Tri-State Auto Insurance Review (2024)

TSC Direct car insurance, recently acquired by Stillwater Insurance, averages $185/mo for policyholders in New York City. Below, our Tri-State auto insurance review will overview more about Tri-State auto reviews, how to make a TSC Direct payment, and other ways for Tri State drivers to save on their policy.

UPDATED: Mar 18, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Heidi Mertlich

Licensed Insurance Agent

Heidi works with top-rated insurance carriers to bring her clients the highest quality protection at the most competitive prices. She founded NoPhysicalTermLife.com, specializing in life insurance that doesn’t require a medical exam. Heidi is a regular contributor to several insurance websites, including FinanceBuzz.com, Insurist.com, and Forbes. As a parent herself, she understands the need ...

Licensed Insurance Agent

UPDATED: Mar 18, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Mar 18, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

UPDATED: Mar 18, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Tri-State Consumer Direct (TSC)

Average monthly rate for good drivers:

N/AA.M. Best rating:

A-Complaint level:

LowPros

- Auto insurance policyholders who own a home can also enroll in a Tri-State Consumer home insurance policy

- TSC rewards policyholders who have a clean driving record with a discount

Cons

- Tri-State Consumer Insurance is only available in New York and only has one location

- Their coverage rates usually aren’t readily available online

Final Verdict: Review of Tri-State Consumer Direct (TSC)

Tri-State Consumer Direct (TSC), now owned by the Stillwater Insurance Company, offers full coverage for around $185 monthly. If you’re in New York City, Tri-State is one of the local auto insurance companies available to you. Learn more about NYC, NY auto insurance.

Looking around at Tri State reviews is a great way to see if it’s the best auto insurance company for you. We’ll cover the company’s reputation, how to get quotes, the Tri State Insurance phone number, and the Tri State auto claims process to help you decide if it’s a good fit for your insurance needs.

Finding the best auto insurance company doesn’t have to be hard. Just enter your ZIP code in the free comparison tool above to compare your Tri State auto quote against top competitors near you.

What You Should Know About TSC Direct

Smaller car insurance companies can fly under the financial and credit rating radar, but Tri State Insurance in NY (also referred to as Tri-State Direct) managed to get a few grades among the top financial and credit rating agencies.

Keep reading our Tri State auto review to see how the company did.

TSC Direct Reviews: Customer Service and Financial Stability

We’ll start with a summary of Tri-State’s ratings and Tri State Consumer Insurance reviews among the most prominent financial and credit rating agencies. See the Tri State auto insurance ratings in the data table below.

| Financial & Credit Rating Agency | Tri-State's Rating |

|---|---|

| AM Best | A- |

| Better Business Bureau | A+ |

| NAIC Complaint Index | 0 |

Of course, these are actually Stillwater Insurance reviews since the company now owns Tri-State.

Tri State auto insurance reviews with BBB show the company is reliable for policyholders. In addition, the Tri State auto insurance company A.M. Best rating indicates it has good financial strength.Michelle Robbins Licensed Insurance Agent

We did research on TSC Direct insurance complaints; the NAIC reported that Tri-State Consumer Insurance had a complaint index of zero. It could be that TSC is very good at keeping customers satisfied, or it could be that it just doesn’t have enough complaints that conform to NAIC standards.

TSC Insurance Rates by Borough

Check out the table below to see how much you could pay for coverage from the Tri State Consumer Insurance Company:

| NYC Borough | Liability Rates | Full Coverage Rates |

|---|---|---|

| Manhattan | $120 | $200 |

| Brooklyn | $110 | $190 |

| Queens | $115 | $170 |

| The Bronx | $105 | $185 |

| Staten Island | $100 | $180 |

As you can see, Tri State car insurance policyholders in the Bronx pay around $185 monthly for coverage, whereas drivers in Manhattan pay $200 on average. For the Tri-State Insurance company phone number, read on.

More About the Tri-State Auto Insurance Company

Tri-State Consumer Insurance was founded as an auto insurance company in 1982. This New York-based company does not sell insurance anywhere outside of the state of New York.

