each of the top 10 companies.

Find out which of the top 10 insurance providers care the most about your credit score by looking at the rates below.

| Company | Good Credit | Fair Credit | Bad Credit |

|---|---|---|---|

| AAA | $135 | $165 | $245 |

| Allstate | $166 | $197 | $296 |

| American Family | $116 | $136 | $203 |

| Farmers | $140 | $161 | $269 |

| Geico | $82 | $100 | $148 |

| Hartford | $120 | $155 | $230 |

| Liberty Mutual | $177 | $226 | $355 |

| Nationwide | $120 | $133 | $166 |

| Progressive | $109 | $138 | $206 |

| State Farm | $91 | $118 | $200 |

| Travelers | $107 | $128 | $194 |

| U.S. Average | $123 | $148 | $226 |

You will have a rate based on your credit score when you purchase your first policy, and this rate may change in the future if your credit score dips or improves.

For this reason, we have looked at the jump in rates from good credit to fair credit and from fair credit to poor credit.

Farmers, Progressive, and Travelers are the most forgiving of drivers who move from a good credit score to a fair one.

Progressive, Nationwide, and Travelers are the most forgiving for drivers who move from a fair credit score to a poor credit score. So if your credit isn’t the best, Progressive may be your best bet.

Read More: Best Auto Insurance Companies That Don’t Check Credit.

The Best Auto Insurance Rates by Driving Record

If there’s one factor that insurance companies can use in determining rates that is non-discriminatory, it’s your driving record.

Suppose you are a dangerous driver who’s caused multiple accidents or committed numerous traffic violations. In that case, you’ll be considered a high-risk driver and receive auto insurance rates higher than average.

Look at the table below to see how the top 10 insurance companies weigh various traffic violations against your auto insurance rates.

| Insurance Company | One Ticket | Clean Record | One DUI | One Accident |

|---|---|---|---|---|

| Allstate | $195 | $166 | $303 | $237 |

| American Family | $131 | $116 | $177 | $167 |

| Cure | $139 | $111 | $201 | $175 |

| Farmers | $176 | $140 | $191 | $199 |

| Liberty Mutual | $217 | $177 | $325 | $237 |

| Nationwide | $145 | $120 | $252 | $165 |

| Progressive | $143 | $109 | $147 | $190 |

| State Farm | $102 | $91 | $124 | $107 |

| Travelers | $148 | $107 | $230 | $157 |

| U.S. Average | $152 | $123 | $218 | $177 |

When you purchase your first six-month policy, your rates are based on your driving record when getting the policy.

If you already have a driving record with a speeding ticket, American Family, Geico, or USAA are your best bets.

Geico, State Farm, and USAA have better rates for those with an accident, and Progressive, State Farm, and USAA have better auto insurance rates for drivers with a DUI.

The Best Auto Insurance Rates by Commute

The more you drive, the more your chance of getting into a car accident increases. If you regularly drive during hectic times of the day, like rush hour, this might impact your auto insurance rates.

Driving less than average can help you save money and qualify for low-mileage discounts. However, driving more than average could lead to higher overall rates.

In commute distance, a shorter commute is considered 10 miles or 6,000 miles per year. A long commute is considered 25 miles or 12,000 miles per year.

Although the monthly increase is typically small for longer commutes, your drive time does raise your rates. For example, Farmers, Progressive, and Nationwide have the smallest rate jump at less than $3 monthly between short and long commutes.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

The Best Auto Insurance Companies for Teens

Now, let’s look at how much auto insurance from the top 10 auto insurance companies will cost a teenager or a driver under 25. Again, young drivers get charged the most for auto insurance.

Not only do insurers equate age with driving experience, but fatal crash statistics back up this claim.

With that in mind, see the average rates teenagers pay monthly for auto insurance with the top 10 companies in the table below.

| Company | Teen Only | Teen Added |

|---|---|---|

| Allstate | $638 | $538 |

| American Family | $509 | $180 |

| Farmers | $773 | $315 |

| Geico | $312 | $304 |

| Liberty Mutual | $785 | $255 |

| Nationwide | $476 | $259 |

| Progressive | $814 | $375 |

| State Farm | $349 | $218 |

| Travelers | $910 | $538 |

| U.S. Average | $618 | $271 |

On a national level, Geico, Nationwide, and USAA are some of the best auto insurance companies for young drivers since they charge the least for their rates.