Its motto is, “For New Yorkers, by New Yorkers.”

TSC has made great strides in providing New York residents with auto and home insurance. The company doesn’t list any major highlights on its website, other than its good A.M. Best rating.

The company does have a website with several pages for visitors to explore. Potential customers who want auto insurance from Tri-State Consumer Insurance will have to contact the company’s agents through its website or toll-free phone service.

Visitors to the website can get a quote, pay their TSC payment online, sign applications, file claims, contact TSC representatives, and read blog posts under the resources section.

With a smaller company, claims may be seen more attentively due to the smaller number of policyholders. TSC is proud of its commitment to good customer service.

If there is any involvement in the community, TSC has not made it known to the public. However, it may have some involvement in community development without necessarily having any specific programs for this purpose. Should the company experience higher than average growth over several years, it may expand its philanthropy.

So, what is the Tri State auto insurance phone number?

To get in touch with Tri-State, you’ll need to call Stillwater Insurance Services, since they now own Tri-State. The Stillwater Insurance phone number is 855-712-4092 for policyholders who need to speak with Stillwater customer service. On the other hand, the Stillwater Insurance claims phone number is 800-220-1351.

Tri-State Availability by State

You can find the Tri-State headquarters at the Stillwater Insurance address:

6800 Southpoint Parkway, Suite 700. Jacksonville, FL 32216

To speak with customer service, the Tri State Insurance Company phone number is 855-712-4092. In addition, the Tri State insurance claims phone number is 800-220-1351.

Calling the Tri State Consumer Insurance company phone number is the best way to get in touch with an agent.

TSC Direct Insurance Coverage Options

TSC, also known as Tristate auto insurance, doesn’t talk much about what it offers, but liability auto insurance coverage is definitely available because all auto insurance companies, including Tri-State, must carry the New York auto insurance minimum requirements.

If a policyholder needs collision and/or comprehensive, they’ll have to ask an agent if these are available. But what about bundling options, discounts, and other programs? We’ll go over all that information next.

What can Tri-State Consumer Insurance offer you as a potential customer? Continue through the guide to find out more.

Tri-State Bundling Options

Auto insurance policyholders who own a home can also enroll in a Tri-State Consumer home insurance policy. This is particularly convenient for New York residents who want to consolidate their auto and home insurance rates into one bill.

In addition to auto and home bundling, TSC allows policyholders to have multiple vehicles on a single policy, which could mean auto insurance discounts.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

TSC Direct Discounts Available

TSC offers several other discounts for policyholders to make Tri-State auto insurance affordable on top of the already competitive rates. We’ve summarized them in a data table for your convenience.

| General Discounts | Vehicle Discounts | Other Discounts |

|---|---|---|

| Accident Prevention Course | New Vehicle Discount | Senior Citizen Discount |

| Driver’s Training Course | Multi-Vehicle Discount | Military Discount |

| Good Student Discount | Recovery System | Loyalty Discount |

| Student Away at School | VIN Etching | |

| Good Driver Discount | Safety Feature Discount |

You can earn a discount on your car insurance by completing a state-approved defensive driving and accident prevention course. Drivers under 21 years old who complete state-approved driver’s training courses are eligible for a discount.

In addition to driver’s training courses, TSC auto insurance will give discounts to students who perform well in academics as part of its Good Student Discount program (the student must maintain a 3.0 or above).

Do auto insurance companies check your driving record? Yes, they do, without exception.

Like most auto insurance companies, TSC rewards policyholders who have a clean driving record with a discount.

Combined with other discounts, auto insurance rates could be significantly reduced.

Earlier we mentioned how policyholders can include more than one vehicle in their policy. TSC will also give you a discount for having multiple vehicles insured with them.

Also, owning a newer vehicle or used vehicle with safety features such as anti-lock brakes, a recovery system, and a security system will entitle policyholders to discounts. These preventative measures reduce your chances of having an accident or having your car targeted by thieves, which means your insurer is less likely to have to pay out an expensive claim.

VIN Etching is another way to get a discount with TSC.

VIN etching is when a vehicle identification number (VIN) is engraved into the vehicle’s windshield and windows. Most vehicles have VIN etching. This practice helps law enforcement to locate your vehicle if it’s stolen, which can ultimately save you and your insurer some money.

Finally, policyholders can save money through senior citizen discounts, military discounts, and loyalty discounts. Loyalty discounts are given by insurance companies to customers as a reward for renewing their policy.

How to Cancel Your Tri-State Auto Insurance Policy

Auto insurance companies will do everything they can to keep their policyholders. If you get in touch with your insurer to tell them you wish to cancel, the representative you speak to will likely try to sway you to stay by informing you of any discounts you may be eligible for.

Next, the insurer will ask if you have a new policy already in place because in most states it’s illegal to drive without insurance.

Do you still feel like canceling car insurance with Tri-State Consumer Insurance? Let’s take a look at the process.

TSC doesn’t give a lot of information on its website about how to cancel your auto insurance policy, but based on how other companies operate, there’s a good chance you’ll have to pay something when you cancel.

If you’re not canceling at the end of a policy’s term limit, you may be required to pay for the insurance you’ve already used and/or to make payments for the length of the contract you signed with TSC.

You may also get a refund for insurance you didn’t use.

You can look for refund information in the terms and conditions of your policy, or ask a TSC representative about this.

Ask for an agent and tell them that you want to cancel your policy. If you have an online account, you may be able to cancel through the company’s website. We’d like to walk you through it, but TSC has limited this particular part of the site to policyholders.

When to Cancel Your Tri-State Policy

Ideally, an auto insurance company would prefer you to cancel when your policy is about to run out, but policyholders generally can cancel whenever they want to.

There may be some penalties or fees involved if you allow your auto insurance to lapse. So, it’s not a good idea to allow your auto insurance to cancel due to nonpayment.

Switching car 🚘insurance companies might be in your best interest, but how do you actually do it🤔? That's where https://t.co/27f1xf1ARb comes in with the details. For step-by-step🔢 help, check out👉: https://t.co/QC0Z11qaSz pic.twitter.com/w8VBDBcye0

— AutoInsurance.org (@AutoInsurance) August 9, 2023

The state of New York has statues that cover certain aspects of the industry, but you can get the information you need when you speak to a Tri-State insurance agent about the appropriate time to cancel. Contacting the Tri-State insurance agency is a great way to get all your questions answered.

In the next section, we offer information on how to make a claim with Tri-State and provide the Tri-State Insurance claims phone number.

How to File a Tri-State Auto Insurance Claim

How can you file a claim with an auto insurance company in New York? You can file a claim with Tri-State one of two ways: you can call the company and report your claim, or you can download the appropriate forms, fill them out, and fax or email them back.

To file an auto insurance claim you need to provide the following information:

- Policy number

- Date of occurrence

- Time of occurrence

- Type of loss

- Location of loss

- Injuries related to the incident

- Names and contact information of others involved

- Type of damage sustained

- Police contact information

Tri-State does request that you report your claim as quickly as possible so an agent can start working on it, even if you don’t have all of the above information available. There is no indication as to the claim center’s hours of operation on the website.

According to Tri-State, most of its claims are paid within three days of being filed.

If you want to make a claim by phone, contact TSC at 855-712-4092.

How to Get a Tri-State Auto Insurance Quote Online

Tri-State does offer a quote tool option on its website. However, Tri-State Consumer Insurance is one of the companies that will call you continuously to see why you haven’t followed up on a quote you received from them.

Tri-State is very strict about who it accepts. You’ll be asked many questions about your driving habits. Because TSC insures New York City residents, you may also be asked where you park your car if you drive somewhere to ride the subway to work.

Looking to compare your Tri-State quotes vs. the top companies? Insert your ZIP code into our quote tool below to get started.

Frequently Asked Questions

What are the liability coverage requirements in New York?