The Best Auto Insurance Rates for Young Drivers

Moving on to drivers in their 20s and 30s, you’ll see a substantial decrease in these auto insurance rates. Although, drivers in this age group are the most likely to need comprehensive coverage.

Check out the average monthly rates from the top providers for drivers in their 20s and 30s in the table below.

| Insurance Company | 25-34 Year Old Female | 25-34 Year Old Male |

|---|---|---|

| Allstate | $285 | $298 |

| American Family | $191 | $225 |

| Farmers | $246 | $253 |

| Geico | $198 | $189 |

| Liberty Mutual | $330 | $375 |

| Nationwide | $224 | $241 |

| Progressive | $225 | $230 |

| State Farm | $195 | $213 |

| Travelers | $194 | $208 |

| USAA | $166 | $177 |

| U.S. Average | $225 | $241 |

On a national level, Geico, Travelers, and USAA charge the least for covering single drivers in their mid-20s to mid-30s.

The Best Auto Insurance Rates for Mature Drivers

If you’re between 30 and 50, you’re getting some pretty competitive average rates. In fact, your rates will likely be slightly lower than drivers in their 20s.

In the table below, check out the average monthly rates from the top providers for drivers in their 30s through their 50s.

| Insurance Company | Married 35-59 Year Old Female | Married 35-59 Year Old Male |

|---|---|---|

| Allstate | $263 | $260 |

| American Family | $184 | $185 |

| Farmers | $213 | $213 |

| Geico | $192 | $193 |

| Liberty Mutual | $317 | $321 |

| Nationwide | $197 | $199 |

| Progressive | $191 | $181 |

| State Farm | $173 | $173 |

| Travelers | $182 | $183 |

| USAA | $129 | $128 |

| U.S. Average | $204 | $204 |

On a national level, State Farm, Travelers, and USAA charge the least for covering drivers in their mid-30s until age 60.

The Best Auto Insurance Rates for Senior Drivers

If you’re in your 60s, you’re probably paying some of the lowest auto insurance rates in the country.

See how much auto insurance costs monthly on average for drivers older than 60 in the table below.

| Insurance Company | 60-Year-Old Female | 60-Year-Old Male |

|---|---|---|

| Allstate | $243 | $249 |

| American Family | $166 | $168 |

| Farmers | $195 | $204 |

| Geico | $187 | $190 |

| Liberty Mutual | $287 | $307 |

| Nationwide | $178 | $185 |

| Progressive | $166 | $171 |

| State Farm | $156 | $156 |

| Travelers | $171 | $173 |

| USAA | $121 | $121 |

| U.S. Average | $187 | $192 |

On a national level, American Family, State Farm, and USAA charge the least for covering drivers 60 and older.

Read More: Cheap Auto Insurance for Drivers Over 80

The Best Auto Insurance Companies by Vehicle

The type of car you drive will influence your auto insurance rates. Like luxury SUVs, vehicles that are more expensive to repair or replace almost always cost more to insure than economy sedans.

Similarly, some car models are more likely to be stolen than others. Like sports cars, some vehicles are considered high risk because the temptation to drive recklessly is just too strong.

The cheapest vehicles to insure will be safe, reliable, and relatively inexpensive to fix or replace. See more details about average monthly auto insurance rates based on car models from the top 10 insurance providers in the table below.

| Vehicle | Rates |

|---|---|

| Minivan | $111 |

| SUV | $125 |

| Sedan | $142 |

| Pickup Truck | $167 |

On a national level, Geico, State Farm, and USAA charge the least for used and new sedans and used SUVs and trucks. Also, car insurance rates on used vehicles are lower than for new cars.

However, the companies that provide the best rates for a new SUV and a new truck are Geico, Nationwide, and USAA. In addition, USAA auto insurance is consistently among the most affordable, though exclusive.