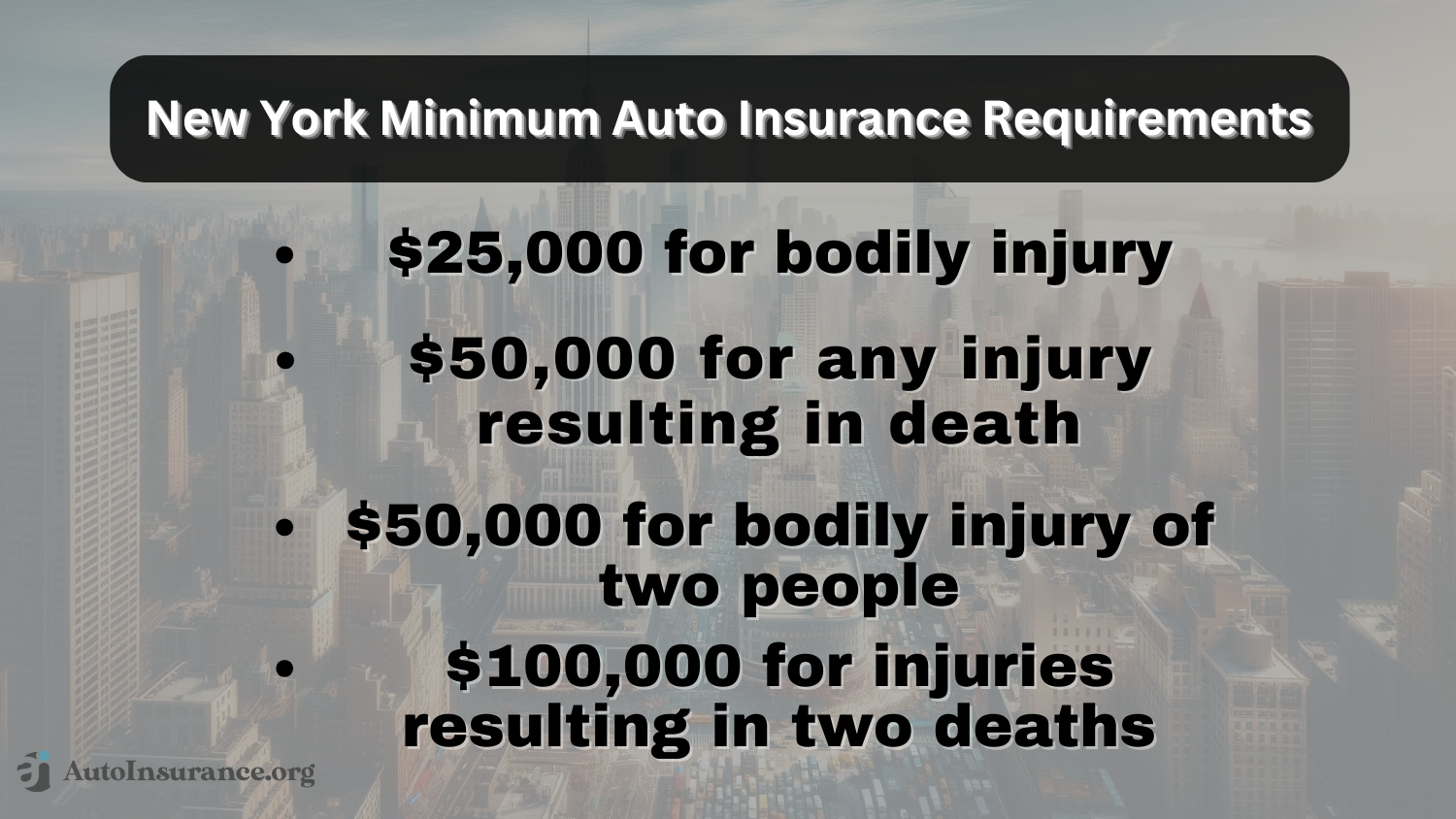

The minimum requirement for auto insurance is liability coverage. The liability coverage limit in New York is $25,000 for bodily injury and $50,000 for the death of one person involved in an accident, $50,000 for bodily injury and $100,000 for the death of two or more people in an accident. The property damage limit is $10,000 for a single accident.

With the Tri State Insurance Company, you’ll pay around $110 monthly for liability insurance.

What is full coverage auto insurance?

Full coverage is a combination of liability, collision, and comprehensive coverage. With Tri-State Consumer Direct Insurance services, NYC drivers can pay around $185 for full coverage auto insurance.

Are small auto insurance companies cheaper than big auto insurance companies?

Who has the cheapest auto insurance? The best way to determine that is to compare quotes from multiple companies, big and small. Every company is different in terms of the rates they charge. A small company may not have the clout and name recognition of a big company like Geico, but that doesn’t mean it won’t have low rates. Some people prefer smaller companies for personal service and local focus, even if the rates are a little higher.

However, good insurance means much more than low rates. Check out Tri State auto insurance company reviews to see if the company has good customer service.

What auto insurance coverages are available at Tri State Insurance?

From what we’ve seen on its website, liability, collision, and comprehensive coverage are available at TSC, also known as the Tristate Insurance Company. In addition to the basic coverages, TSC also has additional liability coverages such as personal injury protection (PIP) and medical payments (Med Pay).

Is TSC Direct a good insurance company?

As noted above, the company has an A+ rating with the BBB and A- rating with A.M. Best. Those are both signs of a solid reputation. Individual experience with an insurance company can vary, but TSC, or the Tristate Insurance Group, appears to be a good company overall.

Learn More: Auto Insurance Companies With the Best Customer Service

What is Tri-State Health Insurance?

Tri-State (Tristate) Health Insurance is a health insurance company located in Illinois that has no connection to Tri-State auto insurance or any Tri-State Consumer Direct services.

Is Tri-State Consumers Direct known for another name?

No. There are a lot of similar company names out there, including TSR insurance, TC insurance, Tri-State Insurance Group of Keller, TX, Tri State Insurance Company of Minnesota, State Auto, Tri State General Insurance, and Tri-State Insurance Group. Although the names can be confusing, none of these are connected to Tri-State Consumers Direct (TSC) in New York.

How can I manage my Tristate car insurance policy?

The Tri-State Consumer insurance company provider portal will navigate you to the TSC login page where Tri State Insurance Co customers can manage their auto insurance policy.

Does Tri-State Auto Insurance offer discounts?

Yes, the Tri State Insurance Group offers various discounts to policyholders. These discounts may be based on factors such as safe driving, multiple policies with the company, bundling multiple vehicles, and having certain safety features in your vehicle.

Enter your ZIP code below to see how much you’ll pay for TSC Direct with these discounts by getting a quote.

What is the Tri State auto telephone number?

Wondering how to get in touch with Tri State auto insurance customer service?

The Tri State auto insurance phone number is 855-712-4092, which also serves as the Tri State auto billing phone number. In addition, the Tri State auto insurance claims phone number is 800-220-1351.

What are the Tri State auto customer service hours?

You can call the Tri-State phone number between 8 a.m. and 9 p.m. ET from Monday to Friday, or between 8 a.m. and 3 p.m. ET on Saturday.

How do I pay my Tri-State insurance premiums?

Can I pay my auto insurance online? Since Stillwater now owns Tri-State, visit Stillwater.com for payment options.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Heidi Mertlich

Licensed Insurance Agent

Heidi works with top-rated insurance carriers to bring her clients the highest quality protection at the most competitive prices. She founded NoPhysicalTermLife.com, specializing in life insurance that doesn’t require a medical exam. Heidi is a regular contributor to several insurance websites, including FinanceBuzz.com, Insurist.com, and Forbes. As a parent herself, she understands the need ...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

thatmarine

THE WORST

tori96

Way to Go TSC Direct

grandmajess

Affordable & Friendly

shuvog

TSC Direct - one person view

Mark33D

Low Price!

Sandi17

TSC Direct

susan11757

great prices