- Best Auto Insurance by Vehicle Type

- Best Auto Insurance for Used Cars (2024)

- Compare Auto Insurance Rates by Vehicle Make and Model

- Best Auto Insurance for Leased Vehicles in 2024 (Your Guide to the Top 10 Providers)

- Best Auto Insurance Companies for Modified Cars (2024)

- Cheap Tesla Auto Insurance in 2024 (Save Money With These 10 Companies)

- Best Auto Insurance for Sports Cars in 2024 (Find the Top 10 Companies Here!)

- Best Auto Insurance for Supercars in 2024

- Auto Insurance for Exotic Vehicles (2024)

- Auto Insurance for Off-Road Vehicles (2024)

- Cheap Auto Insurance for Older Vehicles in 2024 (Save With These 8 Companies!)

- Best Parked Car Insurance in 2024

- Auto Insurance for Custom Vehicles (2024)

- Cheap Auto Insurance for Smart Cars in 2024 (Your Guide to the Top 10 Providers)

- Best Auto Insurance for Wheelchair-Accessible Vehicles in 2024

- Cheap Auto Insurance for Vans in 2024

- Best Auto Insurance for Luxury Cars in 2024

- Auto Insurance for Convertibles (2024)

- Auto Insurance for Turbocharged Vehicles (2024)

- Does my car qualify for classic auto insurance? (2024)

- Cheap Auto Insurance for Rebuilt or Salvage Title Vehicles in 2024

- Best Auto Insurance for Limousines in 2024

- Best Auto Insurance for Trucks (2024)

- Best Auto Insurance for Hybrid Vehicles in 2024 (Your Guide to the Top 10 Companies)

- Best Auto Insurance Companies for Classic Cars (2024)

- Nissan Leaf vs. Toyota Prius [Infographic]

The Best Auto Insurance Companies by Coverage Level

You may ask yourself, “Should I try to find affordable auto insurance or the best coverage?” After an accident, a policyholder with insufficient coverage will have to pay for losses above the payout limits. This is a spot in which you do not want to be.

The Insurance Institute for Highway Safety tracks all accident and repair statistics and reports them as insurance loss ratios. A visit to the website will reveal the perceived risk of driving each vehicle’s make and model. Some cars do not perform well in crashes.

In addition, expensive vehicles cost more to repair or replace, and insurance companies charge more to insure them.

Auto insurance coverage levels refer to the differences in the cost of coverage based on the minimum requirements (low coverage), slightly above the minimum (medium coverage), and well above the minimum (high coverage).

Below, you will find the monthly rates from the top 10 insurance providers based on coverage levels.

| Coverage | Rates |

|---|---|

| Low | $313 |

| Medium | $330 |

| High | $345 |

American Family, Nationwide, and USAA provide value regarding coverage, whether you are going from low to medium coverage, medium to high coverage, or low to high coverage.

While full coverage auto insurance is more expensive, it provides the best protection and saves you from substantial out-of-pocket expenses.

- Best Auto Insurance by Policy Type

- Auto Insurance for the Summer Months (2024)

- Cheap Auto Insurance After an Accident in 2024

- Cheap Auto Insurance With No Down Payment in 2024 (Save With These 10 Companies!)

- Best Property Damage Liability (PDL) Auto Insurance Companies

- 8 Best Commercial Truck Insurance Companies (2024)

- Best Companies for Bundling Home and Auto Insurance (2024)

- Best Auto Insurance Companies That Offer Grants (2024)

- Best Auto Insurance Companies That Offer Agreed Value (2024)

- Best Auto Insurance Companies That Offer Cash Back for Safe Drivers (2024)

- 9 Best Auto Insurance Companies That Take Salvage Titles (2024)

- Best Auto Insurance Companies That Don’t Check Accidents Reported by CARFAX (2024)

- Best Auto Insurance Companies That Offer OEM Parts Coverage (2024)

- Best Uninsured and Underinsured Motorist (UM/UIM) Coverage in 2024 (Top 9 Companies)

- 8 Best Auto Insurance Companies That Don’t Ask for Your SSN (2024)

- Best Auto Insurance Companies That Don’t Require Proof of Garaging (2024)

- Best Auto Insurance Companies That Don’t Require Prior Insurance (2024)

- Best Auto Insurance Without Penalties for No-Fault Accidents in 2024 (Your Guide to the Top 8 Providers)

- 8 Best Auto Insurance Companies That Don’t Penalize for a Lapse in Coverage (2024)

- Best Auto Insurance Companies That Don’t Require Vehicle Inspection (2024)

- Best Auto Insurance Companies That Don’t Use the CCC Car Value (2024)

- Best Auto Insurance Companies That Pay Dividends to Policyholders (2024)

- Best Auto Insurance Companies for Accident Forgiveness (2024)

- Best Auto Insurance Companies That Don’t Penalize for Speeding Tickets (2024)

- 9 Best Auto Insurance Companies That Don’t Use Credit Scores (2024)

- Best Auto Insurance Companies That Don’t Raise Rates After a Claim (2024)

- 8 Best Auto Insurance Companies That Don’t Lobby (2024)

- Best Auto Insurance Companies That Use LexisNexis (2024)

- 10 Best Auto Insurance Companies for Paying Claims (2024)

- 8 Best Auto Insurance Companies That Don’t Sell Your Information (2024)

- 10 Best Comprehensive Auto Insurance Companies in 2024

- Best States for Affordable DUI Auto Insurance (2024)

- 8 Best Auto Insurance Companies for Multiple Vehicles (2024)

- Cheap 2-Month Auto Insurance in 2024 (Save Big With These 9 Companies!)

- Cheap Auto Insurance for Driving Tests in 2024 (Save Money With These 10 Companies!)

- Cheap Auto Insurance for a Bad Driving Record in 2024 (Save Big With These 9 Companies!)

- Best Track Day Auto Insurance in 2024

- Best International Car Shipping Auto Insurance in 2024 (See the Top 7 Providers)

- Best Two-Day Auto Insurance in 2024

- Two-Week Auto Insurance (2024)

- Best Auto Insurance for Limited-Use Vehicles (2024)

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

The Best Auto Insurance Companies by Region

If you plan to move to a new state, these tables may help. When moving to a different state, your current carrier may not have the best car insurance rates, even within the same region.

In some cases, neighboring states have much cheaper auto insurance. As a result, moving there and commuting to work or riding the subway may be more feasible.

We’ve broken down the 50 states into regions so you can take a quick look at the average rate of your current (or future) insurance company.

Midwest

Let’s start with the Midwest. Find your state in the table below and see which company offers competitive rates near you.

| State | Allstate | Farmers | Geico | Liberty Mutual | Progressive | State Farm |

|---|---|---|---|---|---|---|

| Illinois | $176 | $117 | $47 | $76 | $89 | $64 |

| Indiana | $140 | $79 | $63 | $183 | $69 | $71 |

| Iowa | $126 | $82 | $81 | $116 | $75 | $65 |

| Kansas | $160 | $144 | $75 | $174 | $127 | $81 |

| Michigan | $406 | $335 | $99 | $424 | $152 | $209 |

| Minnesota | $160 | $108 | $90 | $375 | $101 | $67 |

| Missouri | $148 | $135 | $90 | $129 | $98 | $85 |

| Nebraska | $125 | $130 | $92 | $179 | $95 | $69 |

| North Dakota | $136 | $107 | $61 | $398 | $110 | $76 |

| Ohio | $120 | $96 | $59 | $106 | $85 | $70 |

| South Dakota | $136 | $113 | $57 | $230 | $105 | $67 |

| Wisconsin | $123 | $109 | $62 | $84 | $94 | $58 |

There is a $183 monthly difference between the highest and lowest rates per state. Some companies have a difference of $1,583 a month or less. However, we’re specifically referencing Allstate’s rates in Michigan. As you can see, it pays to shop around.

Northeast

Next, let’s take a look at the Northeast. If you’re a New Englander, find your state in the table below to determine what companies offer the lowest monthly rates on average near you.

| State | Allstate | Farmers | Geico | Liberty Mutual | Progressive | State Farm |

|---|---|---|---|---|---|---|

| Connecticut | $196 | $151 | $62 | $201 | $133 | $91 |

| Maine | $108 | $117 | $37 | $120 | $94 | $59 |

| Massachusetts | $143 | $120 | $72 | $155 | $95 | $78 |

| New Hampshire | $128 | $93 | $50 | $198 | $63 | $59 |

| New Jersey | $157 | $231 | $74 | $279 | $93 | $113 |

| New York | $147 | $165 | $78 | $200 | $96 | $137 |

| Rhode Island | $189 | $183 | $125 | $235 | $116 | $76 |

| Vermont | $142 | $103 | $38 | $100 | $181 | $87 |

For the Northeast, the difference between the highest and lowest rates for each state is between $183 and $567 monthly. Therefore, the spread isn’t quite as wide as the Midwest.

Southeast

Now, we move to the Southeast. Check out the monthly auto insurance rates by state for the Southeast down below.

| State | Allstate | Farmers | Geico | Liberty Mutual | Progressive | State Farm |

|---|---|---|---|---|---|---|

| Alabama | $108 | $133 | $89 | $162 | $112 | $108 |

| Arkansas | $162 | $165 | $91 | $99 | $131 | $80 |

| Delaware | $207 | $157 | $101 | $494 | $90 | $116 |

| Florida | $183 | $227 | $89 | $161 | $153 | $99 |

| Georgia | $165 | $149 | $61 | $263 | $115 | $107 |

| Kentucky | $236 | $197 | $80 | $168 | $111 | $98 |

| Louisiana | $206 | $212 | $141 | $274 | $161 | $124 |

| Maryland | $201 | $140 | $135 | $181 | $121 | $107 |

| Mississippi | $147 | $145 | $72 | $119 | $120 | $82 |

| North Carolina | $169 | $99 | $69 | $82 | $32 | $77 |

| South Carolina | $133 | $166 | $79 | $185 | $105 | $88 |

| Tennessee | $144 | $86 | $78 | $184 | $92 | $72 |

| Virginia | $103 | $100 | $69 | $129 | $61 | $63 |

| West Virginia | $162 | $139 | $83 | $196 | $110 | $79 |

With 14 states, the Southeast is the largest region in the nation. The discrepancy between the highest and lowest rate isn’t quite as drastic as in the Midwest, but it’s close.

Drivers in the Southeast expect to pay a difference of up to $1,333 a month, depending on which company they choose.

Southwest

Next, we shift over to the Southwest, the smallest of the regions. Find your state below.

| State | Allstate | Farmers | Geico | Liberty Mutual | Progressive | State Farm |

|---|---|---|---|---|---|---|

| Arizona | $180 | $135 | $65 | $178 | $84 | $81 |

| New Mexico | $158 | $131 | $90 | $161 | $86 | $69 |

| Oklahoma | $69 | $136 | $109 | $184 | $110 | $91 |

| Texas | $201 | $137 | $105 | $178 | $121 | $90 |

The playing field is smaller in the Southwest—only four states exist. Their situation is similar to the Northeast.

Drivers in the Southwest will see a difference between the highest and lowest rates, somewhere between $175 and $342 a month, so that’s still worth the time to research and choose the best company for you.

West Coast

Finally, we move to the West Coast. Please look at the chart below.

| State | Allstate | Farmers | Geico | Liberty Mutual | Progressive | State Farm |

|---|---|---|---|---|---|---|

| Alaska | $135 | $127 | $76 | $164 | $97 | $65 |

| California | $199 | $167 | $101 | $216 | $132 | $108 |

| Colorado | $166 | $163 | $94 | $92 | $120 | $94 |

| Hawaii | $118 | $99 | $60 | $128 | $78 | $64 |

| Idaho | $128 | $92 | $57 | $79 | $79 | $53 |

| Montana | $154 | $164 | $82 | $59 | $171 | $70 |

| Nevada | $165 | $155 | $110 | $111 | $82 | $103 |

| Oregon | $153 | $111 | $93 | $141 | $78 | $75 |

| Utah | $117 | $115 | $73 | $119 | $95 | $103 |

| Washington | $114 | $102 | $75 | $92 | $60 | $69 |

| Wyoming | $162 | $139 | $83 | $196 | $110 | $79 |

Regarding auto insurance rates, the West is the most fortunate region in the United States. There is only a $150 and $308 monthly difference in rates, depending on the company drivers choose in each state.

Regardless of what part of the country you live in, one thing is clear: Shopping around for auto insurance pays off. To truly find the best company for you, you will want to seek multiple quotes from the best car insurance companies.

The Best Auto Insurance Companies by State

The state in which you live has a huge influence on your rate. Every state is different, and that difference usually has a lot to do with the laws. For example, one dividing factor between 11 states and the remaining 39 is whether their laws are at-fault-based or no-fault-based.

Typically, no-fault states require drivers to purchase a certain amount of personal injury protection (PIP), which is elective in most at-fault states. However, some no-fault states, such as Michigan, New Jersey, and Florida, have outrageous rates.

In the table below, you can click on the link for different states for an overview of local auto insurance laws and rates. You can also view the average monthly rates by the top companies for full coverage auto insurance.

| State | Allstate | Geico | Progressive | State Farm | U.S. Average |

|---|---|---|---|---|---|

| Alaska | $135 | $76 | $97 | $65 | $93 |

| Alabama | $108 | $89 | $112 | $108 | $104 |

| Arkansas | $162 | $91 | $131 | $80 | $116 |

| Arizona | $180 | $65 | $84 | $81 | $103 |

| California | $199 | $101 | $132 | $108 | $135 |

| Colorado | $166 | $94 | $120 | $94 | $119 |

| Connecticut | $196 | $62 | $133 | $91 | $120 |

| District of Columbia | $241 | $69 | $115 | $111 | $134 |

| Delaware | $207 | $101 | $90 | $116 | $128 |

| Florida | $183 | $89 | $153 | $99 | $131 |

| Georgia | $165 | $61 | $115 | $107 | $112 |

| Hawaii | $118 | $60 | $78 | $64 | $80 |

| Iowa | $126 | $81 | $75 | $65 | $87 |

| Idaho | $128 | $57 | $91 | $53 | $82 |

| Illinois | $176 | $47 | $89 | $64 | $94 |

| Indiana | $140 | $63 | $69 | $71 | $86 |

| Kansas | $160 | $75 | $127 | $81 | $111 |

| Kentucky | $236 | $80 | $111 | $98 | $131 |

| Louisiana | $206 | $141 | $161 | $124 | $158 |

| Massachusetts | $143 | $72 | $95 | $78 | $97 |

| Maryland | $201 | $135 | $121 | $107 | $141 |

| Maine | $108 | $37 | $94 | $59 | $74 |

| Michigan | $406 | $99 | $152 | $209 | $216 |

| Minnesota | $160 | $90 | $101 | $67 | $105 |

| Missouri | $148 | $90 | $98 | $85 | $105 |

| Mississippi | $147 | $72 | $120 | $82 | $105 |

| Montana | $154 | $82 | $171 | $70 | $119 |

| North Carolina | $169 | $69 | $32 | $77 | $87 |

| North Dakota | $136 | $61 | $110 | $76 | $96 |

| Nebraska | $125 | $92 | $95 | $69 | $95 |

| New Hampshire | $128 | $50 | $63 | $59 | $75 |

| New Jersey | $157 | $74 | $93 | $113 | $110 |

| New Mexico | $158 | $90 | $86 | $69 | $101 |

| Nevada | $165 | $110 | $82 | $103 | $115 |

| New York | $147 | $78 | $96 | $137 | $114 |

| Ohio | $120 | $59 | $85 | $70 | $83 |

| Oklahoma | $135 | $109 | $110 | $91 | $111 |

| Oregon | $153 | $93 | $78 | $75 | $100 |

| Pennsylvania | $148 | $68 | $148 | $76 | $110 |

| Rhode Island | $189 | $125 | $116 | $76 | $126 |

| South Carolina | $133 | $79 | $105 | $88 | $101 |

| South Dakota | $136 | $57 | $105 | $67 | $91 |

| Tennessee | $144 | $78 | $92 | $72 | $97 |

| Texas | $201 | $105 | $121 | $90 | $129 |

| Utah | $117 | $73 | $95 | $103 | $97 |

| Virginia | $103 | $69 | $61 | $63 | $74 |

| Vermont | $142 | $38 | $181 | $87 | $112 |

| Washington | $114 | $75 | $60 | $69 | $80 |

| Wisconsin | $123 | $62 | $94 | $58 | $84 |

| West Virginia | $162 | $83 | $110 | $79 | $109 |

| Wyoming | $155 | $111 | $106 | $82 | $113 |

Find out which states have the cheapest auto insurance rates to get the most affordable coverage near you.

Financial Ratings of The Best Auto Insurance Companies

The table below shows these three figures for the top 10 companies in the auto insurance market for 2018 and indicates whether they’re rising, falling, or remaining steady based on the NAIC data from 2015 through 2018.

Check out our company reviews to see more specific trend data for these three figures.

| Insurance Company | A.M. Best Ratings | Direct Premiums Written (in Billions) | Market Shares (in Percent) | Loss Ratios (in Percent) |

|---|---|---|---|---|

| Allstate | A+ (Superior) | $22.7 (↑) | 9.19% (↓) | 56% (↓) |

| American Family | A (Excellent) | $4.7 (↑) | 1.9% (↑) | 69% (~) |

| Farmers | A (Excellent) | $10.5 (↑) | 4.26% (↓) | 61% (~) |

| Geico | A++ (Superior) | $33.1 (↑) | 13.41% (↑) | 71% (~) |

| Liberty Mutual | A (Excellent) | $11.8 (↑) | 4.77% (↓) | 62% (~) |

| Nationwide | A+ (Superior) | $6.7 (↓) | 2.73% (↓) | 58% (↓) |

| Progressive | A+ (Superior) | $27.1 (↑) | 10.97% (↑) | 62% (~) |

| State Farm | A++ (Superior) | $41.9 (↑) | 17.01% (↓) | 63% (↓) |

| Travelers | A++ (Superior) | $4.7 (↑) | 1.9% (↑) | 60% (~) |

| USAA (Military & Family Members) | A++ (Superior) | $14.5 (↑) | 5.87% (↑) | 77% (~) |

State Farm, Geico, and Progressive are the top three auto insurance companies in the NAIC market share. In addition, expect these three companies to be in the top 10 in all other research data across the internet.

It’s assumed that any company’s goal is to increase profits. Still, competition and financial stability are seen chiefly in market share and loss ratios, especially in the top 10 companies.

Note that loss ratios can fluctuate yearly, but they should still stay in the safe zone between 60% and 70%. A loss ratio that is lower than 60% shows the company is not paying out on claims. Conversely, a loss ratio above 70% indicates the company may be losing money.

Financial success is a critical aspect of choosing a successful insurance company. Several financial rating companies rank insurance companies based on their financial information, claims, growth, etc.

The Top Four Auto Insurance Companies Based on Market Share

Allstate, Geico, Progressive, and State Farm have dominated the auto insurance industry for quite some time.

We looked as far back as possible on NAIC’s website (2004) and found something interesting. In 2018, these four companies claimed over half the entire auto insurance industry’s market share, but it hasn’t always been that much.

In 2004, these four companies claimed only 41%. In a roughly 15-year period, they fought for and gained 10% of the market share from other companies in the top 10.

Comparing market share in 2004 and market share in 2018 shows who has won the battles and who might win the war. See what we mean in the table below.

| Insurance Company | 2004 Market Share (in percent) | 2018 Market Share (in percent) | Growth / Decline (in percent) |

|---|---|---|---|

| Allstate | 10.21% | 9.19% | -1.02% |

| Geico | 5.49% | 13.41% | +7.92% |

| Progressive | 7.12% | 10.97% | +3.85% |

| State Farm | 18.52% | 17.01% | -1.51% |

| Total market share of the top four | 41.34% | 50.58% | +9.24% |

As you can see, Geico has grown the most over the last 15 years, followed by Progressive, while State Farm and Allstate have lost market share.

But, when you look at the period between 2013 and 2018, Geico has been closing the market share gap with State Farm, and Progressive has been closing the gap in market share with Geico.

Based on 2018 financials, State Farm is well in the lead in total direct premiums written. Both Geico and Progressive conquered Allstate in 2013 and 2017, respectively.

What sets these four auto insurance leaders apart from one another? There are a few key differences:

- Allstate offers only an agent-based model.